Friendly collection letter template

Creating a friendly collection letter doesn’t mean sacrificing professionalism. It’s about maintaining a polite and respectful tone while gently reminding your clients of outstanding payments. A well-crafted letter can increase the chances of getting paid on time without damaging the relationship you’ve built with the client.

Start by addressing your client by name and referencing the specific outstanding invoice. Be clear about the amount owed, but avoid sounding accusatory. Offering assistance or flexibility, like installment plans or payment options, can make your request feel more considerate and less transactional.

Keep the language simple and direct. Include a clear call to action, such as requesting a payment by a specific date. Encourage communication if there are any issues or concerns, showing that you’re open to discussion rather than just demanding payment. This creates an atmosphere of understanding and collaboration, helping both parties resolve the situation smoothly.

End your letter with a polite closing that expresses appreciation for their business. This reinforces goodwill and leaves the door open for future transactions. By keeping the tone positive and cooperative, you can maintain professional relationships while ensuring timely payments.

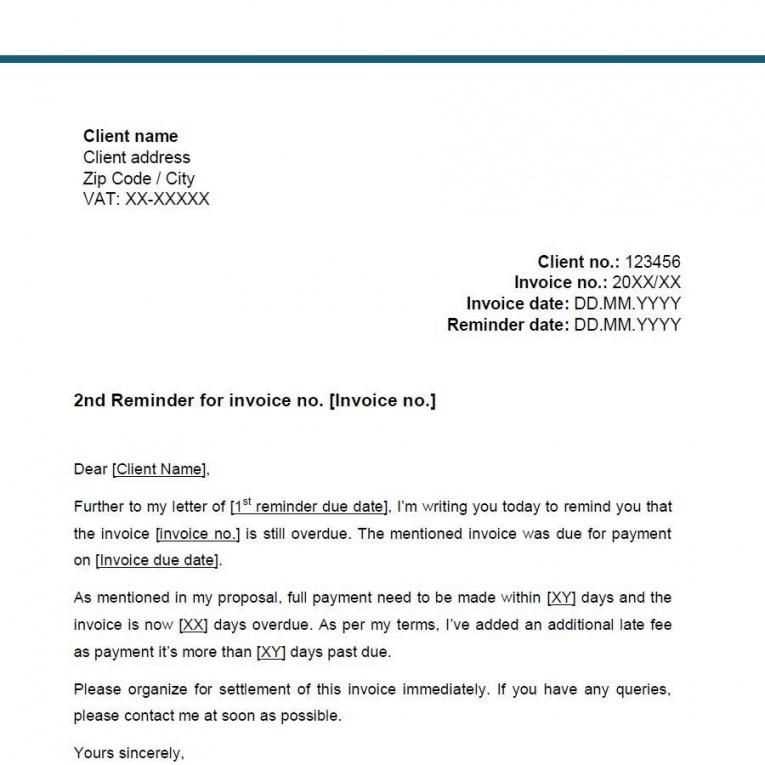

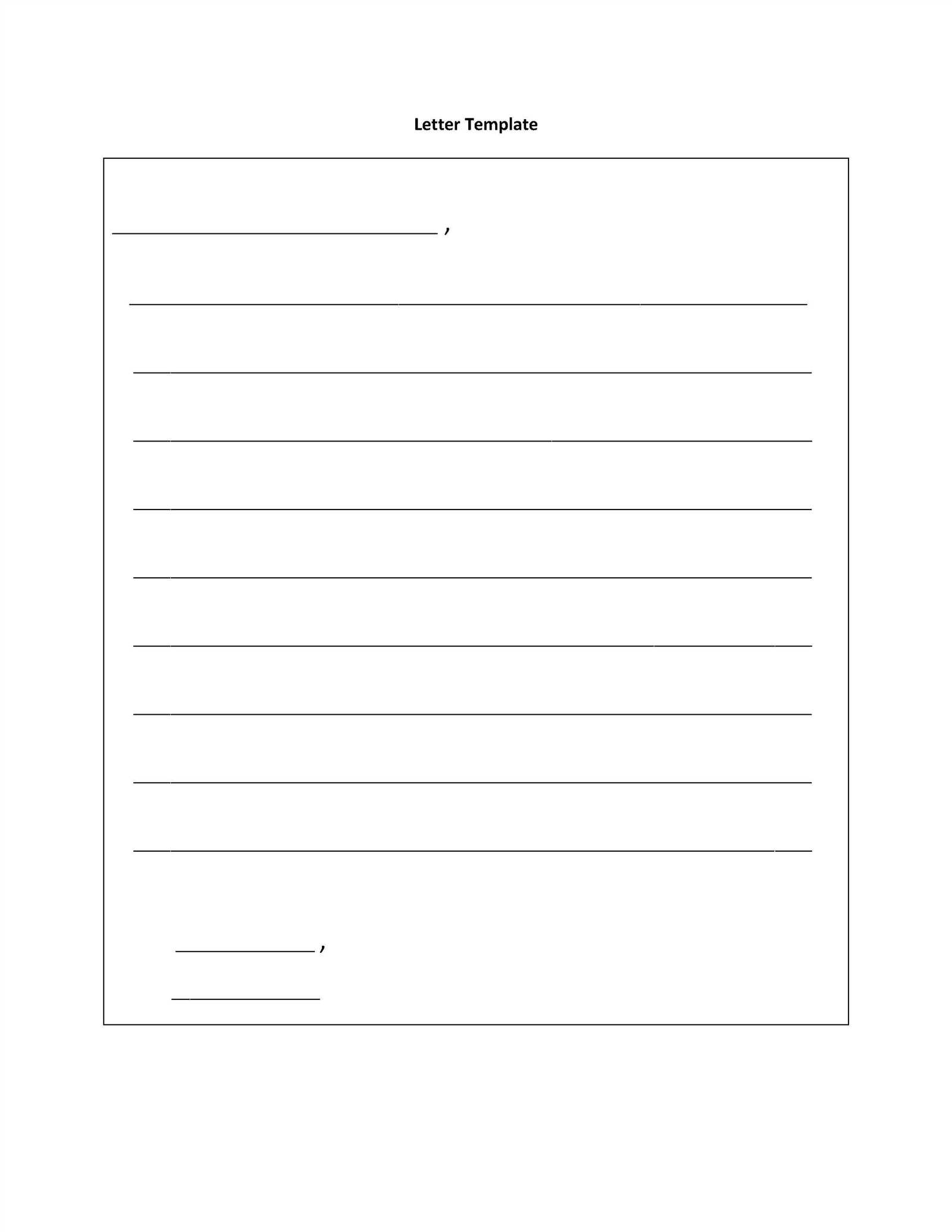

Friendly Collection Letter Template

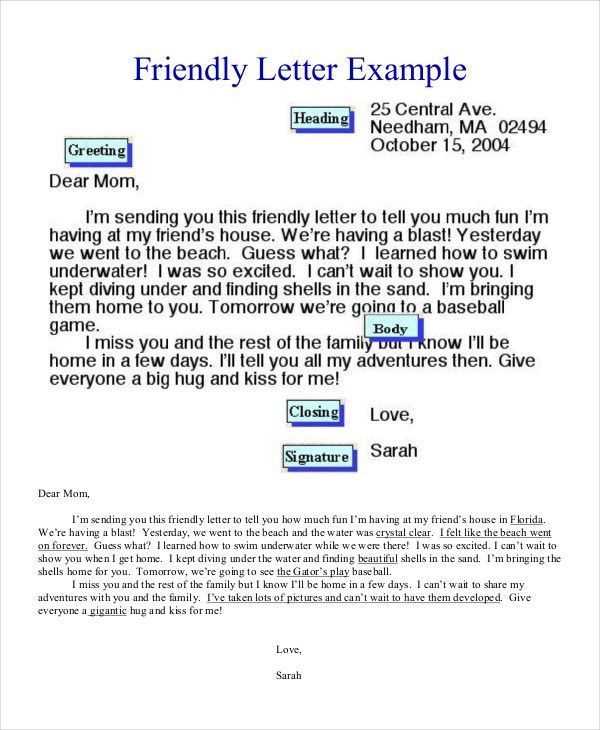

Begin with a friendly, polite greeting that maintains a positive tone. Make sure to address the recipient by name to create a personal connection.

First Reminder: Polite and Direct Approach

Start by gently reminding the recipient of the overdue balance. Mention the amount due and the due date, keeping the tone light and conversational. Acknowledge that sometimes payments can be overlooked or delayed due to various reasons.

Example: “Hi [Name], I hope this message finds you well. I wanted to kindly remind you that the payment of [amount] for [service/product] was due on [date]. If you’ve already taken care of it, please disregard this notice. If not, we would appreciate it if you could settle the balance at your earliest convenience.”

Second Reminder: Reinforce with Gratitude

If the first reminder doesn’t elicit a response, follow up with a second letter. Keep the tone friendly while reiterating the importance of settling the balance. Acknowledge the relationship you have with the recipient and express appreciation for their previous business.

Example: “Hello [Name], I wanted to follow up on my previous message regarding the outstanding balance of [amount]. We truly value your business and understand that things can sometimes slip through the cracks. We would be grateful if you could make the payment by [new date] to keep everything on track.”

Finish with a warm closing, ensuring you leave room for further conversation if needed. Acknowledge that sometimes delays happen and express understanding while reinforcing the need for the payment to be completed soon.

Example: “Thank you so much for your attention to this matter. Please don’t hesitate to reach out if you have any questions or need further assistance. We look forward to continuing to work with you.”

Key Phrases to Use for Setting a Positive Tone in Your Letter

Choose phrases that express understanding and appreciation while encouraging prompt action. A well-balanced approach avoids being too forceful or passive.

1. Show Appreciation

- “We appreciate your continued partnership.”

- “Thank you for your attention to this matter.”

- “We value your business and are happy to work with you.”

2. Offer Support

- “Please feel free to contact us if you need any assistance.”

- “We’re here to help make this process easier for you.”

- “Let us know if you have any questions or need further clarification.”

3. Be Encouraging

- “We’re confident that this issue can be resolved smoothly.”

- “We trust you’ll be able to take care of this promptly.”

- “We’re looking forward to your response and are happy to assist you in any way.”

These phrases set a positive, cooperative tone and encourage a response, fostering a relationship built on trust and respect.

Balancing Firmness and Kindness: How to Request Payment without Pressure

Keep your tone polite yet clear. Start with a friendly reminder of the due date or previous agreement. Acknowledge that people sometimes overlook payments, making it easy to unintentionally forget. Offer to provide any details that might be needed to facilitate the payment. This sets a cooperative tone and opens the door for communication without sounding demanding.

Be Clear and Specific

Clearly state the amount owed and the specific due date. Avoid vague language. Providing exact details helps the recipient understand exactly what is expected, reducing confusion. Additionally, if possible, offer flexible payment options or suggest a new payment plan if they are experiencing difficulties. This shows understanding while maintaining clarity in your request.

Express Understanding and Provide Next Steps

Let the recipient know you understand life can get busy, and you’re simply following up. Offer a straightforward next step, like confirming the payment date or providing any assistance they may need. If the payment is still overdue after your follow-up, kindly mention any necessary actions or late fees, but do so in a way that emphasizes cooperation rather than confrontation.

When and How to Offer Payment Flexibility in Your Collection Letter

Offer payment flexibility when your client is experiencing financial strain but is otherwise reliable. This approach can help you maintain a positive relationship while ensuring that you receive payment. Use it strategically, but avoid over-extending credit. It’s best to offer options early in the collection process, ideally after a first overdue notice but before escalating to more severe measures like involving a collections agency.

Set Clear Terms

Outline specific payment plans that are manageable for the client. For example, break the balance into smaller installments, and define the amount, frequency, and deadline of each payment. Keep the tone supportive, highlighting that you understand their situation and are offering flexibility to make the process easier.

Offer Multiple Options

Present different payment methods: a one-time lump sum, installment payments, or even deferred payments if the client needs more time. This allows the client to choose the option that best suits their cash flow while reinforcing that you are willing to work with them to settle the balance.

Examples of Language That Encourages a Prompt Response from Your Debtor

Use clear deadlines to make your expectations known. For example, “Please arrange payment by the 15th to avoid further action.” This creates a sense of urgency without being forceful.

Provide a reminder of the potential consequences, but in a non-threatening way: “Settling this matter by [date] will help avoid additional fees and keep your account in good standing.” It gives your debtor a clear incentive to act.

Be positive and encourage action with phrases like, “We’re happy to help you resolve this quickly,” or “We’re confident this can be sorted out easily.” These words show you’re working with them, not against them.

Offer an easy way for the debtor to contact you if they need assistance: “If you need any help or have questions about your payment options, don’t hesitate to reach out.” This shows support and removes barriers to communication.

Use reminders of past positive interactions: “We’ve enjoyed working with you in the past and look forward to continuing our great partnership.” This helps the debtor feel more comfortable responding, emphasizing the relationship.

Use a friendly call to action: “We look forward to receiving your payment by [date]. Please let us know if you need any clarification.” This keeps the tone upbeat and encourages timely action without sounding harsh.

What to Include in a Friendly Collection Letter’s Closing for a Smooth Resolution

Close the letter by offering a clear and easy path to resolve the matter. Express understanding and flexibility, making it clear that you’re open to discussion. Suggest a reasonable deadline for payment or a follow-up conversation, without sounding rigid. A tone that invites collaboration can motivate the recipient to act sooner.

Reassure them that you’re willing to find a solution that works for both sides. For instance, you could mention options like payment plans or adjustments if the person is facing financial difficulties. This keeps the tone positive and problem-solving, instead of confrontational.

Politely restate the value of the relationship, whether personal or professional. Let them know you’re looking forward to continuing a strong connection once the payment is taken care of. Reinforce your willingness to discuss any concerns, ensuring they feel comfortable reaching out.

Finally, include a simple closing statement, such as “I appreciate your prompt attention to this matter” or “Thank you for addressing this as soon as possible.” Use a warm sign-off, like “Sincerely,” or “Best regards,” followed by your name or signature, ensuring a courteous end to the letter.