Understanding the IRS Template Letter for Tax Communication

When dealing with tax matters, official documents are often required to communicate with government agencies. These forms help ensure that important information is conveyed clearly and efficiently, making them an essential part of the process. Understanding how to properly use and complete these forms can save time and prevent errors during correspondence.

Why These Forms Are Important

Official communication documents serve as a formal means of conveying financial information. They are frequently used for clarifying discrepancies, addressing concerns, or confirming important details with tax authorities. These forms are crucial for both individuals and businesses to resolve any issues with their accounts or filings.

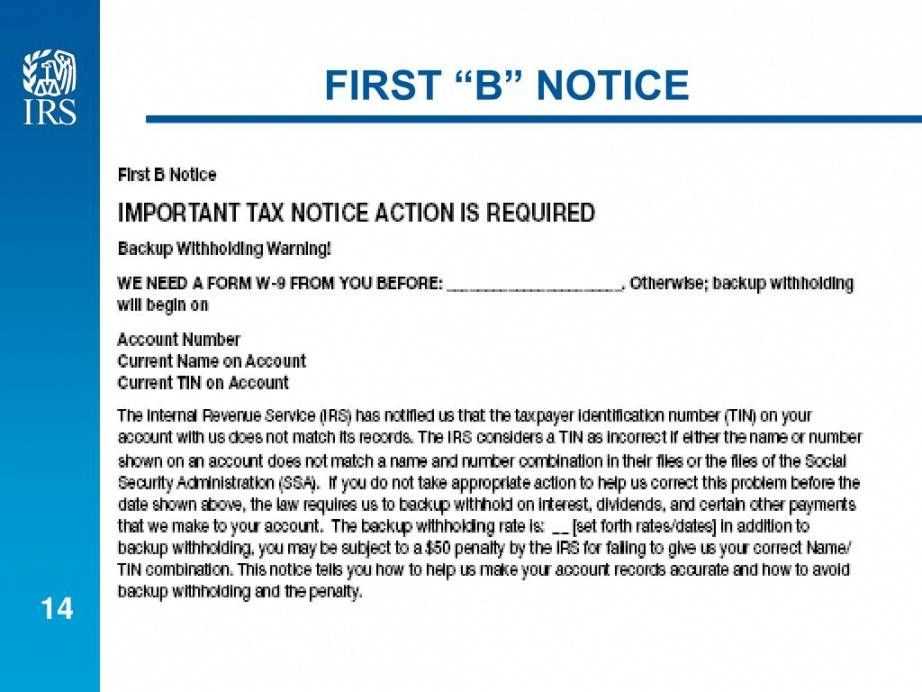

Key Elements of the Document

- Sender Information: Personal or business details that identify the individual submitting the form.

- Taxpayer Identification: A unique number used to track the taxpayer’s information.

- Specific Issue: A clear explanation of the matter that requires attention, whether it’s a correction, request, or clarification.

- Required Action: The desired outcome or request that is being made from the agency.

Common Mistakes to Avoid

- Incomplete Information: Failing to fill in all required fields can delay the resolution of your issue.

- Incorrect Details: Providing wrong information may result in misunderstandings or further complications.

- Missing Signatures: Ensure all forms are signed as necessary to avoid invalid submissions.

How to Use These Documents Effectively

To ensure that your submission is processed without delay, it’s important to follow the guidelines provided. Double-check that all fields are completed accurately and review any instructions included with the form. Submitting the right documentation in a timely manner is key to ensuring a smooth interaction with tax authorities.

Understanding Tax Forms and Their Usage

Official documents used for communicating with government agencies play a vital role in resolving financial matters. These forms are structured to streamline the process of submitting required information, addressing issues, and receiving responses. A proper understanding of how these documents function can simplify interactions and ensure accuracy in submissions.

How These Forms Help Taxpayers

These documents provide a standardized way to address specific financial issues with tax authorities. They assist individuals and businesses in clearly stating their concerns, making requests, or correcting errors in previous filings. By following the correct procedures, taxpayers can avoid delays and ensure their cases are handled efficiently.

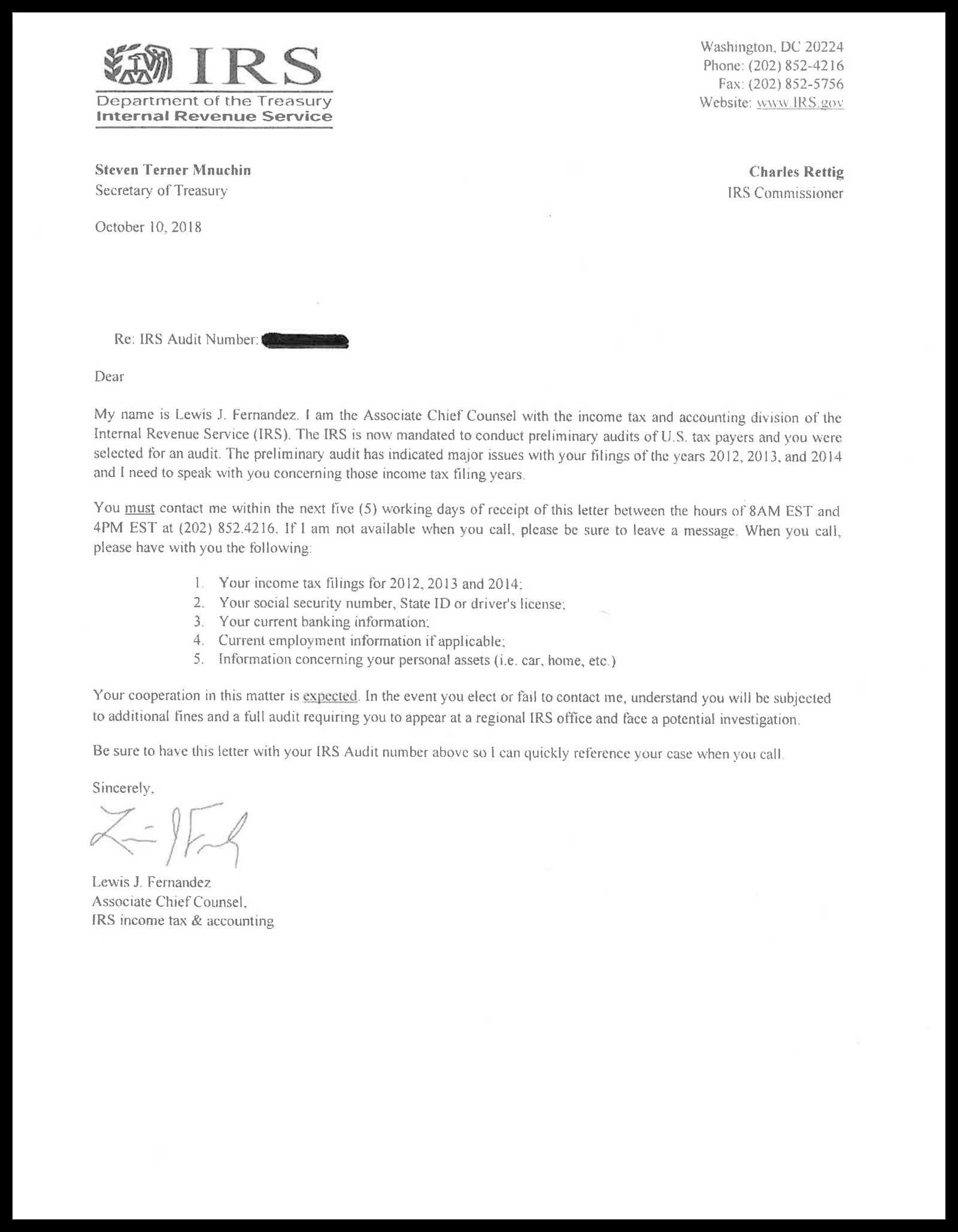

Key Elements of the Document

- Sender’s Details: Includes personal or business information to identify the filer.

- Identification Number: A unique reference used to track the taxpayer’s account.

- Clear Description of the Issue: The specific problem or request being addressed.

- Desired Outcome: The action or response being sought from the tax agency.

Steps to Complete the Form

Completing these forms requires careful attention to detail. Begin by gathering all necessary documents and identifying the correct form for your situation. Ensure that all required fields are filled out accurately, including personal details, identification numbers, and the reason for submitting the form. Double-check for completeness before submitting.

Common Mistakes in Using Tax Forms

- Omitting Information: Failing to include key details or sections can delay processing.

- Incorrect Data: Providing inaccurate information can lead to miscommunication and further complications.

- Unsigned Forms: Missing signatures may render your submission invalid.

How to Properly Submit the Document

Ensure that the completed form is submitted through the proper channels. This may involve mailing the document to the correct address or submitting it online through an official portal. Be mindful of deadlines to avoid penalties, and keep a copy of the submission for your records.