Dispute debt collection letter template

Start with a clear statement of your dispute. Reference the debt and explain why you believe it is incorrect. Be concise and direct to avoid any confusion. If possible, include any documentation that supports your claim, such as payment records or communications with the creditor.

Address specific errors in the debt claim. If you identify any discrepancies, such as incorrect amounts, dates, or charges, point them out clearly. For example, you can say: “I dispute the amount of $500 charged on my account, as it does not match my payment records from June 2024.” This provides a solid foundation for your dispute.

Request verification of the debt in your letter. According to the Fair Debt Collection Practices Act (FDCPA), debt collectors must provide proof that they have the right to collect the debt. Politely ask for verification of the debt, including any relevant documents that show it is valid and accurate.

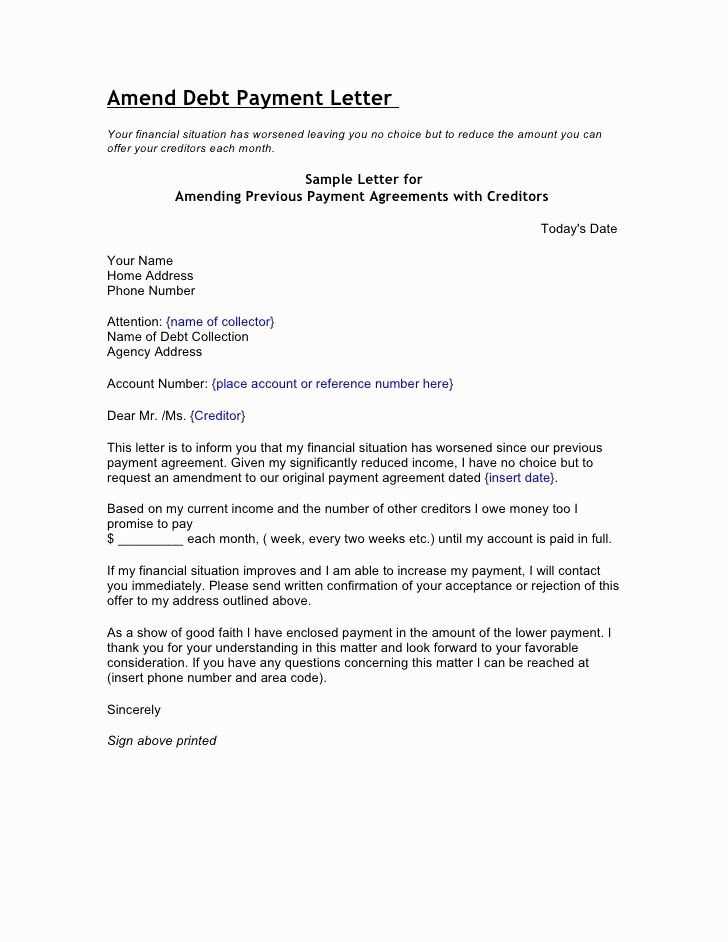

Finally, request a resolution. If the debt is incorrect, ask for it to be removed from your account. If the debt is valid, but there is a dispute over the amount or terms, offer to negotiate a payment plan or settlement. Keep the tone respectful and professional to foster a positive outcome.

Here are the corrected lines with minimized word repetition:

Review the wording in each section carefully to ensure clarity and avoid redundancy. Instead of repeating similar terms, vary your phrasing while keeping the message clear.

For example, replace “owing to the fact that” with “because.” This simple switch reduces unnecessary wordiness without losing meaning.

Another improvement: rather than saying “in relation to the matter at hand,” consider using “regarding” or “concerning” to streamline your message.

Be mindful of repeating terms like “in addition,” “moreover,” or “furthermore”–these can often be eliminated without affecting the tone or meaning of your statement. Instead, focus on being direct and concise.

Lastly, ensure that each paragraph addresses a unique point to maintain clarity. This avoids the tendency to rephrase the same concept multiple times.

- Dispute Debt Collection Letter Template

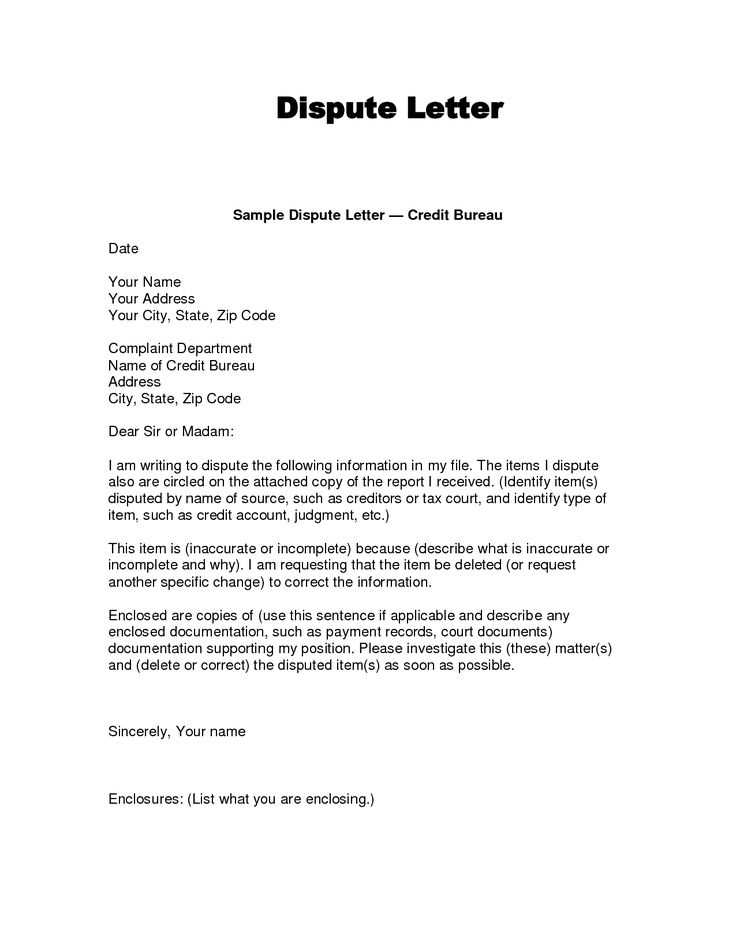

Begin by addressing the debt collection agency with your name and address at the top of the letter, followed by the date. Clearly state that you are disputing the debt in question. This sets the tone of the letter and establishes your position. Below is a simple template to guide you:

Template for Dispute Debt Collection Letter

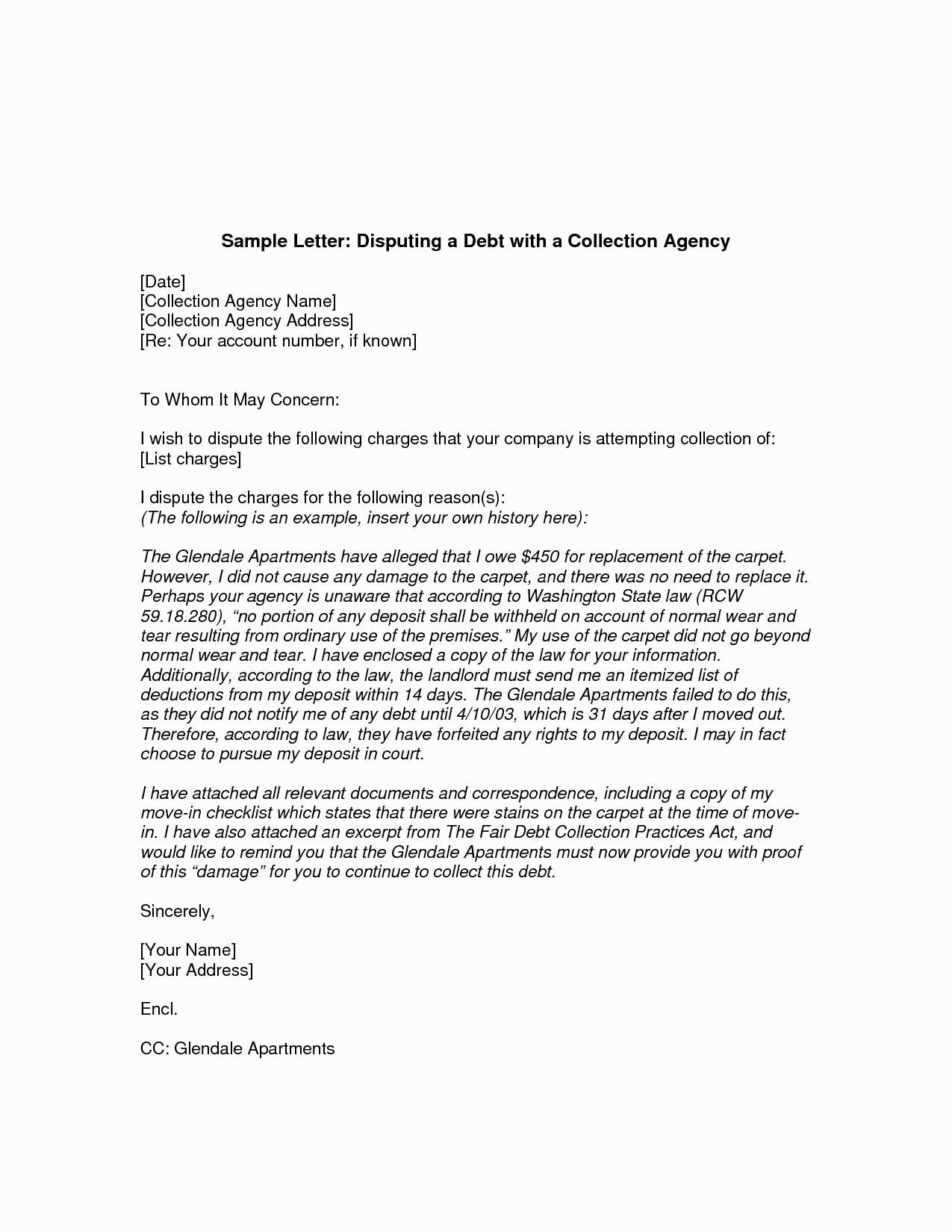

First, include the recipient’s name, title, and the name of the collection agency, followed by their address. Use a polite but firm tone to explain that you dispute the debt being claimed. Include specific details such as the amount, account number, and the reason for the dispute.

Example:

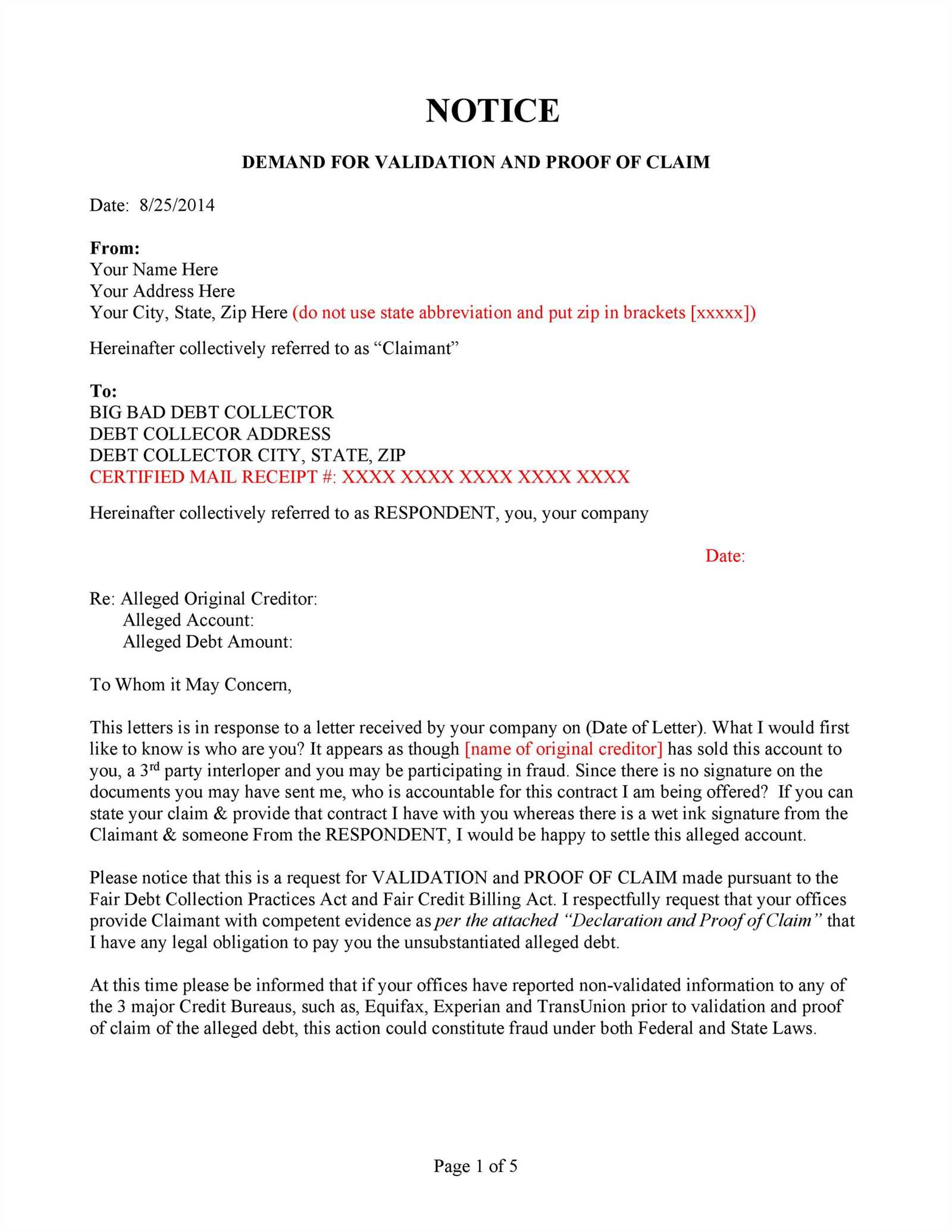

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Debt Collector's Name] [Collection Agency Name] [Agency Address] [City, State, ZIP Code] Dear [Debt Collector's Name], I am writing to formally dispute the debt referenced in your correspondence dated [insert date], with the account number [insert account number]. I believe that this debt is either incorrect or not owed by me, and I request that you provide verification of this debt in accordance with the Fair Debt Collection Practices Act (FDCPA). I request the following information: 1. The original creditor's name and address. 2. The total amount of the debt and a breakdown of any fees. 3. Proof that you are authorized to collect this debt. Until this verification is provided, I ask that you cease any further collection activity on this account. Sincerely, [Your Name]

Be clear and concise in your request for verification, and avoid any unnecessary details. If you have supporting documents, mention them briefly but don’t overwhelm the letter with too much information.

Once the letter is ready, send it by certified mail so you can keep a record of the correspondence. Be sure to retain a copy of the letter and any responses for your records.

Begin your dispute letter by clearly stating that the debt amount is incorrect. Specify the exact amount that you believe is accurate and provide evidence to support your claim. This can include receipts, bank statements, or other documentation that shows the actual amount you owe.

Provide Detailed Documentation

Attach copies of any relevant documents that back up your position. Be sure to reference these documents in your letter. For example, if you have a receipt or contract that shows a different debt amount, make sure to include it and mention it specifically in your dispute letter.

Be Clear and Concise

Avoid lengthy explanations or unnecessary details. Clearly highlight the discrepancies and the correct amount. Stay direct and factual in your tone. If you are disputing a specific charge, explain why it is inaccurate, referencing the document(s) that prove your case.

Conclude by requesting that the creditor provide verification of the debt or correct the amount in their records. This shows that you are aware of your rights and are actively disputing the incorrect claim.

Begin the letter by clearly stating your intent to dispute the debt. Specify the amount in question, as well as any reference numbers provided by the creditor or collection agency. Make sure to identify the original creditor and provide any relevant details about the debt, such as dates and amounts, that will help clarify the dispute.

Next, request a validation of the debt. This can include a demand for proof that the collection agency has the legal right to collect the debt and that the amount is correct. Be specific about your request for documentation, such as account statements or original agreements.

Include your contact details and any supporting documentation that strengthens your case, like bank statements or receipts. This helps the creditor or agency understand your perspective and verifies that you’re acting in good faith.

Close by providing a clear statement about your expectations. Mention that you expect a written response and set a reasonable timeframe for receiving the necessary documents. Also, state your intention to resolve the issue quickly to avoid further complications.

Verify the debt thoroughly before disputing it. This ensures that your dispute is based on accurate information, and avoids unnecessary delays. Below are the key steps to follow:

1. Review the Original Creditor’s Statement

Request a detailed statement from the original creditor. Ensure that the amount listed matches your records. Cross-check the date and the transaction history to confirm the legitimacy of the debt.

2. Check the Debt Collection Agency’s Documentation

If the debt is being handled by a collection agency, ask for proof that they are authorized to collect the debt. This should include an agreement or documentation from the original creditor confirming the transfer of the debt.

3. Examine Your Credit Report

Review your credit report for any entries related to the debt. Verify if the debt shows up as owed to the correct creditor and if the amount is accurate.

4. Confirm the Statute of Limitations

Check if the debt is past its statute of limitations. A debt may no longer be collectible if it falls outside this period, depending on your jurisdiction.

5. Verify Your Personal Information

Ensure that the debt is linked to your personal details. Mistakes in reporting can lead to incorrect debts being assigned to you. Cross-reference your personal information with what is listed on the documentation.

6. Use a Debt Validation Letter

Send a debt validation letter to the collector. Request the original creditor’s name, the amount owed, and proof of the debt’s validity. They are required by law to provide this information.

7. Compare with Your Financial Records

Cross-check your financial records for receipts, payment records, or previous statements that might indicate that the debt was paid off or settled.

8. Identify Any Potential Errors

Look for discrepancies or errors in dates, amounts, or creditor names. Mistakes could indicate that the debt is incorrect or belongs to someone else.

| Step | Action | Purpose |

|---|---|---|

| Review the Original Creditor’s Statement | Request and cross-check statements | Ensure the amount is accurate and matches your records |

| Check the Debt Collection Agency’s Documentation | Ask for proof of authorization | Verify the agency’s right to collect the debt |

| Examine Your Credit Report | Review entries related to the debt | Confirm the debt is accurately reflected |

| Confirm the Statute of Limitations | Check if the debt is time-barred | Ensure the debt can still be legally collected |

| Verify Your Personal Information | Double-check personal details | Ensure the debt is correctly linked to you |

These steps will help you determine if the debt is valid and whether the collector has a right to pursue payment. Proceed with the dispute only once you’ve confirmed all the details.

Write your debt dispute letter clearly and concisely. Avoid using vague language or making general statements. Specify the exact debt, including account numbers and dates, to make your position clear.

1. Failing to Provide Documentation

Always include supporting documentation with your dispute. This may include receipts, statements, or previous correspondence. Without this, your letter will lack credibility and may be dismissed.

2. Not Addressing the Correct Party

Ensure the letter is directed to the right party, whether it’s the creditor, collection agency, or another relevant entity. Addressing the wrong party can delay the resolution process.

3. Using Aggressive or Threatening Language

Maintain professionalism in your tone. Threatening or hostile language may hinder your case and could escalate the situation unnecessarily. Stick to facts and calmly explain your dispute.

4. Ignoring Deadlines

Pay attention to any deadlines mentioned in the initial correspondence from the creditor or collector. Missing deadlines can weaken your case and may result in further legal action.

5. Forgetting to Request a Response

Always request a confirmation of receipt or a response within a reasonable timeframe. This ensures your dispute is being processed and prevents misunderstandings.

6. Not Being Specific About the Dispute

Clearly state the reason for the dispute. Whether it’s due to an error, an incorrect amount, or any other issue, specify the exact nature of the problem.

7. Failing to Keep a Record

Document all correspondence related to the dispute. This includes keeping copies of letters, emails, and phone calls. Having a record of communication can be valuable if the dispute escalates.

Begin your letter with a clear header that includes your name, address, and contact information, followed by the creditor’s name and contact details. This ensures both parties have all relevant details easily accessible.

Use a direct and polite tone throughout the letter. State the purpose of your letter clearly in the first sentence: dispute the debt, explain why, and what you expect to happen next.

- Introduce the Disputed Debt: Mention the account number, the amount in question, and the creditor’s name. This will help the creditor easily identify the case.

- State the Reason for Dispute: Specify why you are disputing the debt. Include any supporting evidence or details to clarify your position.

- Request Validation: Politely request that the creditor provide proof of the debt. This could include a copy of the signed agreement or any other relevant documentation.

- Provide Your Contact Information: Ensure your contact information is clearly stated to allow the creditor to reach out to you for further communication.

Close the letter with a concise summary, thanking the creditor for their attention, and remind them of their obligation to provide validation. Always sign the letter and keep a copy for your records.

If the debt collection agency ignores your dispute, take action by documenting every communication. Keep a copy of your dispute letter, any responses, and proof of delivery (such as certified mail receipts). This will serve as evidence if you need to escalate the issue.

File a complaint with the Consumer Financial Protection Bureau (CFPB) if the agency refuses to acknowledge or address your dispute. The CFPB allows you to submit a formal complaint, which the agency is legally required to respond to within a specific timeframe.

Consider contacting your state’s attorney general if the debt collection agency continues to ignore your dispute. Many states have consumer protection laws that offer additional support in cases of unresponsiveness or harassment by debt collectors.

If necessary, consult a lawyer who specializes in debt collection practices. A legal professional can help you understand your rights and guide you through the process of taking further legal action if needed.

Structure is maintained, and repetition of words is minimized.

Keep the language concise and direct. For clarity, focus on presenting the key points related to the debt dispute. Avoid unnecessary repetition of terms or phrases. The main goal is to address the dispute clearly without overwhelming the reader with redundant information. Use simple, straightforward sentences that make the content easy to follow.

Key Elements in Debt Dispute Letters

In a debt dispute letter, state the reason for the dispute early on. Clearly mention the specific charge or amount being disputed and provide any supporting evidence. Ensure that the facts are laid out logically to avoid confusion.

Tips for Effective Communication

Maintain a polite tone, even when disputing a debt. Clearly request a response or action, such as a review of the charges or a request for more information. Use the letter to ensure all communication regarding the dispute is documented, helping to resolve the issue efficiently.