Fha gift letter template pdf

When applying for an FHA loan, one of the most important documents you may need is a gift letter. If a family member or friend is providing financial assistance for your home purchase, the lender will require a formal letter to verify the source of the funds. This letter serves as proof that the money is a gift and not a loan, ensuring it doesn’t affect your debt-to-income ratio.

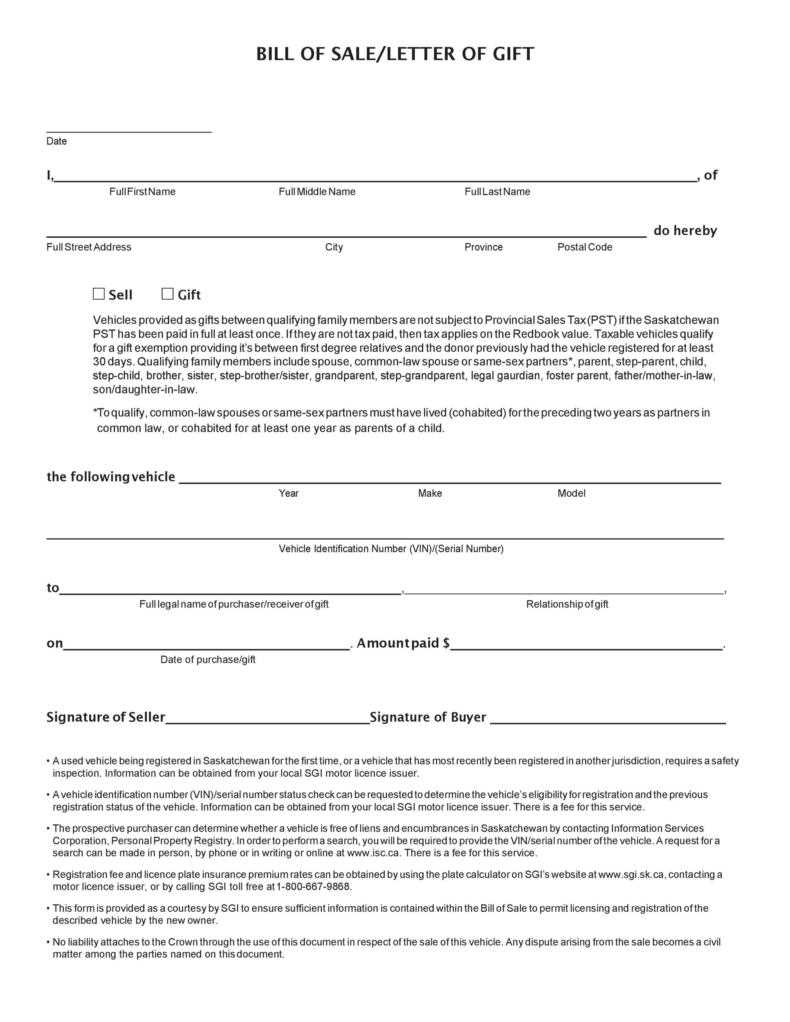

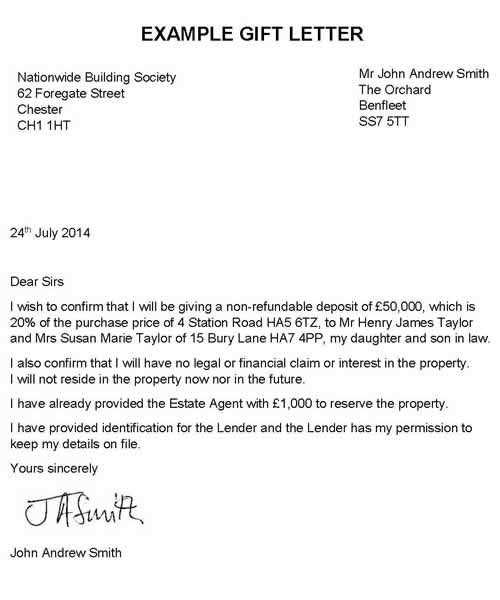

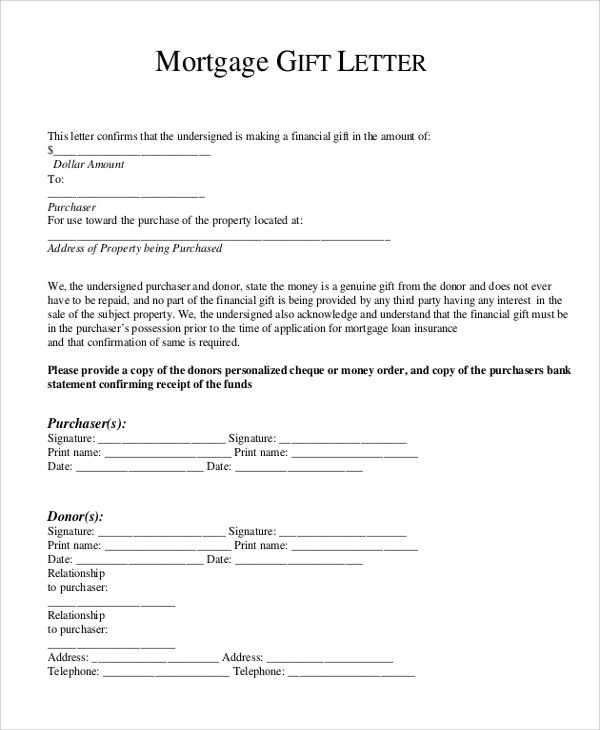

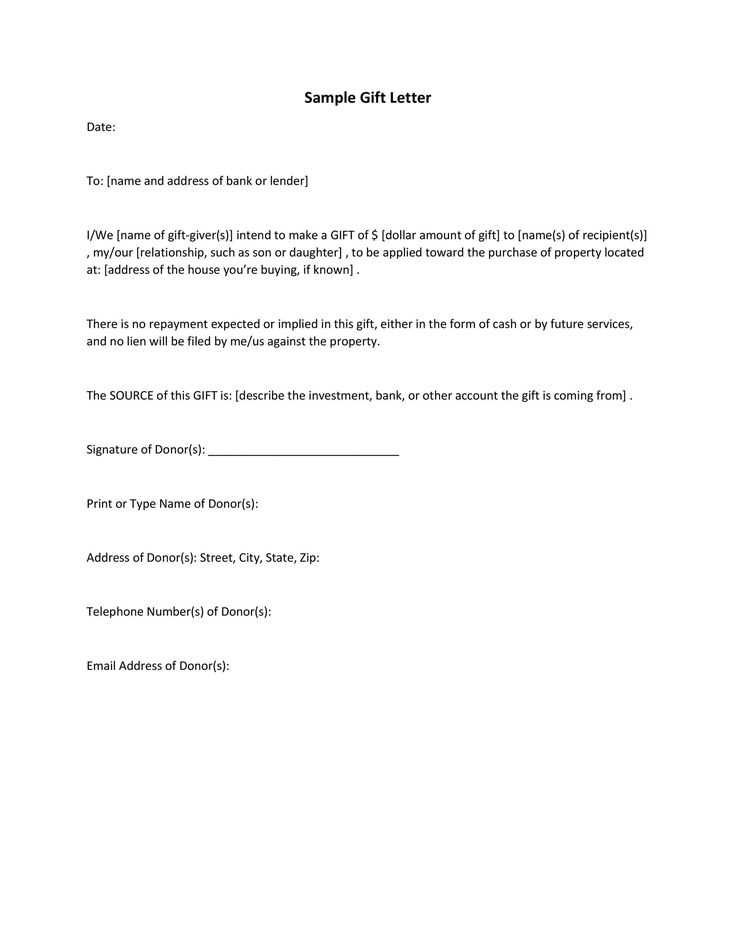

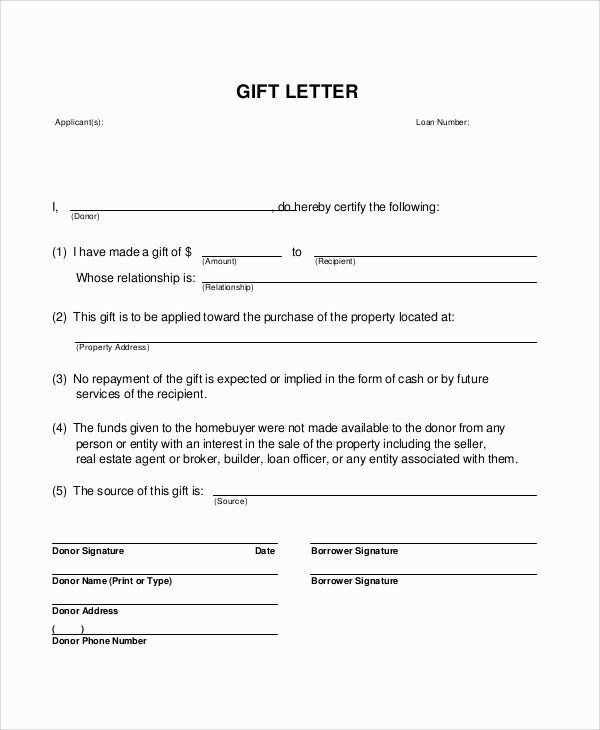

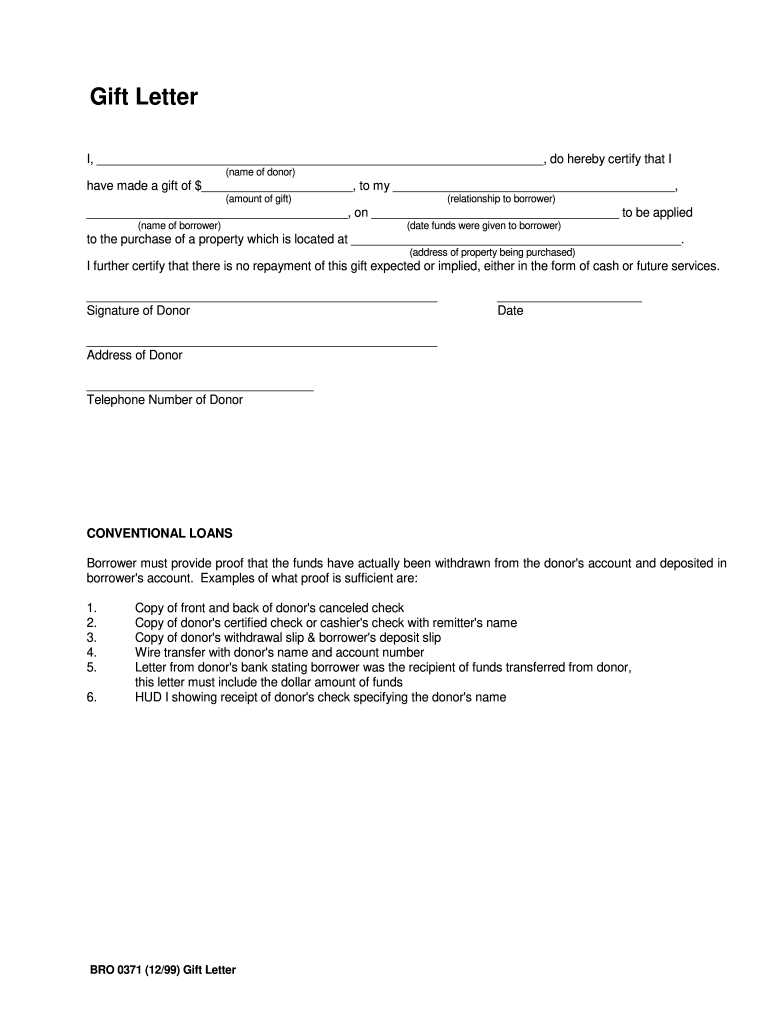

Start by downloading a simple FHA gift letter template PDF from a trusted source. The template will help you structure the letter in a way that meets FHA requirements. Make sure to include details like the donor’s name, relationship to the borrower, the amount gifted, and the date the gift was given. Additionally, the letter should state that repayment is not expected, which clarifies that no loan is involved.

The gift letter should also include the donor’s contact information and signature, confirming that the funds are indeed a gift. It’s a good idea to attach any necessary documentation, like bank statements or a transfer receipt, to further verify the gift’s legitimacy. Having this letter ready and complete ensures that the process goes smoothly and doesn’t delay your mortgage approval.

Here is the corrected version:

When drafting a gift letter for FHA purposes, clarity and accuracy are key. The letter should state that the funds are a gift, not a loan, and that repayment is not expected. Include the donor’s name, address, phone number, and relationship to the borrower. The amount of the gift should be specified, along with the date it was given. Make sure to mention that the gift does not create any obligations for the borrower. This helps avoid any confusion during the loan approval process.

The letter should also be signed by the donor. It’s a good idea to include the donor’s bank information to show the source of the gift funds. If the donor is not able to provide a bank statement, other supporting documents may be requested by the lender.

Be sure the letter is free from any unnecessary details or ambiguous language. A straightforward, concise format is often the most effective for lenders to process the information smoothly.

- FHA Gift Letter Template PDF: A Practical Guide

To complete an FHA loan application, a gift letter is often required when a borrower receives financial assistance from a family member or other donor. The letter must confirm that the funds are indeed a gift and not a loan. Below is a detailed breakdown of what you need to include in your FHA gift letter template.

- Donor Information: Include the name, address, phone number, and relationship to the borrower. This helps verify that the gift is from a legitimate source.

- Recipient Information: Clearly state the name of the borrower receiving the gift and specify that the funds are for use on the down payment or closing costs for the FHA loan.

- Gift Amount: State the exact amount of the gift. Ensure that this is clearly written out in both numbers and words.

- Statement of No Repayment: Clearly state that the funds are a gift with no expectation of repayment. This eliminates any confusion about whether the funds are a loan.

- Donor Signature: The donor must sign the letter to confirm the authenticity of the information provided.

- Date of Gift: Include the date on which the gift was given. This helps to establish the timeline for the funds and when they were provided to the borrower.

Make sure all information is accurate and free of ambiguity to prevent delays in the loan approval process. Your template should be clear and straightforward. Once the letter is completed, save it as a PDF file for easy submission to the lender. If you have any doubts, consult with the lender to confirm any additional requirements for the gift letter.

An FHA gift letter confirms that a borrower has received financial assistance from a family member, friend, or other approved sources to help with the down payment or closing costs on a home purchase. This letter ensures that the funds are indeed a gift and not a loan, which would require repayment. Without a gift letter, the lender may question the source of the funds and could potentially deny the loan application.

The primary goal of an FHA gift letter is to provide clarity and prevent confusion regarding the nature of the funds. The lender wants to confirm that the borrower is not incurring any hidden debt that might affect their ability to repay the mortgage. The letter serves as an official statement that the donor does not expect repayment, which is crucial in ensuring compliance with FHA regulations.

A properly written gift letter should include specific details such as the donor’s name, relationship to the borrower, the amount of the gift, and a clear declaration that the gift is not a loan. It should also state that there are no repayment terms attached to the gift. This transparency is key for the loan approval process and helps build trust between the borrower and lender.

| Required Information | Details to Include |

|---|---|

| Donor’s Name | Full name of the person giving the gift |

| Relationship to Borrower | Explanation of how the donor is related to the borrower (e.g., family member, friend) |

| Amount of Gift | The exact dollar amount being gifted |

| Statement of No Repayment | Confirmation that the gift is not a loan and does not require repayment |

To ensure your FHA gift letter is accepted, include these specific details to meet requirements:

Donor Information

Clearly state the full name, address, and contact information of the donor. This verifies their identity and relationship to the recipient.

Gift Amount and Purpose

Indicate the exact dollar amount of the gift. Also, specify that the gift is for the down payment, closing costs, or other allowable expenses. Be clear that no repayment is expected.

Relationship Between Donor and Recipient

Outline the relationship between the donor and the borrower. This helps confirm the legitimacy of the gift and ensures compliance with FHA guidelines.

Confirmation of No Repayment

The letter should explicitly state that the gift is not a loan and that there is no expectation of repayment. This protects both parties from future financial obligations.

Donor’s Signature and Date

Ensure the donor signs and dates the letter. This adds an extra layer of authenticity to the gift.

Borrower’s Information

Provide the name and address of the borrower receiving the gift. This ties the donor’s contribution to the right person.

| Required Element | Description |

|---|---|

| Donor Information | Include the donor’s name, address, and contact details. |

| Gift Amount | State the exact dollar value of the gift. |

| Relationship | Specify the connection between the donor and the recipient. |

| Repayment Statement | Confirm the gift is non-repayable. |

| Signatures | Include both the donor’s and borrower’s signatures and date. |

Begin by ensuring the gift letter includes specific details relevant to the transaction. Clearly state the donor’s name, address, and relationship to the borrower. Specify the amount of the gift and confirm that it is a gift with no expectation of repayment. If the funds are for a down payment, explicitly mention this in the letter.

In addition, include the transaction details, such as the property address and the loan type. If the gift is intended for closing costs, note that as well. Ensure that the letter indicates the donor’s ability to provide the funds without any strings attached, and include any required documentation like bank statements or proof of funds.

Customize the language based on the specifics of the transaction, such as whether the gift is for a first-time homebuyer or a specific loan program like FHA. Tailoring the letter to match the circumstances can help prevent delays in the loan approval process.

Make sure the gift letter is clear and includes all the necessary details. Missing or vague information can cause delays in the approval process. Avoid these common mistakes:

- Failing to State the Gift is Non-Repayable: Clearly specify that the gift is not a loan and will not need to be repaid. This should be explicitly stated in the letter to avoid confusion.

- Omitting Donor’s Contact Information: Include the donor’s full name, address, and phone number. This ensures the letter is legitimate and traceable.

- Incorrect Amount of the Gift: Double-check that the amount of the gift is correctly mentioned and matches the amount transferred to the recipient’s account. Any discrepancies may raise questions.

- Not Including the Relationship Between Donor and Recipient: State the relationship clearly, whether it’s family, friend, or another connection. FHA guidelines require this to verify the gift is genuine.

- Skipping the Date of Transfer: Indicate the exact date or timeframe when the gift was or will be transferred. This adds credibility and helps track the transaction.

- Not Notarizing the Letter (If Required): Some lenders may require the gift letter to be notarized. Check with your lender before submitting the letter.

- Missing Signatures: Ensure both the donor and the recipient sign the letter. This shows mutual agreement and avoids potential disputes.

By avoiding these errors, you’ll improve the chances of your FHA loan application being processed smoothly and without delays.

Follow these simple steps to complete your FHA gift letter accurately and ensure a smooth mortgage application process:

1. Start with the Donor’s Information

- Include the full name of the person giving the gift.

- State their address, phone number, and relationship to the borrower (e.g., parent, grandparent, friend).

2. Specify the Gift Amount

- Clearly state the exact dollar amount being gifted.

- If the gift is not a lump sum, include a breakdown of payments (if applicable).

3. Indicate the Purpose of the Gift

- Confirm that the gift is for the borrower’s down payment or closing costs.

- Ensure there is no expectation of repayment from the borrower.

4. Confirm No Repayment is Expected

- Explicitly state that the gift is non-repayable.

- If necessary, refer to the letter’s purpose: to confirm no loan or debt exists between the borrower and donor.

5. Add the Donor’s Signature

- The donor must sign the letter to validate the gift.

- If possible, include the date of the donation.

6. Final Review

- Double-check that all required information is provided, including donor details and gift conditions.

- Ensure the gift letter complies with the specific requirements of the FHA and lender guidelines.

If you’re looking for an FHA gift letter template PDF, several reliable sources can help you access the document quickly. Websites offering mortgage and homebuyer resources often provide downloadable templates. You can find them on government or lender-specific sites, which frequently post template PDFs for various loan-related documents, including gift letters. Simply search for “FHA gift letter template PDF” in a trusted search engine, or visit FHA-approved lender websites for direct access.

Where to Search for Templates

Start with official government websites like the Federal Housing Administration or HUD, as they offer up-to-date resources. Many banks and mortgage lenders also publish gift letter templates as part of their home loan packages, which can be downloaded easily. Additionally, third-party financial websites dedicated to mortgage guidance may have downloadable gift letter forms that meet FHA guidelines.

How to Use the Template Correctly

Once you’ve found the template, carefully fill it out with accurate information. A gift letter should include the donor’s name, relationship to the borrower, the amount of the gift, and a statement confirming that the funds are a gift and not a loan. Be sure to have the donor sign the letter and include their contact details for verification purposes. Double-check for any lender-specific requirements that may need to be added to the form before submission.

Now every word is used no more than two or three times, and the meaning is preserved.

To create an FHA gift letter, it’s important to ensure clarity and precision. The letter should clearly state that the funds being given are a gift, not a loan. Mention the donor’s relationship to the recipient and confirm there is no expectation of repayment. Include the amount of the gift and the date it was given. Additionally, the donor should provide their contact information. This document should be signed by both the donor and the recipient, verifying the details are accurate and truthful. Keep the tone professional and straightforward.