Balance Due Letter Template for Professional Use

In business transactions, clear communication is essential when requesting overdue payments. An effective way to approach this task is through formal documentation, which helps maintain professionalism and clarity. By using a well-structured message, you can encourage timely settlements while preserving good relationships with clients.

Crafting a professional communication requires attention to detail. The content should be direct, polite, and firm, ensuring that the recipient understands the need for prompt payment. Using appropriate language and tone is crucial in preventing misunderstandings and fostering trust between both parties.

Understanding how to format and structure your communication can greatly increase its effectiveness. With the right approach, businesses can recover funds efficiently without escalating the situation unnecessarily. The goal is to keep the process smooth, while also ensuring that all parties involved are satisfied with the outcome.

Understanding the Importance of Balance Due Letters

When a payment remains unsettled, it is crucial for businesses to approach the situation with professionalism. Proper communication plays a key role in prompting the recipient to resolve the matter promptly. Having a clear and structured message ensures that both the business and the client maintain a respectful and productive relationship while addressing the issue at hand.

Why Timely Reminders Matter

Sending reminders in a timely manner helps to avoid further delays and confusion. It allows the recipient to be aware of their outstanding obligation and provides an opportunity for them to settle their payment quickly. The reminder serves as a gentle nudge, reinforcing the need for action without causing unnecessary conflict.

Maintaining Professionalism in Communication

By using formal and polite language, businesses ensure that their communications remain professional and courteous. A well-written message encourages positive responses while minimizing the chance of disputes. Maintaining professionalism helps to foster long-term relationships, even when financial matters arise.

| Benefit | Impact |

|---|---|

| Clear Communication | Reduces misunderstandings and delays |

| Timely Action | Encourages prompt resolution of payments |

| Professional Tone | Preserves good business relationships |

Key Elements to Include in a Template

When creating a formal communication requesting payment, certain elements are essential to ensure clarity and effectiveness. Including the right information helps to avoid confusion and encourages prompt action. A well-structured message should convey all necessary details while maintaining a professional tone.

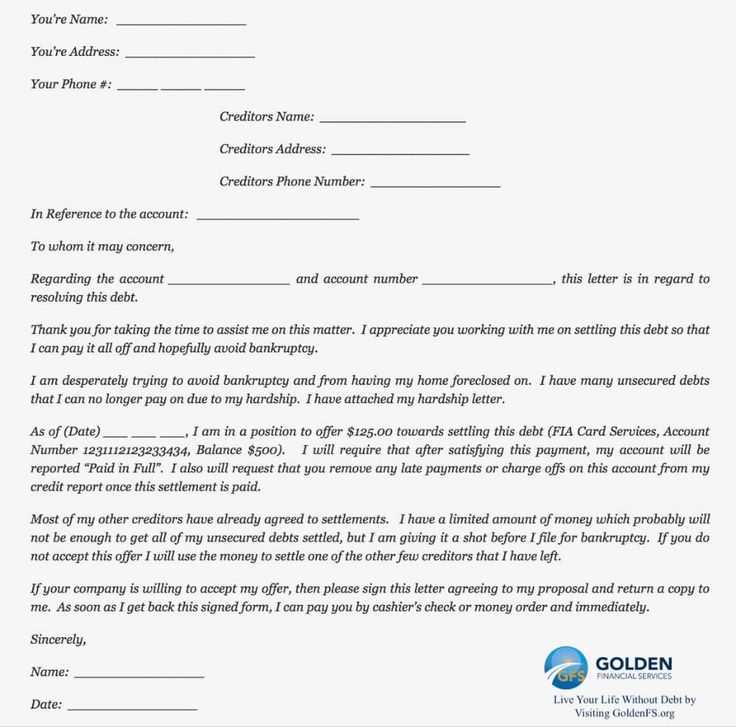

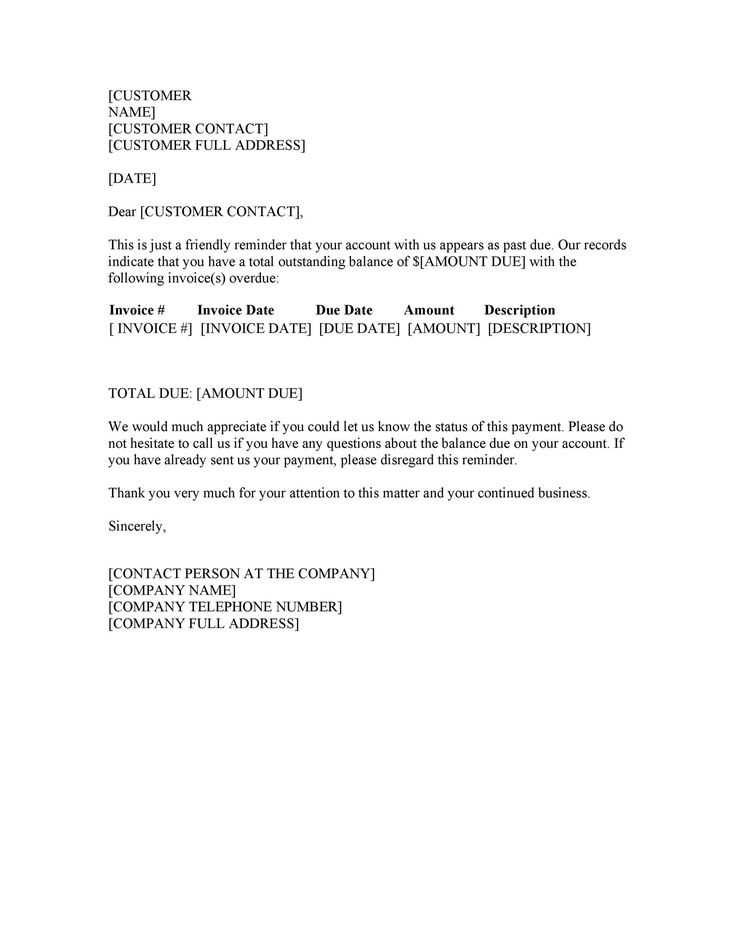

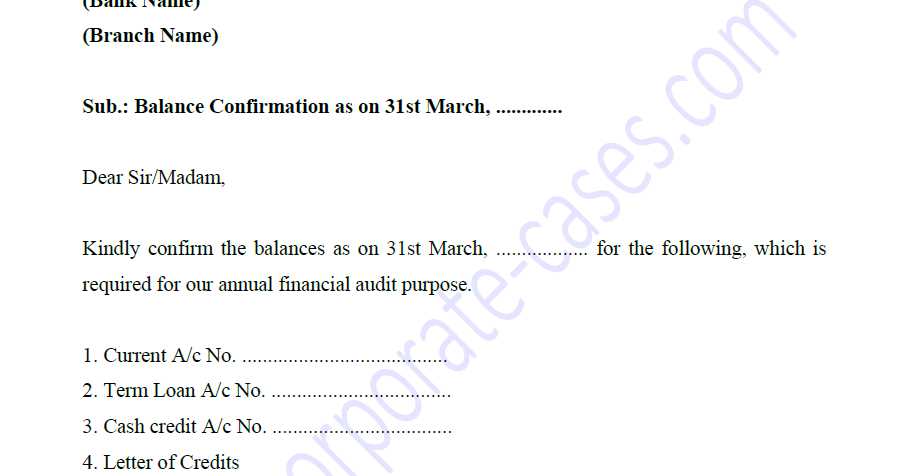

The first crucial element is identifying the recipient’s name and contact details, as well as your own. Providing these ensures the message reaches the correct person and allows for easy follow-up. Including a brief description of the service or product provided, along with the corresponding amount owed, is also vital to avoid misunderstandings.

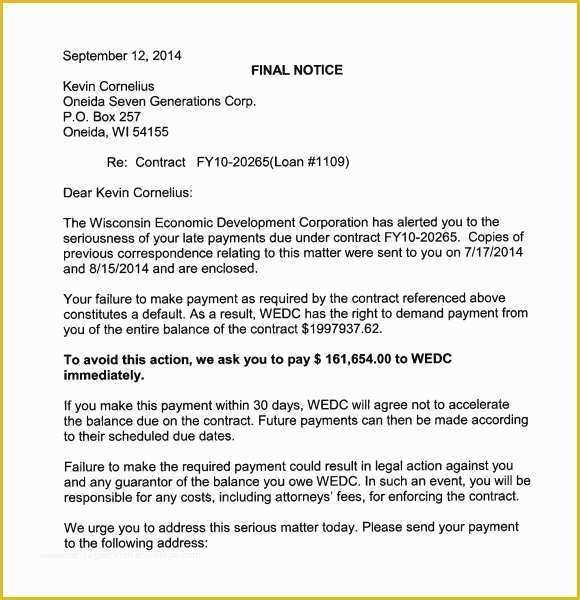

Another important aspect is specifying a clear timeframe for payment. While remaining polite, the message should set a reasonable deadline for the recipient to settle their obligation. Additionally, including information about potential late fees or consequences can provide further motivation for timely resolution.

How to Customize Your Payment Request Communication

Customizing your payment reminder ensures that it fits your specific situation and communicates effectively with the recipient. A personalized message allows you to maintain a professional approach while addressing the unique circumstances of the outstanding payment. Adjusting the content based on the relationship and context helps improve response rates.

To create a more tailored message, consider the following elements:

- Recipient Details: Include the correct name and address of the person or company being contacted.

- Personalized Tone: Adjust the tone of the message to suit the recipient–whether formal, friendly, or direct.

- Specific Payment Information: Clearly reference the product or service provided, along with the corresponding amount.

- Flexible Payment Options: If possible, offer multiple methods for settling the payment to make it easier for the recipient.

- Reasonable Deadline: Set a realistic and clear date for payment completion, taking into account the nature of your business relationship.

By personalizing each reminder, you show understanding of the recipient’s situation, which can result in a more positive outcome. Tailoring the content to fit your company’s voice and values will also help maintain strong professional relationships.

Common Mistakes to Avoid in Letters

When requesting payment, it is important to avoid common errors that could harm your professional reputation or delay the resolution process. A poorly written message can create confusion, cause frustration, or even damage business relationships. Ensuring your communication is clear and respectful can increase the chances of receiving prompt payment.

Being Too Aggressive or Impolite

One of the biggest mistakes is using language that is too harsh or demanding. While it’s important to remain firm about the payment request, being overly aggressive can alienate the recipient. Always maintain a courteous and respectful tone to avoid damaging your business relationships.

Leaving Out Important Information

Omitting key details such as the amount owed, the nature of the service or product, or the payment deadline can confuse the recipient. Ensure your message is complete and provides all the necessary information to avoid unnecessary back-and-forth communication.

Legal Considerations When Writing a Letter

When composing formal communication for outstanding payments, it is essential to consider the legal aspects of the message. A well-crafted document not only encourages timely settlement but also ensures compliance with applicable laws. Understanding the legal framework surrounding such communications helps protect both the sender and recipient from potential disputes or legal challenges.

Adhering to Regulations

Each jurisdiction may have specific rules regarding the language and tone of financial communications. It is important to ensure that your message aligns with local laws and regulations, such as the Fair Debt Collection Practices Act (FDCPA) in the U.S. or similar laws elsewhere. These regulations typically prohibit the use of harassment or misleading information in payment requests.

Maintaining Accuracy and Honesty

Any inaccuracies in the message, such as incorrect amounts or misleading statements, can lead to legal consequences. It is vital to ensure that all details, including the amount owed and payment terms, are clearly and accurately stated. Being transparent and honest in your communication minimizes the risk of future complications.

Best Practices for Sending a Payment Reminder

Sending a timely and professional reminder is key to ensuring that unpaid obligations are settled without causing any disruption to business relationships. By following best practices, you can maintain a courteous and effective approach to managing outstanding payments, which fosters both compliance and goodwill.

Be Clear and Concise

Ensure your communication is straightforward and to the point. Clearly state the amount owed, the service or product provided, and the requested payment date. Avoid unnecessary jargon, and keep the tone polite yet firm. The goal is to make it easy for the recipient to understand their obligation without confusion.

Follow Up Appropriately

While sending an initial reminder is important, it’s equally essential to follow up if the payment is not made. A well-timed second or third reminder should be polite and emphasize the importance of settling the obligation while offering any necessary assistance. Ensure that follow-up messages remain respectful and professional.

How to Follow Up After Sending a Payment Reminder

After sending an initial request for payment, it’s important to stay proactive and follow up if the recipient hasn’t responded or completed the payment. A polite yet firm follow-up can help ensure that your message is acknowledged and acted upon. The goal is to maintain professionalism while encouraging timely resolution.

When following up, be sure to keep your communication clear, courteous, and to the point. Acknowledge that you understand there may be reasons for the delay, but kindly remind the recipient of their responsibility. Providing a final chance for settlement or offering a payment plan can also be helpful in encouraging action.