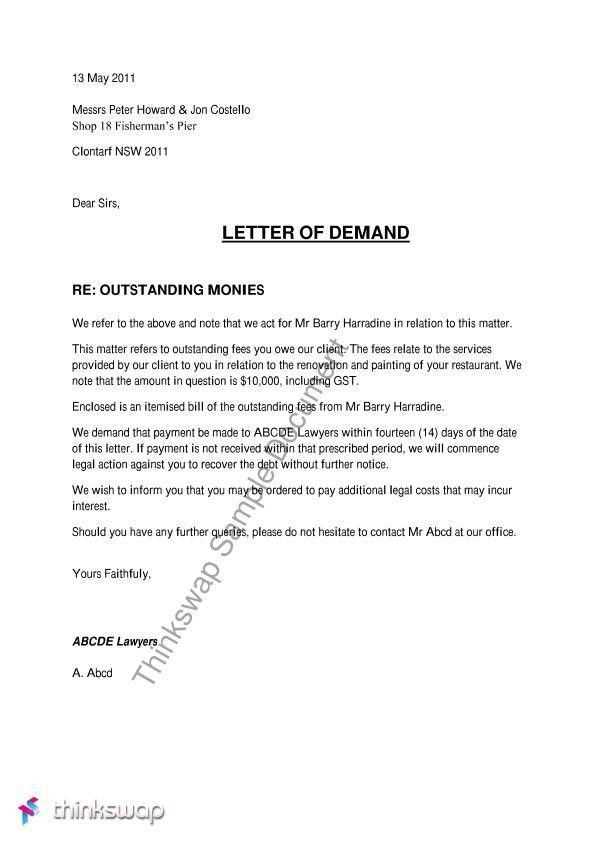

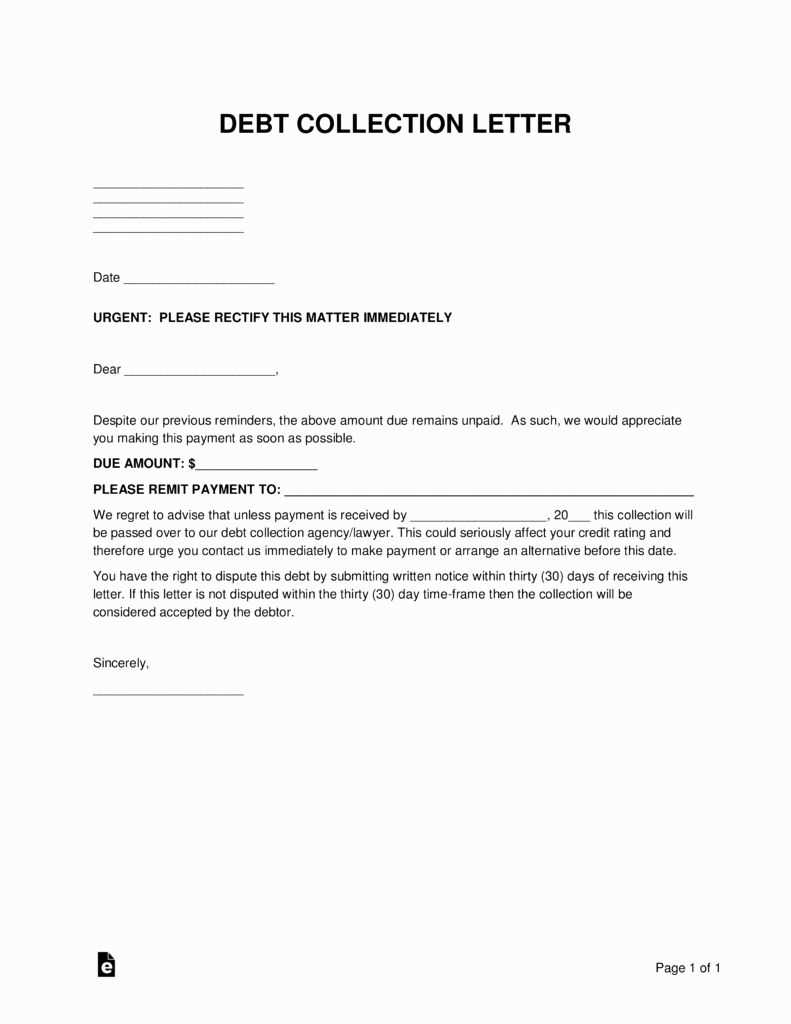

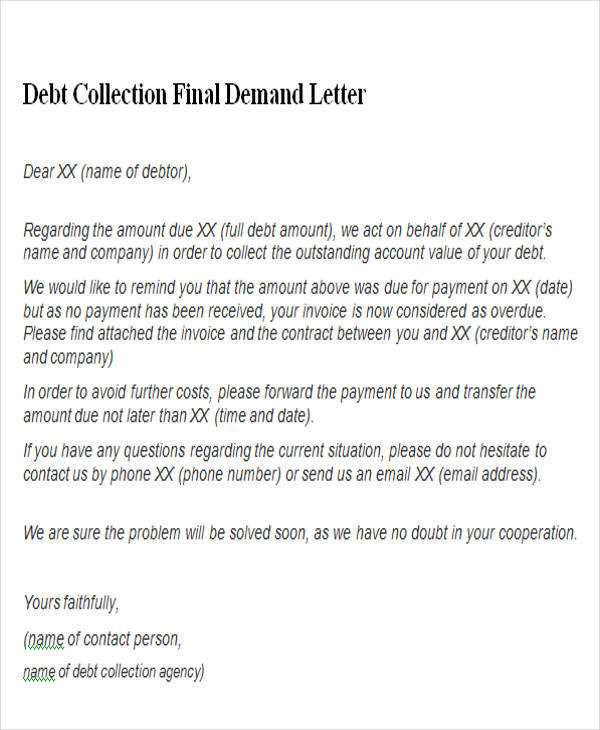

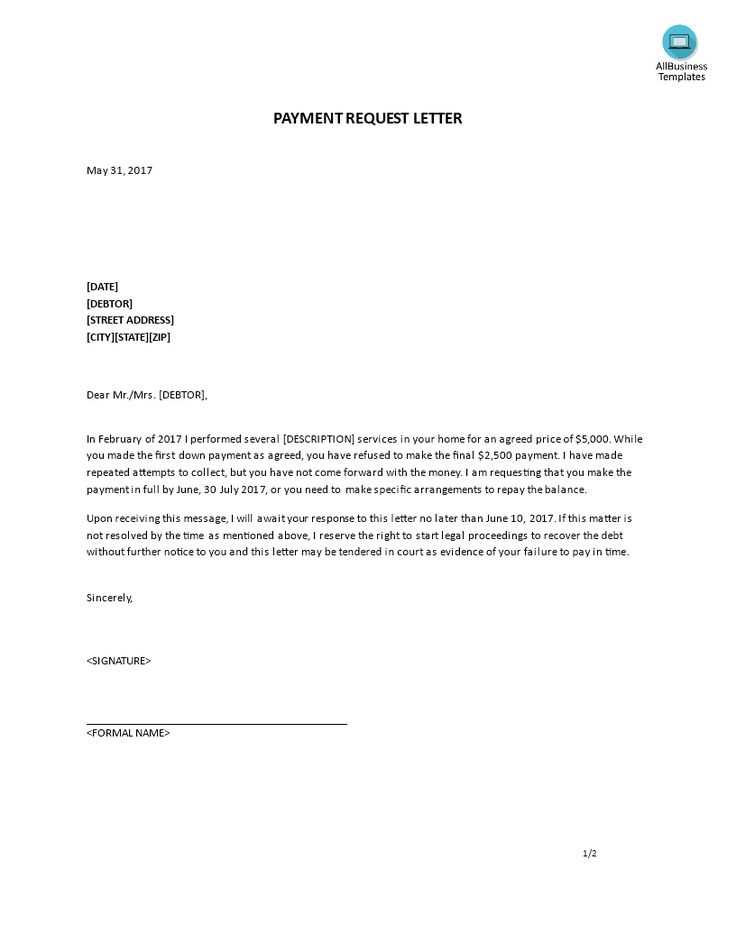

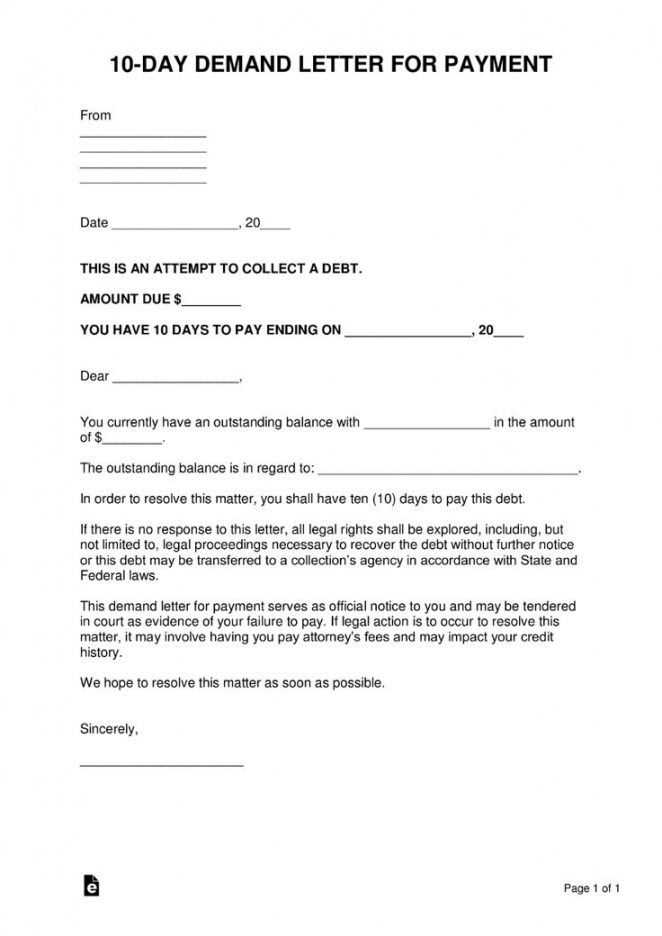

Template for collection demand letter

Draft a collection demand letter that is clear and firm. Address the recipient directly, specifying the outstanding amount, payment due date, and any penalties or interest for delayed payments. Be concise and direct, while maintaining a professional tone throughout.

Clearly state the amount owed and provide a breakdown if necessary. This avoids any confusion and ensures the debtor understands the specifics of the debt. Include the payment due date to create urgency and stress the importance of resolving the matter swiftly.

Always mention the consequences for failing to pay, whether it be legal action or involvement of a collection agency. Make sure to specify the deadline for payment and the method of payment accepted. Offer a way for the debtor to reach out for clarification or if they need assistance with the payment process.

Here are the corrected lines:

Ensure that each statement clearly reflects your intention. Use direct language to avoid ambiguity.

- Replace any vague terms with precise and clear language. For example, instead of saying “urgent request”, specify the exact date or time by which payment is due.

- Make sure the tone remains firm but polite. For instance, use phrases like “We expect to receive the payment by [date]” rather than “We hope you can pay soon.”

- Be specific about the amount owed. Instead of “outstanding balance”, specify the exact number, such as “the outstanding balance of $500.”

- Remove unnecessary fillers that do not add value to the message. Avoid over-explaining the situation, focus on the key points: the amount due, the due date, and the expectation for payment.

- If there is a late fee, mention it clearly, e.g., “A late fee of 5% will apply after [date].”

Double-check your letter to ensure there is no ambiguity in the demand. Avoid convoluted sentences that might confuse the recipient. Clear, direct statements will lead to faster resolution.

- Key Elements to Include in a Demand Letter

A demand letter should include clear and direct details to avoid confusion. The key elements must be organized and easy to follow.

1. Clear Identification of Parties

Begin by identifying both parties involved. Include the full name and address of the recipient, as well as your own. This helps to avoid any uncertainty about who the letter is addressed to and ensures the correct individual or organization is held accountable.

2. Statement of Facts

Present a detailed account of the situation that led to the demand. Provide dates, events, and any relevant evidence. Stick to the facts and avoid unnecessary information. This will make your demand more compelling and difficult to dispute.

3. Specific Demand

Clearly state what you are asking for. Specify the amount owed, the action required, or any other resolution you are seeking. Be direct, leaving no room for misunderstanding.

4. Deadline for Compliance

Set a reasonable deadline for the recipient to meet the demand. This creates urgency and provides a clear timeframe for action. Avoid vague terms like “soon” or “ASAP” to ensure that the deadline is understood.

5. Consequences of Non-Compliance

Outline the consequences the recipient will face if the demand is not met within the given timeframe. This may include legal action, interest, or other steps you are prepared to take. Be clear and firm, but avoid threats that cannot be followed through.

6. Professional Tone

While the letter is a formal demand, keep the tone polite and professional. Avoid inflammatory language or personal attacks, as this may undermine the strength of your letter and the seriousness of your request.

7. Contact Information

Provide clear contact details so the recipient can easily respond. Include your phone number, email address, and any other method of contact that may be appropriate for communication.

8. Closing Statement

Finish the letter with a strong but courteous closing statement, indicating that you expect a prompt response and are open to resolving the matter amicably. Sign the letter with your name and title, if applicable.

Focus on clarity and politeness. Keep the language formal and direct, avoiding slang or overly casual phrasing.

- Use precise language. Choose words that are clear and unambiguous to avoid any misunderstandings.

- Maintain a neutral and respectful tone. Even when expressing dissatisfaction, avoid sounding hostile or aggressive.

- Be concise. Avoid long-winded sentences and unnecessary elaboration that could dilute your message.

- Personalize your approach. Acknowledge the recipient’s position and show understanding of their situation.

- Use a professional greeting and closing. Address the recipient properly and close the letter politely, reinforcing respect.

Consider the recipient’s perspective. A tone that acknowledges their point of view and offers solutions can go a long way in fostering positive communication.

Ensure your collection notice complies with the Fair Debt Collection Practices Act (FDCPA) to avoid legal issues. Clearly identify the debt, including the amount owed, the creditor’s name, and the date of the notice. Avoid using language that may be perceived as threatening, harassing, or misleading. Instead, maintain a professional tone and provide the debtor with clear instructions on how to resolve the matter.

Debt Validation

Include information that allows the debtor to verify the debt. This may include the original creditor’s name and the outstanding balance. Offer a reasonable period, typically 30 days, for the debtor to dispute the debt. If the debtor requests validation, you must cease collection activities until you provide them with the required information.

Time Limitations and Local Laws

Check state-specific regulations as they may impose additional requirements, such as stricter deadlines for dispute resolution or limits on the actions a collector can take. Be mindful of statutes of limitations for collecting debt in your jurisdiction. Failure to observe these laws can lead to claims of illegal debt collection practices.

Begin by reviewing the terms outlined in the agreement or contract. Look for the total amount owed, interest rates, late fees, and any other applicable charges. Gather all relevant invoices, payment records, and communication documents related to the debt.

1. Verify the Principal Amount

The principal amount is the original sum agreed upon, minus any partial payments made. Ensure you subtract any payments received to avoid overestimating the debt.

2. Include Interest and Fees

If the agreement includes interest, calculate the total interest based on the specified rate and time period. Late fees or penalties should also be added if applicable. Make sure to follow the specific rules regarding how and when fees are applied.

3. Double Check for Adjustments

Some debts might involve adjustments for errors, credits, or disputes. Confirm there are no discrepancies or errors in previous calculations that could affect the final amount due.

By carefully adding the principal, interest, fees, and adjustments, you’ll have a clear and accurate calculation of the exact amount due. Make sure to document all the steps for clarity and transparency.

First, gather all relevant documents and evidence supporting your claim. This includes contracts, invoices, emails, or any communication that shows the obligation of the other party to fulfill the terms.

1. Identify the Correct Recipient

Ensure the letter is addressed to the right person or department. Use the full legal name and contact details to avoid delays in delivery or miscommunication.

2. Write a Clear and Direct Message

Start by stating your claim directly. Specify the amount owed, the due date, and the action you require. Keep the tone firm but polite. Avoid unnecessary details, but be clear about the consequences if the issue isn’t resolved.

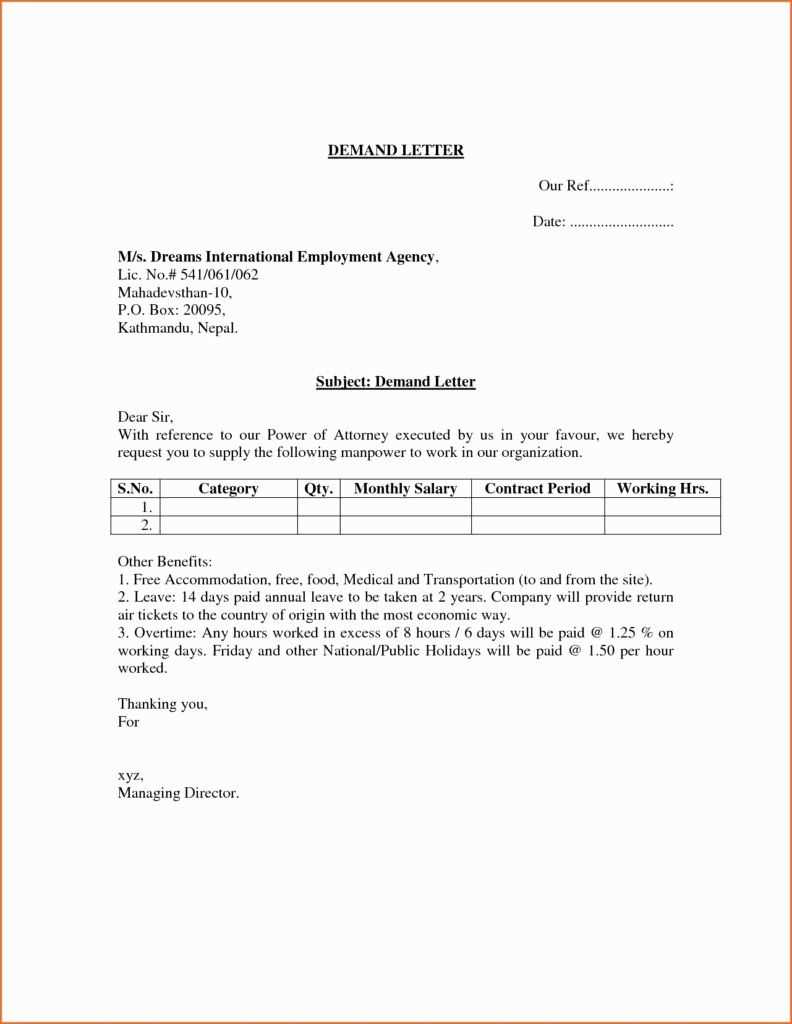

| Section | Details |

|---|---|

| Subject | State the nature of the demand in the subject line, e.g., “Payment Due for Invoice #12345.” |

| Introductory Paragraph | Include a brief introduction of who you are and the purpose of the letter. |

| Claim Details | Clearly outline the amount owed, the terms of agreement, and any supporting documents. |

| Action Requested | State the specific actions the recipient needs to take and the deadline for doing so. |

| Consequences | Inform the recipient of potential legal actions or fees if the demand is not met. |

| Closing | Express expectation for resolution and provide contact information for further communication. |

3. Review and Proofread

Check for clarity, spelling, and grammar. Confirm all relevant details are included. A professional letter without errors increases the chances of a positive response.

4. Send the Letter

Send the letter using a trackable method, such as certified mail, to ensure delivery. If you send it via email, request a read receipt or delivery confirmation.

If your demand letter goes unanswered, take a structured approach. First, follow up with a polite reminder, either by phone or email. This shows your willingness to resolve the matter amicably and helps reaffirm the seriousness of the issue.

If there’s still no response, consider sending a second letter with a stronger tone. Include specific details of your previous attempt and set a firm deadline for resolution. Be clear about the next steps, such as legal action, if the matter is not addressed within that timeframe.

If the debtor continues to ignore your communications, you may need to escalate. Explore your legal options, such as consulting with a lawyer or pursuing small claims court. Document every attempt to contact them to support your case if legal action becomes necessary.

Begin with a clear subject line to immediately inform the recipient about the nature of the letter, such as “Payment Due for Invoice #12345.” This directs attention to the purpose of the letter right away.

Next, specify the outstanding amount with details, including any relevant invoice numbers, dates, and payment terms. Be concise and accurate in this section to avoid confusion.

Afterward, include a polite but firm request for payment, offering the recipient a reasonable period for resolution. Mention any penalties or interest that may apply if the payment isn’t made by the due date.

Conclude with a clear call to action, specifying how the recipient can make the payment, whether by bank transfer, check, or online payment system. Provide the necessary details to make the transaction as easy as possible.

Finally, express willingness to discuss any issues or concerns they may have, reinforcing your intention to resolve the matter amicably.