Section 609 letter template

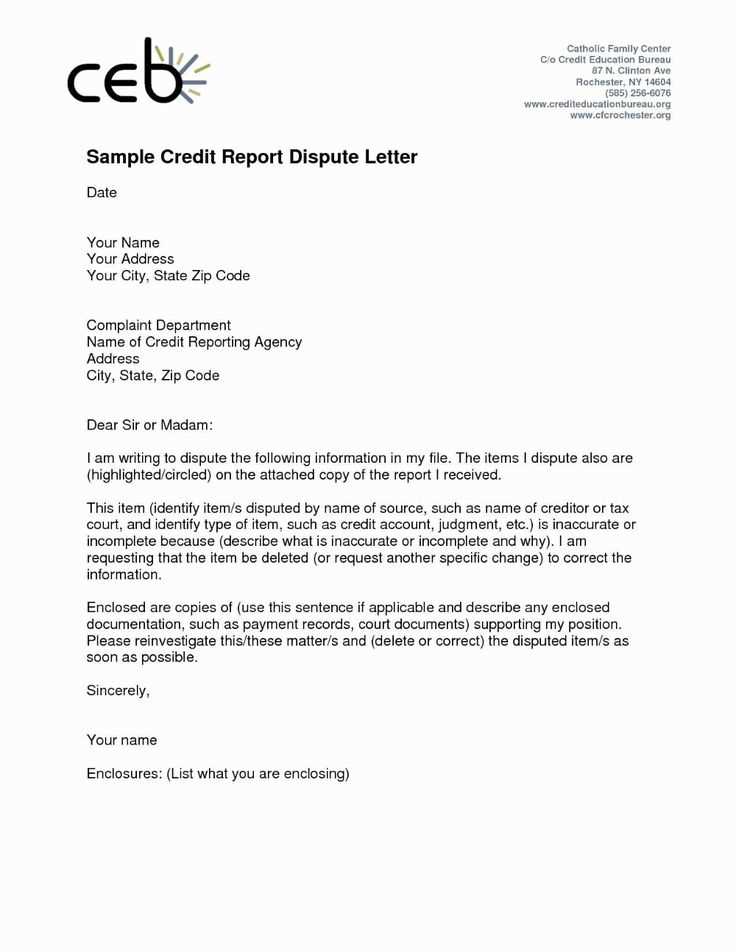

A Section 609 letter can help you dispute inaccurate information on your credit report. If you notice any errors or unverified items, this letter provides a formal approach to challenge them directly with the credit bureaus. Use this template to assert your rights under the Fair Credit Reporting Act (FCRA), which mandates that all information reported on your credit file must be accurate and verifiable.

Begin by clearly identifying the discrepancies in your report. Include specific details, such as account numbers, dates, and amounts. Ensure that each inaccuracy is highlighted for easy reference. Make sure your request is concise and factual, and always ask for verification or removal of the disputed items within the legally required 30 days.

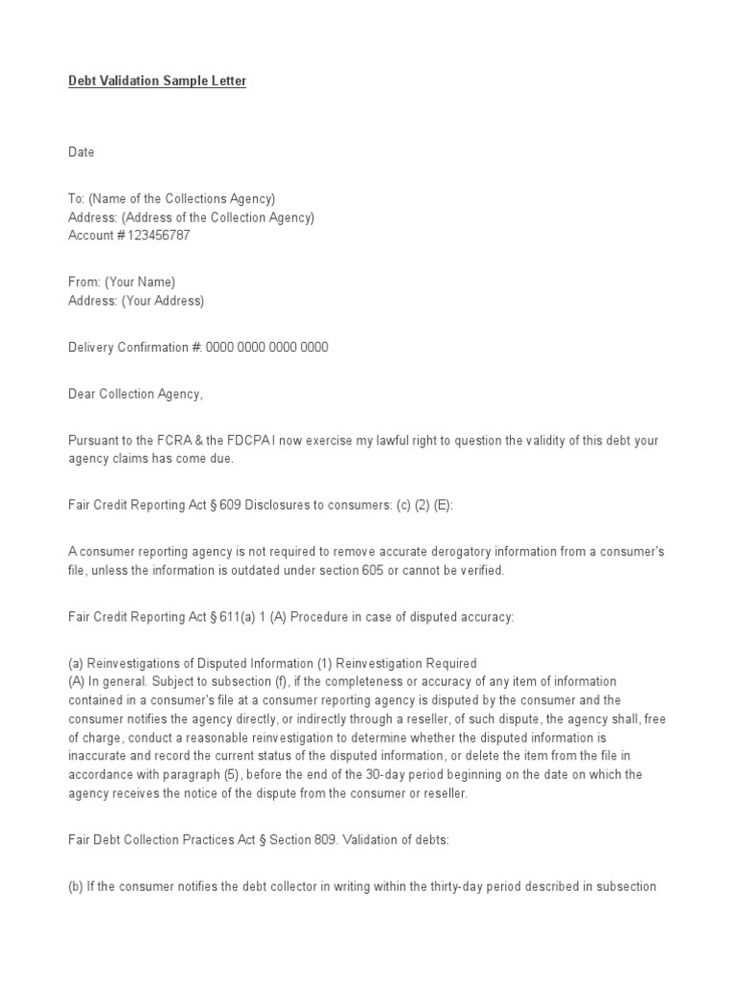

It’s important to send the letter through a method that confirms receipt, such as certified mail. This will provide you with a proof of delivery, which is useful should you need to follow up or take further action. Make sure to keep a copy of your letter for your own records.

Once the credit bureaus receive your letter, they are obligated to investigate the disputed items. If they cannot verify the information within the 30-day window, the item must be removed from your credit report. Using a Section 609 letter is an efficient way to ensure that your credit history reflects only accurate data.

Here is the revised version of your text, keeping the original meaning and language intact while reducing word repetition:

To craft a strong Section 609 letter, follow these steps:

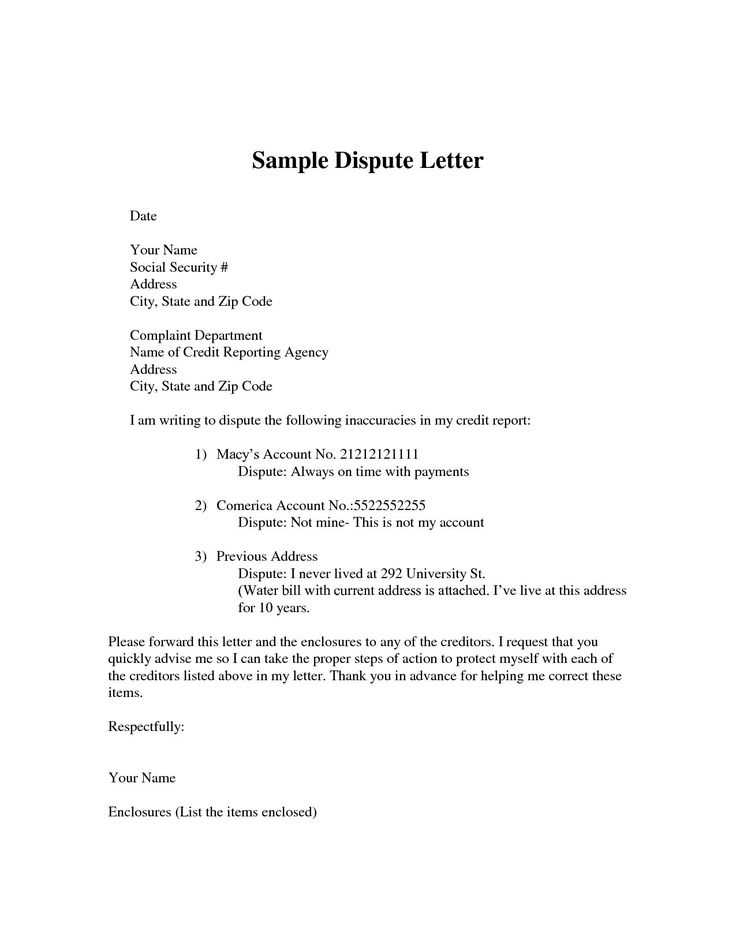

- Identify the incorrect information on your credit report. Be precise in detailing the dispute.

- Request the removal or correction of the inaccuracies, providing clear explanations for why each entry is wrong.

- Support your claims with documentation. Attach any relevant records, such as payment receipts or legal notices, to back your argument.

- Ensure your letter is concise and professional. Avoid unnecessary details and keep the focus on the key points.

- Send the letter via certified mail to confirm receipt. This step provides proof of your submission and starts the clock on their response time.

After sending the letter, track the progress. The credit bureau must respond within 30 days. If they fail to resolve the dispute, consider escalating the issue to the relevant authorities or seek legal advice.

Section 609 Letter Template: A Practical Guide

How to Draft a Section 609 Letter for Credit Report Disputes

Key Elements to Include in a Dispute Letter Under Section 609

How to Address Inaccurate Information Using Section 609

How to Verify and Validate Your Credit Information with a Dispute Letter

Common Mistakes to Avoid When Writing a Section 609 Dispute Letter

What to Do If Your Section 609 Letter Is Ignored or Denied

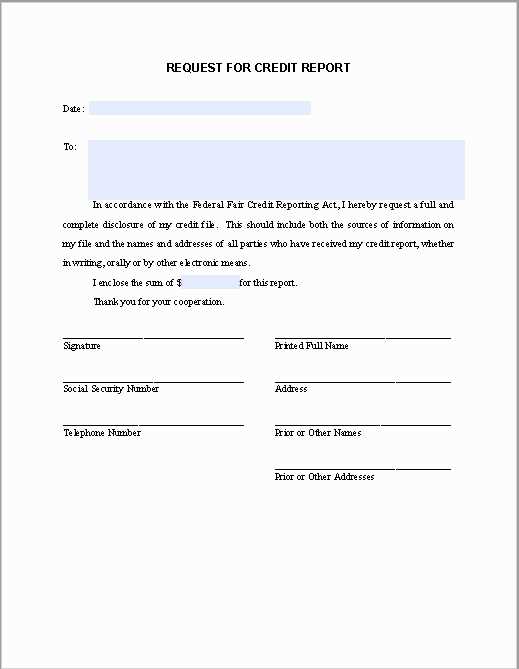

To create a Section 609 dispute letter, begin by identifying the inaccurate information on your credit report. Clearly list each item that you believe is incorrect, providing any necessary details such as account numbers or dates. Ensure that your letter addresses each dispute separately for clarity.

Key elements to include in the letter are: a formal salutation, a statement requesting verification of the disputed information, a clear explanation of why the information is incorrect, and a request for it to be removed or corrected. It’s important to provide documentation supporting your claim, such as receipts, statements, or legal documents. This helps the credit bureau investigate your case efficiently.

Use Section 609 to request that the credit bureau verify the accuracy of the information. If the information cannot be verified, Section 609 mandates that it must be removed from your report. Be precise in stating that you are exercising your right to have the information validated under this section of the Fair Credit Reporting Act (FCRA).

When verifying or validating your credit information, include a direct request for the credit bureau to confirm that the data is accurate and complete. Make it clear that if they cannot verify the information within 30 days, it must be removed from your report. This reinforces your legal rights under Section 609.

Avoid common mistakes such as including irrelevant details or using vague language. Keep the letter concise and professional. Do not threaten the credit bureaus or use inflammatory language, as it can delay the process. Another common error is forgetting to sign your letter–always include your signature at the end to make it valid.

If your Section 609 letter is ignored or denied, take further action by submitting an appeal or filing a complaint with the Consumer Financial Protection Bureau (CFPB). Additionally, consider sending a follow-up letter to remind the credit bureau of their legal obligation to respond to your dispute.

I’ve adjusted the wording to avoid repetition and ensure clarity.

When writing a Section 609 dispute letter, clarity is key. It’s important to avoid redundancy and ensure that each sentence serves a specific purpose. To achieve this, review your letter for repetitive phrases or ideas. For instance, instead of stating “I disagree with this report” multiple times, rephrase it by explaining why the report is inaccurate and provide specific examples. This reduces unnecessary repetition and strengthens your argument.

Tips for Clear Writing

Use varied sentence structures. If you repeat the same sentence pattern too often, it can make your letter feel monotonous. Mix in simple, compound, and complex sentences to keep your reader engaged. Additionally, keep your points direct and to the point. Avoid wordy phrases that don’t add value to your message.

Editing for Precision

After drafting your letter, read it through with a critical eye. Focus on the clarity of each sentence. If a phrase feels unclear or redundant, rephrase it. For example, instead of saying “I have checked my records, and I can confirm that the information is incorrect,” you might say, “The information provided is inaccurate according to my records.” This makes your letter more concise and impactful.