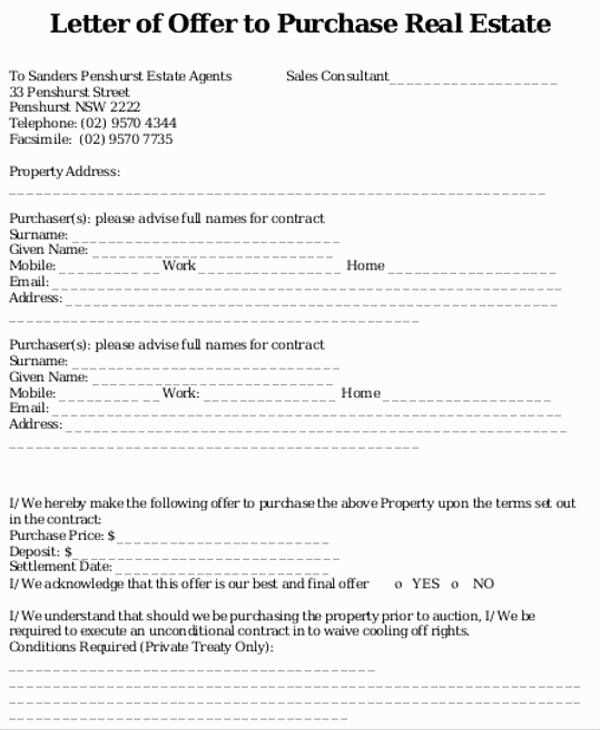

Offer for property letter template

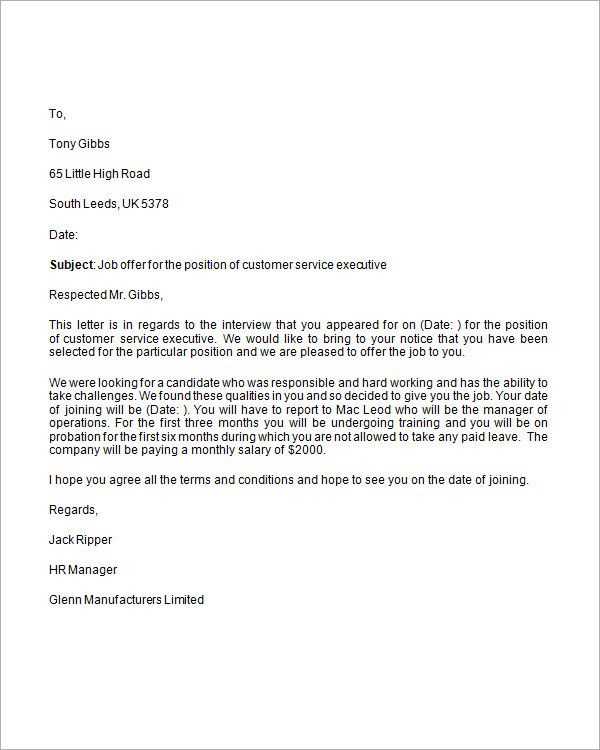

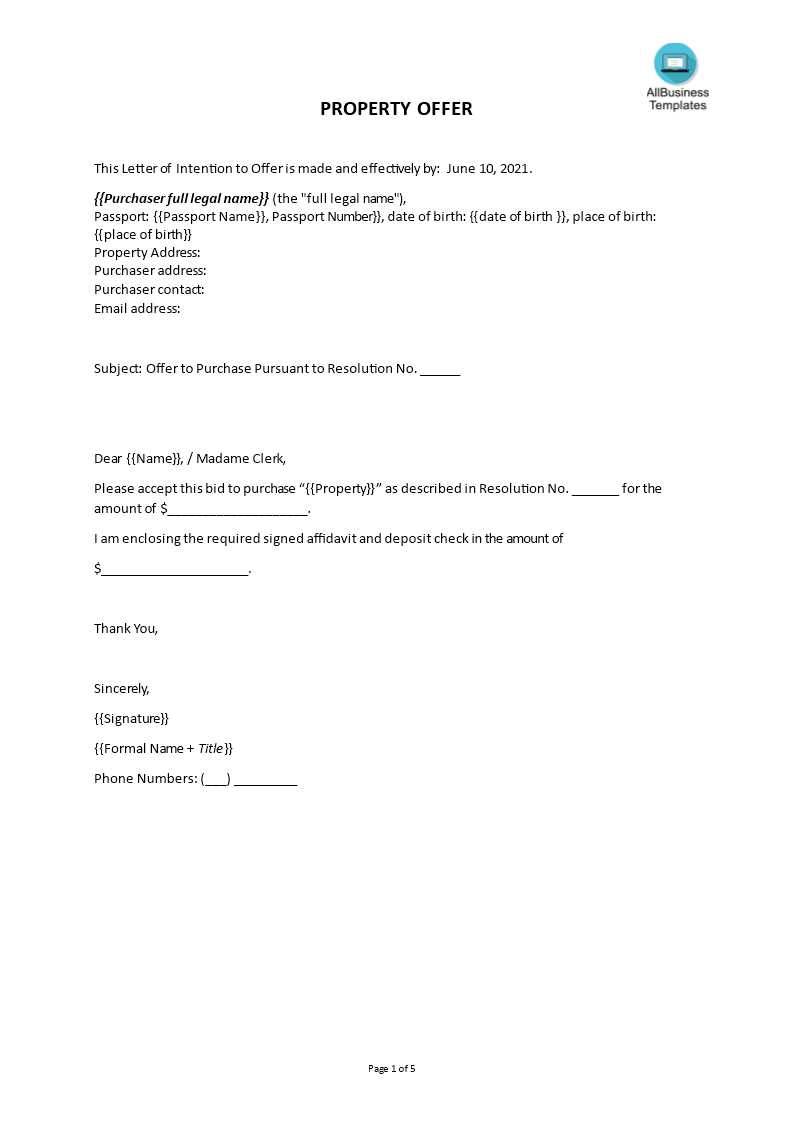

If you need to craft a professional offer for a property, having a clear and concise template is key. Start with a formal greeting and address the recipient by name. This sets the tone for a respectful and personalized offer.

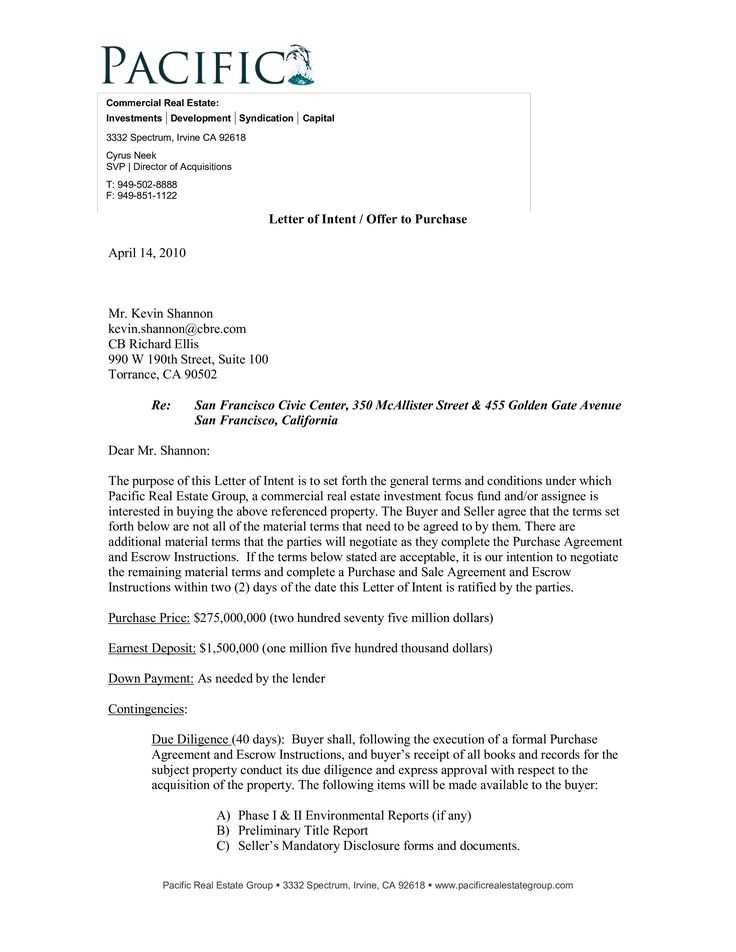

Next, clearly state your intent and specify the property in question. Be precise about the terms, such as the price, payment conditions, and any deadlines that may apply. Including these details ensures both parties understand the expectations upfront.

It’s also helpful to include any conditions that could affect the offer, such as financing approval or property inspections. This adds transparency and prevents misunderstandings later on.

Conclude with a polite call to action, inviting the recipient to respond or ask questions. This keeps the conversation open and encourages engagement. Ending with a professional closing statement further solidifies the offer’s credibility.

Here’s the revised version with minimal repetition:

Be concise and direct in your property offer letter. Start with a clear statement about your interest in the property and the terms you are willing to offer. Keep the tone professional but friendly. Avoid over-explaining or repeating points that have already been made elsewhere in the communication.

- Clear Offer: State the price you are offering and any specific conditions or contingencies tied to the offer.

- Flexible Terms: Highlight any areas where you are open to negotiation, such as timing or payment structure.

- Interest in Quick Response: Express your eagerness to move forward, but avoid sounding too pushy.

- Direct Contact Information: Make sure to provide a clear way for the recipient to reach out with any questions or to discuss further details.

Keep your letter short–this helps ensure your points stand out. A couple of concise paragraphs are often more effective than long-winded explanations. This shows that you are serious, but also respectful of the other party’s time.

- Offer for Property Letter Template

When drafting an offer for property, focus on clarity and precision. The letter should detail the property’s price, terms, and any conditions that may apply. Ensure that both parties clearly understand the expectations from the outset.

Begin with the recipient’s information, including their name, title, and address. Follow with a professional greeting, and move directly to your offer. For example:

“Dear [Recipient’s Name],

I am writing to formally offer [Offer Amount] for the property located at [Property Address]. This offer is based on my evaluation of the market conditions and the property’s value.”

Clearly outline the terms of the offer. Include the proposed closing date, any contingencies such as inspections, and financing details. Example wording for this section might include:

“The offer is contingent upon a satisfactory inspection of the property, and we would require a closing date of [Desired Date]. Please note that financing will be arranged through [Lender Name] upon acceptance of the offer.”

Offer flexibility by leaving room for negotiation. This shows you’re open to discussions but want to keep the process moving forward smoothly.

“We are open to discussing any reasonable counteroffers you may have.”

Conclude with a polite but firm closing, emphasizing your interest in proceeding with the transaction. For example:

“I look forward to your response and hope we can reach an agreement soon. Please feel free to contact me at [Phone Number] or [Email Address] should you have any questions.”

Sign the letter with your full name, and include any necessary attachments, such as proof of financing or a pre-approval letter. Always double-check that all the details are accurate to avoid misunderstandings.

Begin your offer letter with a clear statement of intent. Specify the property you are interested in and the amount you are offering. This establishes the purpose of the letter right away.

Next, include the terms of the offer, including any contingencies or conditions that must be met for the offer to be valid. These may include financing approval, property inspections, or the sale of another property.

State the timeline for the offer. Be specific about how long the offer remains valid. This prevents any confusion and shows that you are serious about closing the deal.

Clearly outline the payment terms, such as the method of payment, any deposit, and when the full payment will be made. This gives the seller clarity on your financial readiness.

Include any additional clauses or terms you feel are necessary, such as the inclusion of personal property, closing costs, or adjustments for repairs.

End with a polite closing, expressing your desire to move forward with the transaction and indicating that you are available for further discussions.

| Section | Details |

|---|---|

| Property Address | Clearly state the property address to avoid any confusion. |

| Offer Price | Specify the price you are offering for the property. |

| Terms and Conditions | Include any contingencies such as financing or inspections. |

| Timeline | State the deadline for the offer and the response time. |

| Payment Details | Outline payment methods, deposits, and payment schedule. |

| Additional Clauses | Mention any additional terms like closing costs or repairs. |

| Closing Remarks | Express your interest and readiness to negotiate or close the deal. |

Clearly outline the purchase price. Specify the exact amount you’re offering for the property. If applicable, mention whether the offer is subject to financing or any conditions. This ensures transparency right from the start.

Property Details

Provide a concise description of the property. Include its address, size (in square footage or meters), and key features (e.g., number of bedrooms, bathrooms, etc.). This helps the seller understand exactly which property you’re referring to and strengthens your position.

Offer Terms

Clarify the proposed closing date and any contingencies, such as inspection or approval of financing. Specify how long the offer is valid, usually 7 to 14 days, to create a sense of urgency for the seller to respond.

Deposit Information

State the amount you are willing to pay as a deposit. Typically, this is a percentage of the purchase price, and it shows the seller you’re serious about the offer.

Contingencies

List any conditions that need to be met for the offer to proceed. This may include things like financing approval, property inspections, or the sale of your current home.

Closing Costs

Indicate who will be responsible for specific closing costs, such as agent fees, title insurance, or transfer taxes. Being clear about these responsibilities can prevent misunderstandings later.

Additional Terms

If you’re including any specific requests or terms, such as a request for certain items to remain in the property (furniture, appliances), make sure to detail them here.

Offer Expiry

Specify the deadline for the seller to accept or decline the offer. A clear expiration date ensures that both parties are aligned on the timeline.

Table Example: Key Elements of a Property Offer

| Element | Details |

|---|---|

| Purchase Price | The exact amount you are offering for the property. |

| Property Details | Address, size, and key features of the property. |

| Offer Terms | Proposed closing date, contingencies, and offer validity period. |

| Deposit Information | The amount of deposit offered to show seriousness. |

| Contingencies | Conditions like financing approval or property inspections. |

| Closing Costs | Who will pay specific closing costs. |

| Additional Terms | Specific requests or terms such as keeping certain items. |

| Offer Expiry | Deadline for seller’s response to the offer. |

Before submitting an offer for property, ensure that your proposal complies with all local laws and regulations. This includes being aware of zoning laws, property taxes, and any existing liens on the property. Failure to account for these elements could lead to costly legal issues down the line.

Verify Ownership and Title

Confirm that the seller is the rightful owner of the property and that the title is clear of any encumbrances. A title search can help identify any disputes or claims that could affect the transaction. It’s crucial to avoid situations where ownership is challenged after your offer is accepted.

Offer Terms and Contingencies

Include specific contingencies in your offer, such as financing, inspections, or appraisal clauses. These clauses protect your interests and allow you to back out if certain conditions aren’t met. Be clear on timelines and deadlines for these contingencies to avoid misunderstandings.

Additionally, outline the terms of payment and the closing process. These details will ensure both parties are on the same page and help avoid future disputes regarding the financial aspects of the transaction.

Consult Legal Experts

Even if you’re familiar with the basics, having a real estate lawyer review your offer is wise. They can identify potential risks or ambiguities in the contract and provide advice tailored to your situation. Legal professionals can also ensure that all clauses are enforceable and meet local legal requirements.

Understand the seller’s position. Before making any offer, research the property’s market history and the seller’s motivations. This allows you to craft a deal that resonates with their needs while maintaining your budgetary limits.

1. Set a Realistic Initial Offer

Make your first offer competitive but not overzealous. Offering too low can alienate the seller, while offering too high could limit your negotiating room. Base your starting point on comparable sales in the area and the property’s condition.

2. Offer Flexibility in Closing

Sometimes, the terms of the deal can be as valuable as the price. Offering flexibility on the closing date can make your offer stand out, especially if the seller is in a hurry or needs extra time to move.

3. Use Contingencies Strategically

Contingencies protect you, but excessive contingencies can make your offer less attractive. Use them sparingly and consider removing some if you’re confident in the property’s condition or if it’s a competitive market.

4. Show Financial Strength

Present proof of funds or a mortgage pre-approval letter. This shows the seller that you are serious and ready to close, giving them confidence in your offer.

5. Consider Seller Concessions

Negotiate seller concessions for closing costs. By asking the seller to contribute to these expenses, you can reduce your upfront cash outlay, making the deal more affordable without altering the offer price.

6. Stay Calm and Be Prepared to Walk Away

Don’t get emotionally attached to a property. If the negotiation isn’t moving in your favor, be prepared to walk away. This can often prompt the seller to reconsider or make more favorable terms.

7. Counter-Offer Smartly

If the seller rejects your initial offer, respond quickly with a reasonable counter-offer. Highlight the strengths of your proposal, such as your financial readiness, and adjust the offer where necessary to meet halfway.

8. Timing Matters

Timing can significantly impact negotiations. Try to present your offer during a slow market period or when the property has been on the market for a while. This can increase the likelihood of a favorable response.

Failing to personalize your offer letter can quickly turn it into a generic message. Address the recipient by name and reference specific details about the property to show your genuine interest. This personal touch creates a more engaging and meaningful communication.

- Overlooking the Offer’s Tone: A letter that is too formal or impersonal may fail to resonate with the reader. Aim for a friendly, approachable tone while still maintaining professionalism.

- Not Being Specific About Terms: Be clear about the offer price, payment terms, and any contingencies. Avoid vague language, as it can cause confusion or hesitation in the seller.

- Neglecting to Include Supporting Documents: Always attach necessary documentation, such as pre-approval letters, proof of funds, or a deposit confirmation. Without these, your offer may seem incomplete or untrustworthy.

- Underestimating the Power of Timing: Submit your offer promptly. Delays can result in missed opportunities, especially if other buyers are involved.

- Overpromising or Misrepresenting Yourself: Avoid making promises you cannot keep, like quick closing or no contingencies, unless you’re certain you can fulfill them. Be honest about your intentions to maintain credibility.

- Using Too Much Flattery: Complimenting the property is fine, but excessive praise can come across as insincere. Focus more on your readiness and interest in making a fair deal.

Pay attention to these details, and your property offer letter will stand out for all the right reasons.

Wait about a week after sending the offer letter before reaching out. This gives the recipient time to review the details and make any necessary decisions. When following up, be clear and direct. Start by confirming that your offer has been received and ask if there are any questions or concerns. This approach keeps the conversation open without being overly pushy.

If you haven’t received a response within this time frame, send a polite email or make a quick phone call. Express your continued interest in the property and offer to provide any further information that might be helpful. Make sure your message is brief, courteous, and to the point.

If the recipient has expressed interest but hasn’t made a decision yet, suggest a specific date for a follow-up. This gives them a clear deadline without feeling pressured, while still maintaining momentum in the conversation.

It’s important to stay professional and courteous throughout the process. Avoid being overly persistent, but do remain proactive. A well-timed follow-up can demonstrate your commitment and help move things along.

Ensure that your offer for property letter is clear and concise. Start by stating the property details including the address, size, and type of property. Follow this with the price or terms of the offer, specifying whether it’s a purchase or rental agreement.

Key Elements to Include

Be specific about any conditions related to the property sale or lease. For instance, mention any repairs or modifications that may need to be made before the transaction. It’s also beneficial to include the proposed timeline for the completion of the sale or the rental agreement, as well as the method of payment.

Additional Considerations

If you’re offering an extended warranty or any other incentives, list them clearly to avoid misunderstandings. Make sure to include contact information for any follow-up questions and set a date for response, creating a sense of urgency and encouraging prompt communication.