Student loan deferment letter template

If you’re looking to request a deferment for your student loan, it’s important to submit a clear and concise letter to your loan servicer. This letter should outline your current financial situation and provide the necessary details to support your request. Here’s a template to guide you in drafting your deferment letter.

1. Begin with your personal information: Include your full name, loan account number, and any other identifying information requested by your loan servicer. This helps ensure the servicer can process your request without delay.

2. State the reason for deferment: Be specific about why you need the deferment. Whether you’re facing financial hardship, continuing education, or dealing with medical issues, provide a brief yet clear explanation. The more precise you are, the easier it will be for your servicer to evaluate your situation.

3. Mention your requested deferment period: Specify the length of time you’re requesting for the deferment. Make sure it aligns with the rules and regulations set by your loan provider.

4. Attach necessary documents: If required, include any supporting documentation like proof of enrollment, financial hardship forms, or medical certificates. This will strengthen your case and expedite the process.

5. Close with a formal conclusion: Politely request confirmation of your deferment approval and offer to provide any additional information if needed. Always sign the letter before submitting it to ensure it’s processed correctly.

Use this template as a starting point to craft your own deferment request letter. Be clear, respectful, and include all necessary information for the best chance of approval.

Here’s the revised text based on your request:

To request a deferment for your student loan, it is crucial to submit a clear and concise letter to your loan servicer. This letter should explain the reason for the deferment and provide any supporting documentation. Here’s an example of how you can structure your letter:

Loan Deferment Request Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Date]

[Loan Servicer Name]

[Loan Servicer Address]

[City, State, Zip Code]

Dear [Loan Servicer],

I am writing to request a deferment for my student loan under [mention the specific reason for deferment, e.g., financial hardship, unemployment, further education]. My loan account number is [Your Account Number]. I am currently experiencing [briefly explain the situation], and I would appreciate your consideration of my deferment request.

I have attached [list any supporting documents such as proof of unemployment, enrollment, or financial statements] to verify my situation. I believe that a deferment will allow me to manage my financial situation without defaulting on my loan.

Please let me know if you require any additional information. I look forward to your prompt response regarding this matter. Thank you for your time and understanding.

Sincerely,

[Your Name]

Things to Keep in Mind

Make sure your letter includes all necessary details, such as the reason for the deferment, your loan account number, and any relevant documents. The more specific and complete your request, the quicker the servicer can process it. If you’re unsure of the eligibility requirements, review your servicer’s deferment guidelines before submitting your letter.

- Student Loan Deferment Letter Template

When requesting a deferment on your student loan, a clear and concise letter is essential. Make sure to provide the necessary details, including the reason for the deferment and the specific loan account information. Below is a template to help you structure your request effectively:

Student Loan Deferment Request Letter

Your Name

Your Address

City, State, ZIP Code

Email Address

Phone Number

Date

Loan Servicer Name

Loan Servicer Address

City, State, ZIP Code

Subject: Request for Student Loan Deferment

Dear [Loan Servicer’s Name],

I am writing to formally request a deferment on my student loan, account number [Your Account Number], due to [briefly explain reason, e.g., enrollment in school, financial hardship, unemployment, etc.]. I understand that deferment options are available for specific circumstances, and I believe my situation qualifies for consideration under your current deferment policies.

Attached, you will find all necessary documentation supporting my request, including [list any documents you are including, e.g., proof of enrollment, financial statements, etc.]. I kindly request that you review my application and approve this deferment request for the period of [specific duration].

If you require any additional information or documentation, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. I look forward to your prompt response and the continued support of my loan management.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

By using this template, make sure to adjust the details based on your specific situation, and attach any required supporting documents. This will ensure your request is processed smoothly and promptly.

Be specific and direct when writing your deferment request. Begin by clearly stating your intention to defer your student loan payments. Specify the reason for your request and include any relevant details, such as changes in your financial situation, education status, or other circumstances that qualify you for deferment.

Key Points to Include in Your Request

| Point | Explanation |

|---|---|

| Your Information | Include your full name, loan account number, and any other identifiers to ensure the lender can easily locate your account. |

| Reason for Deferment | Provide a clear and honest explanation of why you are requesting deferment. Include dates or specific events that triggered the need for deferment. |

| Supporting Documentation | Attach or mention any documentation that supports your claim, such as enrollment verification or financial hardship statements. |

| Request Duration | State the period you are requesting deferment for and clarify if you expect this to be temporary or if you’re unsure of the timeline. |

| Contact Information | Provide accurate contact details for follow-up, ensuring the lender can reach you for any additional information. |

After addressing these key points, close your request by expressing gratitude for the lender’s consideration. Be concise and professional throughout the letter. A well-structured and clear request will increase the chances of your deferment being approved promptly.

Your student loan deferment letter should be clear and concise. Ensure you include the following details:

| 1. Borrower Information | Provide your full name, address, and contact information. This allows the lender to identify your loan account easily. |

| 2. Loan Information | Include the loan account number, the type of loan, and the name of your lender or loan servicer. |

| 3. Reason for Deferment Request | State the reason you are requesting the deferment. Be specific, such as enrollment in school or financial hardship. |

| 4. Dates of Deferment | Clearly mention the start and end date for which you are requesting deferment. |

| 5. Supporting Documentation | If applicable, include any documents that support your request, such as proof of enrollment or financial hardship. |

| 6. Contact Information | Include your current phone number or email so the lender can contact you if necessary. |

Double-check that all information is correct and up-to-date to avoid delays in processing your deferment request.

If your student loan deferment request is denied, it’s important to act quickly and methodically. Follow these steps to understand your options and take the necessary actions:

- Review the Denial Letter

Carefully read the denial letter to understand the reason for rejection. Common reasons include missing documentation, ineligible status, or failure to meet specific criteria. This will guide your next steps.

- Contact the Loan Servicer

If you’re unclear about the reason, reach out to your loan servicer. They can provide specific details and may offer alternative solutions or guidance on what needs to be corrected.

- Submit a Reconsideration Request

If you believe there was an error in the decision, you can request a reconsideration. Ensure you provide any missing documents or updated information that could support your case.

- Explore Other Repayment Options

If deferment is no longer an option, consider other repayment plans, such as Income-Driven Repayment or Extended Repayment, which could better match your current financial situation.

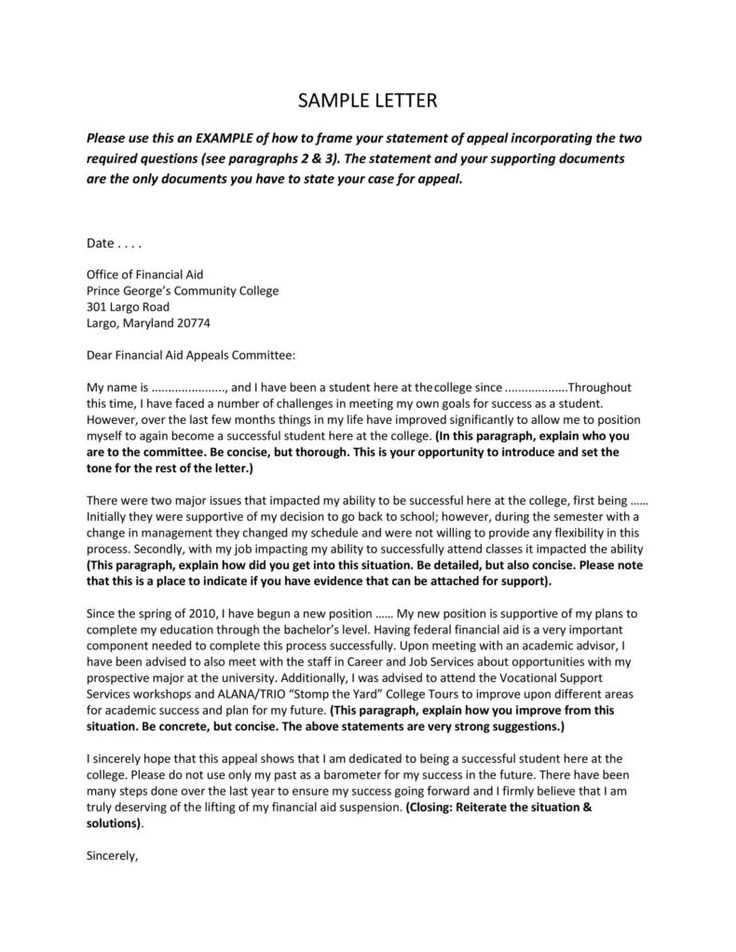

- File an Appeal

If you believe your case was handled incorrectly, you may have the option to file an appeal. This process can be time-consuming but can be worth it if you have strong grounds for reconsideration.

- Seek Professional Advice

If the situation becomes complicated, consider speaking with a financial advisor or student loan expert. They can help you navigate the next steps and provide additional strategies.

Addressing a denial quickly can help you avoid late fees and negative marks on your credit report. Stay proactive and informed about your options.

If you’re struggling to make payments on your student loan, deferment can offer temporary relief. Here are some reasons borrowers typically request a deferment:

1. Enrollment in School

If you are enrolled in at least half-time coursework at an eligible school, you can request deferment until you graduate or drop below the required credit hours. This is one of the most common reasons borrowers seek deferment, as full-time students typically don’t have the income to make loan payments.

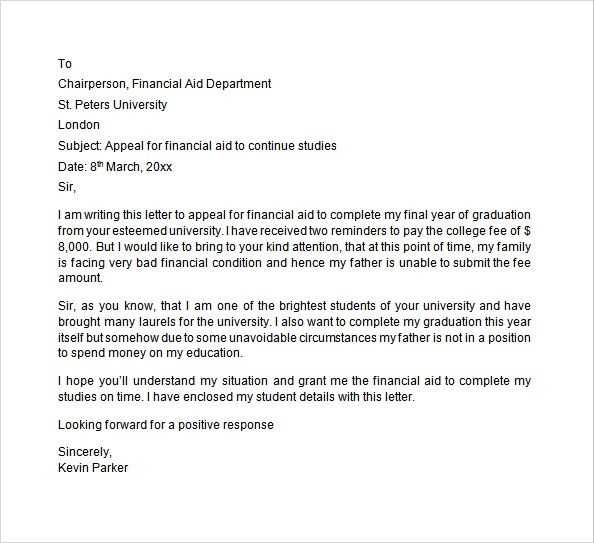

2. Unemployment or Economic Hardship

If you are unemployed or experiencing financial hardship, you may be eligible for deferment. Many loan servicers allow a deferment period for those who are actively seeking work or dealing with significant financial difficulties. It’s important to provide documentation of your status to qualify for this type of deferment.

3. Active Duty Military Service

Military service members who are on active duty may request a deferment while they are deployed or serving in combat zones. This provides peace of mind and financial relief during service. Documentation such as military orders will be required to approve the deferment.

4. Disability

If you are temporarily or permanently disabled, you may qualify for deferment. Depending on the severity of your disability, deferment can allow you to postpone payments while you focus on recovery. Proof of disability from a licensed physician will be necessary to apply for this option.

How to Follow Up After Submitting Your Letter

After submitting your student loan deferment letter, follow up to ensure the process is progressing smoothly. Be proactive but respectful in your communication. Here’s what you can do:

1. Wait a Reasonable Time

Allow at least 7-10 business days for the lender or servicer to process your request. They may need time to review the information and respond to your letter. Patience at this stage shows professionalism.

2. Send a Polite Follow-up Email

- Include your full name, loan account number, and the date you submitted your deferment request.

- Clearly ask for an update on the status of your application.

- Keep your tone polite and concise to ensure a smooth conversation.

Example follow-up message:

Subject: Follow-up on Student Loan Deferment Request – [Your Name]

Dear [Lender’s Name],

I hope this message finds you well. I am writing to inquire about the status of my student loan deferment request submitted on [Date]. My account number is [Account Number], and I would appreciate any updates regarding its processing. Please let me know if you require additional information.

Thank you for your attention to this matter.

Sincerely, [Your Full Name]

3. Call the Lender or Servicer

If you don’t receive a response within the specified time, consider calling the lender. Ask them to confirm whether your deferment request has been received and processed. Keep a record of the conversation, including the representative’s name and the date.

4. Be Ready to Provide Additional Information

If the lender asks for more documentation or clarification, provide it as quickly as possible. Promptly addressing any issues will prevent delays in the process.

5. Keep Records of Your Communications

- Store copies of all emails and letters sent or received.

- Document phone calls, including dates and details of your conversation.

By following up professionally and keeping organized records, you ensure that your deferment request is processed efficiently.

Provide complete and accurate details in your request. Missing or incorrect information can delay the process. Double-check your loan account number, personal information, and the deferment period you’re applying for.

- Submit the correct forms: Use the official deferment form from your loan servicer’s website. Avoid submitting a generic letter or incomplete documents.

- Include supporting documentation: Attach any required proof of eligibility, such as enrollment verification or unemployment status documentation. Ensure the documents are clear and legible.

- Verify deadlines: Submit your request well before the deadline. Late submissions might result in processing delays or denial of your deferment request.

- Confirm receipt: Contact your loan servicer to confirm they received your deferment request and all required documents. This helps avoid any surprises later.

- Follow up: If you don’t receive a response within the expected timeframe, reach out to check on the status. Keep records of all communication for reference.

By following these steps, you increase the chances of your deferment request being processed smoothly and on time.

Student Loan Deferment Letter Template

Write a clear and concise letter to request deferment of your student loans. Address it to your loan servicer and include necessary details such as your loan account number, reason for deferment, and the duration of the requested deferment period.

Step 1: Start with a polite greeting and provide your personal details, such as full name, loan account number, and contact information. Ensure the servicer can easily identify your account.

Step 2: Clearly state the reason for requesting deferment. For example, you may mention financial hardship, unemployment, or returning to school. Be honest and precise in your explanation.

Step 3: Specify the deferment period you are requesting. If you are unsure of the time frame, refer to your servicer’s guidelines or your loan terms.

Step 4: Mention any supporting documents you are submitting to back up your request. These could include financial statements, job search records, or school enrollment forms.

Step 5: Conclude with a polite closing statement, offering to provide additional information or documents if necessary. Include your contact information for follow-up.

Here’s a sample structure:

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Loan Servicer's Name] [Loan Servicer's Address] [City, State, ZIP] Dear [Loan Servicer's Name], I am writing to formally request deferment of my student loan due to [reason for deferment]. My loan account number is [account number]. I kindly ask for a deferment period of [desired time frame]. I have enclosed [supporting documents] for your review. Should you require any additional information, feel free to contact me at [your phone number] or [your email address]. Thank you for considering my request. I look forward to your response. Sincerely, [Your Name]