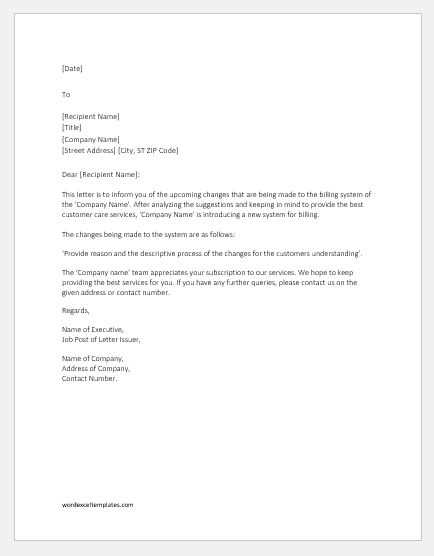

Change of payment terms letter template

When adjusting payment terms, it’s vital to communicate the change clearly and professionally. This ensures both parties understand the new expectations and maintain a positive business relationship. A well-crafted letter can set the tone for the next steps and prevent misunderstandings.

Start by directly stating the change in payment terms, specifying the old and new terms. Use clear language to outline the effective date and any relevant details, such as grace periods or additional charges. Be concise and to the point, so the recipient can quickly absorb the key information.

Offer a brief explanation for the adjustment. Whether it’s due to changes in your business’s cash flow or a shift in operational needs, providing a reason fosters transparency. If appropriate, mention any flexibility or willingness to discuss terms further. Ending the letter on a positive note can help maintain a constructive tone.

Here is the revised version:

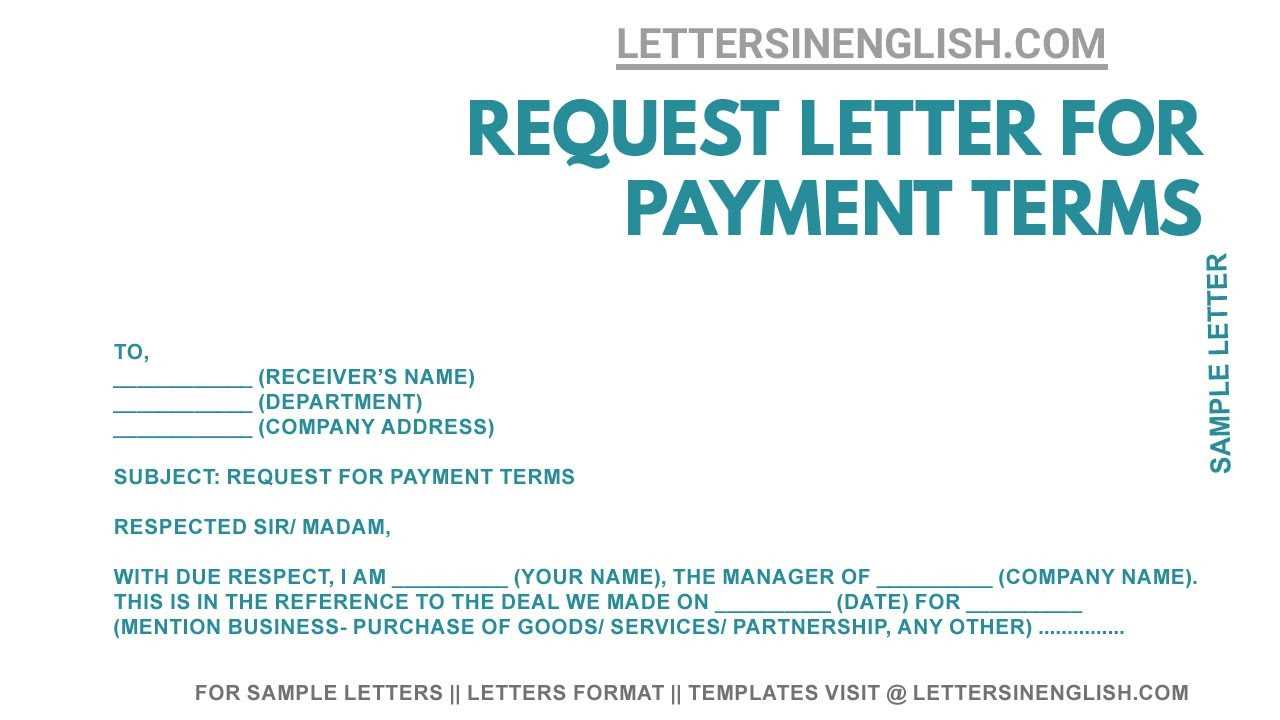

Use clear and direct language to communicate changes to your payment terms. This avoids misunderstandings and ensures that both parties are aligned. Start with the date and reference the original agreement. Mention the specific changes in payment terms, and provide reasoning where necessary to maintain transparency.

Payment Terms Update

We would like to inform you that, effective from [date], the payment terms outlined in our previous agreement will be modified. The new payment terms will be as follows:

- Payment Due Date: [New Due Date]

- Discount: [New Discount Terms, if applicable]

- Late Fee: [New Late Fee Terms, if applicable]

Reason for the Change

This adjustment is necessary due to [reason, e.g., changes in business operations, market conditions, etc.]. We trust that these new terms will continue to support our successful collaboration.

If you have any questions or need further clarification, please feel free to contact us.

Change of Payment Terms Letter Template

Steps to Craft a Payment Terms Modification Letter

How to Address a Customer or Client in the Communication

Key Elements to Include in the Payment Terms Update Notice

How to Explain the Reason Behind Altering Payment Terms

Legal Considerations When Modifying Payment Terms

Best Practices for Sending and Following Up on the Notice

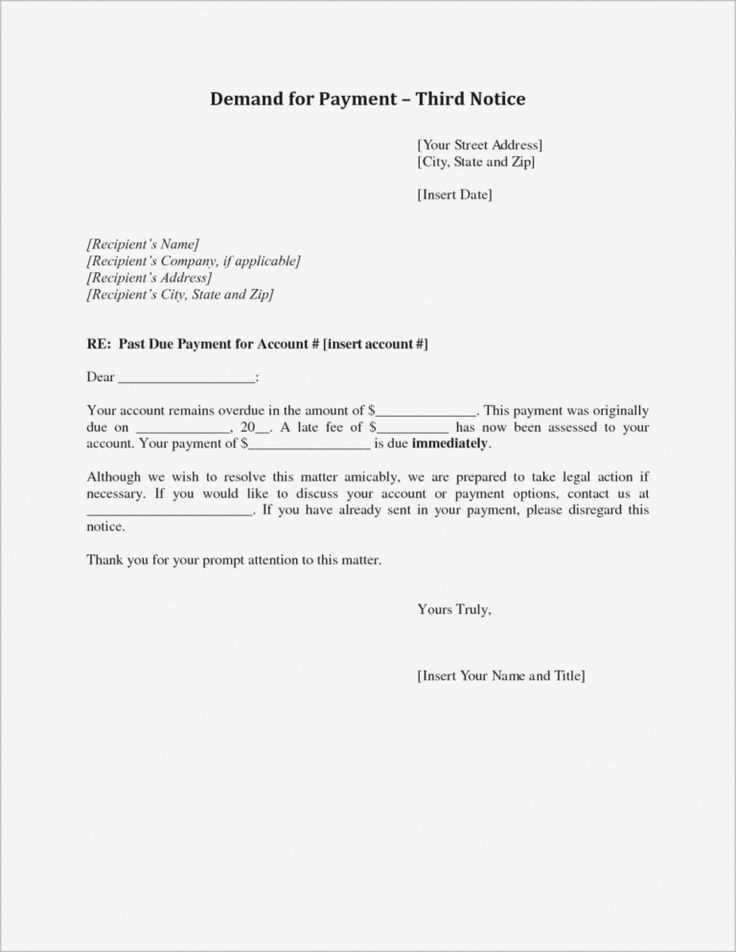

Begin by addressing the recipient respectfully. For a formal letter, use “Dear [Customer’s Name]” or “Dear [Client’s Name].” If the relationship is more informal, you may opt for a simpler greeting, like “Hello [Customer’s Name].” Next, state the purpose of the letter clearly–modifying payment terms. Specify the date the new terms will take effect. Keep the tone polite but direct.

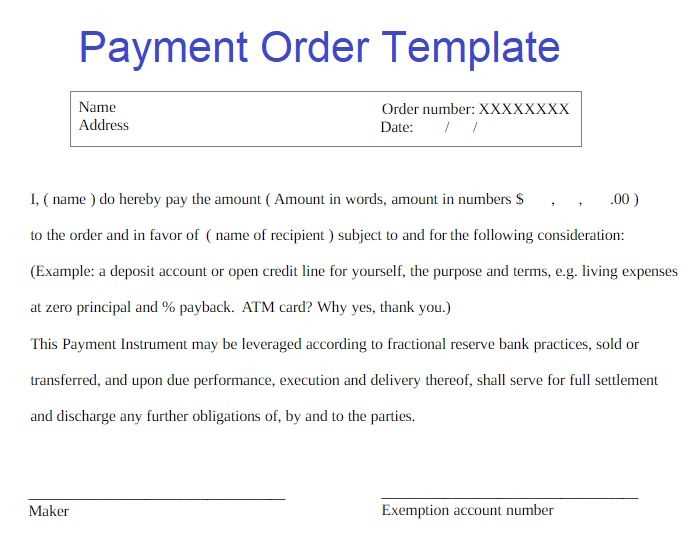

Include the original payment terms and the revised version side by side for easy comparison. Make sure to highlight changes in payment deadlines, methods, or discounts. This transparency avoids confusion and sets clear expectations.

Explain why the changes are necessary. Whether it’s due to adjustments in operational costs, updated financial policies, or market conditions, provide a straightforward reason without overcomplicating the explanation. Be concise and factual to maintain professionalism.

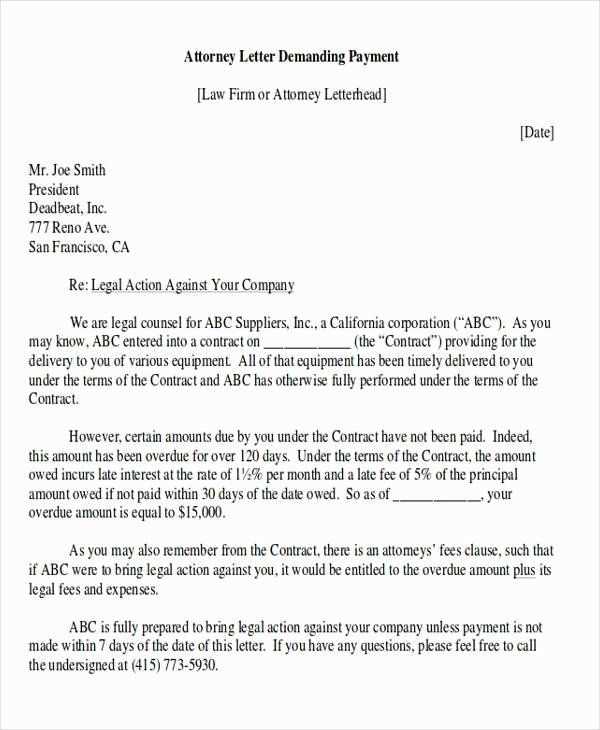

When addressing legal considerations, ensure the changes align with the contract terms. If the contract allows modification, reference the relevant clause. If needed, outline any steps for the client to agree, such as signing a new agreement or providing written consent. Always check local laws to ensure compliance.

Best practices for sending the letter include using a formal letterhead and sending it via a tracked method (email with receipt confirmation or certified mail). Give the recipient enough time to respond or raise any concerns. Follow up after a reasonable period, typically 7–10 days, to confirm receipt and address any questions.