Proof of income letter from employer template

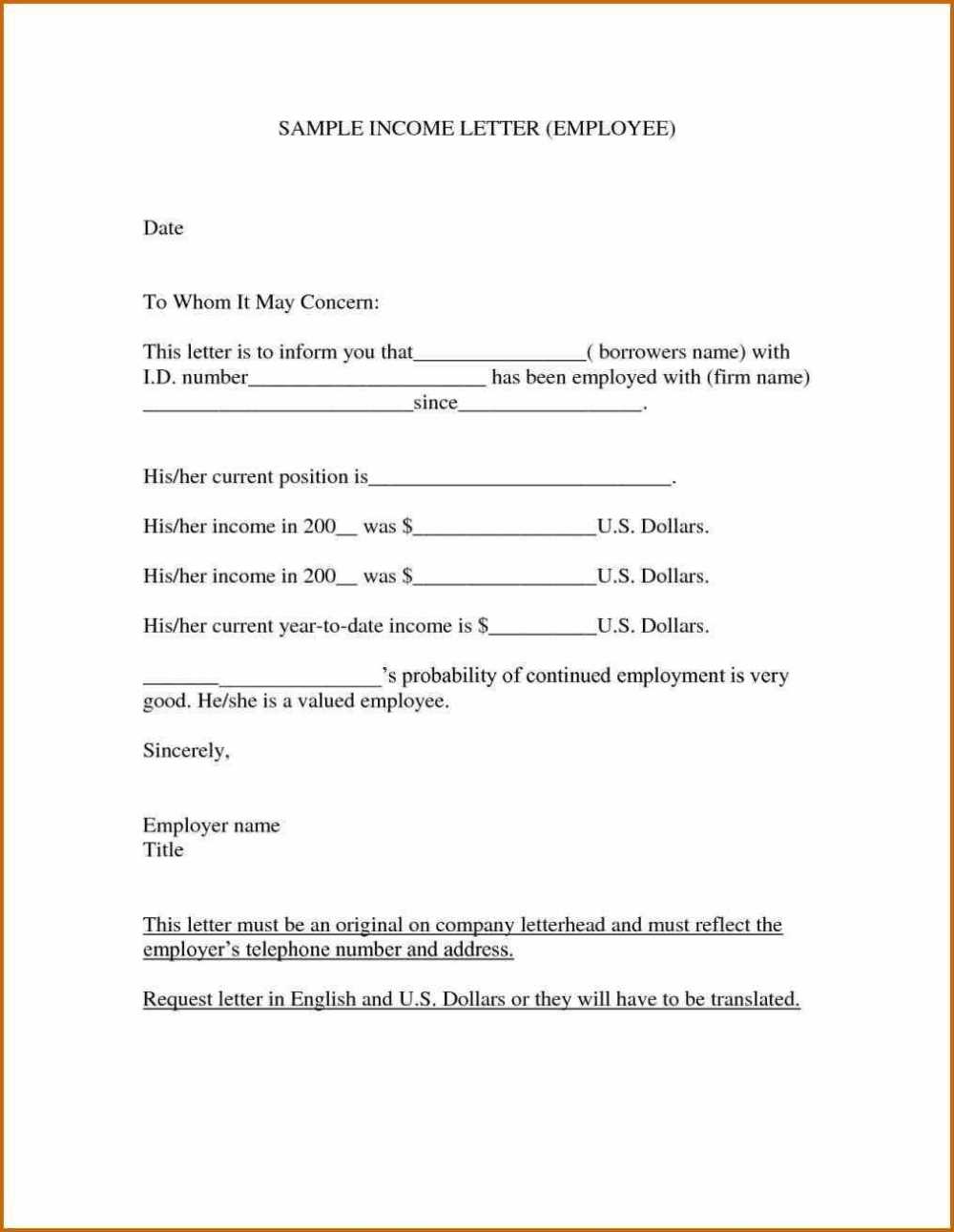

To create a professional proof of income letter from an employer, it’s important to include key details that confirm the employee’s income and employment status. The letter should be on company letterhead and signed by an authorized representative of the employer.

The letter must start with the employee’s name, job title, and the start date of their employment. Clearly state the employee’s current salary or hourly wage, and indicate how often they are paid (weekly, bi-weekly, monthly). Be sure to mention any bonuses, commissions, or additional benefits, if applicable, and specify the total annual income.

Ensure the letter includes the employer’s contact details, such as phone number and email, for verification purposes. The letter should be dated, and the employer’s signature is crucial to authenticate the document. You may also want to add a brief statement confirming the employee’s full-time or part-time status, as this adds clarity to the verification process.

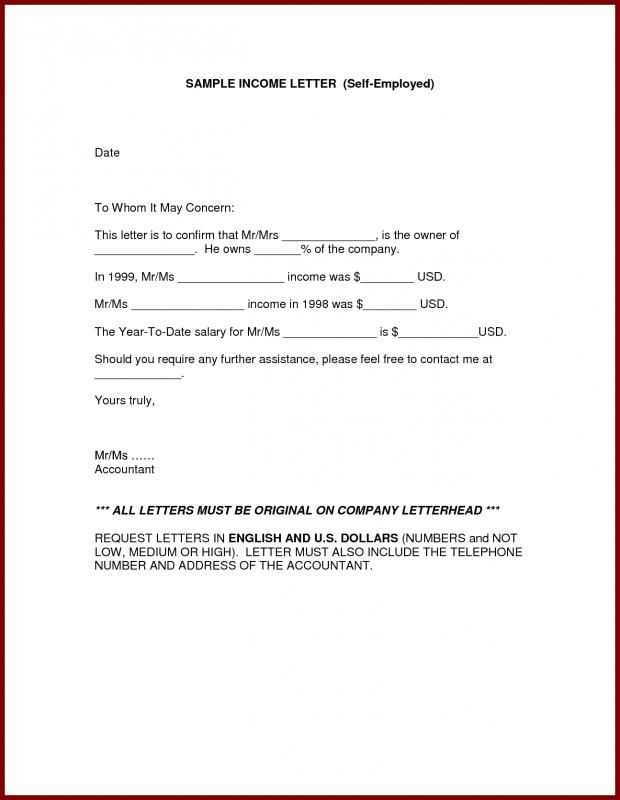

Here’s a sample template to guide you:

[Employer’s Company Name] [Employer’s Address] [Phone Number] [Email Address] [Date] To Whom It May Concern, This letter serves as proof of income for [Employee’s Full Name], who has been employed with [Company Name] since [Start Date]. [Employee’s Full Name] currently holds the position of [Job Title] and earns an annual salary of [Salary Amount] paid [Frequency, e.g., bi-weekly, monthly]. In addition to their salary, [Employee’s Name] receives [Bonuses/Commissions/Other Benefits] amounting to [Additional Income]. For further verification, please contact [Employer’s Name] at [Employer’s Phone Number] or [Employer’s Email]. Sincerely, [Employer’s Name] [Title] [Company Name]

Here are the corrected lines without unnecessary repetition of words:

In the process of drafting a proof of income letter, it’s crucial to keep the language clear and concise. Avoid overusing the same terms. Below is an example of how to correct repetitive phrases:

| Original Text | Corrected Text |

|---|---|

| He is an employee of the company and works as an employee in the marketing department. | He works as a marketing employee at the company. |

| The company provides compensation for his work, offering a salary as his compensation. | The company provides a salary for his work. |

| The monthly income of the employee is paid on a monthly basis. | The employee receives a monthly income. |

Key Changes:

The examples above show how to eliminate redundant expressions. The goal is to simplify the sentences while preserving their meaning.

Final Tips:

When drafting proof of income letters, ensure clarity by using direct and simple language. Remove any unnecessary repetition for a more professional tone.

- Proof of Income Letter from Employer Template

A Proof of Income letter serves as confirmation of an employee’s earnings and employment status. It’s often required for rental applications, loan approvals, and other financial transactions. Below is a template employers can use to draft this important document.

Key Elements to Include

- Employer’s Contact Information: Include the company’s name, address, phone number, and email.

- Employee’s Information: Mention the employee’s full name, job title, and start date with the company.

- Income Details: Specify the employee’s salary or hourly wage, frequency of payment, and any bonuses or commissions if applicable.

- Employment Status: Clarify if the employee is full-time, part-time, or a contractor.

- Signature and Date: The letter must be signed by the employer and include the date of issuance.

Proof of Income Letter Example

- Company Name: XYZ Corp

- Company Address: 123 Business Rd, City, State, Zip Code

- Phone Number: (123) 456-7890

- Email: [email protected]

To Whom It May Concern,

This letter is to confirm that [Employee Name] has been employed with XYZ Corp since [Start Date]. They hold the position of [Job Title] and work on a [Full-Time/Part-Time] basis.

[Employee Name] currently earns a salary of [$X,XXX] per [Month/Year], paid on a [Weekly/Bi-weekly/Monthly] basis. Additionally, they are eligible for performance-based bonuses and other incentives as part of their compensation package.

If you need any additional information, please feel free to contact us at (123) 456-7890 or email [email protected].

Sincerely,

[Employer’s Name]

[Employer’s Job Title]

XYZ Corp

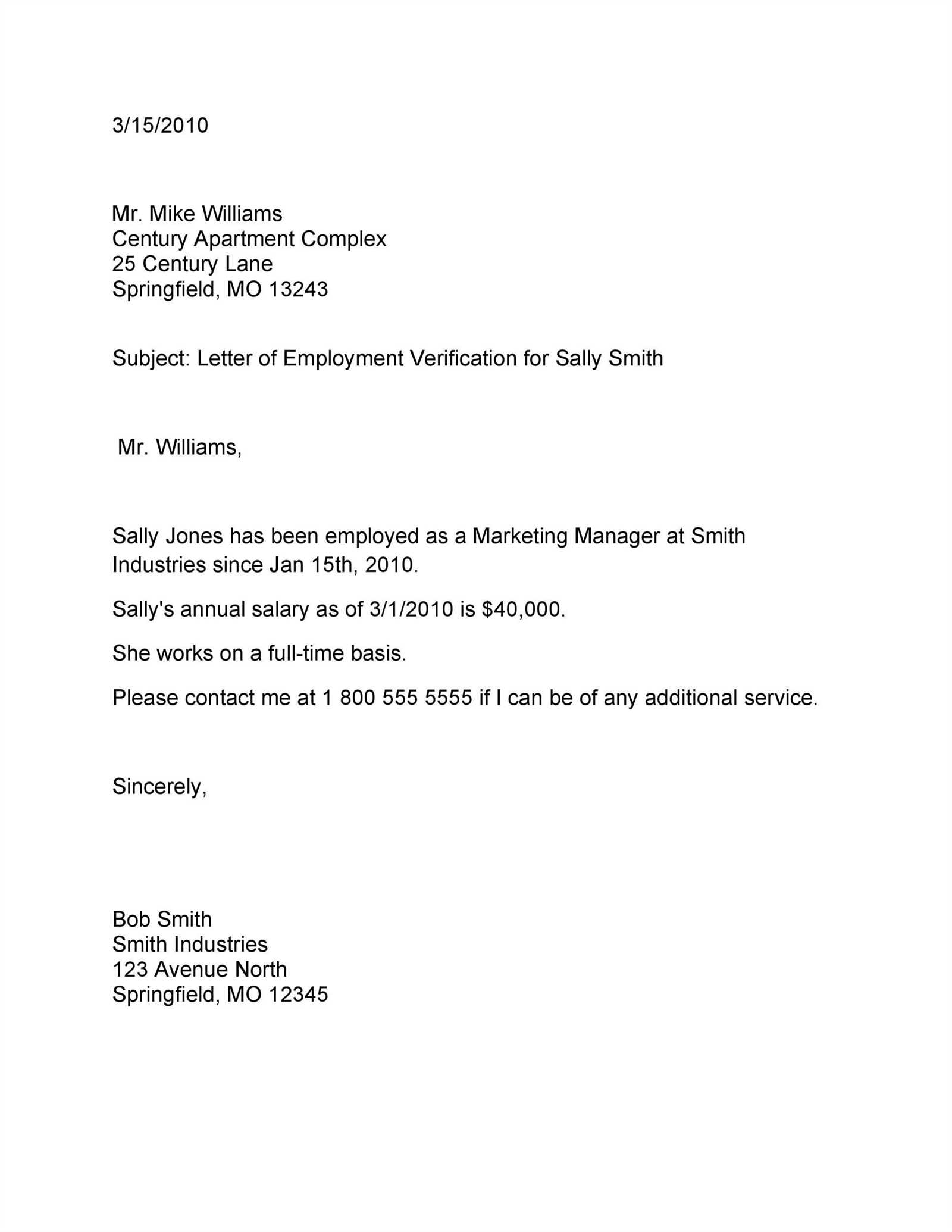

Begin by including the employer’s contact information at the top left corner of the letter. This should consist of the company’s name, address, phone number, and email. On the right side, include the date of the letter.

Next, address the letter to the appropriate recipient. If you know their name, use a personalized salutation such as “Dear [Recipient’s Name],”. If you’re unsure, use a general greeting like “To Whom It May Concern,”.

In the body of the letter, clearly state the employee’s full name, job title, employment status (full-time, part-time, contract), and the duration of their employment. Be specific about their income, listing their annual salary or hourly rate, and mention the frequency of payment (weekly, bi-weekly, or monthly).

Specify any bonuses, commissions, or other sources of income if applicable. Provide a clear breakdown and indicate whether these amounts are regular or one-time payments. Avoid vague or generalized language to ensure the information is accurate.

Conclude the letter by offering your contact details should the recipient need further verification. Close with a polite and professional sign-off, such as “Sincerely”, followed by your signature and title.

Proofread the document to ensure that all details are correct and presented clearly. This makes the letter reliable and trustworthy.

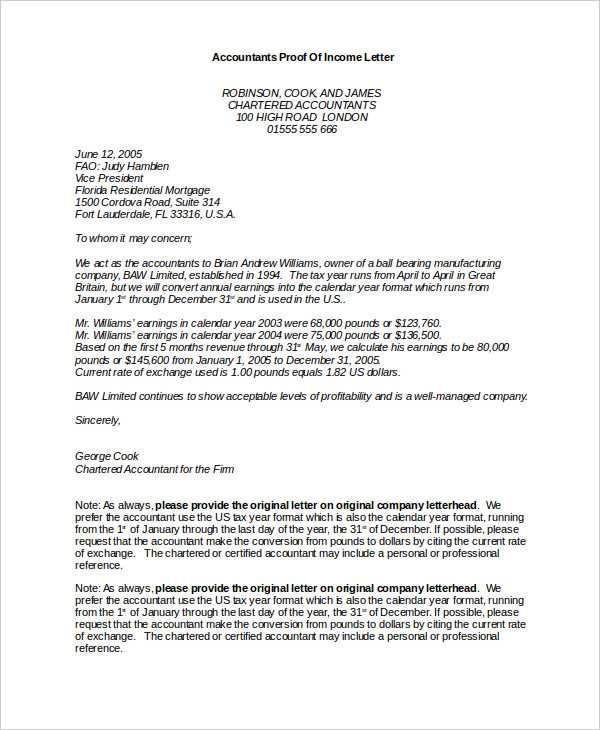

A proof of income letter should contain accurate and detailed information to be accepted by institutions or organizations that request it. Below are key points to include:

- Employer’s Information: Include the employer’s name, address, contact details, and their position within the company. This confirms the authenticity of the document.

- Employee’s Details: Clearly state the employee’s full name, job title, and employment status (full-time, part-time, contract). This verifies the person requesting the proof.

- Income Details: Specify the employee’s gross income, including regular salary and any bonuses or commissions. If applicable, include details about deductions (e.g., taxes, benefits). This provides clarity about the financial situation.

- Payment Frequency: Mention how often the employee is paid (weekly, bi-weekly, monthly) to give a clear understanding of the income pattern.

- Employment Start Date: Including the date the employee started working helps verify the duration of employment, ensuring legitimacy of the income claims.

- Employer’s Signature and Date: A signature from the employer, along with the date the letter was issued, confirms the document’s validity and recentness.

Additional Information

- If applicable, include any other forms of compensation, such as stock options or profit sharing, that are part of the employee’s total income.

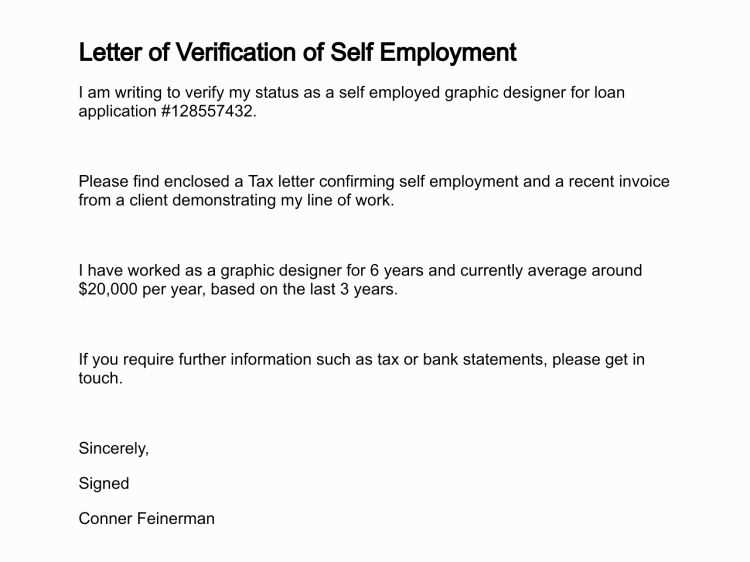

- For freelance or contract work, mention the total amount earned in a specific period to provide an accurate picture of the income.

Begin by identifying the purpose for which you need the income verification letter. This will help ensure that your request is clear and relevant. For example, you may need it for a loan application or rental agreement.

1. Review Company Policies

Before making the request, check your company’s internal policies. Some employers have specific procedures for income verification requests. Make sure you understand any forms or documentation required by HR or payroll departments.

2. Contact HR or Payroll Department

Reach out to your Human Resources (HR) or payroll department. Provide them with the necessary details such as your full name, job title, and the purpose of the letter. Be clear about the time frame in which you need the document.

3. Specify Required Information

Specify the details you need in the letter, such as your salary, employment status, or length of employment. If you have a preference for the format or specific wording, mention that upfront to avoid delays.

4. Follow Up

If you don’t receive the letter within the expected time frame, follow up with HR or payroll. A polite reminder can help ensure timely processing of your request.

5. Review the Letter

Once you receive the letter, review it for accuracy. Ensure that all the requested details are included and correctly stated. If any information is missing or incorrect, contact HR for a revision.

Ensure that the letter includes the correct details about the employee’s income. Avoid vague statements like “the employee earns a decent salary.” Instead, state the exact amount and frequency of payment (e.g., monthly, weekly). This adds clarity and leaves no room for confusion.

Don’t forget to mention the specific employment dates. A common error is omitting when the person started working at the company, or whether they are still employed. It’s crucial to confirm the employment status to avoid misunderstandings.

Use accurate job titles. Mislabeling the employee’s role can raise questions about the authenticity of the letter. Ensure that the title mentioned matches exactly what’s in the employee’s contract or the company records.

Avoid including unnecessary personal details. Limit the information to income and employment-related data only. Adding details like marital status, personal hobbies, or medical information can make the letter look unprofessional and irrelevant.

Don’t overlook the signature. A letter that lacks an authorized signature or the proper company seal can easily be dismissed. Always ensure the letter is signed by someone with appropriate authority, like a supervisor or HR manager.

Lastly, review the format. A messy, unprofessional layout can diminish the letter’s credibility. Use clear, easy-to-read fonts and avoid overly complex language. The goal is clarity, not complexity.

Customize the content to match the specific needs of the recipient. For example, if the letter is intended for a loan application, include details about the employee’s position, length of employment, and salary. Highlight any bonuses or commissions if they are relevant to the loan assessment. If the letter is needed for a rental application, emphasize the regularity of income and the stability of employment to assure the landlord of the tenant’s financial reliability.

For government assistance, include the total annual income along with deductions, as this will provide the full picture of the employee’s financial situation. This will help in calculating eligibility for benefits. If the letter is for visa purposes, mention the duration of employment and confirm the position held to demonstrate the employee’s financial stability in their home country.

For tax purposes, ensure the letter includes a breakdown of income types, such as salary, overtime, and bonuses, if applicable. This provides clarity for tax authorities when evaluating the individual’s taxable income. Tailor the language to the specific audience, using formal language for official or legal purposes and a more straightforward approach for personal requests.

Always ensure accuracy in the details and provide any supporting documentation, such as pay stubs, to back up the information provided in the letter. This will make the letter more credible and complete for its intended purpose.

Check the company letterhead to ensure it includes official contact information like the company name, address, and phone number. Verify these details by visiting the company’s website or calling the business directly.

Confirm the letter is signed by someone with the authority to verify income, typically a human resources or payroll manager. Cross-reference their title and contact information to verify the signature is legitimate.

Review the format of the letter. Official income verification letters should be clear, professional, and free from grammatical or formatting errors. Suspicious formatting may indicate a fake letter.

Check for a recent date on the letter. An outdated letter may indicate that the income details are no longer valid or that the letter was not issued recently.

Ask the employee for supporting documents, such as pay stubs or tax forms, that match the income figures provided in the letter. Discrepancies between these documents can raise red flags.

Finally, if possible, confirm the details with the employer directly. A legitimate employer will be willing to verify employment and income information in a professional manner.

How to Write a Proof of Income Letter from Employer

Begin with a clear statement confirming the employee’s income. Include the job title, the employee’s start date, and the salary or hourly wage. For example, “John Doe has been employed with [Company Name] as a [Job Title] since [Start Date]. His current salary is [$Amount] per year.” This will establish the context of employment right away.

Be Specific About the Employment Terms

Detail the type of employment–whether full-time, part-time, or temporary–and note if the employee is salaried or hourly. If applicable, mention bonuses, commissions, or any other income-related benefits. Clarity is key here to avoid confusion down the line.

Include Contact Information

Include the employer’s contact details such as a phone number and email address in case the recipient needs to verify the information. A signature from the employer or HR representative gives the letter added credibility.

Lastly, keep the tone professional and concise, avoiding unnecessary details that don’t pertain directly to the verification of income. The goal is to ensure the recipient can quickly understand the employment status and income level.