Bank account change letter template

If you need to inform your bank about a change in your account details, drafting a clear and concise letter is key. Use this template to communicate the necessary information without delays. Ensure the letter includes all required details, such as your previous account number, new account number, and any other relevant identification information. This ensures that your request is processed smoothly.

Begin with a polite greeting and introduce yourself, mentioning your current account details. Clearly state the reason for the change and provide the new account number. Make sure to include any additional information that may be required by the bank for verification. Double-check that all details are accurate before submitting.

End the letter by thanking the bank for their attention to your request. This polite closing fosters a professional tone. Ensure to provide your contact information in case they need further clarification. Once your letter is complete, submit it through the appropriate channel to make sure the update is processed promptly.

Here’s the improved version without repetition:

Ensure that the bank name, address, and account details are accurate. Avoid vague language, and use clear, concise terms when stating the reason for the account change. Specify the new account number and any relevant dates. Clearly mention any required documents or identification that need to be provided. Close the letter by offering your contact details for further clarification if needed. Make sure the tone is respectful and professional without being overly formal.

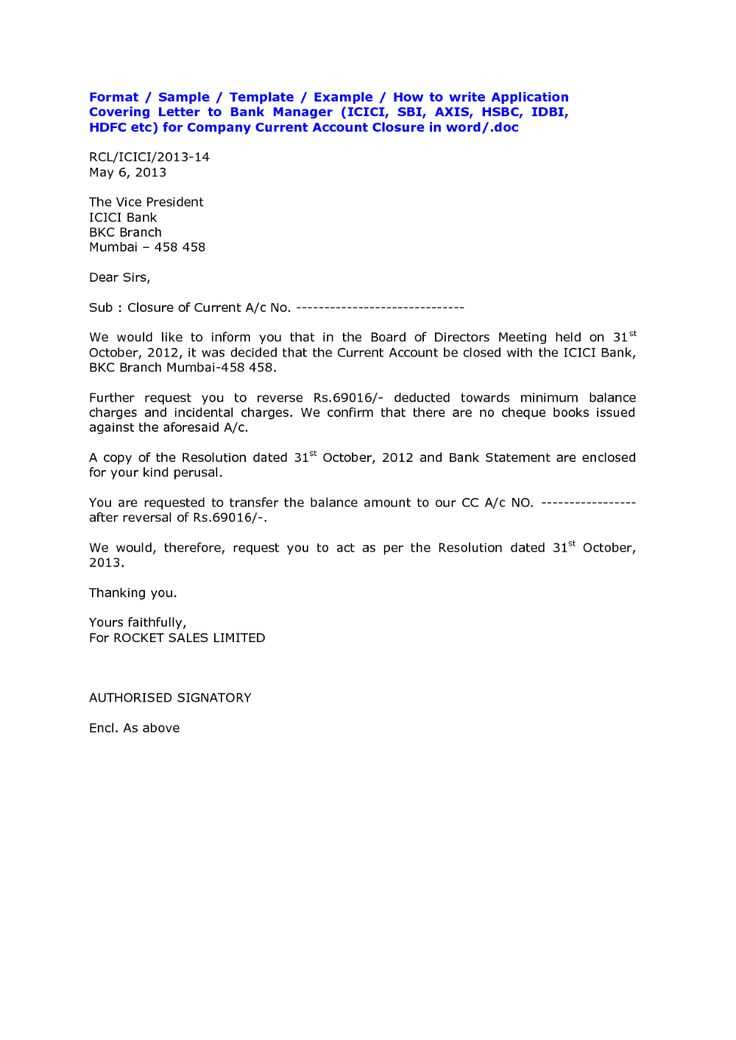

- Bank Account Change Letter Template

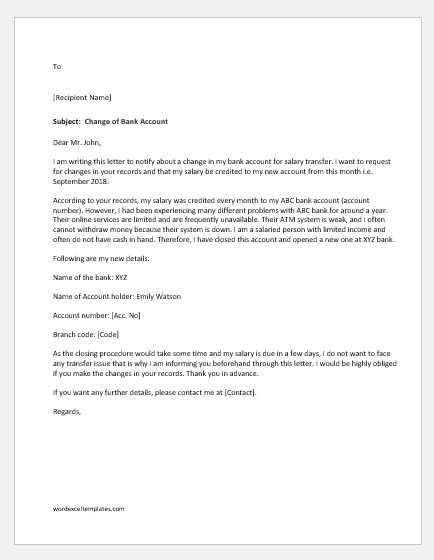

When informing a bank about changing your account details, use a clear and concise letter to ensure smooth processing. Start with your personal information and the current account details, including account number, branch, and type of account. Clearly state the reason for the change, and provide the new account details such as the new bank name, account number, and branch code.

Make sure to request that any future transactions or payments be redirected to the new account. It’s helpful to mention the date from which the change should take effect. Conclude by expressing appreciation for their assistance and request confirmation of the update. Here is a sample structure for your letter:

Sample Bank Account Change Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

To:

[Bank’s Name]

[Bank’s Address]

[City, State, ZIP Code]

Subject: Request for Bank Account Change

Dear [Bank Representative’s Name],

I am writing to inform you of a change in my bank account details. Below are the details of my old and new accounts:

Old Account Details:

Account Holder: [Your Name]

Account Number: [Old Account Number]

Bank Branch: [Old Bank Branch]

New Account Details:

Account Holder: [Your Name]

Account Number: [New Account Number]

Bank Name: [New Bank Name]

Branch Code: [New Branch Code]

I kindly request that all future transactions be processed through my new account starting from [effective date]. Please confirm the update once completed. I appreciate your assistance in this matter.

Thank you for your attention to this request. Should you need any additional information, feel free to contact me.

Sincerely,

[Your Name]

Begin with a clear subject line that indicates the purpose of the letter. For example: “Notification of Change in Bank Account Details.” This helps the recipient understand the context right away.

Include Recipient Information

Start by addressing the recipient with a formal salutation such as “Dear [Recipient’s Name]” or “To Whom It May Concern,” depending on your relationship with the recipient and the formality of the correspondence. Ensure you mention the recipient’s title if applicable, such as “Mr.” or “Ms.”

State the Change Clearly

In the first paragraph, explicitly state that you are changing your bank account details. Include the relevant information, such as the new account number and bank name, and specify that future transactions should be directed to the updated account. Be clear and concise to avoid any confusion.

For example, “Please be informed that I have recently updated my bank account information. Effective [date], all transactions should be processed through the following account details: [Bank Name], [Account Number].” This ensures the recipient has all necessary information at hand.

Close the letter by thanking the recipient for their attention and cooperation in updating your details. Sign off with a polite closing, such as “Sincerely,” followed by your name and contact information.

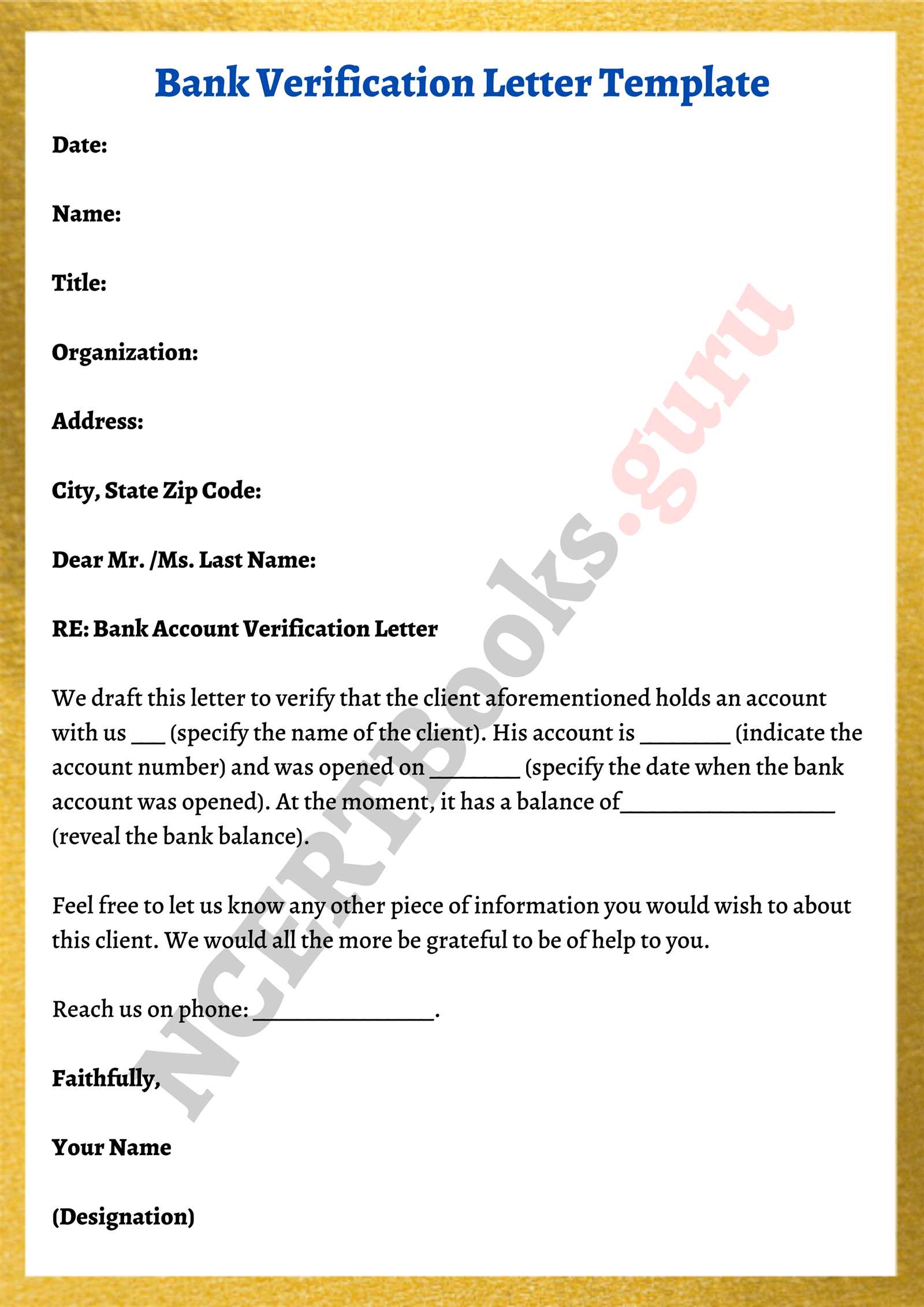

Start with your full name and address at the top of the letter, followed by the date. Next, clearly state the bank’s name and its address. Include a brief subject line that indicates the purpose of your request, such as “Request for Account Information Update.”

Provide your current account details, including the account number, branch name, and type of account. When mentioning your new account information, ensure you include the account number, the branch name, and any relevant changes. Be specific about whether you want to change your account type or update personal information linked to the account.

Include any specific requests, such as the preferred method of updating your account or any necessary documents that may assist with the change. Conclude with a polite request for confirmation of the update and express appreciation for their attention to your request.

Make sure the tone remains professional and concise throughout the letter.

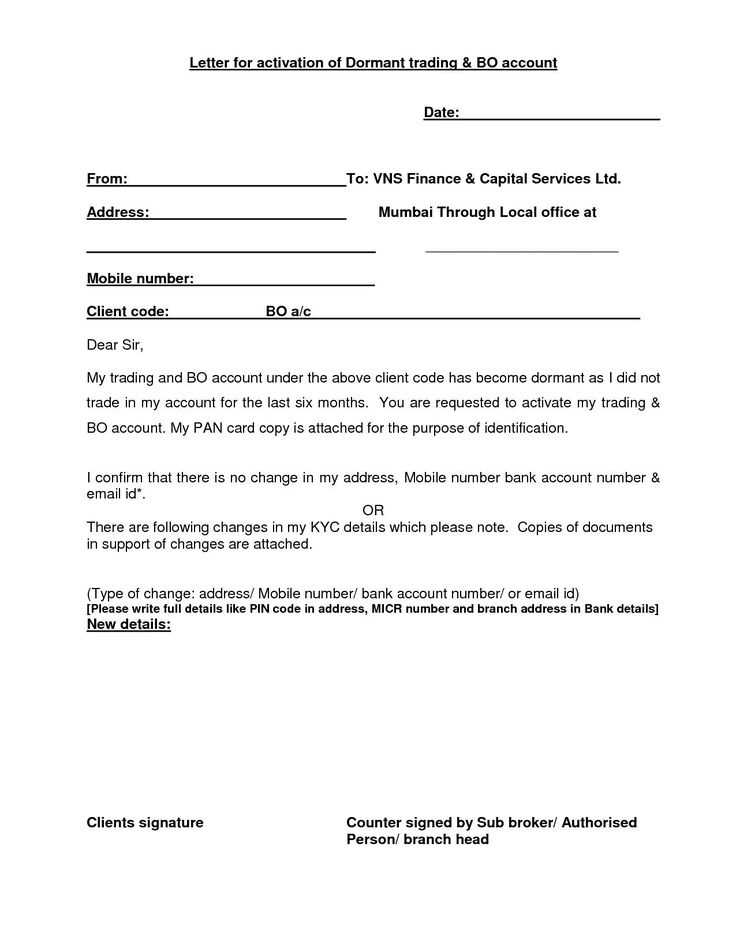

To update your banking information, begin by contacting your bank’s customer support. Use official communication channels, such as their website, email, or telephone. Make sure you have the required documents ready to verify your identity and new banking details.

Follow these steps for a smooth update process:

- Provide your full name, account number, and any other necessary identification details to confirm your identity.

- State clearly that you wish to update your banking details. Specify the type of change (e.g., new account number, bank branch, etc.).

- Attach any relevant documents supporting the change, such as a recent bank statement or new account details.

- Ensure you ask for confirmation of the update to avoid errors. Request an official acknowledgment from the bank in writing or through their online platform.

After submitting your request, monitor your account to ensure the changes have been made correctly. If you notice discrepancies, reach out to customer service for clarification or additional steps.

Ensure the letter uses a clean, organized layout. Begin with a proper header that includes your name, address, date, and recipient’s contact information. Make sure to align the text to the left, keeping the margins consistent. This simple structure enhances readability and shows attention to detail.

1. Use Clear and Readable Fonts

Choose professional fonts such as Arial, Calibri, or Times New Roman. Keep the font size between 10-12 pt for body text. This ensures your message is easy to read while maintaining a formal appearance.

2. Maintain Proper Spacing

Use single spacing within paragraphs and a space between paragraphs. This helps prevent the letter from looking cramped. It also allows each section to stand out, making it easier for the recipient to follow your message.

3. Structure and Alignment

Align the text to the left, keeping paragraphs and sections neatly organized. Avoid center-aligned or right-aligned text, as it can make the letter appear unbalanced and less formal.

| Section | Formatting Tip |

|---|---|

| Header | Use a standard format with your details at the top |

| Body | Use proper spacing and alignment to improve readability |

| Closing | Sign off professionally with “Sincerely” or “Best regards” |

One common mistake is neglecting to provide full account details. Always include both the old and new account numbers to prevent any confusion. Missing information can delay the process or cause errors in updating your records.

Avoid submitting vague or incomplete requests. Be clear about the reason for the change and ensure that all necessary documents are attached. Failure to provide supporting documentation may result in your request being ignored or rejected.

- Not specifying the correct date for the account change can lead to mismatched transactions.

- Relying solely on verbal communication instead of formal written requests can cause misunderstandings.

- Overlooking confirmation of the request can leave you unaware of the status or any potential issues.

Ensure your contact information is up-to-date. If the bank cannot reach you due to incorrect details, your request might be delayed or rejected.

- Missing signatures or unverified personal details can cause your request to be incomplete.

- Requesting changes without thoroughly reviewing the terms and conditions might lead to complications with fees or services.

Finally, always follow up on your request to confirm it has been processed correctly. Waiting too long without checking could result in lost opportunities or uncorrected mistakes.

Ensure you provide all the required details in your request, including full name, account number, and the new bank account information. Double-check that there are no spelling mistakes or missing data. If any field is left blank, it can delay the process.

Submit the Correct Documentation

Attach any necessary documents, such as proof of your new account or identification. Ensure these documents are legible and up-to-date. Banks may not process requests without proper verification, which can slow things down.

Contact the Right Department

Reach out directly to the department handling account updates. If you’re unsure which team to contact, call the bank’s customer service line for guidance. Sending the letter to the correct department saves time and avoids unnecessary delays.

Send your request via the preferred communication method (mail, email, or online form). Banks often have faster processing times for requests submitted through their preferred channels. Always follow up after submission to confirm that your request is being processed.

Proper Structure for a Bank Account Change Letter

Begin your letter by clearly stating the reason for the account change. Provide both the old and new account details. Include your full name, address, and contact information at the top of the letter. Follow with the current account number and the new account number.

Next, briefly explain why you are changing your account. It could be due to a move, a change in banking preferences, or another specific reason. Be concise, but ensure the bank understands the nature of the change.

In the closing, express gratitude for the bank’s service and cooperation in facilitating the change. Make sure to include any necessary documentation, such as account transfer forms, if applicable. Sign the letter at the bottom and include your contact information once again.

Make sure the tone is formal yet friendly, keeping the communication clear and respectful. Double-check all details before sending to avoid errors that may delay the account change process.