Guarantor letter template for rental

If you’re considering renting a property and need a guarantor, it’s crucial to understand the role this document plays. A guarantor letter acts as a formal agreement between the renter, the landlord, and the guarantor, ensuring that rent will be paid even if the tenant is unable to do so. This letter provides landlords with added security, especially when the tenant may not meet all rental criteria on their own.

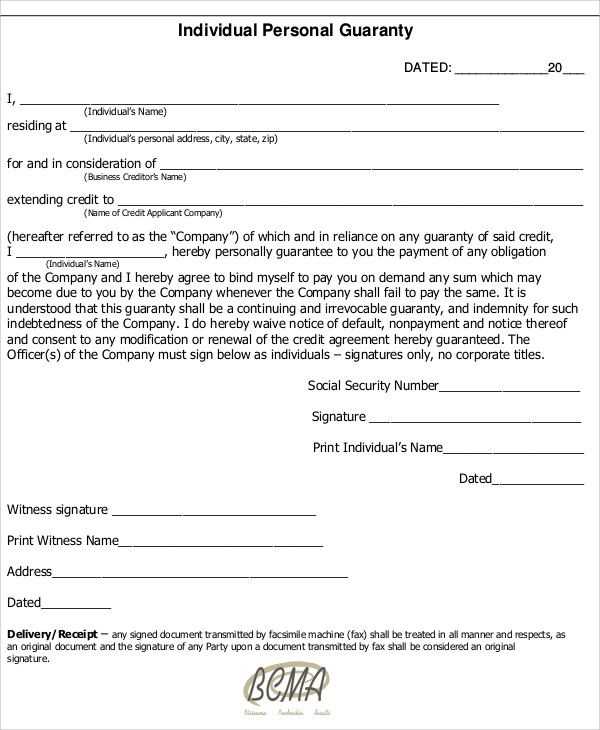

Make sure your guarantor letter includes the necessary details to make it legally sound. Start by clearly stating the names of all parties involved–the tenant, the guarantor, and the landlord. Then, describe the terms of the agreement, specifying the guarantor’s responsibility in case the tenant fails to meet financial obligations. This includes the rent amount and duration of the rental agreement.

Additionally, ensure the letter contains the guarantor’s contact information and their confirmation that they understand the obligations they’re committing to. It should also outline any conditions under which the guarantor’s responsibility may end. The more precise the terms, the clearer the expectations for all parties involved.

By providing a guarantor letter, you establish trust and transparency between the tenant and landlord. This simple document can make the difference in securing the rental property you want without unnecessary complications down the road.

Here’s the revised version with repetitions reduced:

For a guarantor letter to be clear and impactful, it’s important to focus on the key details without redundancy. Here’s a streamlined approach:

- Identify the parties involved: Clearly state who the guarantor is, including their full name, address, and contact information. Specify the tenant’s details as well.

- Confirm the guarantor’s role: Indicate that the guarantor agrees to cover the rent or damages in case the tenant defaults.

- State the rental agreement details: Mention the address of the rental property, the length of the lease, and the rent amount to provide context.

- Define the responsibilities: Clearly describe the scope of the guarantor’s responsibilities, including the duration of the guarantee and any conditions for their involvement.

- Include the guarantor’s consent: State that the guarantor acknowledges the terms and agrees to be bound by them. This ensures clarity and prevents misunderstandings.

Concluding the letter with a clear signature line for both parties will ensure the document’s validity. Avoid repetitive wording and focus on the key components to maintain professionalism and clarity.

- Guarantor Letter Template for Rental

A guarantor letter ensures landlords that someone will take financial responsibility for a tenant’s rent payments in case of default. It should clearly identify the guarantor’s role, provide necessary contact details, and outline the terms of the guarantee. Here’s a straightforward template for a rental guarantor letter:

Guarantor Letter for Rental

[Guarantor’s Name]

[Guarantor’s Address]

[City, State, ZIP Code]

[Phone Number]

[Email Address]

[Date]

[Landlord’s Name]

[Landlord’s Address]

[City, State, ZIP Code]

Subject: Rental Guarantor Agreement for [Tenant’s Full Name]

Dear [Landlord’s Name],

I, [Guarantor’s Name], agree to act as the guarantor for [Tenant’s Full Name], who will be leasing the property located at [Rental Property Address]. I understand my responsibility to cover any unpaid rent or damages caused by the tenant, as outlined in the lease agreement. I confirm that I have the financial capacity to fulfill this commitment and will promptly handle any financial obligations in case of default.

Please find my personal details below for your reference:

- Full Name: [Guarantor’s Full Name]

- Relationship to Tenant: [Relationship]

- Annual Income: [Income Amount]

- Employer: [Employer Name]

- Phone Number: [Guarantor’s Phone Number]

- Email Address: [Guarantor’s Email]

If you require any further details or have questions, feel free to contact me. I look forward to your confirmation and hope this arrangement is satisfactory.

Best regards,

[Guarantor’s Signature]

[Guarantor’s Name]

A guarantor letter should be clear, concise, and well-organized. Follow this structure to ensure your letter serves its purpose effectively.

1. Start with a Proper Heading

Include the date, the recipient’s name, and their address at the top of the letter. This helps establish a formal tone right from the beginning.

2. Introduction

Introduce yourself as the guarantor, including your full name, address, and relationship to the tenant. Mention the purpose of the letter, which is to offer your support in case the tenant is unable to meet their rental obligations.

3. Confirm Financial Responsibility

Clearly state that you are financially capable of covering the rent if the tenant defaults. Include specific details about your income or assets to reassure the landlord of your ability to meet the commitment.

4. Provide Contact Information

Offer your contact information, such as phone number and email, so the landlord can reach out if necessary. This also adds an extra layer of transparency.

5. Signature

End the letter with your signature and full name. It’s also helpful to include a professional closing, like “Sincerely,” followed by your contact information once more.

6. Table for Clarity

| Section | Details |

|---|---|

| Heading | Include date, recipient’s name, and address |

| Introduction | State your name, relationship to tenant, and purpose of the letter |

| Financial Responsibility | Reassure landlord of your financial ability to cover rent |

| Contact Information | Provide phone number and email |

| Signature | Close with your signature and contact information |

To ensure your guarantor letter serves its purpose, include the following details:

- Guarantor’s Full Name and Contact Information: Clearly state the guarantor’s full name, address, phone number, and email. This allows the landlord to reach them if needed.

- Tenant’s Full Name and Relationship to Guarantor: Identify the tenant and describe your relationship, whether it’s familial, professional, or otherwise.

- Statement of Guarantee: Specify that the guarantor agrees to cover the rent and any potential damages if the tenant fails to meet their obligations.

- Details of the Rental Property: Mention the address of the property the tenant will rent, along with any terms relevant to the guarantee, such as rental amount and duration.

- Duration of the Guarantee: Clearly state the length of time the guarantee is valid. This could be for the duration of the lease or until certain conditions are met.

- Guarantor’s Financial Capability: Include a brief statement confirming the guarantor’s financial stability or ability to cover the tenant’s obligations if required.

- Signature and Date: Conclude the letter with the guarantor’s signature and date, which solidifies the commitment and provides legal validity.

Additional Tips:

- Clear and Concise Language: Keep the letter straightforward, without unnecessary details.

- Proper Formatting: Use professional language and structure to present the guarantee in a formal, clear manner.

Always double-check the accuracy of the information you provide. Incorrect details, such as the wrong amount or misidentifying the tenant, can lead to confusion and delay the rental process.

1. Omitting Key Financial Information

Don’t skip over important financial details. A guarantor letter must clearly outline your ability to cover the tenant’s obligations. This includes your income, assets, or other relevant financial information that proves you can fulfill the guarantee if necessary.

2. Vague Language

Be specific. Avoid generalities such as “I will try to pay” or “I can help.” Clearly state your commitment to cover the rent or any other financial obligations if the tenant defaults.

3. Not Stating the Terms of the Agreement

Ensure that the letter includes clear details of the rental agreement terms, including the monthly rent, lease duration, and any conditions under which you would be expected to step in. Leaving this out can create confusion about your responsibilities.

4. Missing Signature and Contact Information

Always include your full name, address, and contact details. Your signature is also necessary to validate the letter, showing you fully accept the terms of the guarantor role.

5. Overloading with Unnecessary Information

A guarantor letter should be to the point. Avoid irrelevant details about your personal life or background. Stick to the essentials of the financial commitment you’re making.

Acting as a rental guarantor involves significant legal responsibilities. A guarantor agrees to cover the rent if the tenant fails to pay, making them liable for any missed payments. This liability can extend to covering damages, legal fees, and other costs if the tenant breaks the lease or causes harm to the property.

Before signing any agreement, guarantors should review the terms carefully. It’s crucial to understand the full extent of the financial commitment, including the duration of the guarantee and any potential legal actions the landlord may take in case of non-payment. Guarantors should also be aware that if the tenant defaults, the guarantor may face collections or even legal proceedings to recover the owed amount.

In some jurisdictions, the guarantor’s personal assets may be at risk, especially if they fail to fulfill the agreement. It’s advisable to seek legal advice before agreeing to guarantee someone else’s rental obligations. Guarantors should also consider the tenant’s financial stability and reliability before committing to such an agreement.

In addition to financial risks, a guarantor’s credit rating can be affected by the tenant’s actions. If the tenant defaults and the guarantor fails to cover the rent, this can lead to a negative impact on the guarantor’s credit score, making it harder to secure loans or other financial services in the future.

Clearly understanding the contract’s specifics and seeking legal guidance can help mitigate risks. Always assess the potential consequences and ensure that the terms are well within your financial capabilities before agreeing to become a guarantor.

A guarantor may be requested when a renter’s financial standing or rental history doesn’t meet the landlord’s requirements. This can occur if the renter is a student, self-employed, or has limited credit history, making them a higher risk in the landlord’s eyes.

Why a Guarantor is Requested

If the tenant has low income or a short-term employment history, a guarantor reassures the landlord that rent will be paid on time. Renters who have had issues with previous leases or have a poor credit score may be asked for a guarantor as an added security.

When a Guarantor is Needed

Landlords often request a guarantor if the renter has an insufficient income (typically under three times the rent amount), lacks a credit history, or has had past financial problems. Students, who may not have a steady income, commonly need a guarantor. It’s also possible that landlords require a guarantor for tenants who have just moved to the area or those with an irregular employment history.

Examples of Guarantor Letters for Various Rental Situations

When you act as a guarantor for a rental agreement, the letter you provide should reflect the specifics of the situation. The tone should be clear, and the commitment unambiguous. Below are examples of guarantor letters tailored for different rental situations:

1. Guarantor Letter for a First-Time Renter

Dear [Landlord’s Name],

I, [Your Full Name], confirm my role as a guarantor for [Tenant’s Full Name] who is applying for a lease at [Rental Property Address]. I understand the financial obligations involved in this agreement and guarantee that I will cover any missed payments up to the amount specified in the rental contract. I am financially capable and willing to assume this responsibility should the tenant fail to meet the terms of the lease.

Thank you for your consideration. Please contact me at [Phone Number] or [Email Address] if further information is needed.

Sincerely,

[Your Full Name]

[Your Address]

2. Guarantor Letter for a Student Rental

Dear [Landlord’s Name],

I am writing to confirm that I, [Your Full Name], will act as a guarantor for [Student Tenant’s Full Name] in their rental application for the property at [Rental Property Address]. As [Student Tenant’s Relationship to You], I am fully aware of their current student status and income level, and I am confident in my ability to cover any rent payments should the tenant be unable to do so. This agreement will remain in effect for the duration of the lease term.

If you require any additional information or documentation, please feel free to reach out at [Phone Number] or [Email Address].

Sincerely,

[Your Full Name]

[Your Address]

3. Guarantor Letter for a Rental After Bankruptcy

Dear [Landlord’s Name],

As a guarantor for [Tenant’s Full Name] at [Rental Property Address], I fully understand the concerns regarding financial stability following a bankruptcy. I am willing to guarantee that I will cover any missed rent payments up to the amount outlined in the lease. Despite [Tenant’s Name]’s recent bankruptcy, I am confident in their commitment to meeting the rental obligations and will take full responsibility if any issues arise.

If you need further details or have any questions, don’t hesitate to contact me at [Phone Number] or [Email Address].

Sincerely,

[Your Full Name]

[Your Address]

4. Guarantor Letter for an International Tenant

Dear [Landlord’s Name],

I, [Your Full Name], am writing to act as a guarantor for [International Tenant’s Full Name] in their application for the rental property located at [Rental Property Address]. I understand that [Tenant’s Full Name] is from [Country] and may not have a local credit history. As their guarantor, I commit to covering any unpaid rent or other lease-related financial obligations should they arise during the term of the lease.

If you require further verification of my ability to meet this guarantee, please feel free to contact me directly at [Phone Number] or [Email Address].

Sincerely,

[Your Full Name]

[Your Address]

Clearly define the terms under which the guarantor agrees to take responsibility. Include specific details on the rental payment schedule, including amounts due and deadlines. Address any potential circumstances that would trigger the guarantor’s involvement, such as missed payments or property damage.

Specify the length of time the guarantor will be liable. Include start and end dates to avoid ambiguity about the duration of the responsibility. If the rental agreement is extended or renewed, clarify whether the guarantor’s responsibility continues.

Provide explicit instructions on how the guarantor should confirm their agreement, such as signing the letter and submitting it to the landlord. Include space for the guarantor’s signature and date to formalize the commitment.