Equity letter template word

Crafting an equity letter is a precise task that requires attention to detail. Use this template to clearly state your position and convey important information in a professional manner. Structure the letter to ensure all key elements are included, such as the purpose of the letter, the equity involved, and any necessary supporting documents.

Start with a clear introduction that states the purpose of the letter. Be direct and concise, ensuring the reader knows what the letter is about right away. This is important when dealing with legal or financial matters.

Follow with the body of the letter, where you outline the terms of the equity, including specifics such as ownership percentages, contributions, and expectations. Clarity is key in this section. Avoid ambiguity to prevent misunderstandings.

Conclude with a closing statement that reiterates the main points and provides any necessary instructions for further steps. Always double-check your wording to make sure everything is clear and professional.

Here’s the improved version with minimal repetition:

Begin by organizing the structure clearly. Start with a direct and concise introduction outlining the purpose of the equity letter. Ensure the tone is formal but approachable, reflecting the seriousness of the subject while being accessible.

Clarify Key Details

Include all necessary financial information. Make sure to highlight the equity holder’s contributions and stake clearly. Precision in the figures and terms used avoids ambiguity and provides transparency.

Highlight Responsibilities

Be specific about the roles and obligations of the parties involved. Clearly state the expectations without overwhelming the reader with unnecessary clauses. Keep the language straightforward to maintain focus on the core details.

End with a clear statement of intent, reaffirming the equity agreement’s terms. Use a respectful tone and finalize with a strong call to action, ensuring the reader knows what steps are next.

- Equity Letter Template in Word

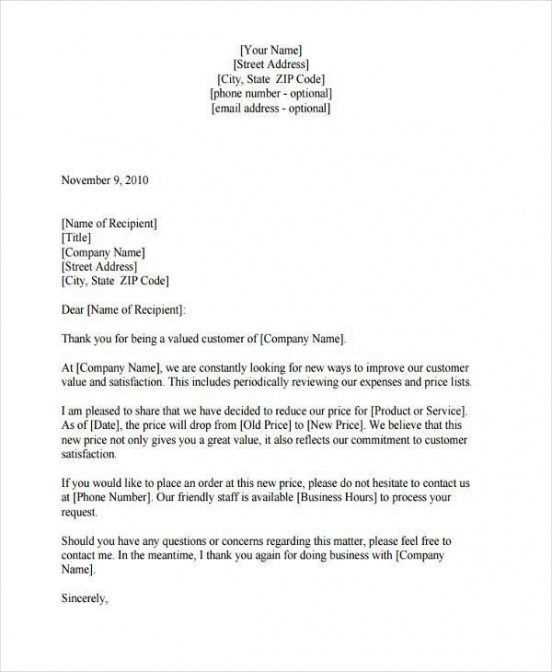

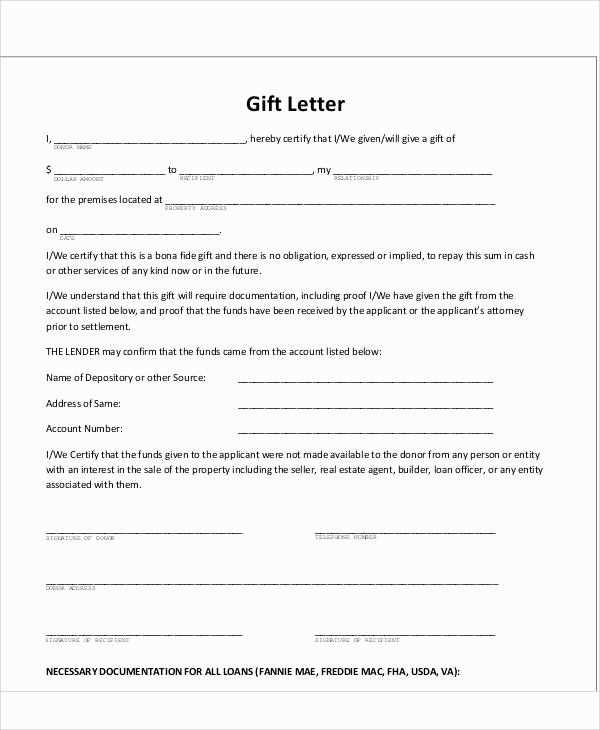

Creating an equity letter in Word is straightforward when you follow a structured template. This ensures that all the necessary details are included and formatted correctly. Start by setting up your document with a clear header, which should include the sender’s name, address, and contact information at the top. Below this, include the recipient’s details, followed by a formal greeting.

Key Sections to Include

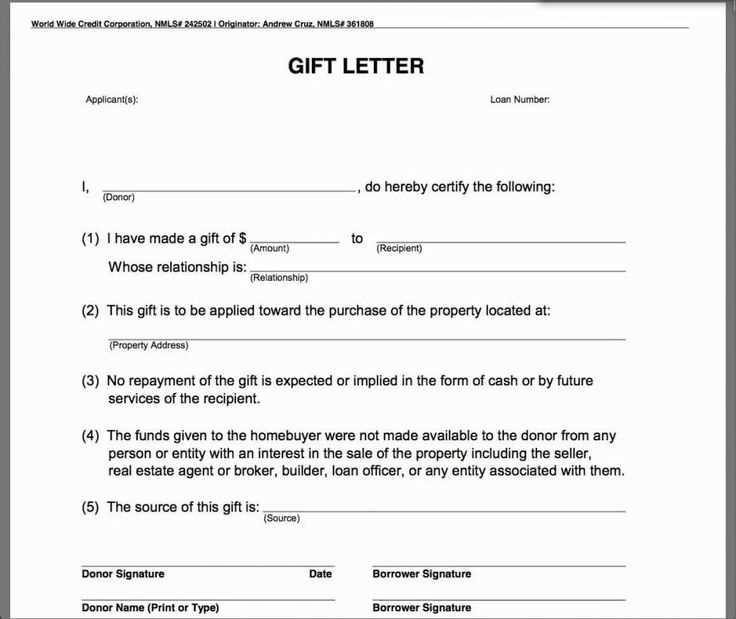

- Subject Line: Clearly state the purpose of the letter, such as “Equity Share Agreement” or “Equity Participation Terms.”

- Introduction: Provide a brief explanation of why the letter is being written and the specific terms or agreement being discussed.

- Terms and Conditions: Detail the terms related to the equity arrangement, including percentages, voting rights, and any other relevant conditions.

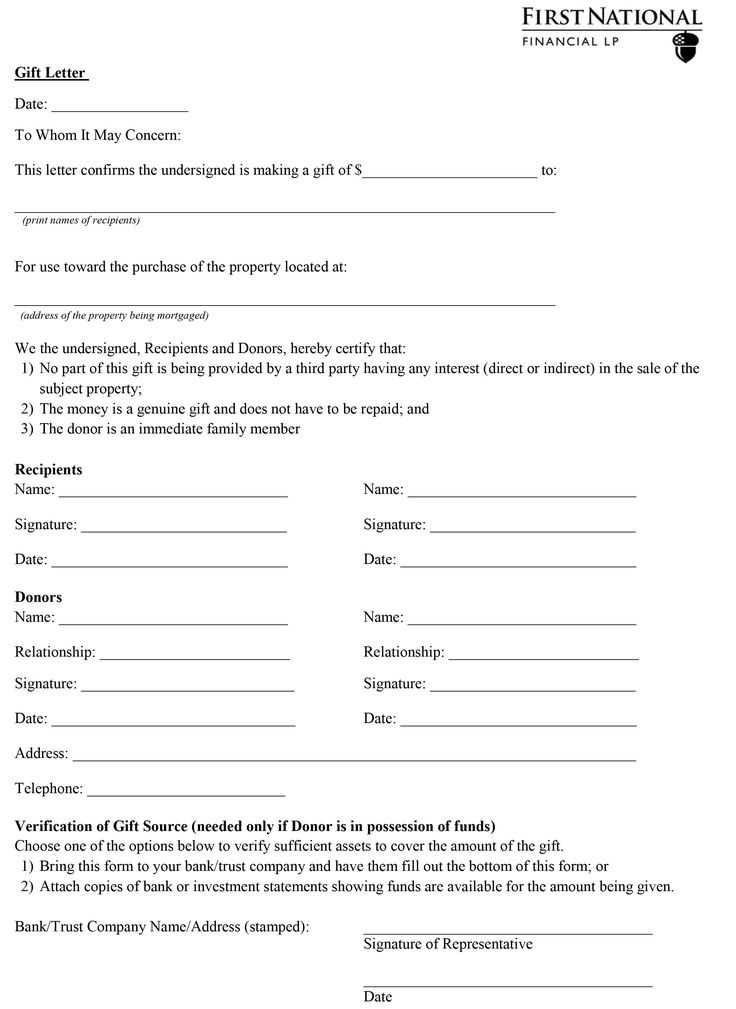

- Signatures: Include space for both parties to sign, confirming the agreement. You may also include a witness section if necessary.

Formatting Tips

- Ensure your font is professional and easy to read, such as Arial or Times New Roman, sized at 12 pt.

- Use bullet points to break down complex sections, making it easier for the reader to grasp the details quickly.

- Maintain consistent margins (typically 1 inch) throughout the document for a clean, organized appearance.

Once you have filled in the necessary details, review the letter for accuracy. Save the document in both .docx and PDF formats to ensure it can be easily shared and printed.

Equity letters serve as formal documents that communicate the financial backing or commitment of a party involved in a transaction. Typically issued by investors or stakeholders, these letters are a key part of negotiations, assuring the recipient of the availability of funds or resources for a specific deal. They are often required in real estate transactions, business deals, or financial agreements to confirm a party’s ability to meet certain financial obligations.

Key Reasons to Use Equity Letters

- To provide verification of financial capacity: Equity letters reassure counterparties that the party has the necessary funds to proceed with a transaction.

- To facilitate negotiations: By confirming financial commitment upfront, equity letters can streamline discussions and help move agreements forward faster.

- To strengthen credibility: Issuing an equity letter can enhance a party’s credibility and demonstrate their seriousness in closing the deal.

How to Utilize an Equity Letter

- Use it as a part of your due diligence package: Include the letter in your proposal or financial documentation to solidify your offer.

- Ensure clarity in the terms: Be specific about the amount of equity being offered and the conditions under which it will be available.

- Consider timing: Present the equity letter at the right stage of negotiations to maximize its impact on decision-making.

Begin with a clear statement of the letter’s purpose. Indicate why the equity support is being provided and the intended outcomes. This helps establish a direct connection between the support and the recipient’s goals.

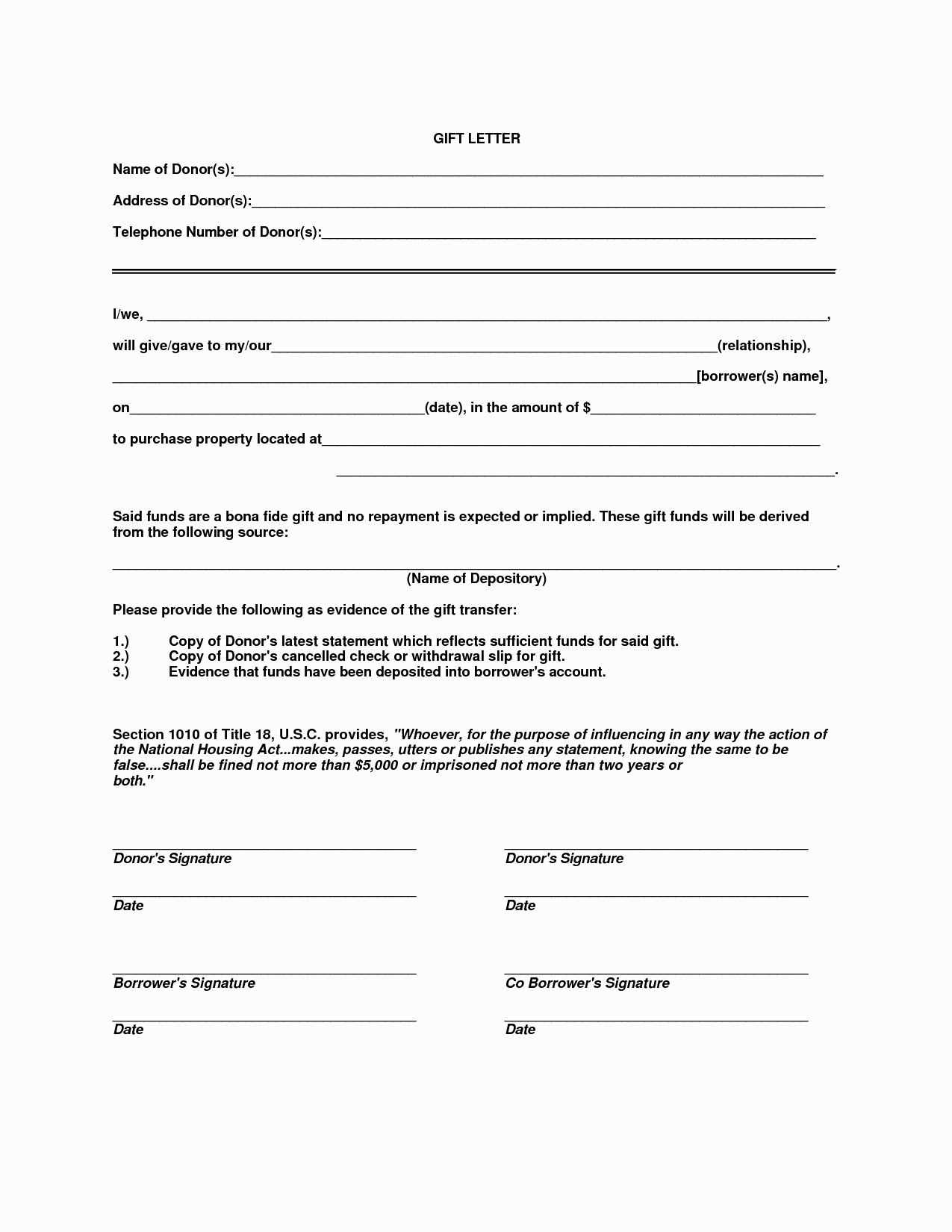

Include precise financial terms, such as the amount of equity offered, the valuation, and the type of securities or shares involved. Transparency in these figures ensures both parties understand the financial commitments being made.

Describe the timeframe for the investment, detailing any specific milestones or conditions that trigger funding. If there are conditions tied to the investment, be specific about how and when these will be met.

Outline the expectations from both parties. Clarify the rights of the equity holder, such as voting rights or dividend entitlements. This section should remove ambiguity regarding the partnership’s terms and provide a clear framework for cooperation.

Include a statement regarding the exit strategy. Address how the investment will be liquidated or repaid, whether through a sale, public offering, or another method. This gives both parties a clear understanding of the potential future actions.

Conclude with a summary of the agreement and the next steps. Indicate if any legal review or additional documentation is required before proceeding, ensuring that all parties are prepared for what comes next.

Customize the letter by replacing the placeholders with specific information related to your situation. Focus on adjusting the tone to match the formality of the communication. If you’re aiming for a more personal approach, soften the language. Alternatively, for a professional tone, opt for concise and clear phrasing.

Review the structure of the letter. Rearrange sections if necessary to reflect the most logical flow for your message. For example, if the recipient requires more detailed background information upfront, position that content accordingly. Ensure the subject and purpose of the letter are easily identifiable from the start.

Include any supporting details or documents relevant to the context of your letter. Modify the template to specify any deadlines, expectations, or required actions. Tailoring these details ensures that the recipient has all the information they need to respond promptly.

Finally, make sure the formatting aligns with your professional standards. Adjust font styles, sizes, and margins as needed, keeping the appearance clean and readable. This attention to detail adds a polished touch to the document.

Ensure the letter includes all required details. Omitting key information can lead to confusion or rejection. The equity letter should clearly specify the terms, including amounts, payment schedules, and responsibilities of all parties involved.

1. Inaccurate Information

Double-check figures and dates. Providing inaccurate amounts or incorrect deadlines can undermine the agreement. Misstating financial terms or legal obligations might cause delays or disputes.

2. Lack of Clear Language

Avoid ambiguous or complex language. The letter must be straightforward, without room for interpretation. Use concise, precise terms to ensure clarity and mutual understanding between all parties.

3. Failing to Address Key Legal Points

Do not overlook the importance of legal provisions. The letter should reflect compliance with relevant laws and regulations. Ensure it covers all necessary clauses, such as dispute resolution and jurisdiction, to prevent future legal issues.

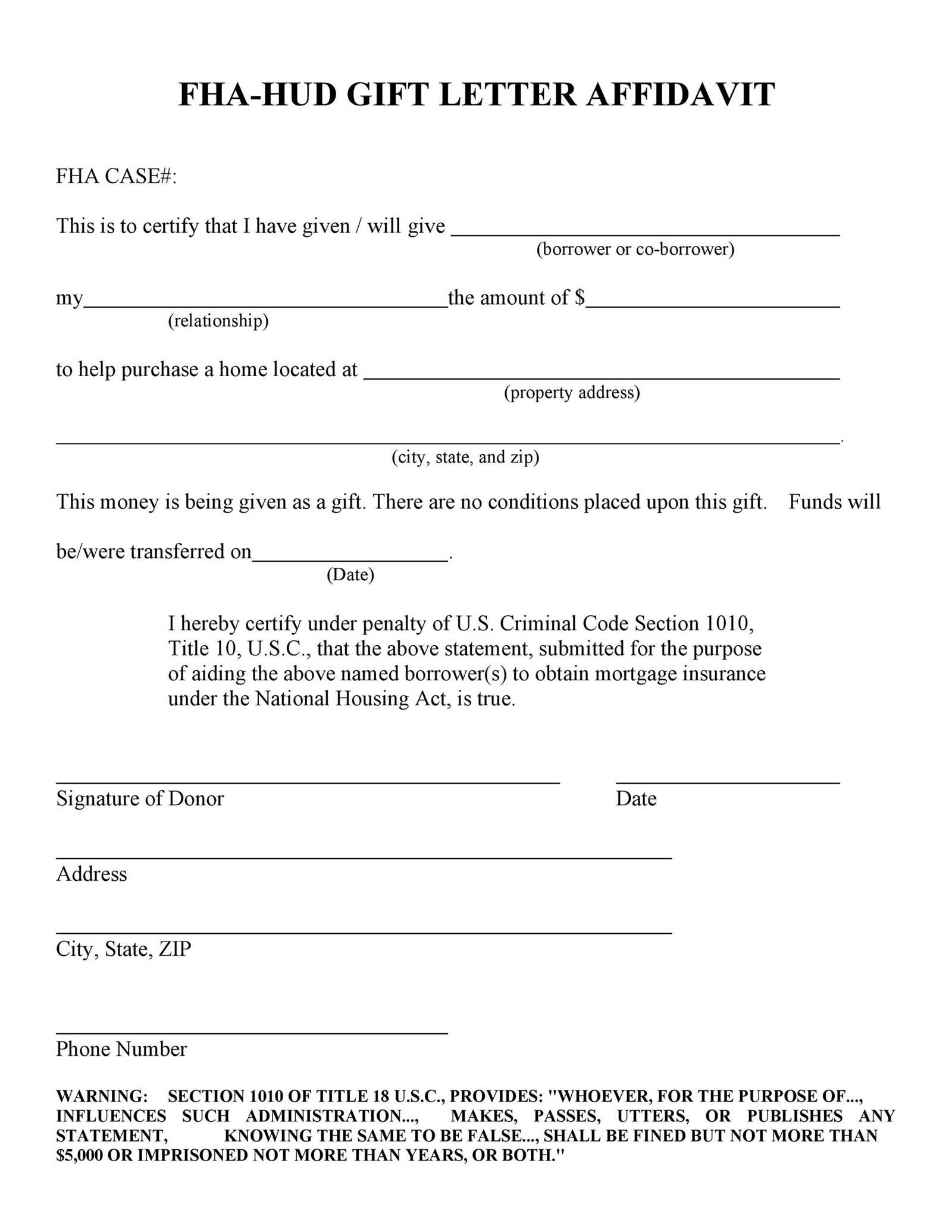

4. Missing Signatures or Notarization

Confirm that all required signatures are present. A letter without proper signatures or notarization can be deemed invalid. Ensure the correct individuals sign the document and include the necessary notarization where applicable.

5. Inconsistent Formatting

Formatting plays a role in professionalism. Avoid inconsistent font styles, sizes, and spacing. Ensure the document looks organized and follows a clear, easy-to-read structure.

6. Failing to Include a Deadline

Always specify a deadline for action. Whether it’s for submitting documents or completing payments, setting clear timelines helps prevent misunderstandings.

7. Overcomplicating the Structure

Avoid overly complicated sentence structures or excessive paragraphs. The equity letter should be easy to read, with information organized logically and in manageable sections.

8. Ignoring Follow-Up Procedures

Neglect to specify how parties should follow up. Make it clear who is responsible for checking progress and communicating next steps. This keeps all parties aligned and reduces the risk of oversight.

9. Forgetting About Confidentiality

If confidentiality is required, explicitly state this in the letter. A failure to address confidentiality can lead to legal consequences if sensitive information is shared improperly.

10. Leaving Out Consequences of Non-Compliance

Clearly define the consequences for non-compliance. Whether financial penalties or legal actions, outlining the repercussions of not adhering to the agreement helps enforce accountability.

Table: Key Components to Include in an Equity Letter

| Component | Details |

|---|---|

| Amount | Clearly state the financial commitment or investment amount. |

| Deadline | Include the specific deadline for the agreement or actions. |

| Signatures | Ensure all necessary signatures are provided. |

| Legal Clauses | Address jurisdiction, dispute resolution, and applicable laws. |

| Follow-Up | Indicate how and when the next steps will occur. |

Ensure you clearly outline the terms and conditions within the equity letter to avoid any legal disputes. This document must explicitly state the financial obligations and the scope of responsibility. Failing to do so may lead to misunderstandings, especially if the equity commitment is later called into question.

Clarifying Financial Terms

Each equity letter should detail the amount of equity being provided, along with the conditions under which it may be used. Include any timelines or deadlines that apply to the commitment. It is essential that these terms are easily understandable to all parties involved to avoid future conflicts.

Legal Binding Nature

Once signed, the equity letter often acts as a binding legal agreement. Make sure that it complies with local regulations and accurately reflects the intent of the parties. The letter should not only mention the financial aspect but also the legal responsibilities that each party assumes upon execution. Ensure that all signatures are properly obtained and that the document is enforceable in the applicable jurisdiction.

Review the letter regularly to ensure it remains in line with evolving legal standards and contractual obligations.

Begin by setting a clear, readable font. Use a standard typeface such as Arial or Times New Roman, ensuring consistency across the document. Stick to a font size of 12pt for the body text, and 14pt for headings. Maintain a professional line spacing, such as 1.5 lines, to enhance readability.

Structure and Alignment

Align text to the left for a clean, organized appearance. Use proper indentation for paragraphs and avoid long blocks of text. Break content into sections with clear headings to guide the reader through the document. Ensure adequate margins on all sides for a polished finish.

Proofreading and Review

Before finalizing, review the document for grammatical errors and inconsistencies. Double-check the accuracy of any financial or legal details, as mistakes can be costly. Use a spell-check tool but don’t rely solely on it; a manual review is essential for catching errors the software might miss.

Once everything looks correct, save the document in both Word format and PDF for compatibility and easy sharing. Consider including a table of contents if the document is lengthy to make navigation easier for the reader.

When formatting an equity letter, maintain clarity and precision throughout the document. Start by identifying the exact terms of the agreement, ensuring all parties involved are clearly listed. Specify the equity stake being offered, along with the expected deliverables or outcomes tied to the agreement. It’s also crucial to establish the duration of the agreement and any contingencies tied to performance or milestones.

Structure of the Equity Letter

Ensure the letter follows a clean structure. Begin with a clear statement of intent and then proceed to outline the specific terms. Use bullet points to list responsibilities or deliverables, making the document easy to reference. Conclude with a section that invites the recipient to review the terms, followed by space for signatures.

Key Elements to Include

- Parties Involved: Clearly state who is involved in the agreement.

- Equity Percentage: Specify the percentage of equity being offered.

- Conditions: Mention any specific conditions or milestones tied to the agreement.

- Duration: Indicate the timeframe for the agreement’s validity.

- Dispute Resolution: Define how disputes will be handled, if necessary.

Ensure that the letter reflects the mutual understanding between all parties. Keep the language professional, yet straightforward. Once finalized, both parties should review the document carefully before signing to avoid misunderstandings.