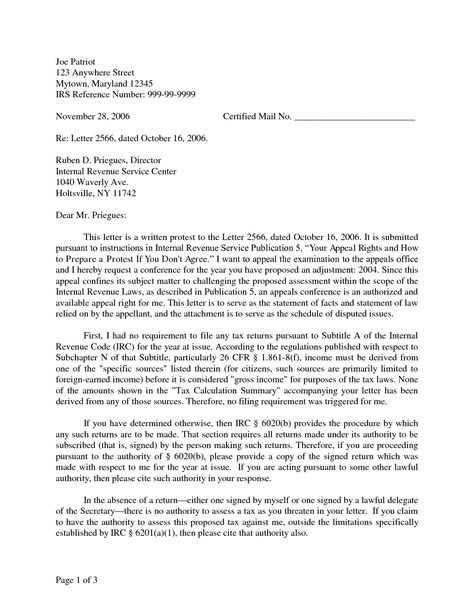

Template for letter to irs

If you need to write a letter to the IRS, using a clear and direct template can simplify the process. A well-structured letter helps convey your message efficiently and ensures you provide all necessary information without missing key details. Below is a simple template you can use to draft your own letter, which covers common situations like addressing a tax issue or requesting clarification on a notice.

Start with your personal information and the IRS’s contact details at the top. This will help the IRS associate your letter with your tax records quickly. Always include your full name, address, and tax identification number. Make sure to reference any notice or case number if you’re addressing a specific issue.

In the body of the letter, clearly explain the purpose of your communication. Be precise and avoid including unnecessary details. If you’re responding to an IRS notice, state the notice number and the reason for your response. If you’re requesting more information or clarification, explain what you need in a straightforward manner. Close with a polite request for a response, and provide any supporting documents that may assist in resolving your issue.

Here’s a basic format you can follow:

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Phone Number]

[Taxpayer Identification Number]

[Date]

Internal Revenue Service

[Address of IRS Office or Correspondence Address]

[City, State, ZIP Code]

Subject: [Brief Description of the Issue]

Dear Sir/Madam,

I am writing in reference to [mention reason for writing, e.g., “Notice CP2000 dated [date]”]. I would like to [explain the purpose of the letter, such as “clarify a discrepancy,” “request an extension,” or “respond to the notice”]. Please find attached [list any supporting documents, if applicable].

I would appreciate your assistance in resolving this matter and look forward to your response. If you require further information, feel free to contact me at the phone number listed above.

Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

Here’s the corrected text without repetitions:

To avoid delays, ensure the IRS address is correct on your letter. Always double-check the IRS contact information for your specific region. If you’re addressing an issue related to a refund or a balance due, clearly state your case and provide the necessary documentation. Keep a copy of all correspondence for your records.

Details to Include

Include your full name, address, and taxpayer identification number (TIN) in the letter. Mention any specific forms or notices that prompted you to contact the IRS. If applicable, refer to any previous communication you’ve received from them.

Structure and Clarity

Be clear and concise in your explanation. Avoid unnecessary details. Stick to the facts and provide supporting evidence where possible. A well-organized letter with a straightforward request can significantly speed up the process.

- Template for IRS Letter

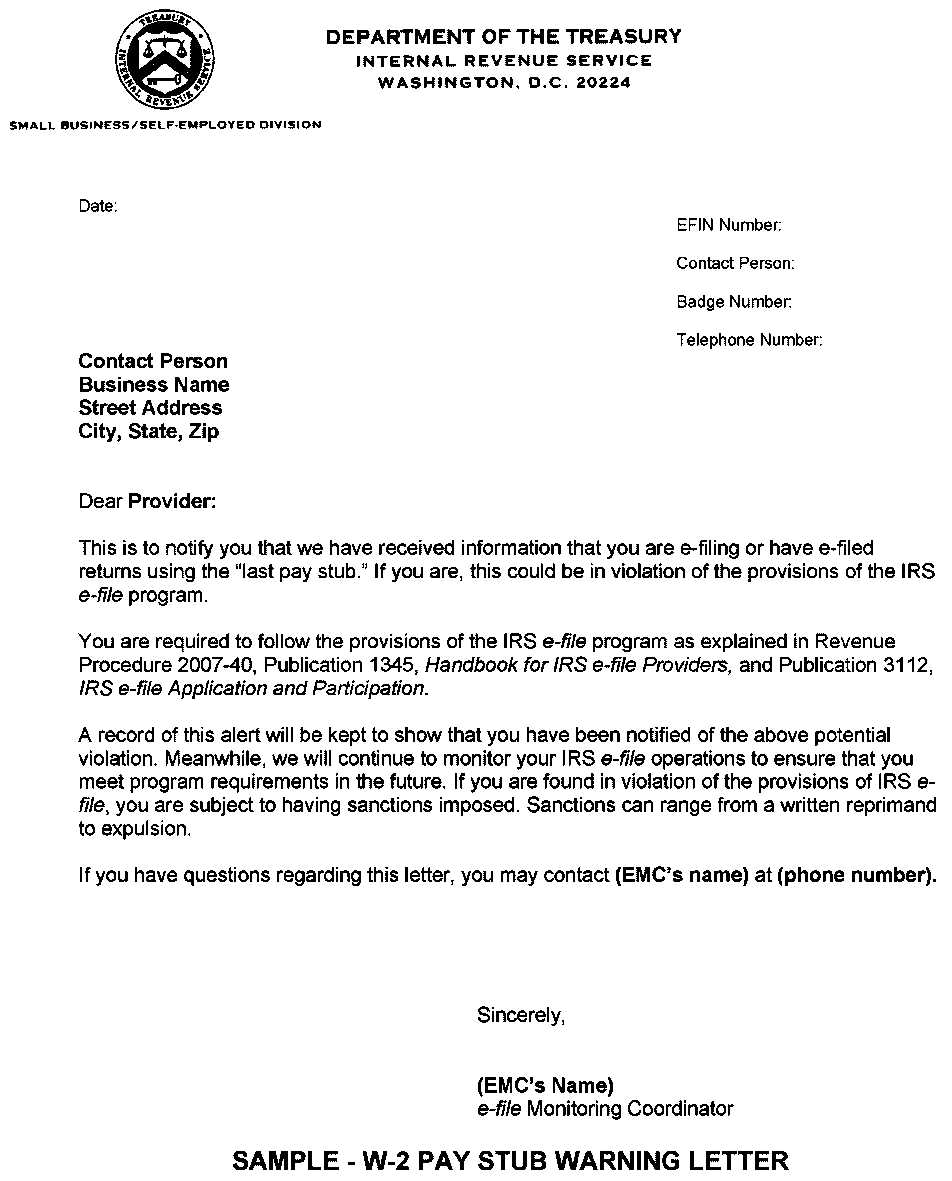

When writing a letter to the IRS, ensure clarity and accuracy. Here’s a basic template to guide your letter writing process. It includes the necessary details and follows a formal structure to improve the chances of a prompt response.

IRS Letter Template

Your Name

Your Address

City, State, ZIP Code

Phone Number

Email Address

Date

Internal Revenue Service

Address of the IRS office you are contacting

City, State, ZIP Code

Dear Sir/Madam,

Subject: [Your Subject – Example: Clarification of Tax Payment or Request for Tax Transcript]

I am writing in regard to [briefly explain the reason for your letter – e.g., “a discrepancy in my tax payment records” or “a request for information regarding my 2022 tax filing”]. Below are the details for your reference:

- Full Name: [Your Full Name]

- Taxpayer Identification Number (TIN) / Social Security Number (SSN): [Your TIN or SSN]

- Tax Year: [Year in question]

- Details of the issue: [Briefly describe the issue, query, or request]

- Supporting Documents: [List any documents you are including, e.g., tax return, payment receipts, etc.]

Should you need additional information, feel free to contact me at the phone number or email listed above. I appreciate your attention to this matter and look forward to your timely response.

Sincerely,

[Your Name]

Important Notes

Be sure to use a formal tone and keep the letter brief. Double-check all provided information for accuracy. Always keep a copy of your letter and any correspondence with the IRS for your records.

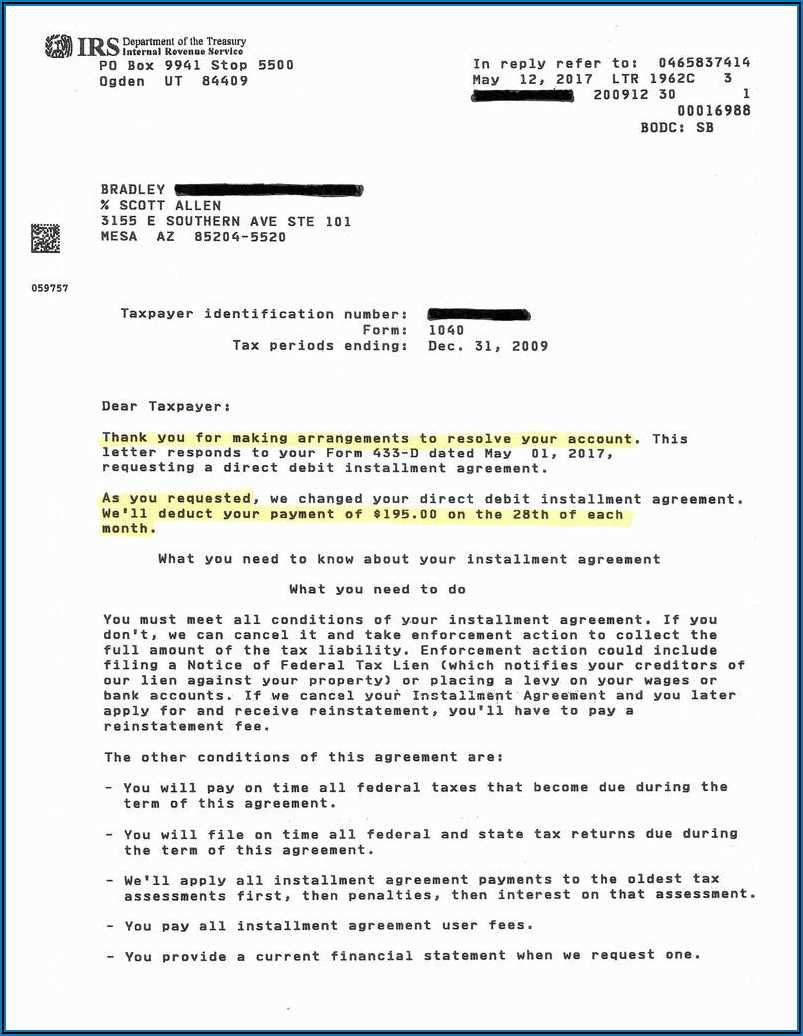

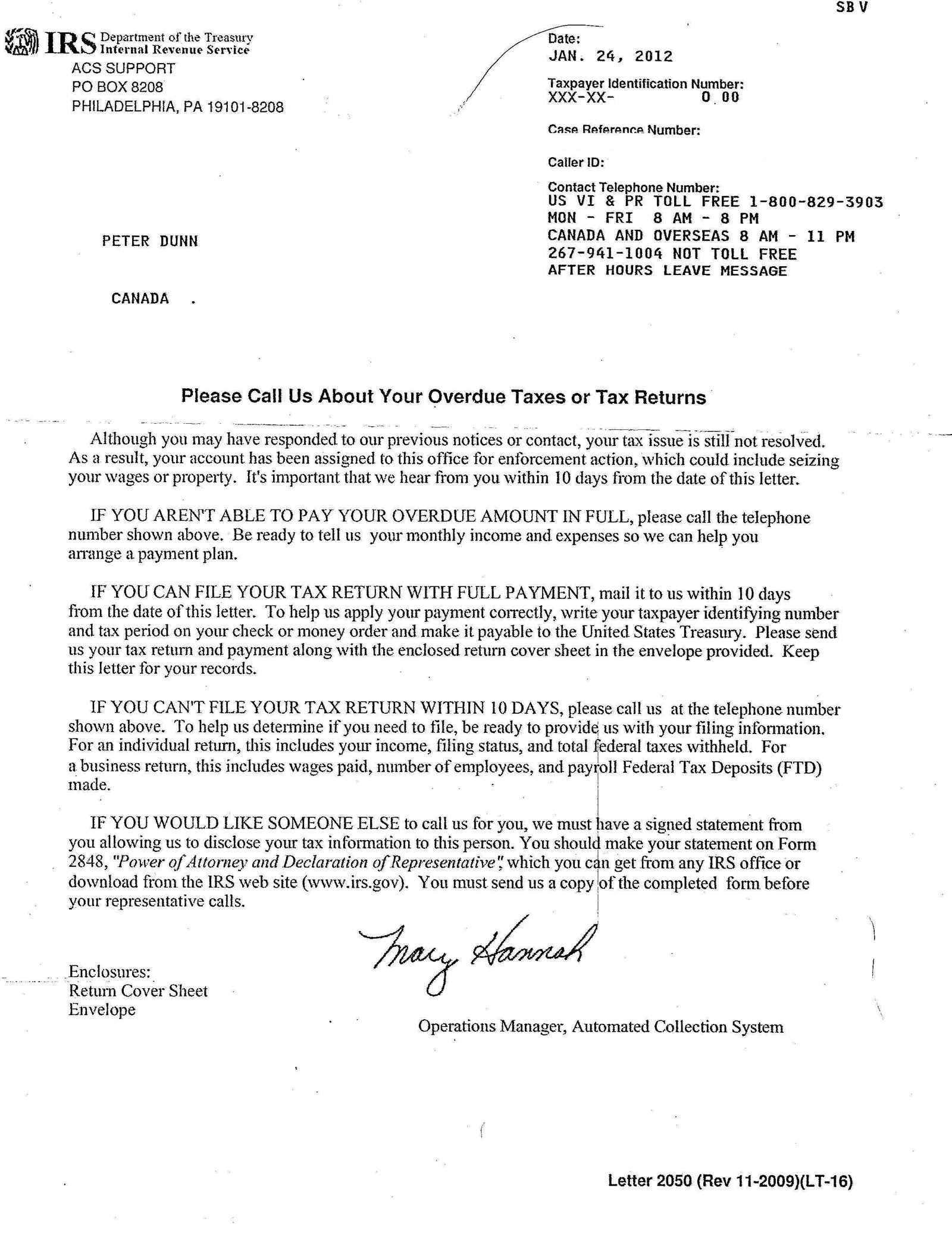

Begin by addressing the IRS with a formal greeting. Use the phrase “To Whom It May Concern” if you are unsure about the recipient. Ensure your contact information is placed at the top, including your full name, address, and taxpayer identification number, which is critical for the IRS to locate your records. If you are responding to a specific notice, reference the notice number in the subject line for quick identification.

State the Purpose Clearly

Open the letter by directly stating the reason for your communication. Whether you are disputing a charge, requesting an extension, or providing additional documents, make this clear in the first paragraph. Be precise and avoid any ambiguity about your request or concern.

Provide Supporting Information

Include relevant documents or data that support your case, such as tax returns, receipts, or correspondence from the IRS. Mention any pertinent facts or figures that will help clarify the situation. Avoid unnecessary details and stick to what is directly related to your issue.

Conclude the letter with a polite closing, offering to provide further information if needed. Use “Sincerely” followed by your name and signature. Ensure that your letter is concise, accurate, and free from errors to make the process smoother for both you and the IRS.

Make sure to include your full name, address, and the best contact number where the IRS can reach you. This helps ensure that they can easily correspond with you about your issue.

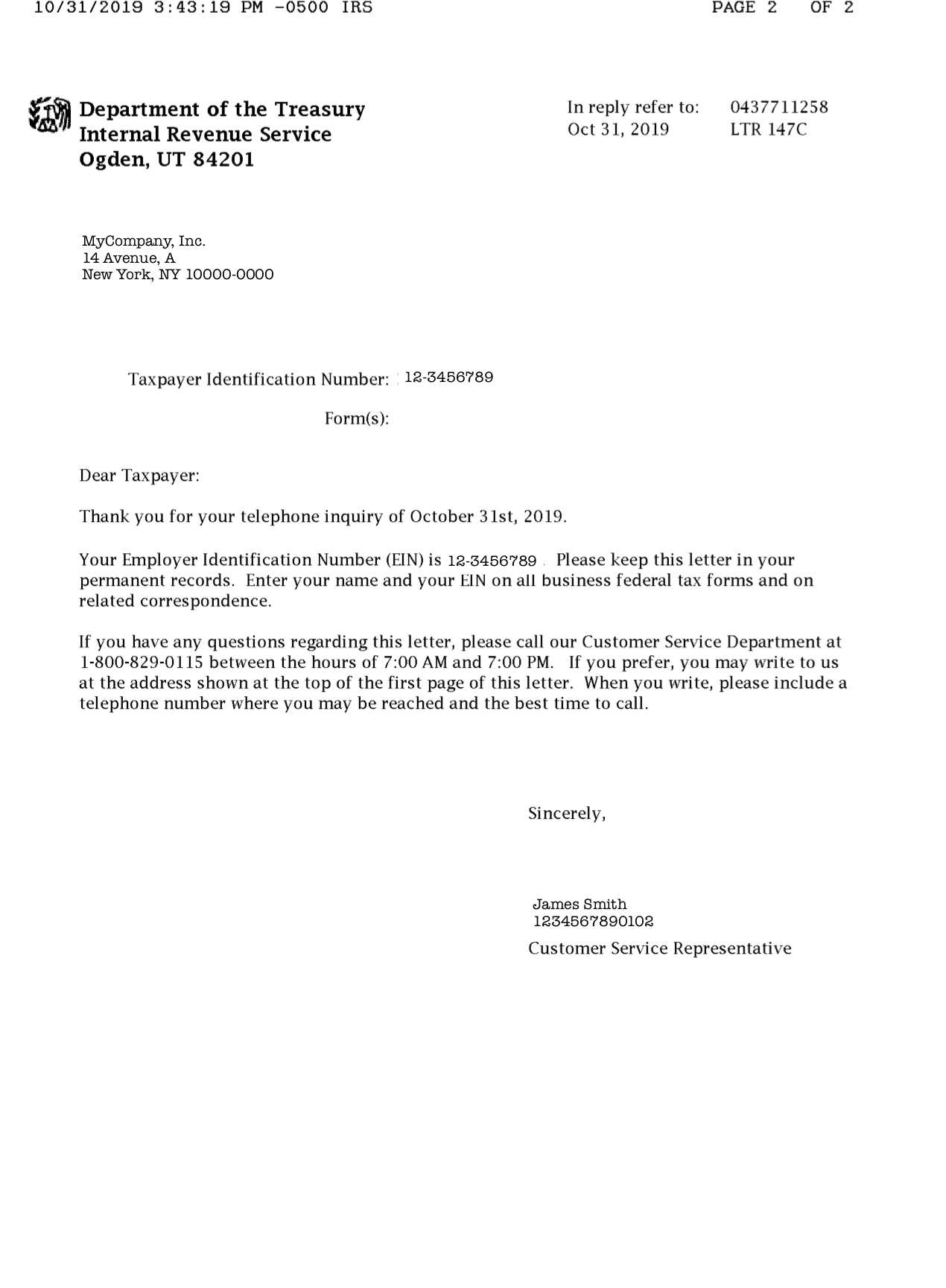

Taxpayer Identification Number (TIN)

Always include your TIN or Social Security Number (SSN) if you’re an individual. For businesses, provide the Employer Identification Number (EIN). This ensures the IRS can correctly identify your account and avoid any confusion.

Tax Year or Period

Specify the tax year or period your letter is concerning. This helps the IRS locate your records quickly and efficiently, ensuring a faster resolution to your issue.

If you’re responding to a specific IRS notice, include the notice number and the date it was issued. This ensures your letter addresses the correct matter and the IRS can match it with their system.

If you’re submitting documents, clearly reference them in your letter. Use specific names or descriptions, and list them out to prevent misunderstandings or misplaced paperwork.

Finally, provide a clear and concise explanation of your issue, question, or request. Be direct and to the point, detailing any actions you’ve already taken or plans you have moving forward.

Ensure your letter is clear and direct. Avoid being vague or overly complex, as the IRS may struggle to understand your request.

1. Missing or Incorrect Information

- Double-check your Taxpayer Identification Number (TIN), Social Security Number (SSN), or Employer Identification Number (EIN). A simple mistake can delay processing.

- Verify the accuracy of your address and contact details to prevent communication delays.

- Clearly state the tax year or period related to your inquiry or request.

2. Not Following the Correct Format

- Adhere to any specific formatting guidelines provided by the IRS. For instance, if you are submitting forms, make sure they are filled out properly.

- Use standard, professional language and avoid informal or overly casual tone in your letter.

3. Ignoring IRS Instructions

- Read any IRS correspondence carefully. Make sure you follow any specific instructions for submitting documents or providing additional details.

- Failure to follow guidelines may result in delays or a request for more information.

4. Not Including Supporting Documents

- Always include any documents requested by the IRS. Missing documents may cause delays or require you to resend your request.

- If you are requesting a tax refund, include proof of payment or other relevant records as needed.

5. Being Too Late

- Submit your letter promptly. Be aware of any deadlines to avoid penalties or complications with your case.

- If you’re responding to an IRS notice, make sure to send your letter before the deadline specified in the notice.

If you haven’t received a response from the IRS, take the following steps to resolve the situation:

1. Check the Status Online

Visit the IRS website and use their “Where’s My Refund?” tool or the “IRS2Go” app. These resources provide up-to-date information about the status of your request. Ensure the details you entered are correct, including your Social Security Number and the exact amount you filed.

2. Review Your Timeline

Confirm that enough time has passed. For example, the IRS typically processes refunds within 21 days if filed electronically. Paper submissions may take longer. Wait for the prescribed period before reaching out to the IRS.

3. Contact the IRS Directly

If you still haven’t received a response after the appropriate waiting time, call the IRS at their toll-free number: 1-800-829-1040. Prepare for long wait times, as this is common during busy periods. Have your tax information ready for faster assistance.

4. Submit a Follow-Up Inquiry

If calling doesn’t work, submit a formal inquiry to the IRS. You can use Form 3949-A to report any issues related to the lack of response or to request clarification. This method might take longer but can help escalate the situation.

5. Contact a Tax Professional

If all else fails, consider reaching out to a tax professional. They can assist with tracking your case or communicating directly with the IRS on your behalf.

| Step | Action | Timeframe |

|---|---|---|

| Check Status | Use IRS online tools or app | Immediately |

| Review Timeline | Wait for the standard processing time | 21 days for e-filed returns, longer for paper returns |

| Contact the IRS | Call 1-800-829-1040 | After waiting the appropriate amount of time |

| Submit a Formal Inquiry | Complete Form 3949-A | When no response is received after contacting the IRS |

| Consult a Tax Professional | Get assistance from an expert | As a last resort |

If you haven’t received a response to your letter from the IRS, follow up after a reasonable time, typically 30 to 45 days. Start by checking the IRS’s current processing times online to see if delays are common for your situation.

Contact the IRS directly by calling their toll-free number, 1-800-829-1040. Have your taxpayer identification number, correspondence details, and any case reference numbers handy when speaking with a representative.

If calling isn’t effective, consider sending a follow-up letter. Be sure to reference your original correspondence, including the date and the issue addressed. Be concise and polite while clearly stating that you’re seeking an update on the status of your inquiry.

For quicker follow-up, you can check the status of certain IRS matters online through their website, particularly for refunds or issues related to specific forms.

In cases of unresolved issues after multiple follow-ups, you can file a formal complaint with the IRS Office of the Taxpayer Advocate for further assistance.

Use clear and legible fonts like Arial or Times New Roman in size 12. This ensures your letter is easy to read and professional.

Align your text to the left and leave margins at 1 inch to maintain a clean, organized appearance. Avoid center-aligning or excessive spacing.

Start with your contact information at the top, followed by the date, and then the IRS address. Ensure the recipient’s details are placed below, aligned to the left.

Use formal, direct language without unnecessary filler. Keep your sentences concise and to the point, ensuring clarity in every paragraph.

Include a subject line if applicable, summarizing the purpose of the letter in a few words. This makes it easier for the IRS to understand the intent of your communication immediately.

Separate different sections of the letter with single-line breaks, and avoid dense blocks of text. This enhances readability and makes your letter look more organized.

End your letter with a professional closing such as “Sincerely” or “Respectfully,” followed by your signature and full name.

Creating an Effective Template for a Letter to the IRS

Begin with a clear, respectful opening statement. Address the IRS by their official name and include your contact details for easy reference. Here’s how you can structure your letter:

- Subject line: Clearly state the reason for writing, such as “Request for Payment Plan” or “Tax Return Inquiry.”

- Introduction: Politely introduce yourself, including your full name, Social Security Number (or Employer Identification Number), and any other relevant identifiers.

- State the issue: Briefly explain the reason for the letter. Be concise and direct to avoid confusion. Mention any previous correspondence or reference numbers that may apply.

- Provide supporting information: Attach any documents that support your case. This may include tax returns, receipts, or notices from the IRS.

- Ask for action: Clearly state what you are requesting. Whether it’s an extension, a correction, or clarification, be precise in your request.

- Polite closing: Thank the recipient for their time and assistance. Include a request for confirmation or follow-up if applicable.

Ensure that all relevant details are included in a straightforward manner. This improves the chances of a quick and favorable response.