Fha gift letter 2021 template

To apply for an FHA loan, a gift letter is often required to confirm that the funds you are receiving for your down payment or closing costs are truly a gift, not a loan. The gift letter must outline key information to ensure compliance with FHA guidelines. Use this template to streamline the process and avoid unnecessary delays.

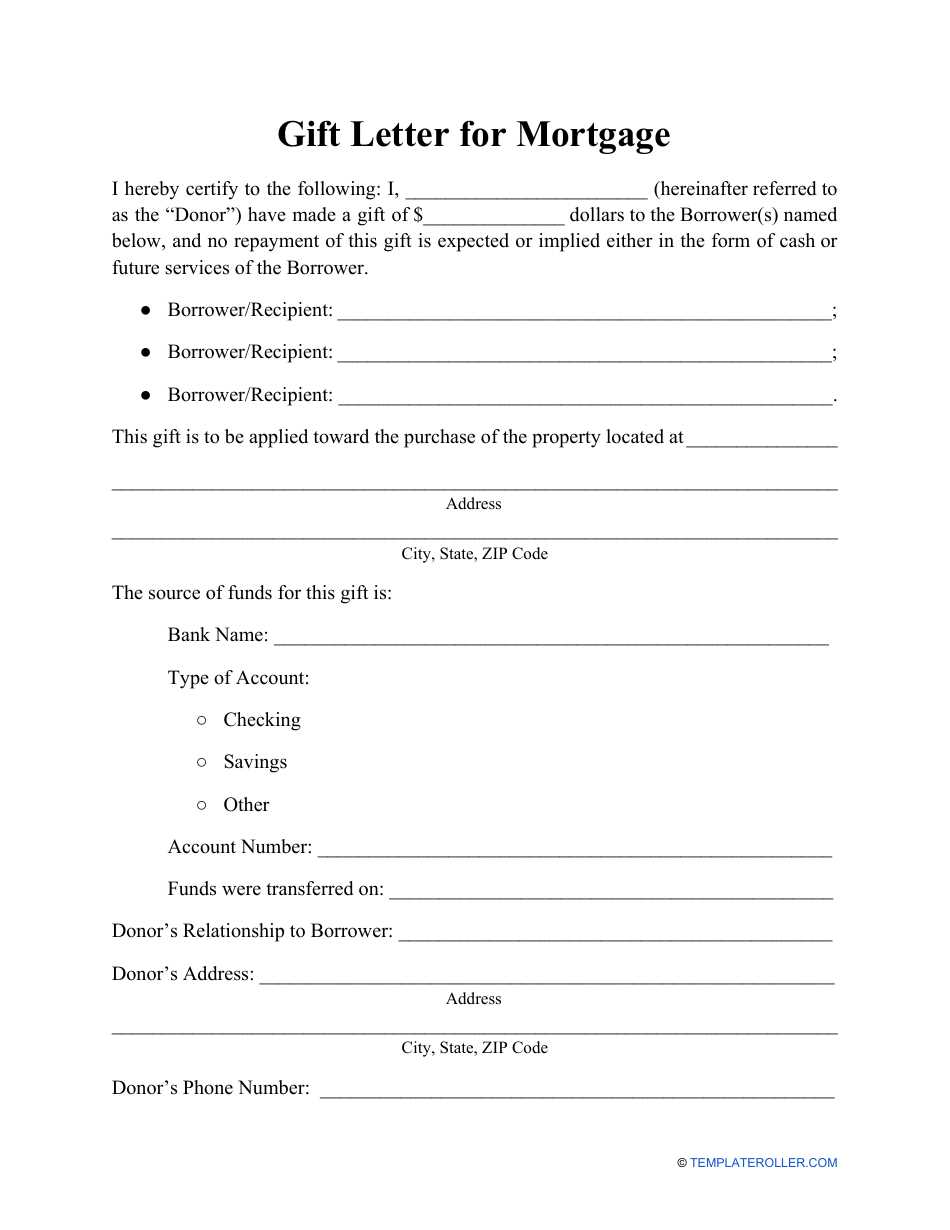

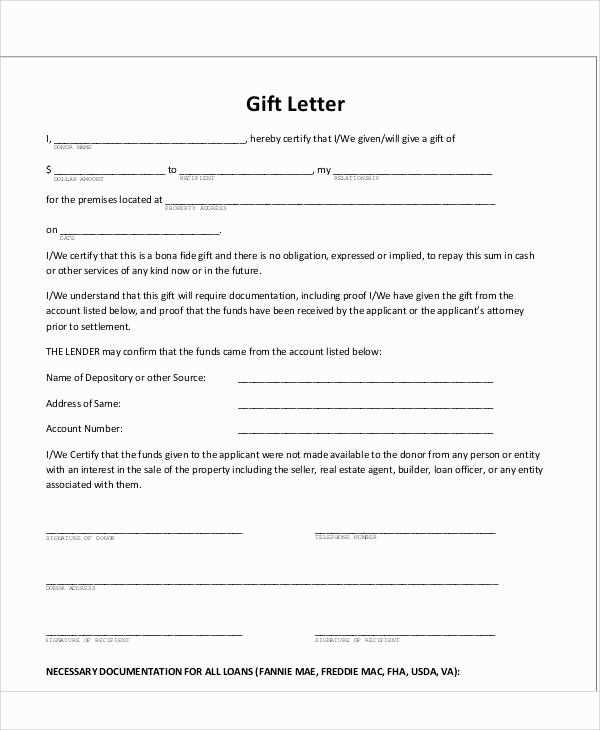

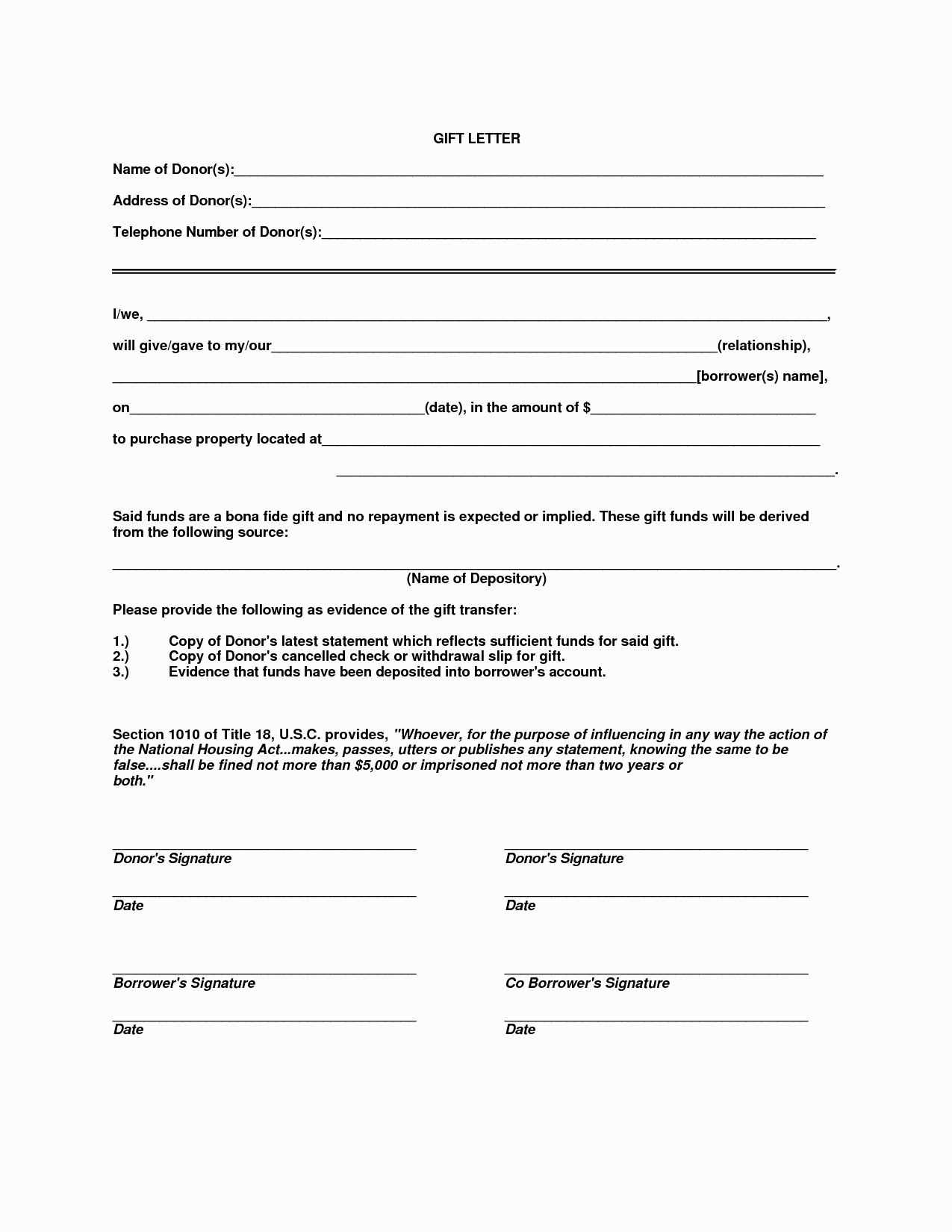

Gift Letter Content: The letter must state that the money being gifted does not need to be repaid. Include the donor’s name, address, phone number, relationship to the borrower, and the amount of the gift. Be sure to specify that the gift is a one-time contribution and is not tied to any future obligations or conditions. If the donor is contributing to multiple family members, list each person separately in the letter.

Required Details: Clearly include the donor’s bank information if requested by the lender to verify the source of the funds. The donor must also confirm they are not receiving anything in return for the gift, as this could disqualify the gift from being considered non-repayable. You should also note the exact date the funds were transferred, or will be transferred, to ensure accuracy in your loan application.

Template Example: When drafting your gift letter, follow the simple structure below. Keep the tone formal but straightforward, and ensure that all necessary details are included to comply with FHA standards.

Here are the corrected lines:

When drafting an FHA gift letter, make sure the donor’s information is clear and specific. The letter must include the donor’s full name, address, and relationship to the borrower. Specify the amount of the gift and state that it is not a loan and does not need to be repaid.

| Donor Information | Borrower Information | Gift Details |

|---|---|---|

| Full Name | Full Name | Gift Amount |

| Address | Address | Statement of No Repayment |

| Relationship to Borrower | Relationship to Borrower | Source of Funds (Optional) |

Clarify that the gift is unconditional and not tied to the purchase or any future expectations. If applicable, mention the source of funds, although this isn’t always necessary. Double-check that the donor signs and dates the letter.

In case the letter is missing any of these details, it could delay the FHA loan approval process. Keep it simple, but ensure all key information is addressed to avoid potential complications.

- FHA Gift Letter 2021 Template: A Complete Guide

To make the most of a gift for your FHA loan, you’ll need to include a well-structured gift letter. This letter confirms that the funds provided to you are a gift, not a loan, and will not need to be repaid. It’s a required document when you are using gifted money to cover your down payment, closing costs, or reserves for an FHA loan. Below is a simple template to follow and the key information it should include:

Key Elements of an FHA Gift Letter

The letter must be written by the donor and include specific details to satisfy FHA guidelines. Ensure your gift letter contains the following:

- Donor’s Information: Full name, address, phone number, and relationship to the borrower.

- Recipient’s Information: Full name of the borrower who is receiving the gift.

- Gift Amount: Clearly state the exact amount being gifted.

- Statement of Gift: Specify that the money is a gift and not a loan. The letter should include wording like: “This is a gift, with no repayment expected.” This clarifies that no repayment terms exist.

- Donor’s Confirmation: A statement from the donor confirming that the funds are not coming from a third party who expects repayment.

- Source of Funds: Include information on the source of the gift funds (e.g., savings, sale of assets).

Sample FHA Gift Letter Template

Here’s a sample gift letter template that meets FHA requirements:

Date: [Insert Date] To Whom It May Concern, I, [Donor’s Full Name], residing at [Donor’s Address], am providing a gift of [Amount of Gift] to [Borrower’s Full Name] for the purpose of assisting with their down payment and/or closing costs associated with the purchase of their home located at [Property Address]. This gift is given freely with no expectation of repayment, either now or in the future. The funds are not a loan and will not need to be repaid. These funds come from [Source of Funds, e.g., my personal savings, proceeds from the sale of property, etc.]. Please feel free to contact me at [Donor’s Phone Number] should you require any additional information. Sincerely, [Donor’s Signature] [Donor’s Printed Name]

Once the letter is drafted and signed, include it with your loan application for FHA approval. This ensures that your lender has the proper documentation to verify the source of your down payment or closing cost funds.

Start by confirming the gift is truly a gift and not a loan. The letter must clearly state that the money given to you is a gift with no expectation of repayment. This is key for meeting FHA guidelines.

Include the full names, addresses, and relationship to you of the donor. Make sure to specify the donor’s contact information to verify their identity if needed. It’s also important to mention the date the gift was given and the exact amount.

Clearly state that the gift is not a loan. Include phrases like, “This gift does not require repayment” or “This gift is unconditional and a true gift.” This removes any confusion and clarifies that there are no terms attached.

It’s helpful to provide the donor’s bank statement or proof of funds to demonstrate where the gift money came from. This ensures that the gift is legitimate and not from another loan or source that could complicate your mortgage application.

Lastly, both the donor and you should sign the letter. This adds an official touch and ensures the accuracy of the information provided. Be sure to check that the information is correct and complete before submitting it with your application.

What Information Should Be Included in an FHA Gift Letter?

An FHA gift letter should clearly specify key details to meet the requirements of the FHA guidelines. Make sure to include the following elements:

- Donor’s Information: Name, address, and relationship to the borrower (e.g., parent, relative, friend).

- Amount of the Gift: Specify the exact dollar amount given to the borrower.

- Donor’s Statement: A declaration stating that the funds are a gift and do not need to be repaid. It should also confirm there is no expectation of repayment.

- Source of Funds: The letter should mention where the donor’s gift funds came from (e.g., savings, proceeds from the sale of property).

- Borrower’s Information: Full name of the borrower receiving the gift.

- Property Information: Include the address of the property the borrower is purchasing with the gift.

- Date of the Gift: The letter must indicate when the gift was given to the borrower.

Additional Considerations

If the gift letter comes from a non-immediate family member, a more thorough explanation of the relationship may be necessary to satisfy FHA requirements.

The lender may request additional documentation, such as bank statements or proof of the transfer of funds, to verify the gift. Make sure all required information is clearly laid out and accurately reflects the transaction to avoid delays in the approval process.

Make sure to include all required details such as the donor’s full name, address, and relationship to the borrower. Missing this crucial information could lead to delays or rejection of the FHA loan application.

Avoid vague language. The letter should clearly state that the gift is a gift, not a loan, and that there is no expectation of repayment. Any ambiguity could raise concerns for the lender.

Don’t forget to include the donor’s contact information. It is important for the lender to have a way to verify the details provided in the letter, so including an address and phone number is necessary.

Be careful not to exaggerate the gift amount. Providing inaccurate figures or inflating the amount could cause problems during the verification process.

Don’t leave out the date of the gift. The letter should specify when the gift was given or is intended to be given. This helps lenders verify the timeline and ensures the funds are available for closing.

Avoid vague statements like “I intend to help” or “I might assist.” The letter should confirm that the funds have been or will be transferred in full to the borrower, without conditions.

To verify the source of gift funds for FHA loans, request documentation from the donor to confirm the legitimacy of the funds. A gift letter must be signed by both the donor and the borrower, clearly stating the amount and that the money is a gift, not a loan. Along with the gift letter, provide evidence of the donor’s ability to give the funds. This may include bank statements, pay stubs, or a letter from the donor’s employer to verify their financial capacity.

If the gift funds were transferred via check or wire, include transaction details such as the check number or wire reference number and the date of transfer. For large deposits or recent transfers, ensure the donor has clear documentation that the funds were not borrowed and that there are no repayment expectations. This helps to confirm the money is a true gift, in line with FHA guidelines.

Lastly, if the donor is a relative, ensure they are listed as a family member according to FHA guidelines. If the gift comes from a non-relative, additional documentation may be required to confirm the relationship and the legitimacy of the gift.

FHA Gift Letter Requirements for Family and Non-Family Donors

When submitting a gift letter for an FHA loan, both family and non-family donors must meet specific criteria to ensure the gift is eligible for use as part of the down payment. The gift letter serves as proof that the funds are a genuine gift, not a loan. Here’s what you need to know:

Requirements for Family Donors

- The donor must be a direct family member, such as a parent, grandparent, sibling, or child.

- The letter must state that the gift is not a loan and there is no expectation of repayment.

- Include the donor’s relationship to the borrower (e.g., “Mother of the borrower”).

- Clearly specify the gift amount and confirm that the donor has sufficient funds to provide it.

- The donor should also provide their contact details (address, phone number) in the letter.

- The donor’s bank account information may be required to show that the funds are legitimate.

Requirements for Non-Family Donors

- Non-family donors are typically allowed, but they must adhere to stricter documentation guidelines.

- In addition to the standard gift letter, the donor may need to explain the nature of their relationship to the borrower.

- The gift letter must include the statement that no repayment is expected.

- The donor’s financial documentation could be requested, including proof of funds to verify the legitimacy of the gift.

- If the donor is a business entity, they must also provide clear documentation of the gift and the reasons for it.

In 2021, when using a gift letter for an FHA loan, you need to ensure the letter adheres to specific lender guidelines. Each lender may have its own requirements, but there are common elements that must be included to meet FHA standards.

Key Components of a Gift Letter

The gift letter must clearly state that the funds are a gift, not a loan. This means no repayment is expected. The letter should include the donor’s name, address, phone number, relationship to the borrower, and the exact amount being gifted. Additionally, it must specify that the gift is non-repayable. Be sure to include the donor’s bank statements or proof of funds, as the lender may request this documentation to confirm the source of the gift.

Important Lender-Specific Considerations

Some lenders may require additional verification to ensure the gift does not violate FHA rules. This could include verification of the donor’s ability to provide the gift, especially for larger amounts. Lenders might also ask for a letter from the donor’s bank confirming the gift has been transferred to the borrower’s account. Be prepared to provide full transparency about the transaction and follow your lender’s specific requests.

By addressing these requirements, you can ensure a smooth process when using a gift letter to secure your FHA loan. Always check your lender’s specific guidelines to avoid delays.

FHA Gift Letter 2021 Template

To comply with FHA loan guidelines, include a gift letter detailing the donor’s relationship to the borrower and the amount of the gift. The letter should confirm that the money is a gift, not a loan, and provide assurances that there is no expectation of repayment.

Here’s a basic template for an FHA gift letter:

[Date] [Name of Donor] [Address of Donor] [City, State, ZIP Code] [Name of Borrower] [Address of Borrower] [City, State, ZIP Code] Dear [Lender's Name], I, [Donor's Full Name], hereby confirm that I am gifting [borrower’s name] the amount of [$amount] to assist with their down payment and/or closing costs for the purchase of the property located at [property address]. This gift is provided freely and without any expectation of repayment. Our relationship is [state relationship, e.g., parent, sibling, friend]. The funds provided are not a loan, and I will not ask for repayment in the future. Sincerely, [Donor's Name] [Donor's Signature]

Ensure the donor’s signature is included, and both parties should date the letter for accuracy. This will verify that the transaction follows the required protocol for FHA loans.