Equity grant letter template

Provide clear and concise details when drafting an equity grant letter. Include the recipient’s name, the amount of equity being granted, and the terms of the grant, such as vesting schedule and any performance criteria. Be specific about the type of equity, whether it’s stock options, restricted stock, or another form. The more precise the information, the less room for confusion down the line.

Start by outlining the key terms–including the date of grant, vesting schedule, and expiration date, if applicable. A straightforward approach ensures the recipient understands the value and timeline associated with the grant. Detail any conditions that must be met for vesting, such as tenure or company performance milestones. Clarity on these aspects helps avoid misunderstandings later.

Follow with legal language that protects both parties. This could involve referencing the relevant agreements, like a stock option agreement or a shareholder agreement, to define rights and responsibilities. Include any confidentiality clauses or restrictions on the sale of shares to ensure the company’s interests are safeguarded.

Close the letter with a personal touch, reinforcing the value of the equity grant and expressing confidence in the recipient’s future contributions. Offer a direct point of contact for any questions, ensuring the recipient feels supported throughout the process. This simple yet personalized approach promotes positive relationships and transparency.

Here’s the corrected list without duplicates:

To maintain clarity and ensure a streamlined document, it’s crucial to list only unique items. Here’s an updated list, free from repetition:

| Item | Description |

|---|---|

| Equity Grant Terms | Specific conditions related to the equity grant offer. |

| Vesting Schedule | The timeline over which equity grants are distributed. |

| Grant Amount | The total number of shares or units offered to the recipient. |

| Cliff Period | The initial waiting period before any equity is vested. |

| Exercise Price | The price at which the recipient can purchase shares in the future. |

| Performance Metrics | Specific targets or benchmarks that must be met for equity grants to be fully vested. |

| Expiration Date | The final date by which equity must be exercised or it will expire. |

Ensure you cross-reference the list to confirm that no terms are repeated. This will simplify the process and avoid confusion when discussing the terms with stakeholders.

- Equity Grant Letter Template

For creating a clear and professional equity grant letter, follow these key elements:

- Header Information: Include the recipient’s name, job title, and the company’s name and address. Also, add the date of the letter for reference.

- Introduction: Start with a brief, direct statement about the purpose of the letter, such as offering an equity grant or stock options.

- Details of the Grant: Outline the specifics of the equity grant: the number of shares, type of equity (stock options, restricted stock units, etc.), vesting schedule, and any performance conditions tied to the grant.

- Grant Terms: Specify any additional terms, such as the exercise price, expiration date, and any restrictions attached to the equity. If applicable, mention the tax implications of the grant.

- Conditions for Acceptance: Clearly state any actions required from the recipient, such as signing a grant agreement or completing necessary forms to accept the grant.

- Next Steps: Provide instructions on how to proceed, including contact information for any follow-up questions.

- Closing Remarks: Reaffirm the company’s commitment to the recipient’s success and express enthusiasm about the equity grant.

Ensure the tone is professional yet welcoming, reflecting the importance of the opportunity being offered. Use clear, simple language to avoid misunderstandings, and make sure all legal and financial terms are outlined precisely.

When issuing an equity grant, clarity in the key terms ensures both parties are aligned. Focus on these elements to avoid misunderstandings:

Grant Size and Type

The size of the equity grant should be clearly defined, whether it’s in the form of stock options, restricted stock units (RSUs), or another type of equity. Specify the exact number of shares or percentage ownership being granted to avoid ambiguity.

Vesting Schedule

The vesting schedule outlines when the recipient earns the equity. Typically, equity grants vest over time, with a common structure being a 4-year vesting period with a 1-year cliff. Be clear about any milestones or conditions that need to be met for the equity to vest.

Include the conditions under which acceleration might occur, such as in the event of a company acquisition or other significant corporate event. This detail helps prevent potential disputes in the future.

Exercise Price or Value

If the equity grant includes stock options, the exercise price should be specified. This is the price at which the employee can purchase shares in the future. Make sure it’s clear whether the price is fixed at the grant date or subject to adjustments.

Expiration Date

The grant should specify an expiration date by which the recipient must exercise their options or claim their shares. This date ensures both parties know the timeline and prevents any confusion or missed opportunities.

Begin with a clear, direct opening. Address the recipient by name and state the purpose of the letter immediately. This sets the tone and ensures the reader understands the subject right away.

Next, break the content into digestible sections. Use bullet points or numbered lists to highlight key terms such as the grant amount, vesting schedule, and any specific conditions. This makes important details stand out and reduces the likelihood of misinterpretation.

- Start with the equity grant amount, specifying the type of equity being granted (e.g., stock options, restricted stock units).

- Clarify the vesting schedule, including important dates and any performance-based milestones.

- List any restrictions or conditions tied to the equity grant, such as employment requirements or transfer limitations.

Ensure each section has a heading or subheading for easy scanning. This allows the reader to quickly locate the information they need without having to read through dense paragraphs.

Conclude by restating the key points, and if necessary, include a call to action or next steps. Make sure the closing is polite but firm, leaving no ambiguity about expectations.

One of the most frequent errors in equity grant letters is unclear or vague terms. Be specific about the number of shares granted, the vesting schedule, and any associated conditions. Ambiguity can lead to misunderstandings, leaving the recipient uncertain about their entitlements.

Another common mistake is neglecting to clearly explain the tax implications. Ensure that the letter outlines the potential tax responsibilities linked to the grant, such as ordinary income tax or capital gains tax, depending on how the equity is treated.

Failure to highlight the impact of termination clauses is also a mistake. Include details on what happens to the equity grants if the recipient leaves the company, whether voluntarily or involuntarily, to avoid confusion or disputes down the line.

Many letters overlook addressing stock dilution, which can affect the value of the grant. Clarifying how potential future stock issuances may dilute the equity can prevent dissatisfaction later.

Lastly, remember to include the expiration date of the equity grant. Failing to mention this can result in missed opportunities for the recipient, especially if they don’t know the window for exercising their options.

Ensure that the grant agreement is clear on the terms of the equity grant, including the number of shares, vesting schedule, and any performance conditions. It’s crucial to outline the specific legal rights and obligations of both the granting company and the recipient. Define the governing law and jurisdiction for any potential disputes. Pay special attention to tax implications for both parties, as they can significantly impact the value of the grant. Ensure compliance with securities laws to avoid any unintended violations. Include provisions on confidentiality, intellectual property rights, and non-compete clauses to protect the company’s interests. If applicable, specify any conditions for early termination or forfeiture of the grant. Make sure the agreement is signed by authorized representatives of both parties to ensure its validity.

Clearly define the vesting timeline and any conditions involved in the grant. Make sure to outline the specific dates when shares will vest, whether it is based on time, milestones, or performance. Include details on cliff periods and incremental vesting to eliminate confusion. Use simple language to explain the process, avoiding jargon that could confuse employees.

Provide a visual aid, such as a timeline or chart, to help employees easily grasp the vesting schedule. A well-designed chart can make complex schedules much easier to understand at a glance.

Send regular reminders to employees about upcoming vesting events. Proactive communication helps employees stay on track and feel reassured about their progress. Ensure the reminders are spaced appropriately, neither too early nor too late, to maintain engagement.

Ensure that employees know who to contact if they have questions about their vesting schedule. Offering a dedicated point of contact can help clarify doubts and prevent miscommunication. Be responsive and transparent in addressing any concerns that arise.

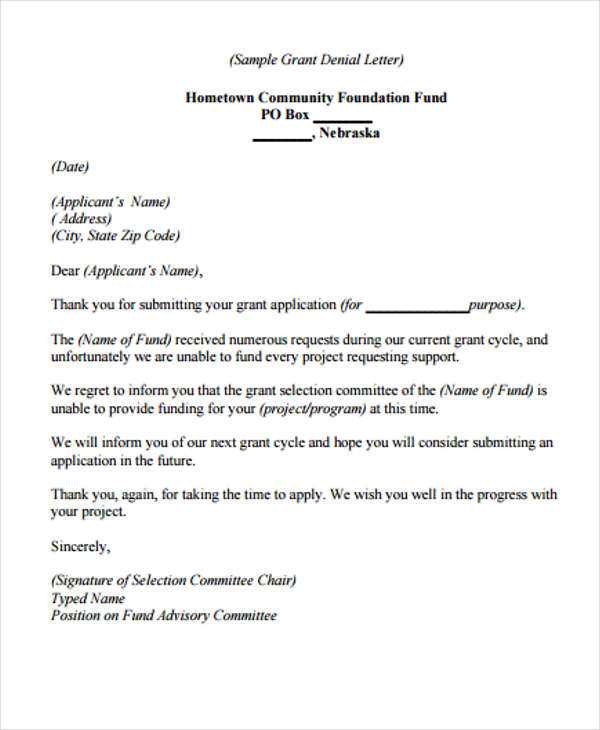

Begin by adjusting the tone and language to align with your organization’s values and culture. For example, if the letter is for a corporate grant, a professional yet approachable tone works best. If it’s for a community-based initiative, a more personal and conversational style may be appropriate. Customizing the letter ensures it resonates with the recipient and reflects the purpose of the grant.

Use templates that provide flexibility for different funding types. A simple grant letter template might include sections for the recipient’s name, grant purpose, amount granted, and terms of the grant. Make sure the template leaves room for personalized comments or explanations, allowing you to explain the specifics of the grant in detail.

For a concise approach, focus on the core elements: introduction, purpose of the grant, conditions or expectations, and closing. Modify these sections to fit your needs. For instance, you could add a brief summary of how the grant will benefit the recipient, highlighting the expected impact. Adjusting the language to suit the audience’s familiarity with formal or informal business language can make the letter feel more tailored.

Another useful template modification involves including a section for next steps. If applicable, include deadlines or required follow-up actions, as this provides clarity and sets expectations for both parties. A clear call to action, such as confirming receipt or scheduling a meeting, can make the process smoother.

Ensure your equity grant letter includes clear terms and precise language. Address key points such as the number of shares, vesting schedule, and any conditions for the grant. This creates transparency and sets clear expectations from the outset.

Clarify Vesting Schedule

Detail how the shares will vest over time, specifying the exact timeline and any milestones that trigger vesting. Avoid vague language; instead, outline if the vesting is based on time or performance metrics. This section should leave no room for ambiguity.

Outline Terms and Conditions

Include any conditions that could affect the equity grant, such as employment status or performance benchmarks. Clearly state any actions that could result in the cancellation or alteration of the grant, making sure both parties fully understand the rules and limitations.