Template letter to credit dispute

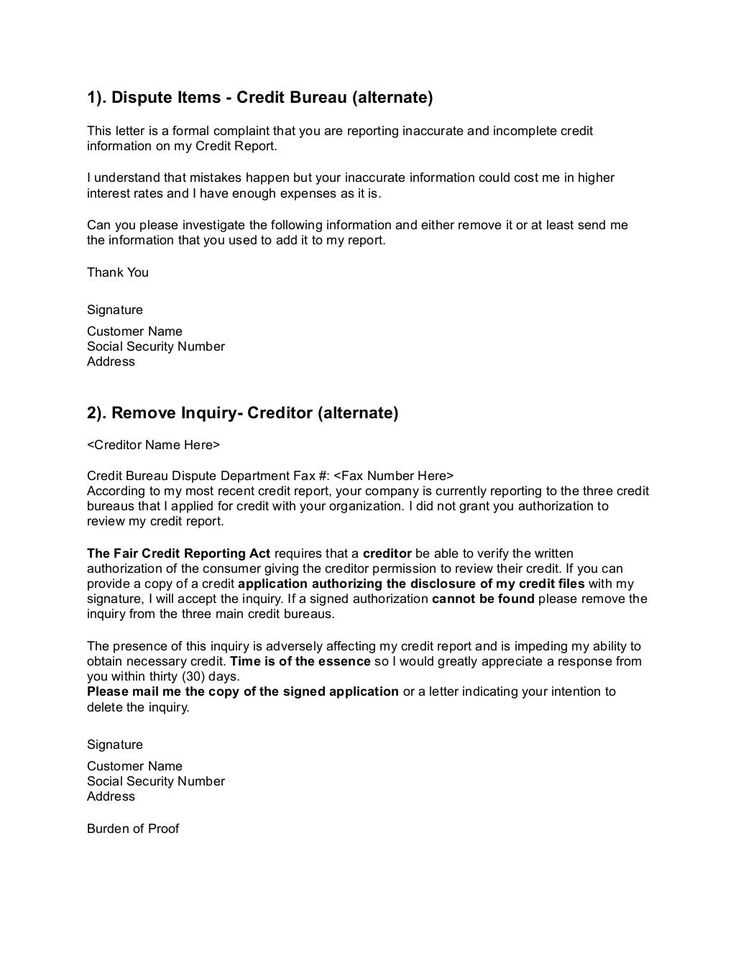

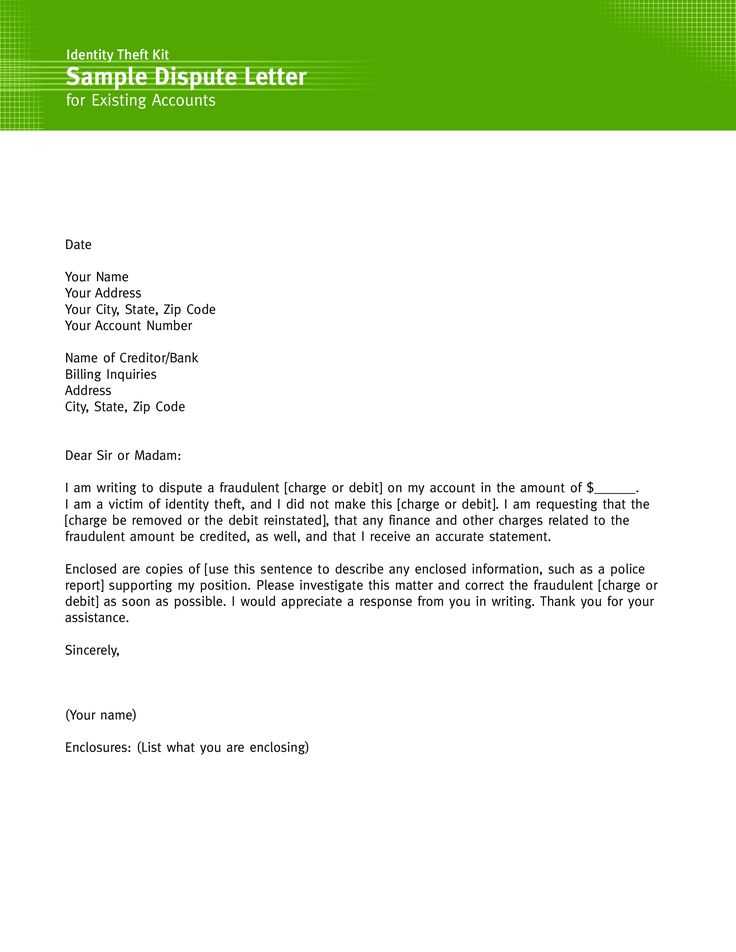

If you find yourself disputing a charge on your credit report or statement, crafting a clear, direct letter is the first step to resolving the issue. This letter should clearly state the nature of your dispute and provide any supporting evidence to back your claims. Be specific about the charge you are disputing, and ensure that all relevant account details are included for quick identification by the recipient.

Start by including your personal information at the top of the letter. Your full name, address, account number, and contact details should be easy to find. This allows the credit agency or creditor to quickly locate your account and address the issue without unnecessary delays.

Clearly state the nature of the dispute. Describe the transaction or charge that is incorrect, why it is incorrect, and any documentation you have to prove your claim. If there are discrepancies, include copies of receipts, bank statements, or other records that show the error. The more precise and organized your information, the smoother the resolution process will be.

End the letter with a firm but polite request for the dispute to be resolved. Specify any actions you expect to be taken and include a timeline for resolution if necessary. Remain professional throughout the letter, as maintaining a courteous tone can help facilitate a quicker, more favorable outcome.

Here is the corrected version:

Ensure your dispute letter includes all necessary details, such as the transaction date, the amount, and the name of the creditor. Clearly state the reason for the dispute and any supporting evidence you have, like receipts or bank statements. Be concise and polite, but firm in your request for a resolution.

If the issue involves a mistake on your credit report, mention the exact error and request an immediate investigation. Include your account number and specify any corrections needed. If applicable, ask for confirmation once the dispute is resolved.

Close the letter by requesting a written response within a reasonable timeframe. Keep a copy of the letter for your records, and send it via certified mail for proof of delivery.

- Understanding the Purpose of a Credit Dispute Letter

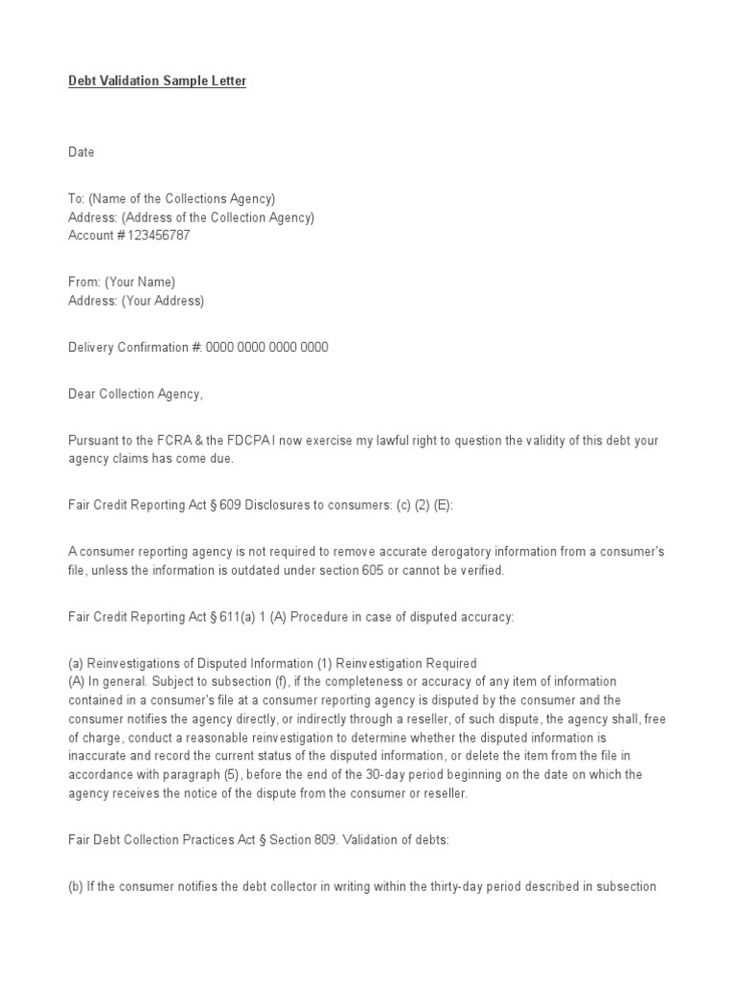

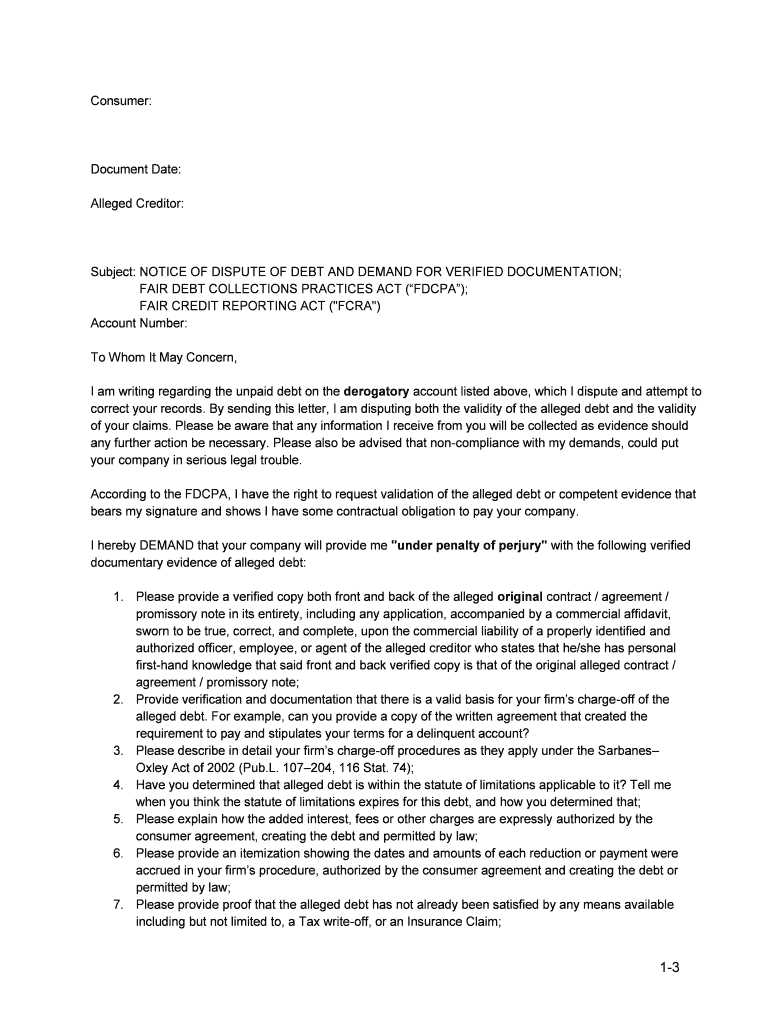

A credit dispute letter serves to formally challenge incorrect or outdated information on your credit report. The goal is to provide the credit reporting agency with clear details of the discrepancies and request a thorough investigation into those items. By disputing an item, you aim to ensure your credit report accurately reflects your financial history.

Addressing the issue directly and concisely will increase the likelihood of a favorable outcome. When drafting the letter, focus on specific errors, such as incorrect account details, outdated debts, or duplicate entries. Providing supporting documentation, such as account statements or receipts, strengthens your case and helps expedite the process.

The letter acts as a tool to clear up any misreported information that could potentially affect your credit score, making it a critical step for anyone who finds errors in their credit profile. Be precise and clear about what needs correction and avoid over-explaining. Stick to the facts for the best results.

Be clear and concise when writing your dispute letter. Ensure you provide all necessary information to support your case.

Account Information

Start with your full name, address, and account number. This ensures that the recipient can easily locate your account and handle your dispute effectively.

Disputed Charge Details

Specify the exact charge(s) you are disputing. Include the date, amount, and any reference number that applies. This will help the recipient understand what needs to be reviewed.

Reason for Dispute

Clearly explain why you are disputing the charge. Include any relevant evidence such as receipts, billing statements, or communication that supports your claim. The more evidence you provide, the stronger your case will be.

Requested Action

State what resolution you are seeking. Whether it’s a refund, charge correction, or account adjustment, make sure your request is clear.

Contact Information

Include your preferred method of contact, whether it’s via phone, email, or mail. Ensure they have all the details to reach you for follow-up.

| Details | Information to Include |

|---|---|

| Account Information | Name, address, account number |

| Disputed Charges | Charge date, amount, reference number |

| Reason for Dispute | Clear explanation and evidence |

| Requested Action | Refund, correction, or adjustment |

| Contact Information | Phone, email, or mail address |

Address the dispute directly and concisely in the opening lines. Begin by clearly stating the reason for the letter, specifying the inaccurate information on your credit report. Include relevant account numbers, dates, and any other specific details that can help identify the issue. Be sure to keep the tone formal and avoid unnecessary language. Make your intention clear: to have the error corrected and request a response in a timely manner.

Next, briefly explain the impact of the error on your credit score or financial standing. This ensures the reader understands the seriousness of the dispute. Refrain from overly emotional language, but express the importance of resolving the issue swiftly. Conclude your opening with a direct request for action, specifying how you expect the error to be corrected.

To dispute incorrect credit report information, it’s crucial to be specific. Below are a few examples of common errors and how to address them directly:

Disputing Incorrect Account Information

If a credit report lists an account that you never opened, immediately file a dispute. Provide supporting documents such as a statement from the creditor stating that no such account exists. This helps prove that the account is incorrectly listed under your name.

Disputing Incorrect Payment History

If your payment history shows late payments that were actually made on time, gather bank statements or confirmation emails showing the payment dates. Include this evidence in your dispute letter to request a correction to your report.

Each dispute should focus on one error at a time and include clear evidence to support your claim. Ensure that all your personal details are correct in your communication to avoid delays.

Once you’ve sent your dispute letter, the next steps will involve waiting for a response. Typically, you can expect one of the following outcomes:

1. Acknowledgment of Receipt

The credit reporting agency or creditor will usually confirm they’ve received your dispute. This may come as a formal acknowledgment via email or mail, and typically happens within a week or two of sending your letter. Be sure to keep track of this communication, as it may include important reference numbers for your case.

2. Investigation Process

After receiving your dispute, the creditor or credit agency must investigate the issue. This can take up to 30 days. They will review the documentation you provided, compare it with their records, and verify the information with the relevant parties. Stay patient during this period, but keep a note of any communication you send or receive during the process.

3. Outcome Notification

Once the investigation is complete, you will receive a response detailing the outcome. If your dispute is successful, the negative information will be corrected or removed. If not, they will explain why the dispute was not resolved in your favor. In either case, the response should clearly outline your next steps if you disagree with the decision.

4. Follow-Up Actions

If the outcome is unsatisfactory, you can take further action. You may request a re-investigation, submit additional evidence, or even file a complaint with the Consumer Financial Protection Bureau (CFPB) if necessary. Always make sure you keep records of any correspondence related to your dispute.

If your dispute remains unresolved after following the standard procedure, you have options to take further action.

- Contact the Credit Bureau – Reach out to the credit bureau where the dispute was filed and request a follow-up. Provide any additional evidence to support your case. If the issue is not resolved within 30 days, you may ask for an escalation.

- File a Complaint with the Consumer Financial Protection Bureau (CFPB) – The CFPB handles credit disputes. Filing a complaint with them can help escalate the issue and prompt a resolution from the creditor or bureau.

- Contact the Original Creditor Directly – If the credit bureau or reporting agency fails to resolve the dispute, reach out to the creditor involved. Request a direct resolution or reconsideration of their decision. Always document your communication for future reference.

- Consider Legal Action – If all other methods fail, consult a lawyer to explore legal options. You may be able to file a lawsuit for unfair reporting or negligence. Be sure to gather all relevant documents before taking this step.

- Consult a Credit Repair Agency – If you are still having trouble, a credit repair service can help guide you through the process. They may negotiate with creditors on your behalf or assist with cleaning up your credit report.

Keep detailed records of all correspondence and actions taken, as this will help you in any follow-up or legal procedures.

Reducing Repetitive Words in a Dispute Letter

When drafting a letter for a credit dispute, limit repetitive words like “dispute” and “letter” to 2-3 instances per sentence. This makes your communication more concise and clear.

Effective Word Use

Start by replacing redundant phrases with synonyms or restructuring sentences. For example, instead of repeating “dispute” multiple times, refer to it as “issue” or “concern.” This reduces monotony without losing clarity.

Keep the Message Clear

Focus on conveying the details of the dispute directly. Avoid over-explaining. A straightforward approach will help the reader understand your position without unnecessary repetition.