Gift tax letter template

When you need to notify the IRS or relevant tax authority about a gift you’ve given, a well-written gift tax letter helps streamline the process. The letter should clearly state the amount of the gift, the recipient, and your relationship with them. In addition, including any necessary tax details can make sure your records are accurate and up-to-date.

Start by including your full name, address, and the recipient’s details. Specify the date of the gift and the total value. It’s a good idea to include any supporting documents, such as a valuation of the gift, if applicable. This will demonstrate transparency and ensure that the tax authority has all the required information for proper processing.

Explain the nature of the gift – whether it was cash, property, or another asset. It’s also helpful to indicate whether the gift is subject to any exceptions or exclusions, such as those for gifts to spouses or charities. Keep the tone formal and ensure all facts are clear and precise to avoid any confusion or delays in processing.

Wrap up by signing and dating the letter. If necessary, include any references to the applicable tax codes or laws that pertain to your situation. This small detail can show that you’ve done your due diligence and are providing a correct and legal declaration.

Here’s the corrected version:

Ensure to address the recipient by name at the start of the letter. Clearly state the purpose of the gift in the first sentence, and provide a brief summary of the relevant tax implications. The tone should remain polite and professional, without unnecessary elaboration.

Key Information to Include:

- Gift Description: Specify the gift’s nature and value. For instance, “A cash gift of $5,000.”

- Donor Information: Include the donor’s full name and address. If the gift is from a business, list its details as well.

- Recipient Information: Provide the recipient’s full name, relationship to the donor, and their address.

- Gift Tax Explanation: Clearly explain the tax responsibility, whether it falls on the donor or the recipient. Refer to the applicable tax laws and any exemptions that apply.

- Amount and Timing: Indicate when the gift was made or will be made, and if it exceeds any exemption limits.

Additional Tips:

- Include any necessary forms or documents related to the gift for tax purposes.

- State if the gift was made under specific conditions, such as for a special occasion or as part of an estate planning arrangement.

- Finish with a reminder to seek professional advice if the recipient has any questions regarding their tax obligations.

By following this structure, you will create a clear, concise, and professional letter that communicates all necessary details without excess verbiage.

- Gift Tax Letter Template

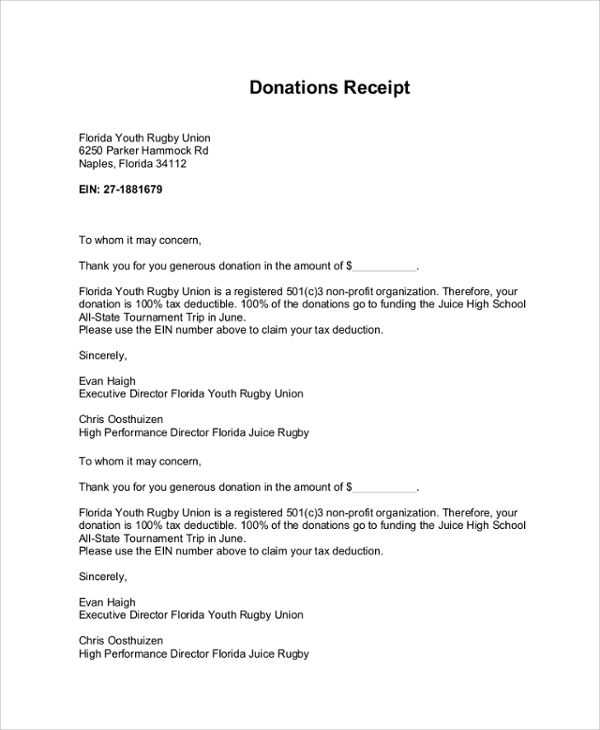

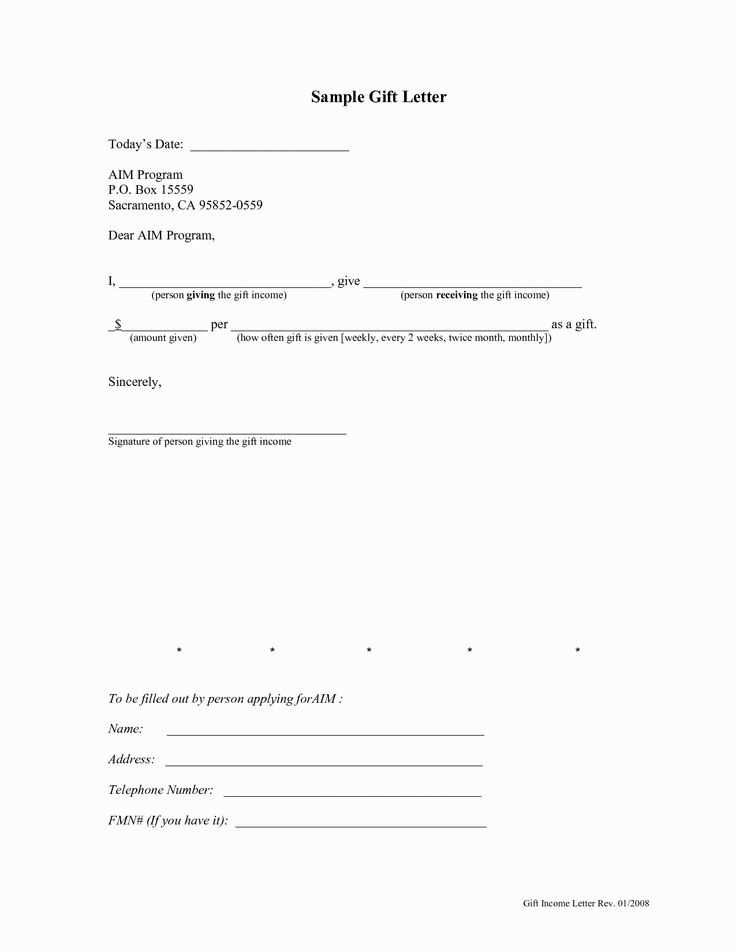

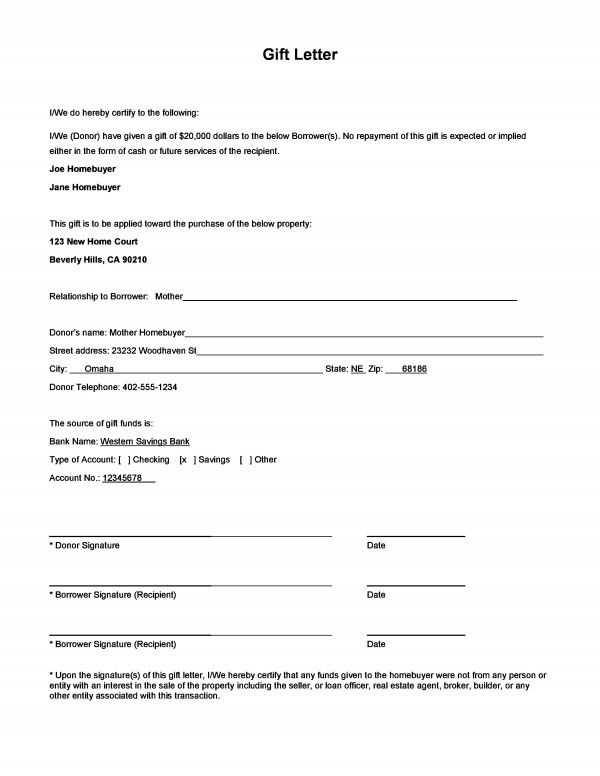

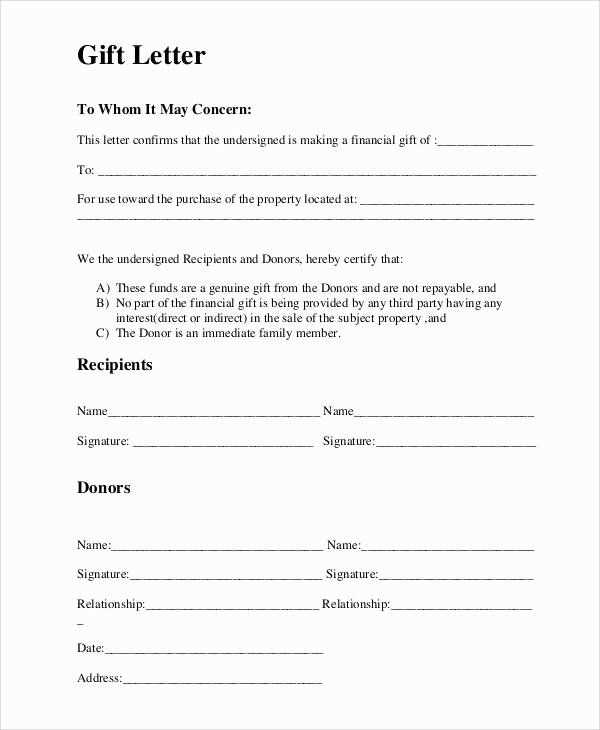

To ensure compliance with gift tax laws, it’s crucial to include specific details in your gift tax letter. This template will guide you through the necessary information to include when notifying a recipient of a gift transfer that may be subject to tax.

Key Elements of a Gift Tax Letter

Your letter should contain the following information:

- Donor’s Full Name and Address

- Recipient’s Full Name and Address

- Gift Description (including the type and value)

- Date of Gift Transfer

- Statement of No Consideration (indicating the gift is not in exchange for any service)

- Tax Identification Numbers (if required by jurisdiction)

- Statement on Gift Tax Liability (if applicable)

Sample Gift Tax Letter Template

Here’s a basic template you can customize:

| Donor’s Name: | [Donor Name] |

| Recipient’s Name: | [Recipient Name] |

| Gift Description: | [Brief Description of Gift] |

| Gift Value: | [Value of Gift] |

| Date of Transfer: | [Date of Transfer] |

| Statement of Consideration: | This is a gift, and no consideration has been received in return. |

| Tax Identification Number (TIN): | [Donor’s TIN (if required)] |

| Tax Liability Statement: | [Indicate who is responsible for any tax liability] |

By including these details, both the donor and the recipient can remain clear about their obligations and avoid misunderstandings regarding gift tax. Be sure to consult with a tax advisor for guidance specific to your jurisdiction.

To create a gift tax document, begin by accurately noting the details of the gift, including the names and addresses of both the giver and the recipient. This establishes the essential context. Ensure that the value of the gift is stated clearly. This is often determined based on its fair market value at the time of transfer.

What to Include

Provide a clear description of the gift, whether it’s cash, property, or any other type of asset. If the gift involves real estate, include property details such as address, legal descriptions, and the transfer type. Specify any exemptions that apply, such as annual exclusions for gifts under a certain threshold.

Filing Requirements

Most gifts exceeding the annual exclusion limit require filing IRS Form 709. Be sure to file it within the due date, typically by April 15 of the year following the gift. Failing to report can lead to penalties, so submitting the document on time is crucial for compliance.

Use a clear structure to ensure your tax letter is easy to understand. Begin with a formal salutation, addressing the recipient by name or title. Clearly identify the purpose of the letter in the opening sentence, such as “This letter serves as a formal declaration of the gift made on [date].”

Provide details of the gift, including the date of transfer, the value of the gift, and a description of the item or assets given. Include any supporting documentation, like appraisals or receipts, to verify the value of the gift. Be specific about the method of transfer–whether it was in the form of cash, property, or other assets.

Clarify if there are any conditions or restrictions tied to the gift. For example, if the gift was given with a condition or expectation attached, outline it clearly in the letter. If it was a gift with no strings attached, explicitly state that it was a “no strings attached” gift.

End the letter by expressing appreciation for the recipient and reaffirming that all necessary details have been provided for tax purposes. Ensure that the letter is signed and dated, with a contact number in case the recipient has any questions.

Make sure the letter clearly states the full names and addresses of both the donor and the recipient. Specify the relationship between them, as this can affect the tax implications. Include the exact amount or value of the gift, and ensure that it’s recorded accurately. If the gift involves property, such as real estate or assets, provide detailed descriptions, including the address or any distinguishing features.

Include the Date and Method of Transfer

Indicate the date the gift was made, along with the method of transfer. If applicable, mention how the gift was physically transferred (e.g., bank transfer, hand-delivered, etc.). If there are any specific conditions tied to the gift, such as the donor’s right to reclaim it, make sure to state this clearly.

Specify Tax Obligations and Liabilities

Clarify the tax responsibilities for both parties. This includes any gift tax exemptions that may apply and whether either party is responsible for paying the taxes. Providing this information upfront helps prevent confusion and ensures transparency in case of any future inquiries from tax authorities.

Ensure the letter includes accurate details, such as the gift amount and the donor’s intent. Inaccurate or vague information can lead to complications or misunderstandings with tax authorities.

- Not Mentioning the Date of the Gift: Always state the exact date when the gift was made. Without this, the IRS may question the legitimacy of the transaction.

- Forgetting to Identify the Gift as Non-Refundable: Clearly indicate that the gift is non-refundable to prevent potential legal issues later.

- Neglecting to Specify the Relationship: Clarify the relationship between the donor and recipient. This helps in determining the tax implications, especially for gifts between family members.

- Leaving Out Gift Tax Implications: A gift letter should address any tax obligations that may arise, such as the annual exclusion limit for gifts, to avoid confusion later.

- Using Vague Language: Be specific in describing the gift. Avoid general terms like “a valuable item” and include details like “cash amount of $5,000.” This eliminates ambiguity.

Be precise, complete, and clear when drafting the letter to prevent unnecessary issues or delays. The more accurate the details, the smoother the process will be.

Ensure the gift letter includes the exact amount of the gift and the date it was given. This provides clarity for tax authorities and supports accurate reporting. Specify if the gift was cash or property, and if it includes any conditions or requirements attached to it. This helps avoid any misunderstanding about the nature of the gift and its value.

Documenting the Relationship

Include details about the relationship between the giver and the recipient. This is particularly important for tax purposes, as certain exemptions or tax rates apply depending on the relationship. For example, gifts to spouses or children may have different thresholds for reporting or taxation. Be clear about whether the gift qualifies for these exemptions.

Gift Amounts and Reporting Requirements

Report gifts that exceed the annual exclusion limit for tax purposes. If the gift exceeds the annual exclusion amount, the giver may need to file a gift tax return (Form 709 in the U.S.). The letter should clearly state the value of the gift to ensure proper compliance. The recipient is generally not responsible for reporting the gift, but it’s still important to include this information in the letter for transparency.

Once you’ve sent the gift tax document, the next step is to confirm its receipt by the relevant authorities. This ensures they have all the necessary information for processing your submission. It’s a good idea to keep any tracking details or proof of delivery for reference.

Monitor for Any Correspondence

Watch for any follow-up communication from the tax authorities. They may request additional documentation or clarification, so keep an eye on your mail or email for any updates. Respond to these promptly to avoid delays.

Retain Copies for Your Records

Save copies of the gift tax document and any correspondence from the tax office in a secure place. These records might be useful in the future for tax reporting or audits.

If there are no issues after submission, the process will be complete once the tax authorities process the gift tax filing. Be sure to check the deadline for any payments or additional forms you may need to submit later on.

For those looking to draft a gift tax letter, it’s vital to ensure that all necessary details are included. This helps in avoiding any complications or confusion regarding the gift’s value and the potential tax implications.

Key Components of a Gift Tax Letter

Begin by clearly identifying the donor and recipient, stating their full names, addresses, and relationships. The letter should also specify the date the gift was given. Include a detailed description of the gift, whether it’s monetary or property, and provide an estimate of its value based on fair market prices at the time of the gift.

Additional Considerations

Ensure to mention any conditions or restrictions that apply to the gift, if relevant. If the gift is a large one, consulting a tax professional is a wise choice to clarify any potential liabilities. Include a statement that confirms the gift is not a loan, to avoid future confusion with repayments.