Subrogation demand letter template

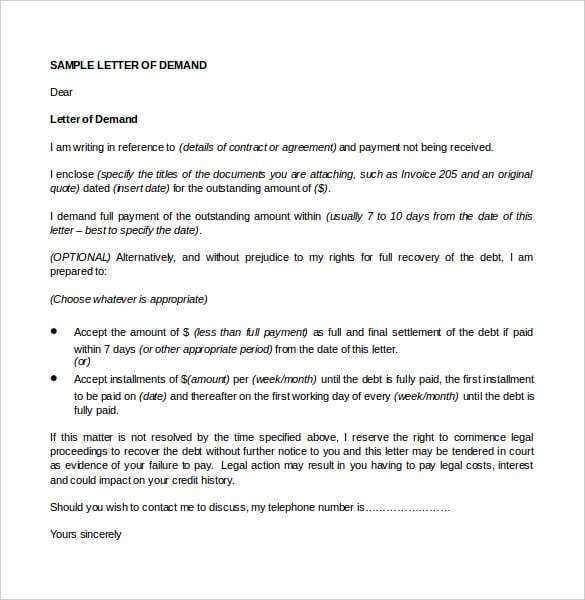

A subrogation demand letter is a formal request from an insurance company or a third party to recover funds from an individual or entity responsible for causing a loss. This letter serves as a critical step in pursuing reimbursement for the costs incurred by the insurer. When drafting a subrogation demand letter, it’s vital to include specific details such as the incident description, the amount owed, and the legal rights under the subrogation agreement.

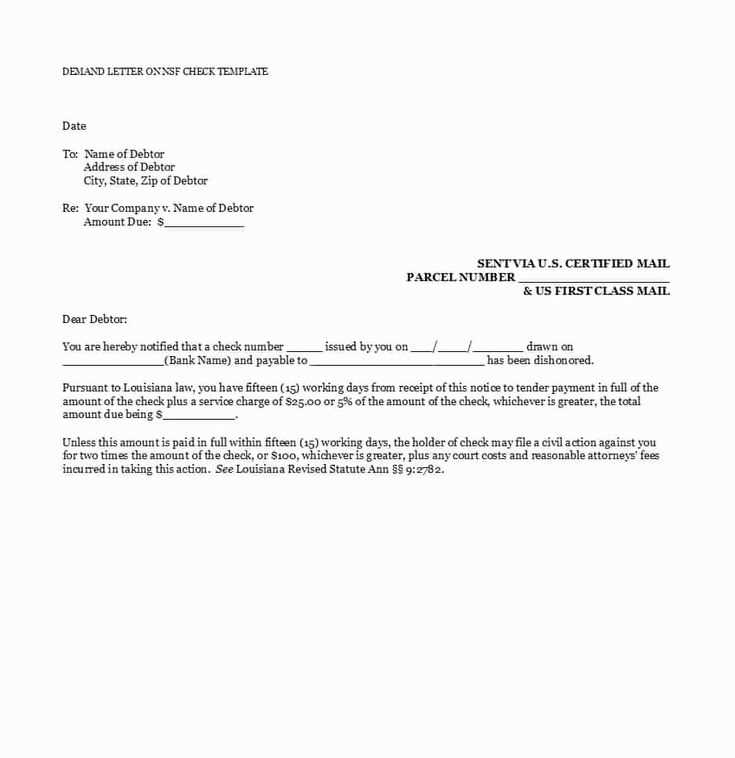

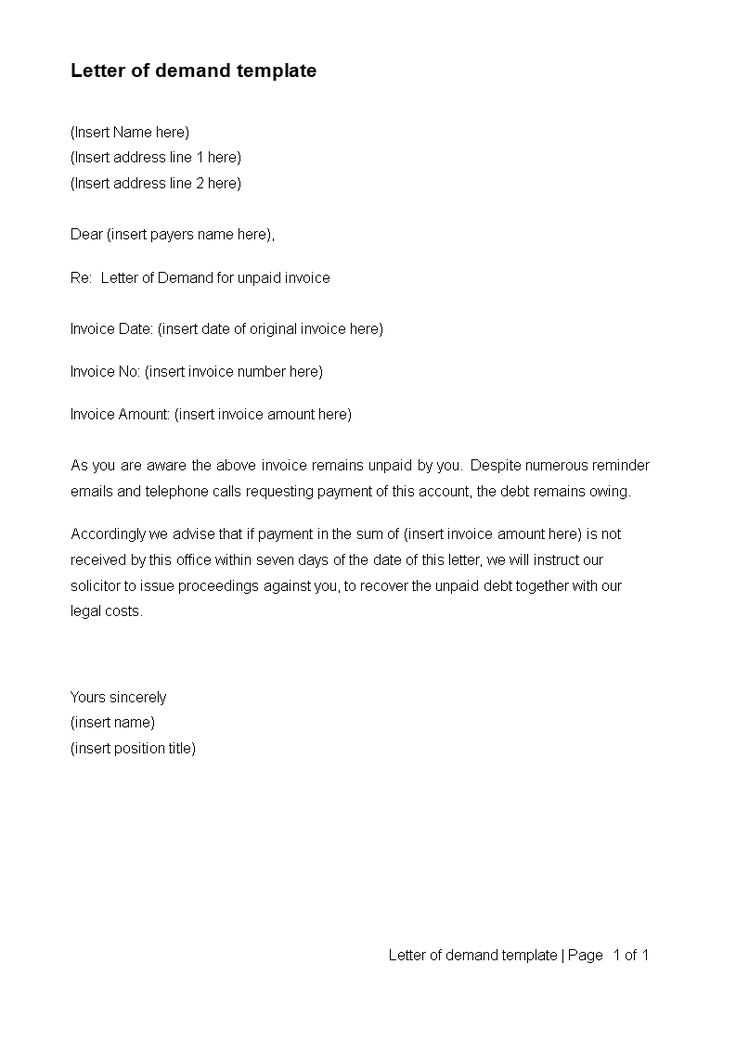

Start by clearly identifying both the claimant and the recipient, providing essential contact details. Mention the date of the incident and outline the circumstances surrounding it. Make sure to reference the insurance policy involved and explain how the payments were made under that policy, emphasizing that the insurer has a legal right to recover the costs from the party responsible. Attach relevant documents, such as police reports, bills, and proof of payment, to support your claim.

Be direct in stating the amount being requested, and specify a reasonable deadline for payment. Remind the recipient of the legal obligations to settle the debt and outline the consequences of non-payment, including potential legal action. Be professional and clear in your communication to avoid misunderstandings and to prompt a timely response.

Here’s the revised text based on your requests:

Clearly outline the purpose of the subrogation demand letter. Begin with an immediate statement of your claim, referencing any supporting documents and previous communications. Mention specific amounts owed and the reason for the subrogation request. Be precise with the dates, amounts, and parties involved.

Example: “We are writing to inform you of our subrogation claim for the amount of $2,500, which was incurred due to damages on [date]. The payment made to [party name] is now your responsibility under the terms of the insurance agreement.”

Next, explain the legal basis of your claim, referencing relevant policies, agreements, or applicable laws. Be clear about the expectations for repayment, including the timeframe within which you anticipate receiving a response or payment.

Example: “Under Section 5.2 of the insurance agreement, the liable party is required to reimburse all costs incurred as a result of the damages caused by [incident]. We kindly request payment of the amount due within 30 days from the date of this letter.”

Conclude with a clear call to action, emphasizing the consequences of non-payment, while remaining polite and professional. Provide your contact details for further communication.

Example: “Please remit the payment directly to our office, or contact us at [phone number] or [email address] to discuss this matter further. If we do not receive payment by [date], we will have no choice but to pursue further legal action.”

Subrogation Demand Letter Template: A Practical Guide

Understanding Subrogation and Its Legal Basis

Key Elements to Include in a Demand Letter for Subrogation

How to Address the Recipient of the Demand Letter

Setting a Clear Deadline for Response in Your Letter

Common Mistakes to Avoid in Subrogation Letters

What to Do After Sending the Demand Letter

Begin your subrogation demand letter with a clear statement of your claim. Specify the amount you seek to recover and reference the underlying event or accident that led to your right of subrogation. The legal basis for your claim should be mentioned early on, making it clear that you are exercising the right to recover payments made on behalf of the responsible party. Ensure your language is direct and factual, as this helps establish credibility and urgency.

Incorporate key details such as the policy number, claim number, and the names of the involved parties. These specifics allow the recipient to easily identify the context of your claim and verify your legal standing. Include a brief description of the incident, outlining the responsible party’s actions or negligence, which caused the financial loss you are now seeking to recover.

Address the recipient formally, using their full name or company title. If you are sending the letter to an insurance company, direct it to the claims department or the adjuster in charge of the case. If you’re unsure who exactly handles subrogation matters, request clarification in your letter. Avoid using informal or vague greetings to maintain a professional tone throughout.

Set a clear and reasonable deadline for a response, typically 30 days from the date of the letter. This time frame gives the recipient enough time to review the information and respond appropriately, but also provides you with a sense of urgency. Make sure to mention that if there is no response within this period, you may take further legal action, such as filing a lawsuit.

Avoid common mistakes like failing to include specific evidence or documentation to support your claim. Attach any relevant documents such as receipts, police reports, medical bills, or a detailed summary of the financial loss. Another mistake is neglecting to keep a copy of the letter for your records. Always document your communication for future reference in case the situation escalates.

After sending the letter, keep track of the recipient’s response. If they acknowledge your claim and agree to settlement terms, proceed with the necessary steps to finalize the recovery process. If they fail to respond or dispute the claim, you may need to consult with an attorney to explore further legal actions.