Garnishment letter template

When you need to notify an individual or employer about wage garnishment, a garnishment letter ensures that the proper steps are followed. This letter outlines the details of the garnishment order and gives clear instructions for compliance.

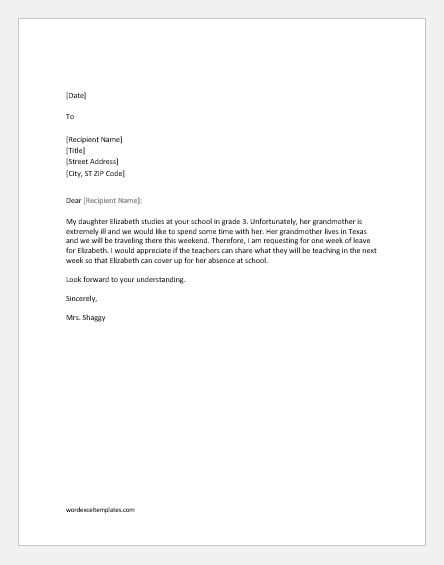

The template should begin with the necessary identification details, such as the name of the person being garnished, the case or reference number, and the amount to be garnished. Use a clear and direct tone to avoid any confusion or delays in the process. Make sure to reference the legal authority that mandates the garnishment, as this adds legitimacy to the request.

It’s important to state the deadlines for any responses or actions required from the recipient. Provide contact information for further inquiries to ensure transparency and reduce misunderstandings. Keep the language formal but approachable to maintain professionalism while being helpful.

Conclude by requesting a prompt acknowledgment of the garnishment order and outline the consequences of non-compliance. A well-structured garnishment letter protects both parties and ensures that legal obligations are met without unnecessary complications.

Here is the revised version with reduced repetition:

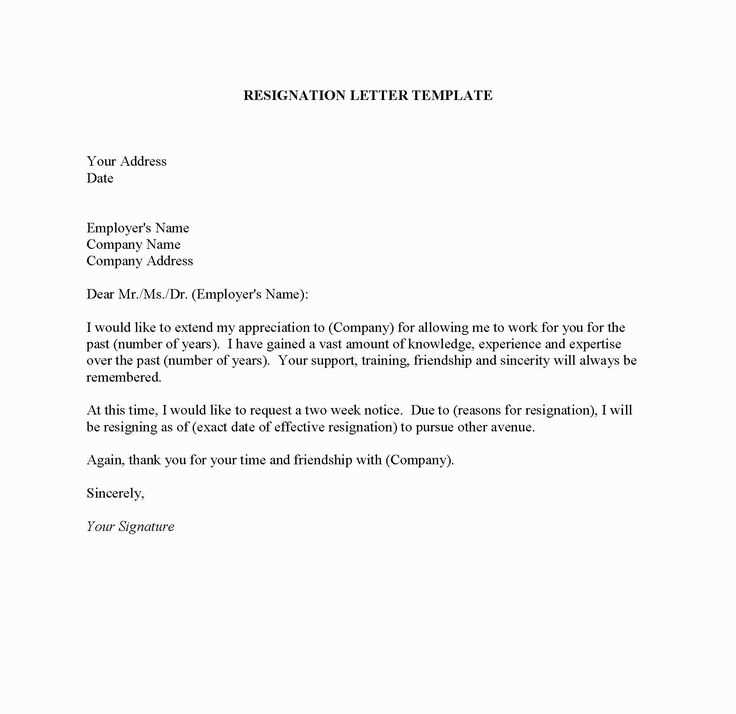

When drafting a garnishment letter, keep it clear and to the point. Avoid repeating the same information multiple times. State the purpose of the garnishment directly, followed by specific details about the amounts owed, payment terms, and deadlines for compliance.

Ensure all necessary legal references are included without overloading the letter with excessive jargon. Address the recipient with respect and maintain a formal tone throughout. Offer clear instructions for the recipient to follow, outlining any actions they must take in response to the garnishment.

Conclude the letter by reiterating the legal obligation without restating previous points. Make sure to include your contact information for further inquiries, and provide a clear method for submitting payments or disputing the garnishment if applicable.

Garnishment Letter Template Guide

What is a Garnishment Letter?

Key Elements to Include in Your Letter

Step-by-Step Instructions for Drafting the Letter

Common Mistakes to Avoid When Writing a Garnishment

How to Tailor Your Letter for Different Situations

Next Steps After Sending the Letter

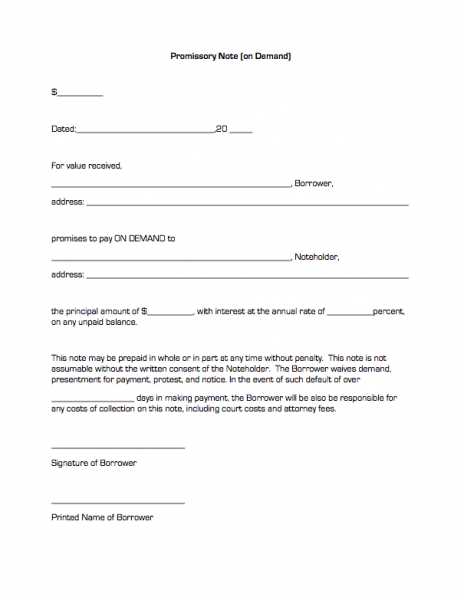

A garnishment letter is a formal document sent to an employer or financial institution to initiate the process of wage or bank account garnishment. This letter is typically issued after a court order, and it outlines the amount to be garnished and the method of payment. It’s crucial that the letter is clear, concise, and legally accurate to ensure compliance and avoid disputes.

The key elements to include are the following:

- The debtor’s full name and contact information.

- The court order number and details of the judgment.

- The specific amount to be garnished, including interest if applicable.

- The payment instructions for the employer or financial institution.

- The deadline by which payments should begin.

- Contact information for questions or clarification.

Here’s a step-by-step guide to drafting the letter:

- Start with a clear subject line stating the purpose (e.g., “Notice of Wage Garnishment”).

- Provide the debtor’s full name, address, and the court order number.

- Specify the garnishment amount and the frequency of payments.

- State the recipient’s responsibilities (e.g., the employer’s obligation to withhold payments).

- Include the due date for the first garnishment payment.

- End with contact information for any questions or disputes.

Common mistakes to avoid:

- Failure to reference the correct court order number.

- Missing or unclear payment instructions.

- Not including specific garnishment amounts and dates.

- Leaving out contact information for disputes or clarifications.

- Sending the letter without verifying all details, leading to potential legal complications.

Tailor your letter based on the situation. For example, if the garnishment is for wages, clearly state the amount per paycheck. If it’s a bank account garnishment, include the account number and specify the amount to be withdrawn. Adjust the tone if necessary to reflect the nature of the garnishment (e.g., a court-mandated garnishment vs. a voluntary payment agreement).

Once the garnishment letter is sent, track its receipt and follow up if payments aren’t received on time. If you’re the debtor, contact the sender to discuss any issues or disputes. Keep all records of correspondence and payments for future reference.