Accounts receivable letter template

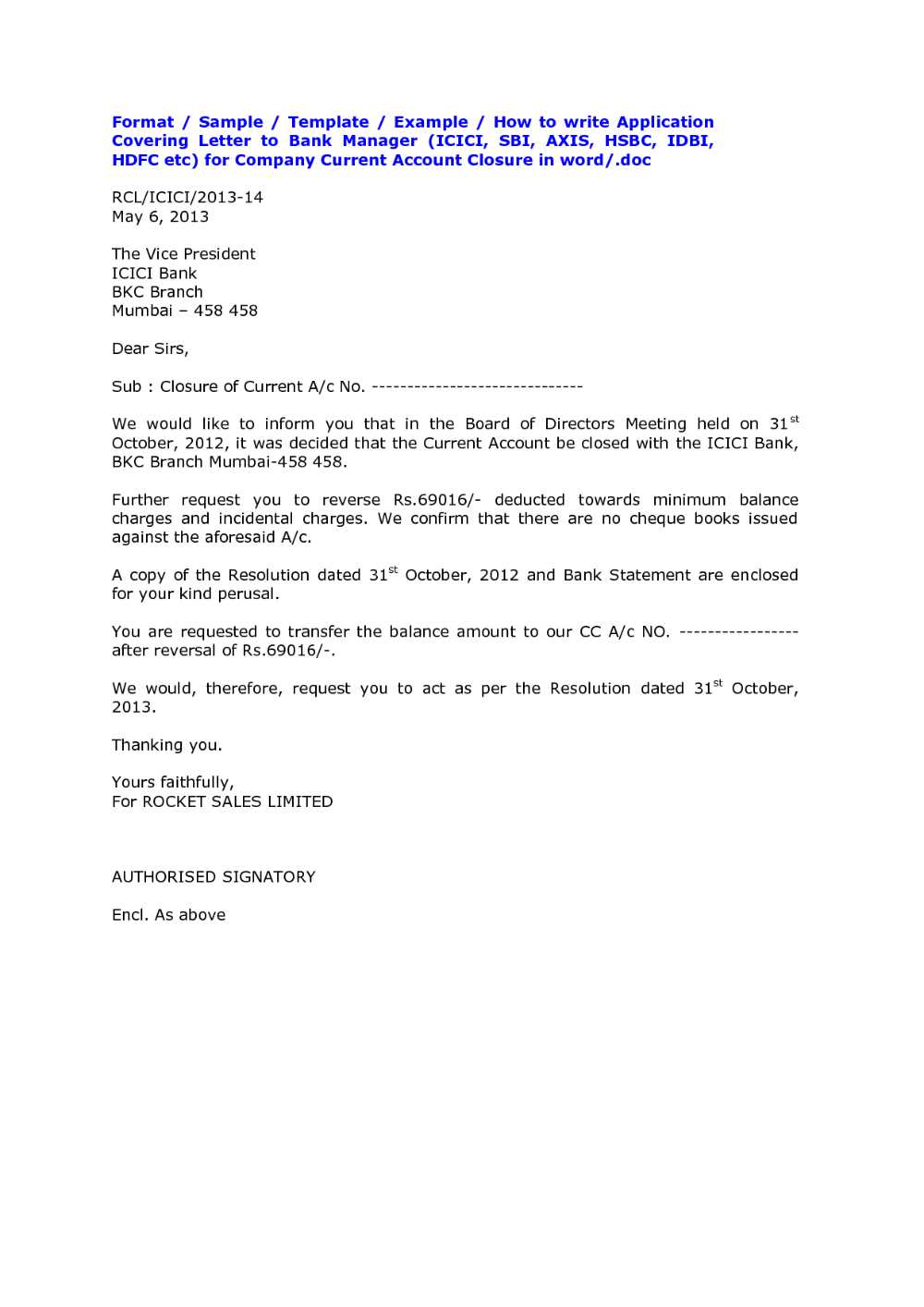

Use a clear and direct approach when drafting an accounts receivable letter. Begin with a polite yet firm request for payment, referencing the outstanding balance and the original terms of the agreement.

In the opening lines, mention the specific invoice number and the due date. Be sure to include the total amount due, so there is no ambiguity. This helps the recipient understand immediately the purpose of your letter.

Be concise and professional while maintaining a tone that encourages prompt action. State the payment methods available and offer assistance if there are any issues with the payment process.

If payment has already been made, express appreciation and ensure that your records are updated. Always include your contact details for any follow-up questions or clarifications.

Here’s the revised version, where words repeat no more than 2-3 times:

Keep your letter clear and to the point. Start by addressing the recipient directly, using their name and company if applicable. Use a friendly yet firm tone to remind them of the outstanding balance. Be concise and specify the due date for payment. Clearly mention the invoice number and date, and reference any previous communications if necessary.

Offer a reminder of payment methods to make it easy for the recipient to act quickly. Suggest a resolution, such as a payment plan if appropriate, but maintain professionalism throughout. End with a polite but firm request for payment, stating the consequences if the payment is not made within a certain timeframe.

Make sure to double-check for any errors before sending to maintain professionalism and avoid misunderstandings. A simple, clear message will help get the desired outcome without overwhelming the recipient.

- Accounts Receivable Letter Template

Start by addressing the recipient with a formal greeting, including their name or title. Use clear language to specify the purpose of the letter: requesting payment for outstanding invoices. Be concise and direct to avoid confusion.

- Subject Line: “Outstanding Payment Request for Invoice #[Invoice Number]”

- Opening Line: “Dear [Recipient’s Name], I hope this message finds you well. I am writing to follow up on the unpaid invoice #[Invoice Number] dated [Date].”

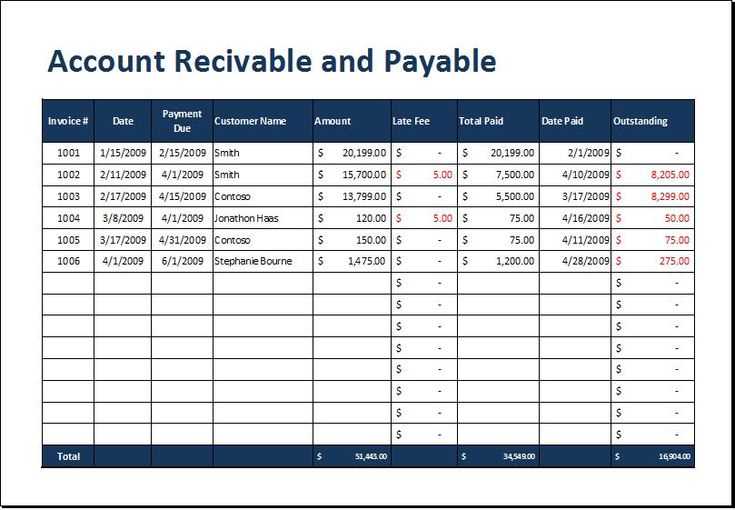

- Details of the Invoice: Provide a summary of the amount due, the due date, and the invoice number. For example, “The total amount of $[Amount] was due on [Due Date].”

- State the Consequences: Mention any late fees or interest if applicable. “Please note that a late fee of $[Late Fee] has been added as per our agreement.”

- Call to Action: Clearly request the payment and provide payment details. “Kindly make the payment by [New Due Date] to avoid further action. Please transfer the amount to [Bank Details or Payment Platform].”

- Closing Line: “If you have already processed the payment, please disregard this notice. Otherwise, please let us know if you have any questions.”

- Sign Off: “Sincerely, [Your Name], [Your Position], [Your Contact Information]”

Adjust the tone based on the relationship with the recipient. For clients with whom you have a long-term relationship, you might use a more gentle approach. For new clients or recurring late payers, a firmer tone may be required.

Begin by addressing the recipient directly with their name and relevant contact details. A clear subject line should follow to ensure the purpose of the letter is immediately understood, such as “Outstanding Payment Reminder” or “Payment Due for Invoice #12345.” This sets a professional tone from the outset.

Structure and Clarity

Keep the content concise and to the point. Start with a polite reminder of the outstanding payment, including the invoice number, date of issue, and amount due. Specify the due date and any penalties or interest if applicable. Clearly state the action required, whether it’s a payment or reaching out for further discussion.

Polite and Professional Language

Maintain a courteous tone throughout the letter, even when requesting overdue payments. Avoid using aggressive language or making assumptions about why the payment is late. Focus on resolution and express your willingness to assist with any queries regarding the payment. Offering flexible payment options can also encourage prompt resolution.

Conclude by thanking the recipient for their attention to the matter and provide clear instructions for how they can make the payment or contact you. Include a professional closing such as “Sincerely” or “Best regards” followed by your full name and business contact information.

Clearly specify the amount due, including any applicable taxes or fees. Include the invoice number and the due date to avoid confusion. It’s important to provide the recipient with all the details they need to understand the payment terms and history.

- Invoice Number: Always reference the specific invoice to which the payment corresponds.

- Amount Due: State the exact amount owed, including any interest or late fees if applicable.

- Payment Terms: Outline the payment deadline and any agreed-upon terms for late payments.

- Contact Information: Provide details on how to reach you for further clarification or questions.

- Payment Methods: Mention acceptable payment methods to ensure ease of transaction.

- Previous Correspondence: If applicable, reference prior communications about the overdue payment.

Clarity on Consequences

Indicate the potential actions that may follow if the payment is not made within the specified timeframe. This could include legal actions or additional fees.

- Late Fees: Specify any additional charges that will apply for overdue payments.

- Legal Actions: Briefly mention the possibility of taking legal steps to recover the debt if necessary.

Friendly Tone

Always aim to maintain a professional yet friendly tone in the letter. A respectful approach fosters better communication and cooperation.

Keep the tone polite and clear, ensuring the recipient understands the importance of the matter without feeling pressured. Be specific about the payment details, such as the amount owed and the due date, to avoid any confusion.

Be Direct Yet Respectful

Avoid vague language. State exactly what is expected from the recipient, whether it’s a payment by a certain date or confirmation of the outstanding balance. Clarity removes any ambiguity and increases the chances of a timely response.

Use Positive Language

Frame your message with positive phrasing. Instead of saying “you haven’t paid yet,” say “we would appreciate your payment.” This maintains a friendly atmosphere and encourages cooperation without sounding confrontational.

Address unpaid invoices by sending a clear, polite reminder as soon as the payment due date passes. Specify the exact amount owed, payment terms, and any applicable late fees. Keep the tone professional and respectful to maintain a positive relationship with the customer.

If reminders are ignored, follow up with a second notice. Include a stronger call to action, such as requesting immediate payment within a specific timeframe or discussing alternative payment arrangements. Offer multiple payment methods to make the process more convenient.

If no response is received after several reminders, consider involving a collections agency or legal action. Before taking this step, review the customer’s payment history and the potential costs involved to ensure it’s a viable solution.

Contact your client a few days after sending the letter, especially if you haven’t received a response. Start by confirming they received the letter and ask if they need any further information. This shows your commitment to resolving the matter and keeps communication open.

If you still haven’t heard back, try a friendly reminder via email or phone. Keep your tone polite, but firm. Be clear about the outstanding balance and offer a specific deadline for payment, such as “Please arrange payment by the end of the week.”

For clients who regularly delay payments, it might help to offer a payment plan, making it easier for them to settle the debt in installments. You can mention this option in your follow-up communication, showing your willingness to find a mutually beneficial solution.

If the matter persists, escalate your communication. Send a more formal letter, highlighting the legal consequences of non-payment. At this stage, it’s important to remain professional, ensuring you don’t damage the business relationship, but also stressing the need for immediate action.

Lastly, ensure you keep a record of all follow-ups, including dates and responses. This can be useful in case further legal steps are required.

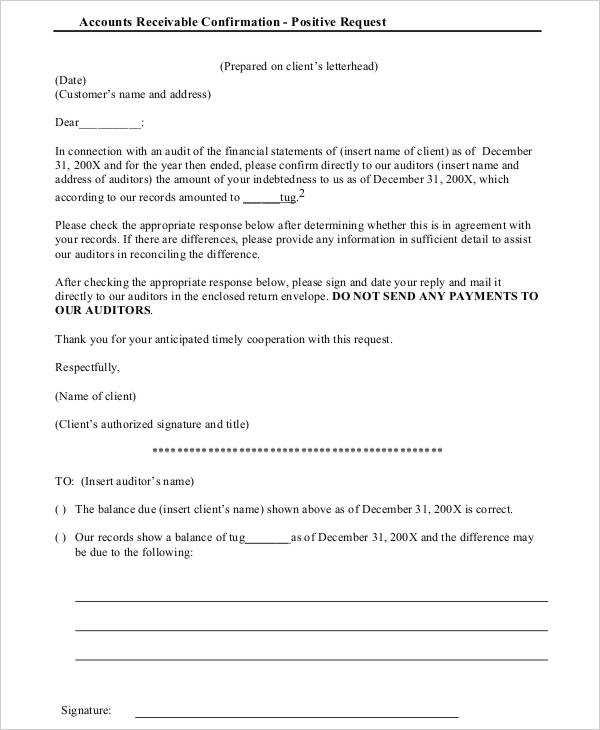

Ensure that all communication regarding accounts receivable adheres to legal requirements. Start by including clear terms and conditions in contracts with clients. These should outline payment schedules, consequences for late payments, and any applicable interest rates or penalties. It’s crucial that both parties understand their obligations to avoid legal disputes.

Always be mindful of the Fair Debt Collection Practices Act (FDCPA) or similar local regulations when collecting overdue payments. These laws regulate how collections are conducted, ensuring that creditors treat debtors fairly and avoid harassment. It’s also important to consider privacy regulations like GDPR if operating in the EU, as client information must be handled with care.

Before sending a collection letter, confirm that it complies with these regulations, including avoiding any language that could be construed as threatening or coercive. Provide sufficient time for clients to respond or dispute charges. If necessary, include a statement of their legal right to dispute the debt within a specified period.

If a legal dispute arises, consider mediation or arbitration to resolve the issue before pursuing court action. Having clear documentation of all transactions, agreements, and communication will strengthen your case if it proceeds to court.

| Legal Requirement | Compliance Action | Relevant Law |

|---|---|---|

| Clear payment terms | Include in contracts | Contract Law |

| Fair debt collection | Follow FDCPA guidelines | FDCPA |

| Privacy protection | Comply with GDPR | GDPR |

| Dispute rights | Allow client dispute within specified time | FDCPA |

Include a clear and direct subject line when writing an accounts receivable letter. This helps the recipient understand the purpose of the letter immediately. For example: “Payment Due: Invoice #12345.” Keep it brief yet informative.

Provide a Detailed Breakdown

In the letter, list the invoice number, the amount due, and the payment terms. If there are any late fees or discounts, mention them clearly. This ensures there is no confusion about the payment expectations.

Set Clear Expectations

Clearly state the deadline for payment. Specify the payment methods you accept and include any relevant details (e.g., bank account information or online payment links). This eliminates unnecessary back-and-forth and speeds up the process.

Use a polite tone, even when addressing overdue payments. A respectful tone maintains a positive relationship while still being firm about the need for payment.