Bank complaint letter template

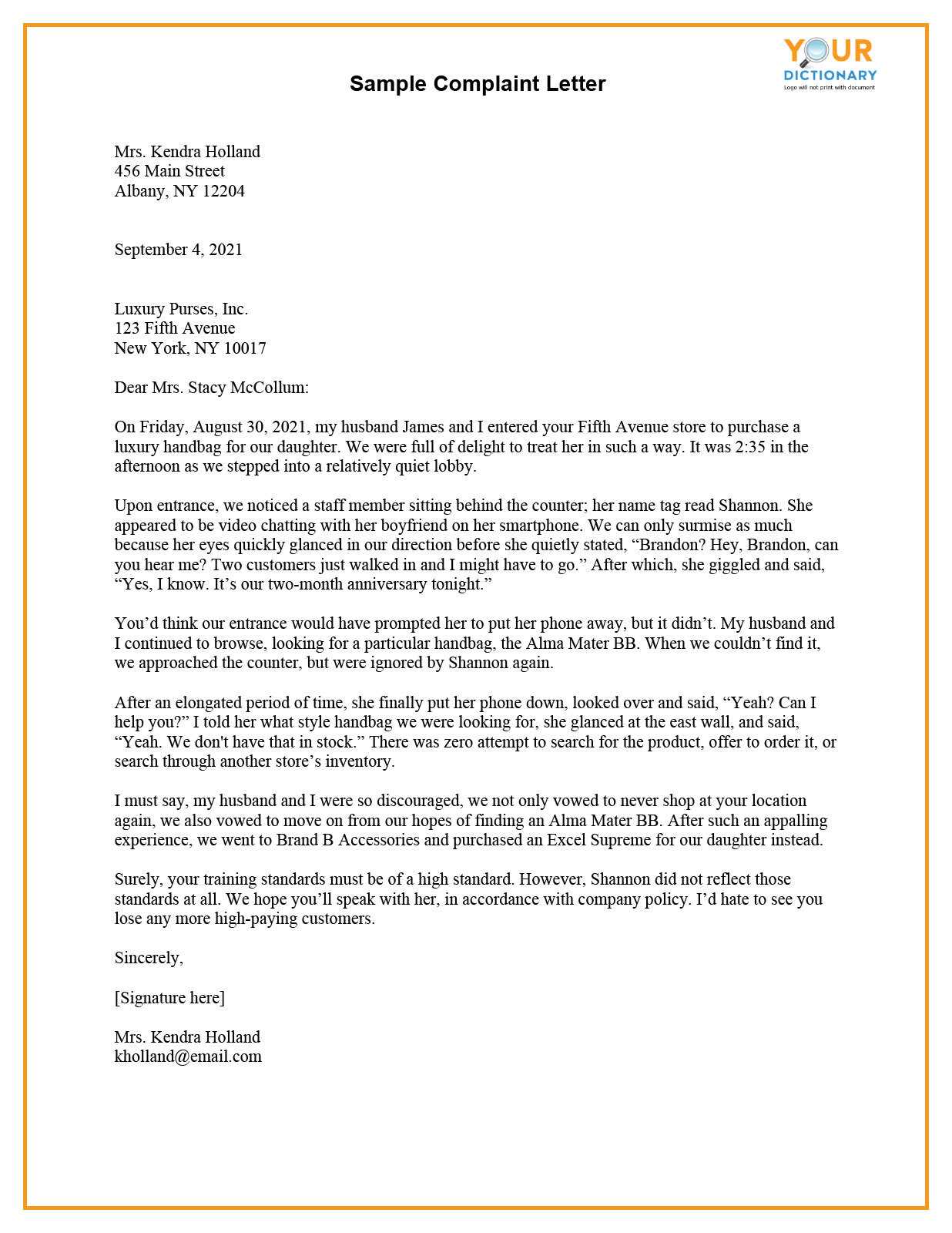

If you need to address an issue with your bank, writing a formal complaint letter is a direct way to ensure your concerns are heard. A well-structured letter can expedite the resolution process and clarify the steps you expect the bank to take. Below is a straightforward template you can use to draft your letter.

Begin by clearly stating your full name, account number, and any relevant transaction details. This ensures the bank can easily identify your case and investigate the issue swiftly. Be concise and stick to the facts, detailing the specific problem you’re facing. Whether it’s an error in your account, an unauthorized transaction, or poor customer service, make sure to describe it clearly and without unnecessary embellishments.

Next, explain the steps you have already taken, if any, to resolve the issue. This could include phone calls, visits to the branch, or online support requests. This information helps the bank track previous attempts at resolution. Then, outline the outcome you expect, whether it’s a refund, correction, or a formal apology, and set a reasonable deadline for a response.

Keep the tone professional and polite, even if you’re frustrated. Expressing your dissatisfaction calmly can encourage a quicker and more cooperative response. Once you’ve completed the letter, proofread for any errors and send it to the appropriate department, whether by email or mail, depending on the bank’s policy.

Here’s the revised version of the text, eliminating word repetition while maintaining meaning and logic:

When writing a complaint letter to a bank, be clear and concise. State your issue directly and provide relevant details such as account numbers or transaction dates. Avoid unnecessary explanations and focus on the facts. For instance, instead of saying “I am very frustrated with the service I received and I am disappointed,” simply state, “I am dissatisfied with the service I received.” This keeps the message clear and to the point.

Next, outline the resolution you expect. Be specific about what you would like the bank to do to address the issue. If you want a refund, state the exact amount. If you want an explanation or apology, request it clearly. This ensures the bank understands your expectations and can act accordingly.

Finally, remain polite throughout the letter. A professional tone helps ensure your complaint is taken seriously and handled promptly. Avoid sounding accusatory or confrontational, as this may hinder the resolution process.

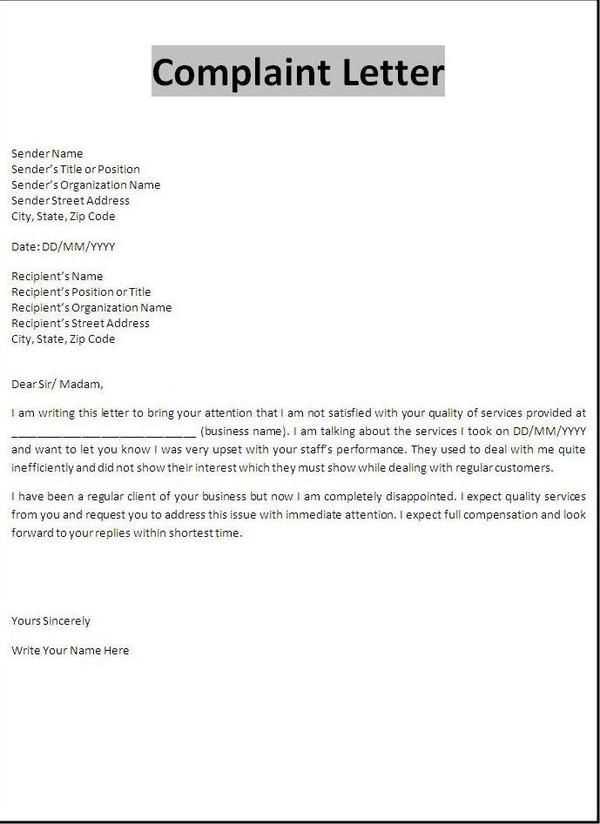

- Bank Complaint Letter Template

Write a clear, concise, and professional letter when addressing a bank issue. Follow this structure to ensure your complaint is taken seriously and resolved efficiently.

1. Header: Include your name, address, and the date at the top of the letter. Below this, write the bank’s name, address, and relevant department (e.g., Customer Service).

| Your Name: | John Doe |

| Your Address: | 123 Main Street, City, Zip Code |

| Date: | January 28, 2025 |

| Bank’s Name: | XYZ Bank |

| Bank’s Address: | 456 Bank Street, City, Zip Code |

2. Subject Line: Make your subject line specific and relevant. For example, “Complaint Regarding Incorrect Charges on Account.” This helps the recipient understand the issue right away.

3. Salutation: Use a formal greeting such as “Dear Customer Service,” or if you know the name of the person handling complaints, use “Dear [Name].”

4. Description of the Issue: Clearly explain the problem you encountered. Include relevant details such as dates, account numbers, or transaction references. Be factual and avoid emotions or assumptions. Example: “I noticed an incorrect charge of $50 on my account on January 20, 2025, for a service I did not request.”

5. Request for Resolution: State what you want the bank to do. Be direct, yet polite. Example: “I kindly request that this charge be reversed and my account updated accordingly.”

6. Contact Information: Ensure they can reach you by providing a phone number or email address. If you prefer a response via mail, include your full address.

7. Closing: Finish with a polite closing. Use “Sincerely,” or “Yours faithfully,” followed by your name.

| Phone: | (123) 456-7890 |

| Email: | [email protected] |

8. Follow-Up: If you don’t receive a response within a reasonable timeframe (typically 10-15 business days), follow up by calling or sending another letter. This shows persistence and ensures your complaint is addressed.

By following this template, you’ll communicate your complaint professionally, increasing the chances of a swift resolution.

Write a subject line that immediately highlights the issue. Make it specific and to the point, avoiding vague terms. Clearly identify the nature of the complaint and the key issue at hand. For example, “Issue with Unauthorised Transaction on Account #12345” is far more effective than simply stating “Bank Complaint.”

Be Concise and Direct

Keep the subject line short and precise. Use key words like “refund,” “charge error,” or “account suspension” to quickly convey your concern. Avoid unnecessary words, and don’t try to explain the whole situation in the subject line. It’s a teaser that encourages the recipient to open your message.

Include Relevant Details

If applicable, add identifiers such as account numbers, transaction dates, or any other specific detail that will help the bank quickly locate your case. For example, “Overcharged Fee on Account #12345, Date: Jan 15, 2025” is a clear and actionable subject line.

- Include your account number or transaction ID when possible.

- Highlight the issue directly (e.g., “unauthorised charge,” “transaction dispute,” “service error”).

- Avoid unnecessary adjectives or over-explanations.

A strong subject line sets the tone for your complaint and helps ensure a quicker response. Keep it clear and easy to understand for the bank’s team handling your case.

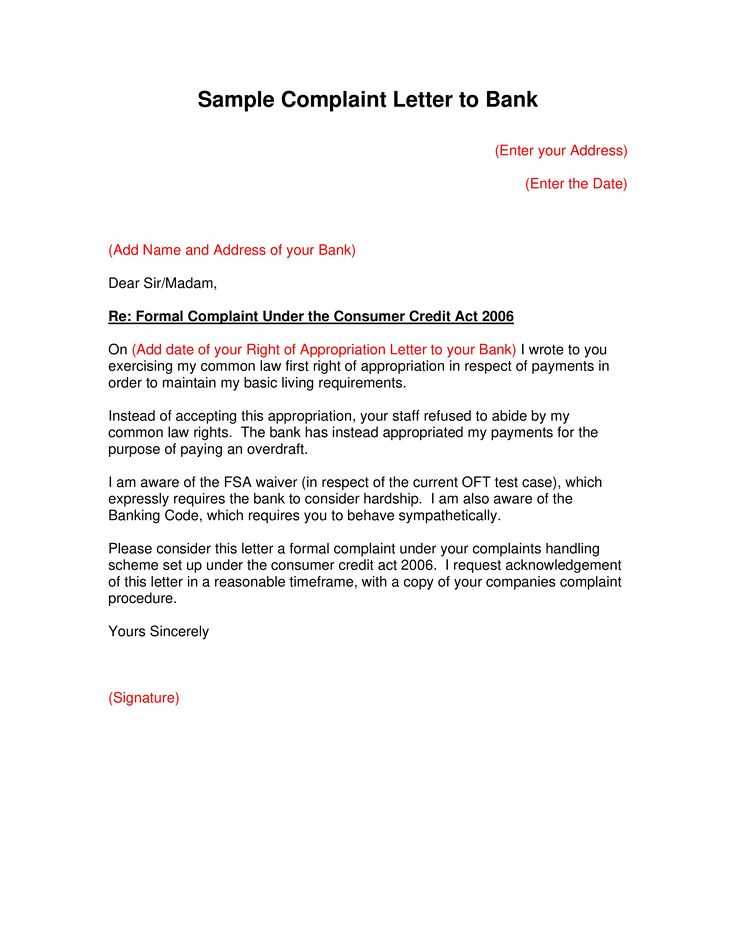

Begin with a clear and concise statement of the issue you’re addressing. Mention the specific event or action that triggered your complaint, such as an error, delay, or poor service. Include relevant details like dates, amounts, and any correspondence or reference numbers. This helps the bank immediately understand the context of your complaint.

Identify the account or service in question, using account numbers or transaction IDs when possible. This directs attention to the specific problem and allows the bank to locate your records swiftly.

Keep the tone polite but direct, and ensure the paragraph sets the stage for the resolution you’re seeking. Whether it’s a refund, correction, or clarification, state your expectations clearly right from the start.

Be precise when detailing the issue. Clearly mention the date the problem first occurred, along with any significant dates that reflect the progression or changes of the situation. If the problem involves a specific transaction, include transaction numbers and related amounts.

List any communication attempts you’ve made regarding the issue. Specify dates and the names of the people you spoke with or emailed. This shows you’ve actively tried to resolve the matter.

If applicable, attach copies of documents, such as bank statements, receipts, or letters, to support your claim. This ensures transparency and strengthens your case.

| Date | Details |

|---|---|

| January 15, 2025 | Attempted to transfer funds, but the transaction was declined due to an account error. |

| January 18, 2025 | Called customer service, spoke with John Doe. The issue was noted, but no resolution was provided. |

| January 22, 2025 | Sent an email to support team, no response received yet. |

By using clear dates and detailed events, you present a clear timeline of the issue. This increases the chance of a swift and accurate resolution from the bank.

Begin by clearly stating the issue you encountered, providing relevant dates and specific details that led to your complaint. Mention any direct consequences you faced as a result of the issue. For example, if there was an unauthorized charge, include the transaction amount and the date it occurred. This helps the bank quickly identify and understand the situation.

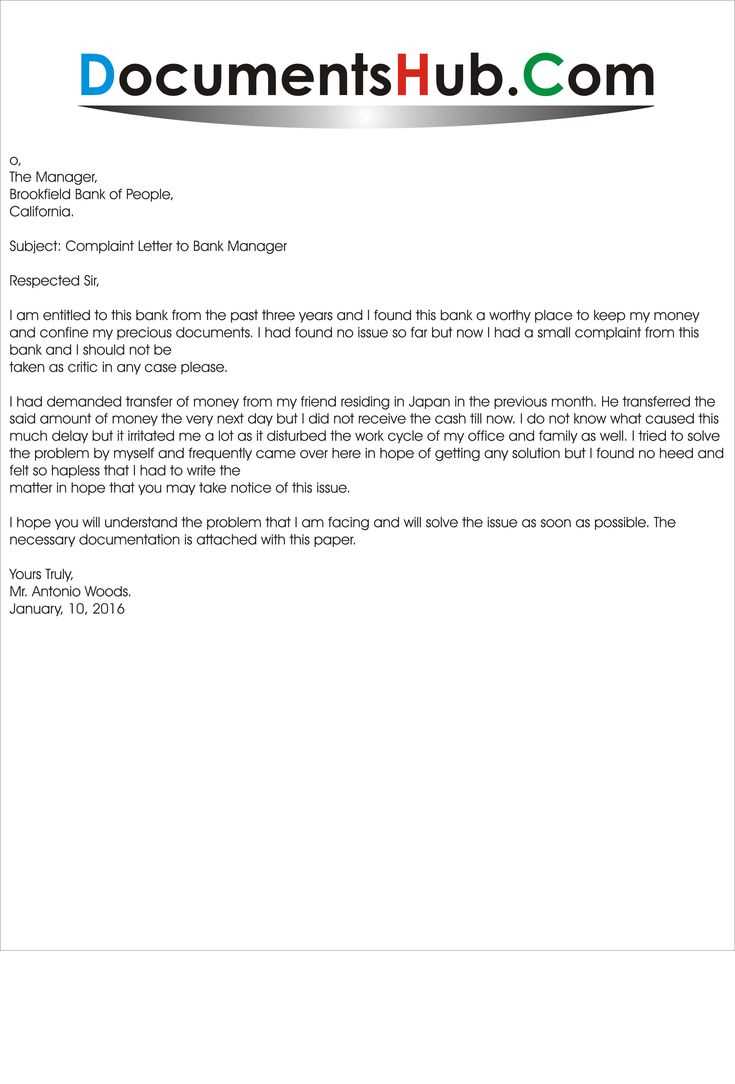

Step 1: Explain the Problem

- Describe the nature of the problem in clear terms.

- Provide supporting evidence, such as screenshots, bank statements, or any correspondence related to the issue.

- Be concise but thorough. Avoid over-explaining, as this may reduce the clarity of your message.

Step 2: State Your Request

- Directly state what you want the bank to do. This could be a refund, fee reversal, account correction, or another appropriate remedy.

- Be realistic in your request. For example, if you’ve faced an inconvenience due to delayed services, you can request a reasonable compensation or fee waiver.

- Be polite but firm, stating why your request is justified based on the situation.

Finally, request confirmation that the issue will be resolved in a timely manner. You can also ask for updates if the resolution process takes time. Close your letter with a courteous note, expressing your expectation for swift resolution and thanking the bank for its attention to the matter.

Focus on using clear, concise language throughout the letter. Avoid any overly casual or emotional phrasing. Stay polite and direct in your statements, ensuring that your concerns are expressed without exaggeration or aggression.

Use formal greetings and closings. For example, begin with “Dear [Bank Name] Customer Service” and close with “Sincerely” or “Kind regards.” This shows respect for the recipient and keeps the interaction professional.

When describing the issue, stick to the facts. Outline the problem briefly and avoid making personal accusations. Stick to clear descriptions of events, dates, and any documentation that supports your claims.

Express your expectations calmly. Rather than demanding immediate action, phrase your request in a way that invites cooperation. For example, “I would appreciate your assistance in resolving this matter at your earliest convenience” sounds polite while remaining firm.

Avoid negative language and instead focus on constructive communication. Phrasing like “I believe there may have been an error” or “I’m hoping for clarification on this matter” conveys a more professional approach than stating “You made a mistake” or “This is unacceptable.”

Lastly, always proofread your letter. Small errors in spelling or grammar can undermine the professional tone. A well-written letter reflects your commitment to resolving the issue professionally and efficiently.

Once you’ve sent your complaint, it’s time to take some key actions to stay on top of the situation.

- Monitor for a response: Check your email and postal mail regularly for any acknowledgment or updates. Banks often send confirmation that they’ve received your complaint and outline the next steps.

- Be patient but proactive: Allow the bank reasonable time to process your complaint. Typically, they should respond within 15 to 30 days. If you don’t hear back, follow up to check the status.

- Keep track of all correspondence: Maintain a file of all emails, letters, and notes from phone calls. This will help you in case you need to escalate or refer to past communications.

- Contact customer service if needed: If you don’t receive a timely reply, reach out to customer service for clarification. Be polite but firm in requesting an update on your complaint’s progress.

- Know your escalation options: If your issue remains unresolved, find out how you can escalate the complaint to higher authorities, such as the bank’s ombudsman or a regulatory body.

- Stay calm and professional: Even if the situation feels frustrating, keep all your communication clear and respectful. This increases the likelihood of a positive resolution.

Changes were made to avoid redundant repetition of words while maintaining the meaning of each point.

Focus on clarity. Each point should be expressed concisely and avoid unnecessary duplication. Streamline your message by using precise language, which ensures the core issue is clearly understood without redundancy. Pay attention to terms that may overlap in meaning and replace them with more specific or varied alternatives to enhance readability.

Specific Language Use

Use terms that directly address the complaint. Instead of repeating similar words, rely on context to clarify your points. For instance, replace repeated words with more descriptive adjectives or related terms that don’t alter the intent but enhance the precision of your message.

Structured Flow

Arrange the points logically. Avoid repeating the same structure in each section. Break down your complaint into clear subsections, with each one covering a distinct aspect of the issue. This approach minimizes the chance of overusing words while keeping the letter cohesive.