Gift deposit letter template uk

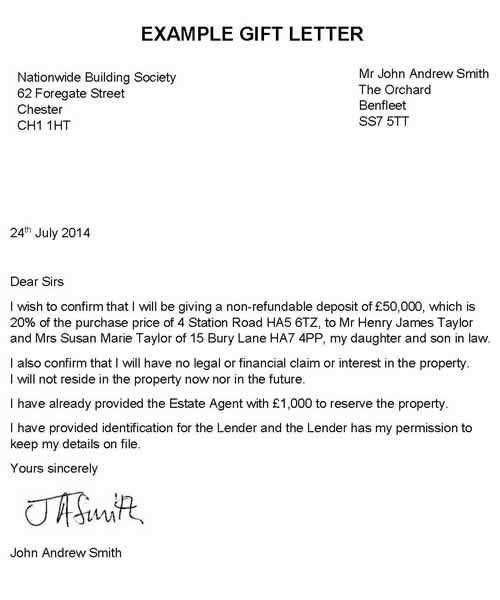

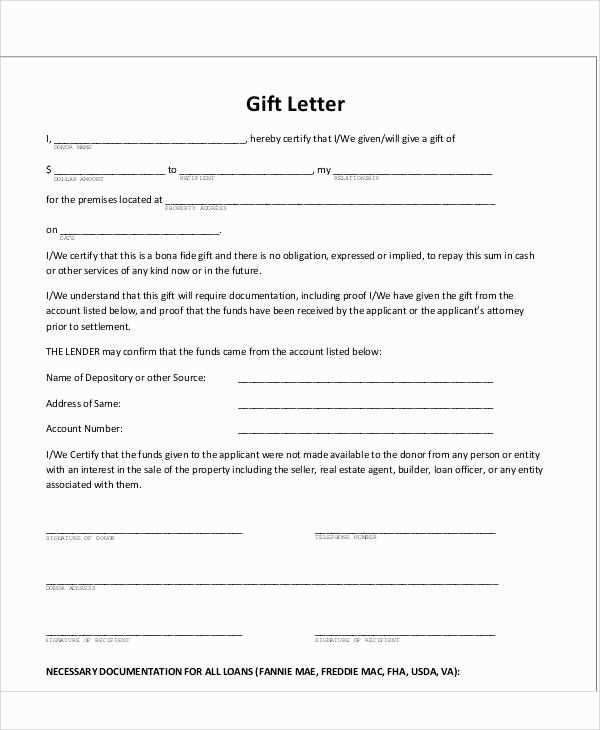

Creating a gift deposit letter is a straightforward process. This document is typically used to confirm that the money being given as a gift is not a loan and does not need to be repaid. It is often required by banks or lenders when individuals are applying for a mortgage and need to show proof of funds from family or friends.

Ensure the letter clearly states the details of the gift, such as the amount being gifted, the relationship between the giver and recipient, and the purpose of the deposit. The letter should also affirm that no repayment is expected. A well-written letter can help avoid any confusion or misunderstandings, especially when the money is a significant amount.

Keep the tone professional but simple. Avoid unnecessary details and focus on the core information. The letter should be signed by the giver, and if necessary, include their contact details. Make sure the date is accurate to avoid any issues with timeframes during the application process.

Here’s the corrected version:

If you’re drafting a gift deposit letter, focus on clarity and accuracy. Ensure all the necessary details are included to avoid misunderstandings. Below is a simple structure you can follow:

Key Elements to Include

- Recipient Information: Clearly state the name and address of the person receiving the gift.

- Donor Information: Include your name and contact details.

- Details of the Gift: Mention the type and value of the gift being deposited. Be as specific as possible.

- Deposit Terms: Outline any terms related to the deposit, such as when it was made and any conditions attached.

- Signature: Both the donor and recipient should sign the letter to confirm agreement.

Additional Recommendations

- Ensure that the letter is dated.

- If applicable, include references to any relevant bank or financial records to support the gift deposit.

- Keep the language formal yet easy to understand, avoiding unnecessary jargon.

- Gift Deposit Letter Template UK

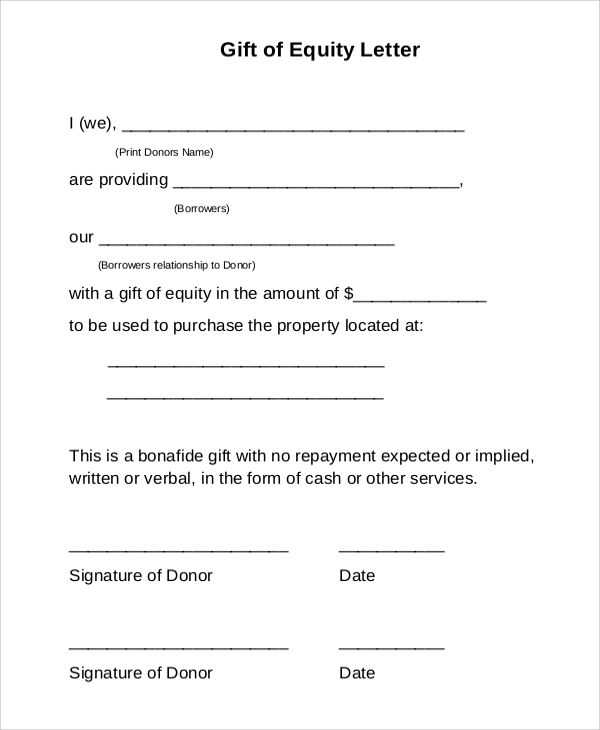

A gift deposit letter is a formal document that confirms the giver’s intention to provide a monetary gift for a home purchase. The letter assures the lender that the funds are a gift and not a loan. To create a straightforward gift deposit letter, include the following key details:

- Donor’s Full Name and Address: Start by identifying the person offering the gift.

- Recipient’s Full Name and Relationship: Clearly mention the relationship between the donor and the recipient.

- Amount of the Gift: Specify the exact amount of the gift being given.

- Confirmation of Gift Nature: State that the gift is non-repayable and is not a loan.

- Donor’s Contact Information: Provide a way for the lender to contact the donor, if necessary.

The letter should be signed by the donor, confirming the details. This document is typically required by mortgage lenders to ensure there are no misunderstandings about the nature of the funds provided. Including all the necessary details will help streamline the home financing process.

A gift deposit letter serves as a formal declaration that the financial contribution is a gift and not a loan. This is crucial for lenders when assessing a mortgage application. It confirms that the borrower is not required to repay the funds, ensuring the legitimacy of the gift and maintaining transparency in the borrowing process.

Why is a Gift Deposit Letter Needed?

Lenders require this letter to verify that the deposit provided by the borrower’s family member or friend is a genuine gift. Without it, the lender may treat the deposit as a loan, which could affect the borrower’s eligibility for a mortgage. The letter helps clarify the nature of the funds and provides reassurance to the lender that the borrower won’t have additional debt to manage.

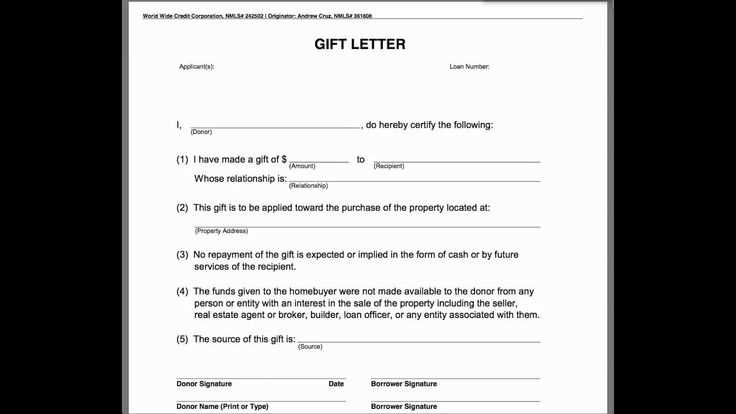

Key Components of a Gift Deposit Letter

A gift deposit letter typically includes the following details:

| Component | Description |

|---|---|

| Donor’s Information | Name, address, and relationship to the borrower. |

| Gift Amount | The exact amount of the gift being provided. |

| Confirmation of Gift | Statement confirming that the money is a gift, with no expectation of repayment. |

| Signature | The donor’s signature to validate the statement. |

A Gift Deposit Letter should clearly state the gift’s purpose, ensuring the lender understands it is a non-repayable contribution. Start by including the donor’s full name, address, and relationship to the recipient. Specify the exact amount of the gift and confirm that no repayment is expected. Indicate the method of transfer, whether it’s via bank transfer, cheque, or another form, to avoid any confusion.

It’s also important to mention the recipient’s details, such as their full name and address, and clarify how the funds will be used (e.g., for a house deposit). A signed statement from the donor affirming the gift’s nature and conditions is critical for verification purposes.

Additionally, include the date the gift was given and state that the donor is financially capable of making the gift. Providing any supporting documents, such as bank statements showing the donor’s ability to give, adds credibility. Always ensure the letter is formal and professionally written to prevent misunderstandings during the mortgage process.

Writing a gift deposit letter is straightforward when you follow these steps:

1. Title and Introduction

- Start with a clear title, such as “Gift Deposit Letter.” Introduce the purpose of the letter briefly, explaining that it’s a formal declaration of a financial gift intended for a property deposit.

2. Details of the Gift

- Specify the exact amount of the gift. Include the currency and any relevant details about the transfer, such as when it was made or will be made.

- State the relationship between the giver and the recipient (e.g., parent, grandparent, friend). Be precise, as this will clarify the nature of the gift.

3. Statement of Non-Repayment

- Clarify that the gift is not a loan and does not require repayment. A simple statement such as, “This gift is not a loan and does not need to be repaid,” ensures transparency.

4. Giver’s Information

- Provide the giver’s full name, address, and contact information. This helps verify the identity of the person offering the gift.

5. Recipient’s Information

- List the recipient’s full name, address, and contact details to confirm who is receiving the gift.

6. Bank Details (Optional)

- If applicable, include the giver’s bank account details to show where the funds are coming from. This can help provide a clear paper trail for both parties.

7. Date and Signature

- End the letter by stating the date the gift is being made. Both the giver and the recipient should sign the letter to confirm the details.

Following these steps will ensure the gift deposit letter is clear, legally sound, and accepted by all involved parties.

Failing to Clearly Specify the Amount: Always specify the exact amount of money being gifted. Ambiguities may lead to confusion or disputes, especially if the deposit is scrutinized later. Be precise to avoid any misunderstanding regarding the funds involved.

Omitting Donor Information: It’s crucial to include full details about the donor, including their full name, address, and relationship to the recipient. Missing this information can make the letter appear incomplete or unprofessional, potentially leading to questions about the legitimacy of the gift.

Not Stating the Purpose of the Gift: Clearly state the reason for the gift. Whether it’s for a deposit or other purposes, outlining this helps clarify the donor’s intent and removes any possibility of the gift being viewed as a loan.

Incorrectly Identifying the Relationship: Be specific about the nature of your relationship with the recipient. If you’re a family member or friend, state this clearly. This helps provide context and shows that the deposit is indeed a gift, not a financial arrangement.

Excluding Signatures: Always ensure both the donor and recipient sign the letter. This demonstrates mutual understanding and agreement, which can be important if the letter is ever required for official purposes.

Using Informal Language: A gift deposit letter should maintain a formal tone. Avoid colloquial language or slang that could diminish the professionalism of the document. Keep the language respectful and clear.

Neglecting to Include a Date: Failing to include the date on the letter can cause problems in case of disputes or if the letter is requested in the future. Always mark the exact date the letter is being written to provide clarity about the timeline of the gift.

A Gift Deposit Letter is often required when a borrower receives funds from a family member or close friend for their home deposit. Lenders need to ensure that the money is indeed a gift and not a loan that will need to be repaid. This prevents confusion regarding the borrower’s financial obligations.

The letter should clearly state that the funds are a gift and will not be expected to be repaid. It should also outline the relationship between the borrower and the gift giver, as well as the amount of the gift and the date it was given. Lenders may also require details about the source of the gift money to confirm it’s not part of a loan or debt arrangement.

If you’re applying for a mortgage and plan to use gifted funds, make sure the letter is signed by the person giving the gift. This document can significantly speed up the approval process, as it removes any uncertainty for the lender about the nature of the deposit.

In cases where the gift is large or the relationship between the borrower and the gift giver is not immediately clear, lenders may request additional verification, such as bank statements or proof of the source of the funds. Prepare these documents in advance to avoid delays.

Focus on the details that apply specifically to your scenario. Begin by clearly stating the gift amount, the relationship between you and the recipient, and the intended purpose of the gift. Include a statement confirming that the deposit is a gift and does not require repayment. This is key for both the recipient and any third parties reviewing the letter, such as a lender.

Clarify the Purpose and Source of Funds

Be transparent about the source of the funds. Whether the money is from personal savings, a family member, or another source, clearly outline where it has come from. If it’s a loan or a non-gift transaction, it may impact the recipient’s financial situation and potentially violate lending terms, so make sure it’s stated unequivocally as a gift.

Provide Necessary Documentation

Attach supporting documentation when necessary. If the gift is a large sum or if it might be questioned, include bank statements, a transfer receipt, or any relevant paperwork. This demonstrates transparency and reassures parties that the gift is legitimate.

Begin by addressing the purpose of the gift deposit letter. Clearly state the intention behind the deposit, specifying the amount, whether it’s a one-time or recurring deposit, and the recipient’s details. This ensures that the letter serves as an official record of the transaction.

Key Information to Include

Include the date of the letter, donor’s full name, address, and contact information. Specify the recipient’s details as well, ensuring there are no discrepancies. Clearly mention the exact sum deposited, the method of deposit (e.g., bank transfer, cheque), and any special conditions associated with the gift.

Legal Considerations

If relevant, reference any legal frameworks, including tax regulations, that might apply to the gift deposit. This will avoid potential misunderstandings regarding the gift’s nature or any obligations from both parties.

Conclude the letter with both parties’ signatures and contact details for verification, ensuring all necessary documentation is in place.