Template letter to cancel credit card

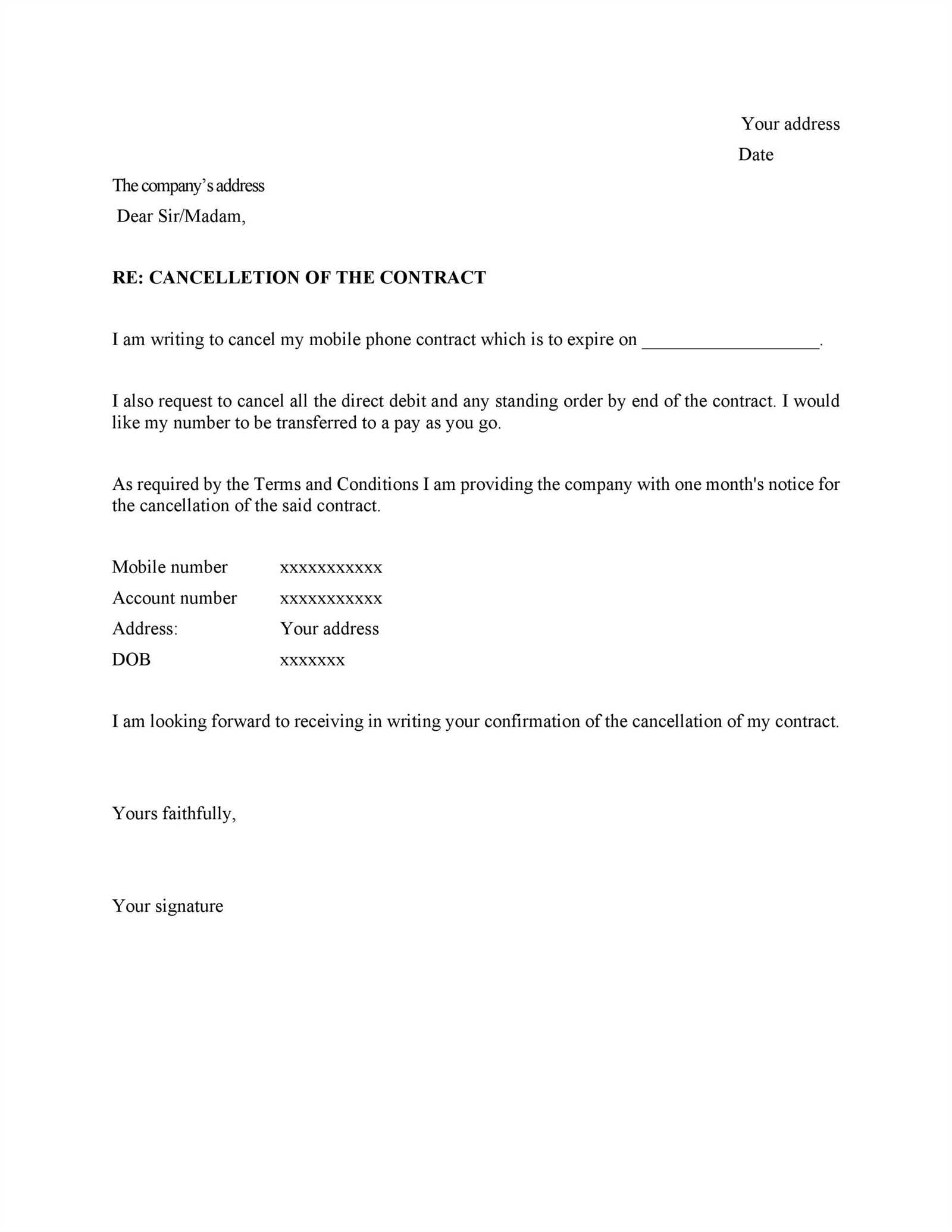

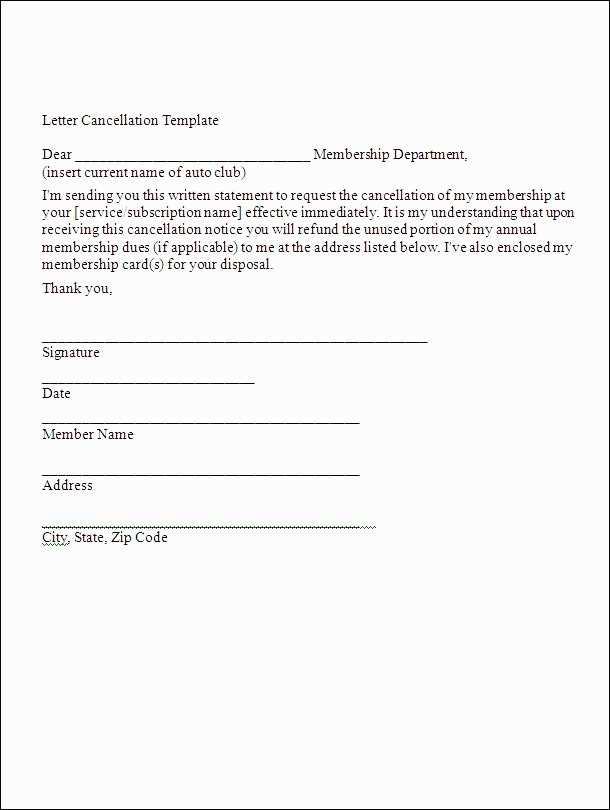

If you want to cancel your credit card, a formal written request is necessary. Use the template below to draft a clear and concise cancellation letter. Be sure to include all required details to avoid any misunderstandings with the issuer.

Start with your personal information, including your name, address, and contact details. This ensures the issuer can quickly identify your account. Then, clearly state your request to cancel the credit card. Make sure to mention the card type and the last four digits of your account number to prevent any confusion.

It’s important to confirm that you no longer wish to carry a balance or use the card. Additionally, ask for a written confirmation that the cancellation process has been completed. This provides peace of mind and a record of your request.

Finally, ensure that all payments are up to date before sending the letter to avoid any complications. Review the issuer’s cancellation policy, as some might require additional steps. Once the letter is sent, monitor your account to verify the cancellation has been processed correctly.

Here are the revised lines with reduced repetition:

To cancel your credit card, it’s crucial to inform the issuing bank in a clear, concise manner. Avoid including redundant details, as a brief letter is more effective.

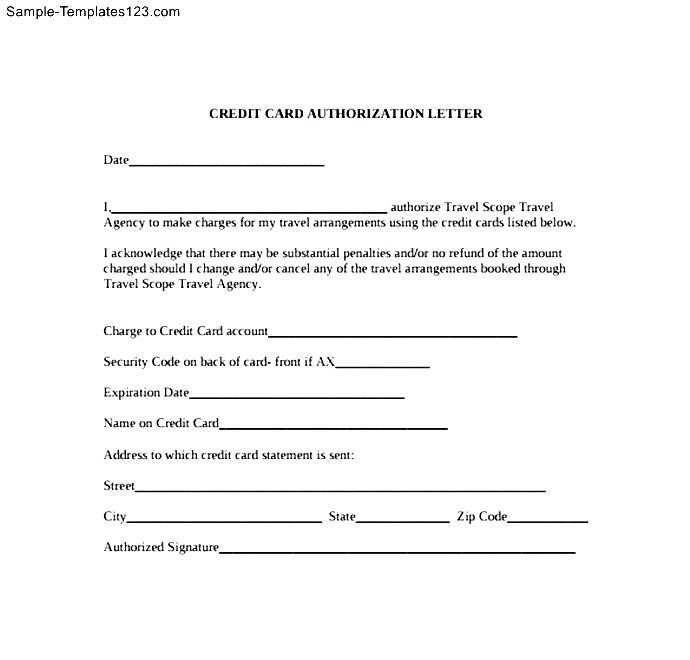

Template for Cancellation Request

Dear [Bank Name],

I am writing to formally request the cancellation of my credit card account, with the following details:

Account Holder Name: [Your Full Name]

Account Number: [Your Account Number]

I would appreciate it if you could confirm the closure of the account and provide any additional steps I may need to take. Kindly ensure that no further charges will be applied, and my information will be securely handled.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Full Name]

[Your Contact Information]

Template Letter for Cancelling a Credit Card

Understanding the Right Time to Cancel Your Card

Important Details to Include in a Cancellation Letter

How to Format Your Request to Cancel the Card

Managing Unpaid Balances Before Card Cancellation

What Steps to Take After Sending the Cancellation Request

How to Track the Progress of Your Card Cancellation

When you decide to cancel your credit card, timing is key. Canceling a card too soon may affect your credit score, so ensure the balance is paid off and avoid closing the account prematurely. Keep an eye on the card’s interest rates and fees as they may change after you make a request for cancellation.

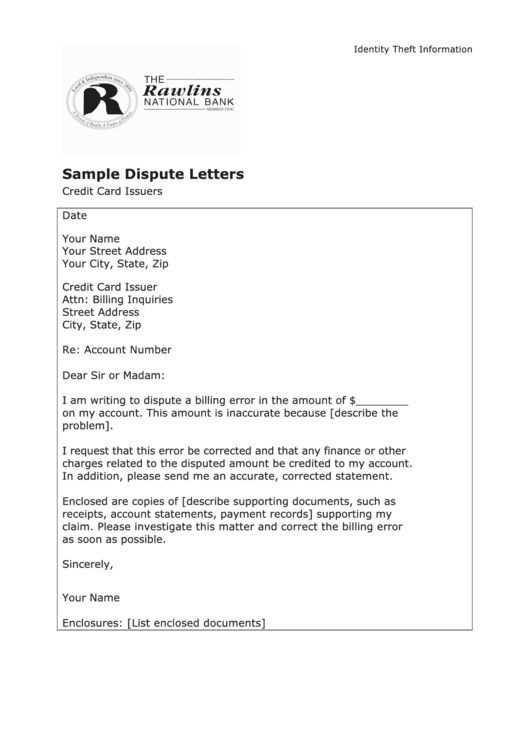

Important Details to Include in a Cancellation Letter

Clearly state your request to cancel the card and provide your account number. Make sure to mention the specific reason for cancellation, whether it’s due to high fees, an unappealing rewards program, or another reason. Include your personal details, such as your name, address, and contact information, to make processing easier. Always ask for written confirmation of cancellation from the card issuer.

Managing Unpaid Balances Before Card Cancellation

Before submitting a cancellation request, ensure your balance is fully paid. Leaving an outstanding balance could lead to complications or additional charges. If there’s any remaining balance, pay it off before submitting your cancellation request to avoid surprises later.

After you’ve sent the cancellation request, keep a record of the communication. If the card issuer fails to respond, follow up with them. Request a confirmation letter or email stating that your account has been successfully closed. Monitoring your account after cancellation is important to ensure no further transactions are processed.

To track the progress of your cancellation request, review your account statements regularly and verify that no new charges have been made. If necessary, request a final statement from the card issuer to confirm that the balance is zero and the card is closed. Stay proactive to ensure the process runs smoothly.