Non profit donation acknowledgement letter template

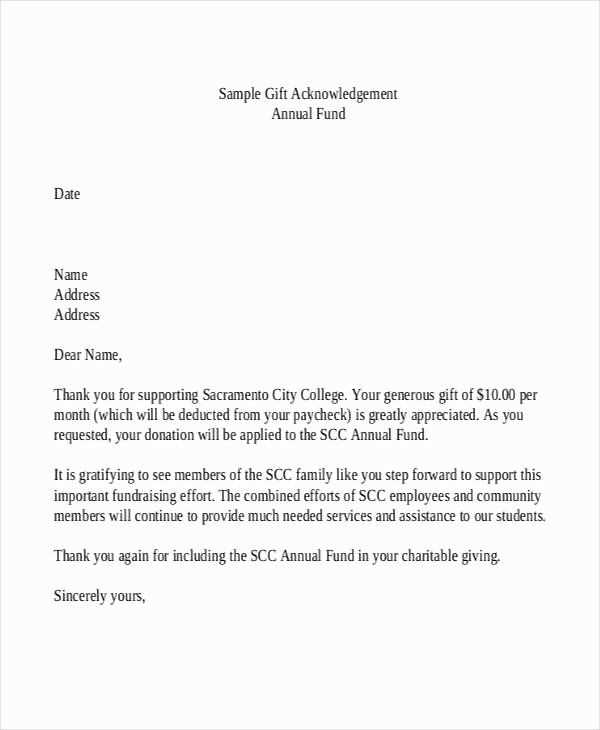

When a donor contributes to your non-profit organization, acknowledging their generosity promptly is a crucial step. The donation acknowledgement letter is more than a simple thank-you note; it is a formal record that helps maintain positive relationships with supporters. Craft a letter that is sincere, personal, and clear to show the impact of their contribution.

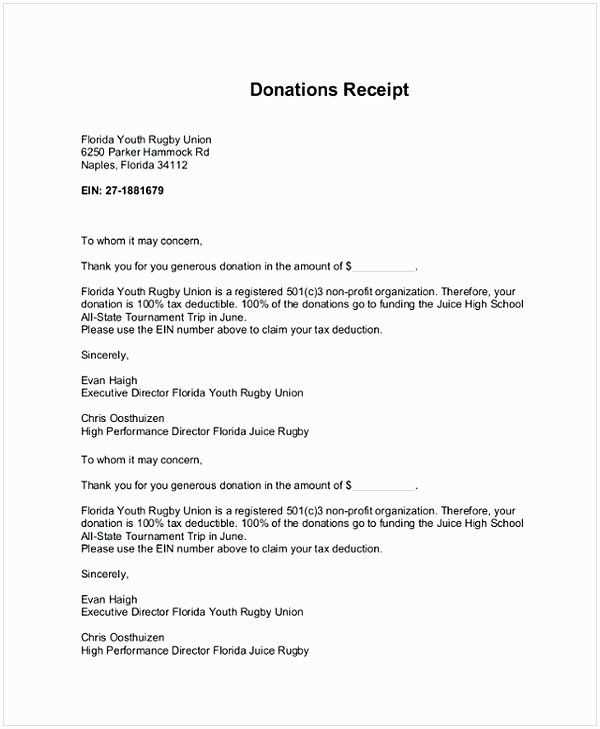

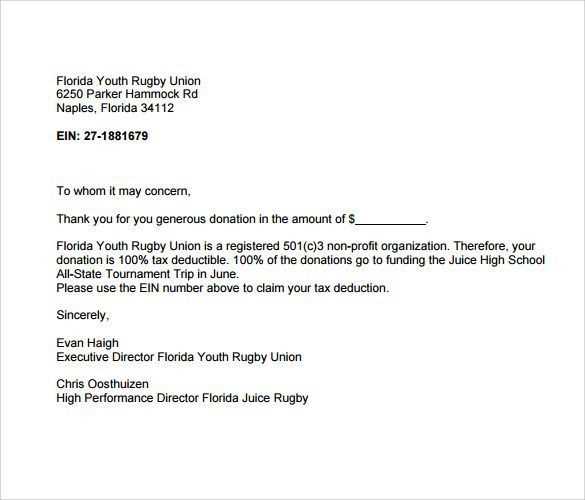

Ensure the letter includes key details like the donation amount, the date it was received, and how the funds will be used. This transparency reinforces the donor’s trust in your organization. A well-structured letter also provides a receipt for tax purposes, making it a practical tool for both you and the donor.

Express gratitude without sounding overly formal. A warm, conversational tone builds rapport and encourages future support. Mention specific projects or causes that the donation will support, as this gives the donor a clear understanding of the difference they are making.

Here’s the corrected version:

Ensure that the opening lines are clear and direct, expressing gratitude for the donation. Acknowledge the donor’s generosity without unnecessary embellishments.

Provide the donor with a detailed summary of the contribution. Include specifics such as the amount, the date received, and any relevant campaign or event information that ties into their support.

| Donation Amount | Date Received | Campaign/Event |

|---|---|---|

| $500 | January 15, 2025 | Annual Charity Gala |

End the letter with a reminder of how the funds will be used. Be transparent about the impact, whether it’s funding a specific program or supporting general operations.

Close by expressing appreciation again and providing any necessary contact details for further communication. Reaffirm the relationship, ensuring the donor feels connected to the cause.

- Non-Profit Donation Acknowledgement Letter Template

Begin with a clear expression of gratitude. Acknowledge the donor’s generosity with sincerity. It’s important to mention the donation amount and its intended use. Personalizing the letter by referring to the donor’s specific contribution makes the message more meaningful.

Structure and Key Components

The letter should follow a simple structure:

- Opening Statement: Start by thanking the donor and clearly stating the purpose of the letter.

- Donation Details: Include the amount or the nature of the donation, and clarify its purpose.

- Impact Statement: Explain how their donation will be used and the difference it will make.

- Closing Remarks: Reinforce your appreciation and invite the donor to stay involved with the organization.

Example Template

Dear [Donor’s Name],

On behalf of [Organization Name], I want to extend our deepest thanks for your generous donation of [Donation Amount] on [Date]. Your support allows us to [describe how the donation will be used].

Your contribution directly supports our efforts to [briefly explain mission]. Thanks to your generosity, we will be able to [state specific impact of the donation].

We are truly grateful for your commitment to our cause. Your support makes a real difference, and we hope you will continue to be part of our community.

With appreciation,

[Your Name]

[Your Position]

[Organization Name]

Tailoring the donation acknowledgement letter to the specific donor significantly enhances its impact. Instead of generic phrases, refer to the individual’s name, donation amount, and specific purpose of their gift. This shows that you value their contribution on a personal level and strengthens the connection between them and your organization.

Personalizing the letter can make the recipient feel recognized for their unique support, encouraging future involvement. Highlighting the difference their donation makes in the community or within your cause will resonate with them more deeply than a standard thank-you message.

Additionally, including a handwritten note or specific reference to the donor’s past contributions helps build trust. It reassures them that their continued support is appreciated and noticed, fostering loyalty and ongoing engagement with your nonprofit.

Begin with a warm and clear expression of gratitude. Let the donor know their contribution is valued and appreciated.

1. Donor’s Information

- Include the full name of the donor and any other identifying details such as company name if applicable.

- If the donation was made in someone else’s name, acknowledge this as well.

2. Donation Details

- Specify the amount or value of the donation, or if it is an in-kind gift, describe what was donated.

- Include the date the donation was received.

3. Tax Deduction Information

- Clearly state whether the donation is tax-deductible.

- Provide any relevant tax ID number or EIN (Employer Identification Number) for reference.

4. Purpose of the Donation

- Explain how the donation will be used, giving the donor context on the impact of their contribution.

- If the donation supports a specific project, mention it here.

5. Contact Information

- Provide a way for the donor to contact the organization for further inquiries or if they have additional questions.

- Include the organization’s website and phone number for easy access.

Be specific in your appreciation. Recognize the exact contribution made by the donor to show that you truly value their support.

Personalize Your Acknowledgement

Customize your message to reflect the unique impact of their donation. Mention how their support has directly benefited your cause or project. This adds a personal touch that feels genuine and meaningful.

Keep it Clear and Concise

Avoid unnecessary elaboration. Keep the message short but impactful. Donors will appreciate a straightforward and heartfelt expression of thanks, rather than a lengthy or overly formal letter.

- State the amount or nature of the donation (if applicable and appropriate).

- Highlight the specific project or need that the donation supports.

- Express how their support makes a tangible difference.

Wrap up with a future-focused note. Encourage ongoing involvement or highlight upcoming initiatives they can be part of, showing the continued importance of their support.

Donation acknowledgements must include specific information to comply with IRS guidelines, ensuring donors can claim tax deductions. Each acknowledgement should contain the following elements:

- Donor’s Name: Clearly state the name of the donor to match their records.

- Donation Amount: Specify the exact amount donated for monetary gifts. For non-cash donations, include a description, but not a valuation.

- Nonprofit Information: Provide the nonprofit’s name, tax-exempt status, and EIN (Employer Identification Number) for identification purposes.

- Statement on Goods or Services: If any goods or services were provided in exchange for the donation, include a statement detailing what was given, along with the estimated value of the goods or services.

- Written Acknowledgement: The acknowledgement must be in writing, and for donations of $250 or more, it must be received before the donor files their tax return.

These elements are crucial for maintaining transparency and ensuring compliance with tax laws. It’s important that each donation acknowledgment meets the IRS criteria to facilitate proper deductions for the donor. Failure to provide adequate details could result in lost deductions for donors and potential penalties for the nonprofit.

Choose a professional font like Arial or Times New Roman, with a size of 11 or 12 points. This ensures readability while maintaining a formal tone. Align the text to the left to keep the structure clean and easy to follow.

Maintain Clear Structure

Start with your organization’s name, address, and contact information at the top, followed by the date. After that, include the recipient’s name and address. Place a formal greeting such as “Dear [Recipient’s Name].” The body should be concise, with clear paragraphs that separate different ideas or points. End with a warm, formal closing, such as “Sincerely” or “Best regards,” followed by your signature and title.

Ensure Proper Spacing

Use single spacing within paragraphs and leave a space between each paragraph. This increases the letter’s readability and gives it a clean, organized look. Avoid cramming too much information into one paragraph–keep it manageable with short sentences and well-organized thoughts.

Keep communication personal and consistent. Regular updates, especially tailored to the donor’s interests and contributions, build trust and strengthen connections. Share the impact of their donations with clear and specific examples, showing how their support has made a difference.

Show Appreciation Beyond the Donation

Go beyond thank-you letters. Send personalized messages, small gifts, or invitations to special events. Acknowledge milestones such as anniversaries of their first donation or their consistent support. These actions create a deeper bond and convey gratitude in meaningful ways.

Engage with Transparency and Integrity

Share the successes and challenges your organization faces. Donors appreciate knowing where their money goes and how it’s used. Be open about how their contributions help and maintain honesty about any setbacks or changes in the project.

Ensure your letter includes a warm expression of gratitude. Acknowledge the donor’s specific contribution with clear details, such as the donation amount or the specific items donated. Mention the impact the donation will have on your organization and how it will support your cause. Personalize the message by referencing the donor’s history or involvement, if relevant. This creates a sense of connection and recognition. Always end the letter with an invitation to stay engaged, highlighting ways they can continue to contribute or stay informed about your organization’s activities.