Template letter to dispute credit report

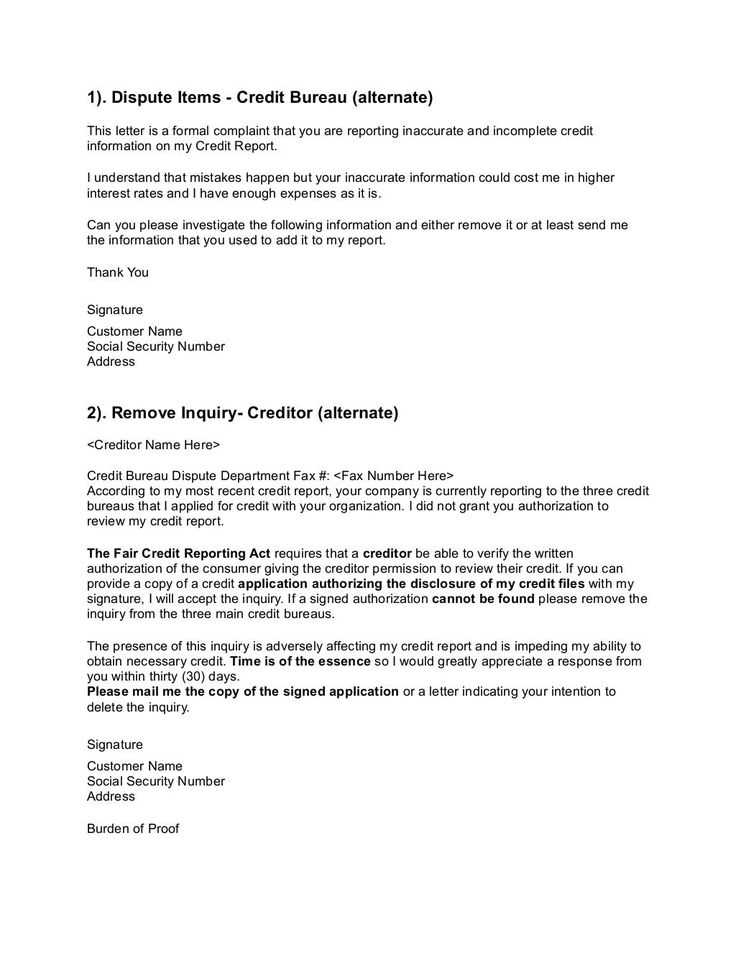

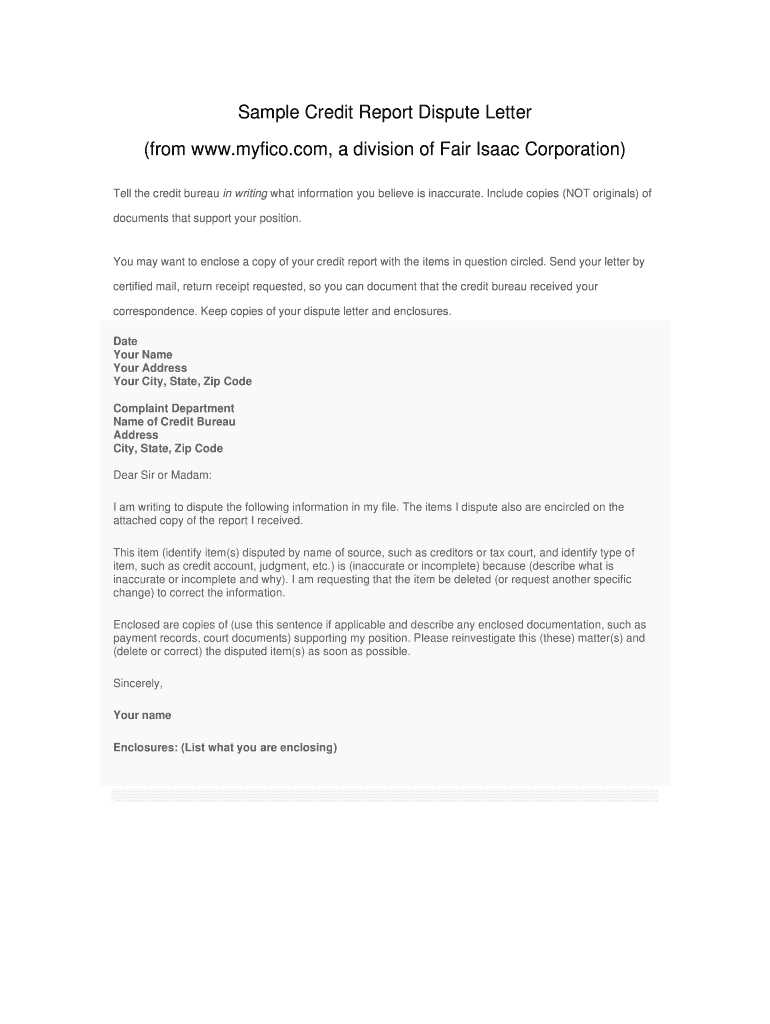

Disputing an error on your credit report is a straightforward process, but it requires clarity and accuracy. Start by addressing the credit bureau directly, using the correct format and tone to ensure your concern is taken seriously. Below is a template letter to guide you through the process of disputing inaccuracies.

Ensure you include all necessary details, such as the specific item you believe is incorrect, your personal information for verification, and any supporting documents that back your claim. This will help the credit bureau process your dispute quickly and efficiently.

Template Letter:

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

Credit Bureau Name

[Credit Bureau Address]

[City, State, ZIP Code]

Dear Sir/Madam,

I am writing to formally dispute an item on my credit report. The item in question is listed as [specific item or account number] and appears on my credit report dated [report date]. I believe this item is incorrect due to [brief explanation of why it’s wrong].

Attached are copies of supporting documents that validate my claim, including [list any documents, e.g., payment receipts, account statements, etc.]. I request that you investigate this issue and correct the error in accordance with the Fair Credit Reporting Act.

Please confirm receipt of this dispute and notify me once the investigation is complete. If you require further information, feel free to contact me at the details provided above.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Here are the revised lines with minimized repetition:

Begin by addressing the item directly, stating clearly that the information is incorrect or outdated. Provide specific details from the credit report and the necessary corrections. Mention the exact dates or amounts that need adjustment. Avoid unnecessary explanations that do not support your claim.

For example:

- “The balance reported on account #123456 does not reflect my recent payment of $500, made on January 10, 2024.”

- “The account was settled in full on May 15, 2023, but it still shows as ‘open.’ Please update this status to ‘closed.’”

Clearly identify the action you expect: “Please update my credit report to reflect this correction” or “Kindly remove this inaccurate entry.”

Provide Supporting Documentation

If possible, include relevant documentation such as payment receipts or settlement agreements. Reference them briefly, but keep it concise: “Attached are the receipts for payment made on January 10, 2024.”

Request a Timely Response

State a clear timeline for resolution, like “I expect a response within 30 days.” This helps set expectations for both parties involved.

- Template Letter to Challenge Credit Report

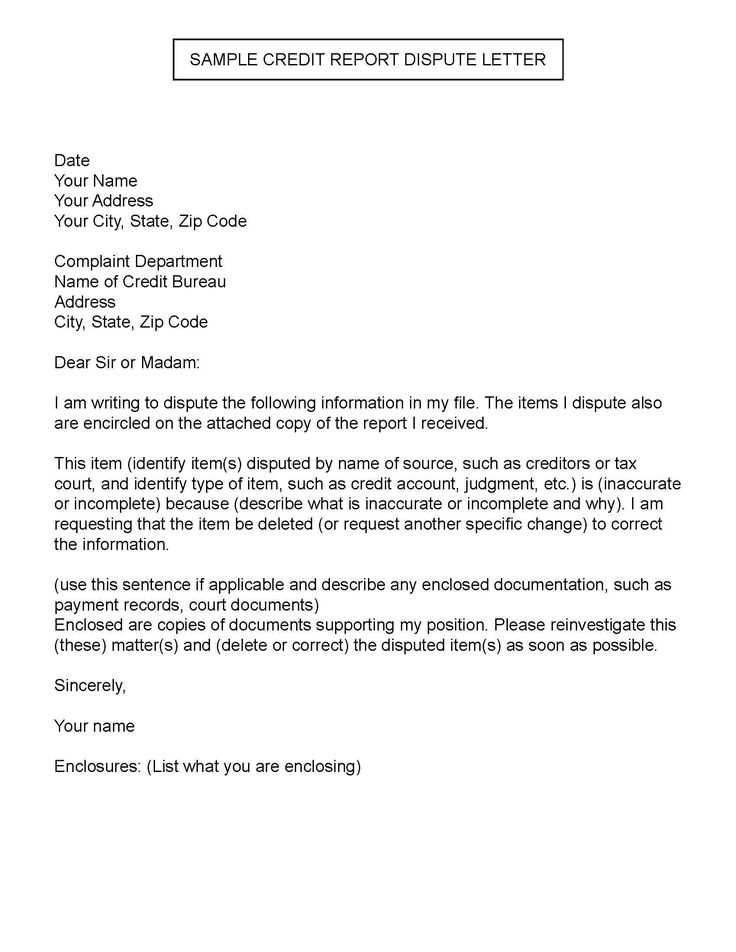

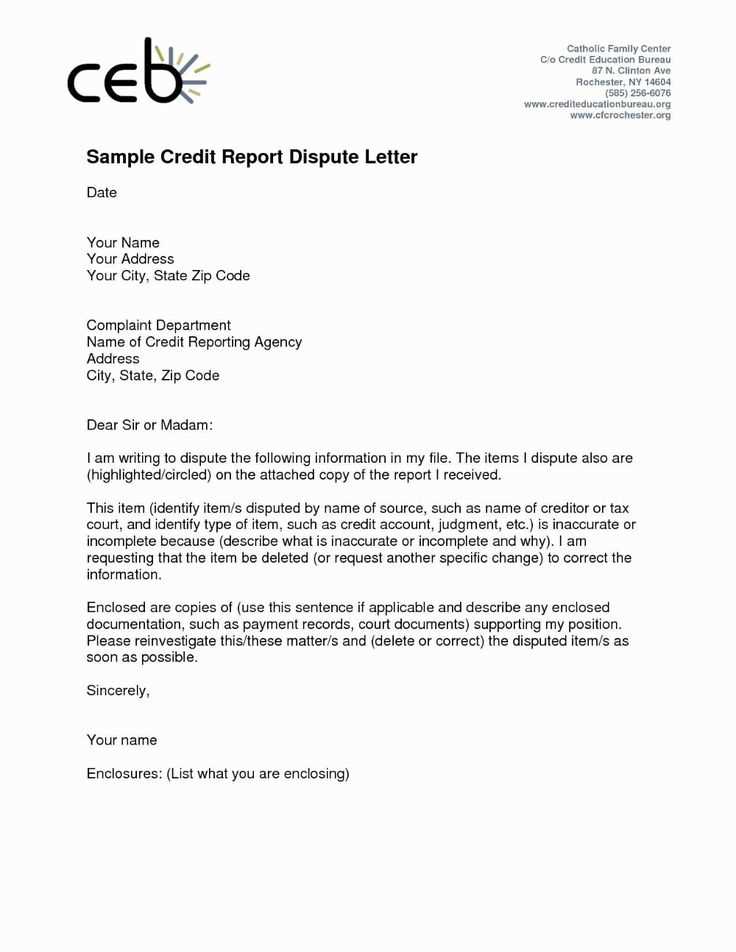

Use the following template to dispute inaccuracies on your credit report. Fill in the specific details relevant to your case, and send it to the credit bureau that issued the report in question. Always keep a copy for your records.

Template Letter

Credit Bureau Name

Address

City, State, Zip Code

Date

Subject: Dispute of Inaccurate Information on Credit Report

Dear Sir/Madam,

I am writing to formally dispute the following item(s) on my credit report. The details of the dispute are outlined below:

- Account Name/Number: [Insert account name and number]

- Disputed Information: [Describe the inaccurate information, such as incorrect account balance, payment history, etc.]

- Reason for Dispute: [Provide a brief explanation as to why the information is incorrect. Attach supporting documents if necessary.]

In accordance with the Fair Credit Reporting Act, I request that the credit bureau investigate this matter and remove or correct the inaccurate information on my credit report. I would appreciate receiving a written confirmation once the dispute has been resolved.

Thank you for your attention to this matter. Please do not hesitate to contact me at [Your Contact Information] should you need further information.

Sincerely,

[Your Full Name]

[Your Address]

[Your City, State, Zip Code]

[Your Contact Information]

Review each section of your credit report carefully. Focus on personal details first–name, address, and date of birth. Errors here can affect your score. Verify that all your accounts are listed correctly, with accurate balances and status.

If any account shows incorrect information, such as a paid-off loan marked as open or a late payment that never occurred, make a note of it. These mistakes can negatively impact your credit. Pay attention to the dates of last activity and ensure they align with your records.

Examine the accounts that may have been opened in your name without your knowledge. This could be a sign of fraud. If you spot any unfamiliar entries, take immediate action to report them to the credit bureau.

Also, review the hard inquiries listed on your report. These are generated when someone checks your credit for lending purposes. Ensure that each inquiry is legitimate and authorized by you. Unfamiliar inquiries may indicate identity theft.

Check for duplicate accounts as well. Sometimes, the same account may be listed more than once, which can artificially lower your score. If this happens, dispute the duplicate with the credit bureau.

Finally, confirm that no outdated negative information is still affecting your score. Negative marks, such as late payments or bankruptcies, typically fall off after seven years. If you find these marks still showing up beyond their expiration, file a dispute.

Begin by including your personal information: full name, address, date of birth, and the last four digits of your Social Security number. This helps the credit bureau easily identify your records. Be sure to include the date of your letter for reference.

Next, clearly state the items you are disputing. Specify each account or entry that you believe is incorrect, including the account number and any other relevant details. If possible, attach supporting documentation, such as statements or proof of payment, to validate your claim.

Explain the reason for your dispute. Be concise and factual, avoiding emotional language. Whether it’s an incorrect balance, a missed payment, or any other error, provide a brief explanation as to why you believe the entry is wrong.

Indicate the actions you want the credit bureau to take. This could include removing the disputed entry, correcting the balance, or updating the account status. Make sure your request is clear and actionable.

Finally, sign the letter and include your contact information for follow-up. Providing an easy way for the bureau to reach you can help speed up the process.

How to Correct Incorrect Personal Data in Your Report

If you spot incorrect personal data in your credit report, take these immediate steps to resolve the issue:

Start by gathering supporting documents that confirm the correct information. This can include ID cards, utility bills, or any legal paperwork that shows the accurate details. You’ll need these documents as evidence when disputing errors.

Next, contact the credit reporting agency directly. Most agencies offer a straightforward process to dispute errors. Visit their website or call their customer service to find out the exact procedure for filing a dispute. Be specific about the information you believe is incorrect and provide all necessary documentation.

After submitting your dispute, monitor the process. Credit bureaus typically have 30 days to investigate the issue and respond. Keep track of your dispute status to ensure timely resolution.

| Step | Action |

|---|---|

| 1 | Gather supporting documents (ID, utility bills, etc.) |

| 2 | Contact the credit bureau to file a dispute |

| 3 | Monitor the dispute process for updates |

If the error is not corrected after the dispute, you can escalate the issue by contacting the creditor directly or filing a complaint with the Consumer Financial Protection Bureau (CFPB). They can help mediate the dispute and ensure that your data is corrected.

Disputing Incorrect Account Details or Payment Records

If you find discrepancies in your account details or payment history, immediately gather supporting documents such as bank statements, receipts, or payment confirmations. These will serve as proof to challenge the inaccurate information. Draft a letter clearly identifying the error, explaining why it is incorrect, and providing the supporting documents that back your claim.

Address the dispute to the credit bureau or creditor, including the account number, a description of the error, and the correct details. Be specific about the incorrect information and how it affects your credit score or report. Keep the tone polite but firm, ensuring your points are clear and concise.

Make sure to follow up in writing if you don’t receive a response within a reasonable time frame. It’s crucial to keep a record of all correspondence and any updates related to your dispute. If the issue is resolved, ensure the correction is reflected in your credit report.

Submit your dispute via the method that ensures tracking and acknowledgment of your request. For faster processing, consider online submission through the credit bureau’s website. This option allows you to monitor the status of your dispute in real time and receive an immediate confirmation of your submission.

If online submission is not feasible, sending your dispute by certified mail provides proof of delivery. Make sure to include all necessary documentation and a clear explanation of the error. Retain a copy of everything you submit for your records.

Email submissions can be another route, but ensure your email is detailed and includes any relevant attachments. Always check the credit bureau’s email address for accuracy before sending.

Choosing a method with tracking or confirmation guarantees your dispute reaches the right team and prevents delays or misunderstandings.

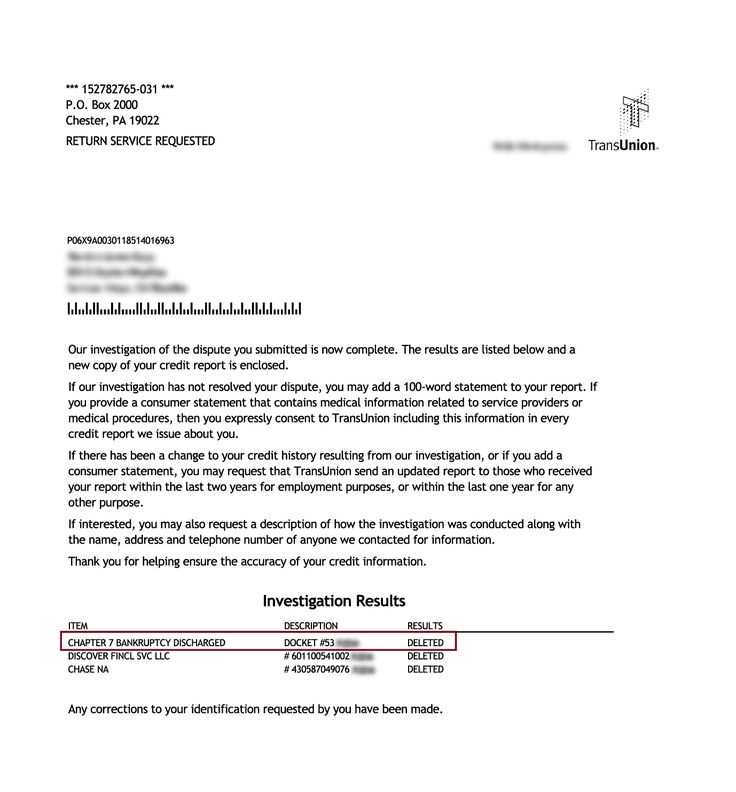

Next Steps After Sending Your Dispute Letter

Once you’ve sent your dispute letter, keep track of all communication with the credit reporting agency. It’s crucial to maintain a record of dates, responses, and any additional documents provided. You can follow up if you don’t receive a response within 30 days, as this is typically the window for credit bureaus to address disputes.

Monitoring the Outcome

After the credit bureau reviews your dispute, they will send you the results of their investigation. This could include corrections to your credit report or explanations for why the disputed information remains unchanged. Review the findings carefully and verify if the changes were made accurately. If not, you may need to escalate the issue or submit additional proof.

Taking Further Action

If the dispute resolution isn’t favorable, you have a few options. You can contact the creditor directly, or if necessary, file a complaint with the Consumer Financial Protection Bureau (CFPB) to get further assistance. It’s important to act swiftly and persistently, as errors on your credit report can impact your financial standing.

To dispute an error on your credit report, start by drafting a clear and concise letter to the credit bureau. Address the letter directly to the bureau’s dispute department, ensuring that you include your full name, address, date of birth, and any other personal information they may need to verify your identity.

State the Discrepancy

In the body of the letter, clearly specify the item(s) you are disputing. Provide detailed information on the error, such as the account number or the nature of the discrepancy. If applicable, attach supporting documents like bank statements, receipts, or any relevant records that can prove your claim.

Request Corrective Action

End the letter by asking the bureau to investigate the disputed information and update your report accordingly. Be polite yet firm in your request for prompt resolution. Keep a copy of the letter for your records, and consider sending it via certified mail to track delivery.