Proof of Funds Letter Template for Easy Use

When engaging in various transactions, especially those involving large sums or important investments, it’s often necessary to provide evidence of available capital. This kind of verification ensures that the person or entity involved is financially capable of following through with their commitments.

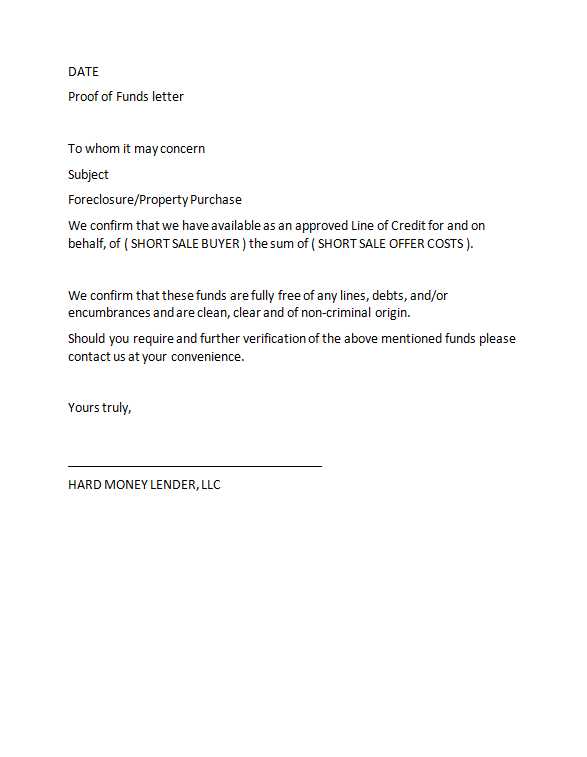

Such documents are commonly requested for a wide range of purposes, from applying for loans to securing property deals. They serve as proof that you have the means to complete a purchase, pay a fee, or cover other financial responsibilities.

Creating a proper statement for this purpose requires careful attention to detail. It must include specific information that satisfies the requirements of the requesting party while ensuring its authenticity and clarity. A well-structured document can significantly streamline processes and help you avoid unnecessary delays.

What is a Financial Verification Document

This type of documentation serves as a written statement confirming an individual’s or organization’s available capital to meet financial obligations. It is typically requested in situations where financial capability needs to be demonstrated, such as during significant transactions or loan applications.

Purpose of a Financial Verification Document

The main purpose of such a document is to provide clear evidence that sufficient assets are available to fulfill the required financial commitment. It assures the other party that the person or entity can cover the associated costs without risk of default.

Key Elements in a Financial Verification Document

A proper statement should include details like the amount of available assets, the source of the capital, and the financial institution’s confirmation. These elements are essential to verify that the person or entity meets the criteria set forth by the requesting party.

Why It’s Important for Financial Transactions

In many high-value financial exchanges, demonstrating available capital is crucial to ensure that all parties involved are confident in the transaction’s completion. Without clear verification of financial capability, the risk of non-fulfillment increases, which can lead to complications or even the failure of the deal.

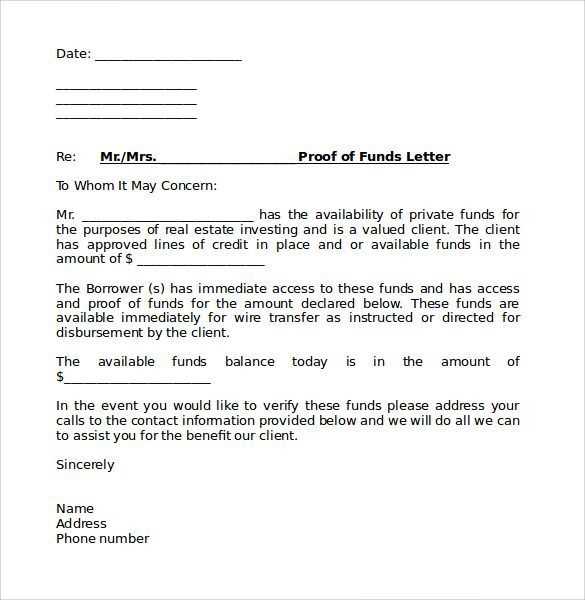

For both buyers and sellers, providing evidence of the ability to meet financial obligations creates a foundation of trust. It allows the other party to proceed with confidence, knowing that the transaction can be carried out as agreed. This documentation can also speed up processes like securing property, obtaining loans, or finalizing business deals.

Steps to Create a Financial Verification Statement

Creating a valid document to verify available capital requires careful preparation and attention to detail. It is essential to follow the necessary steps to ensure that the statement is complete and meets the requirements of the requesting party. Properly drafted documents reduce the risk of confusion or rejection.

Gather Relevant Information

The first step is to collect all necessary details, such as the total amount of assets available, the sources of those assets, and any relevant bank statements or official documentation. This ensures that the information provided is both accurate and sufficient for verification purposes.

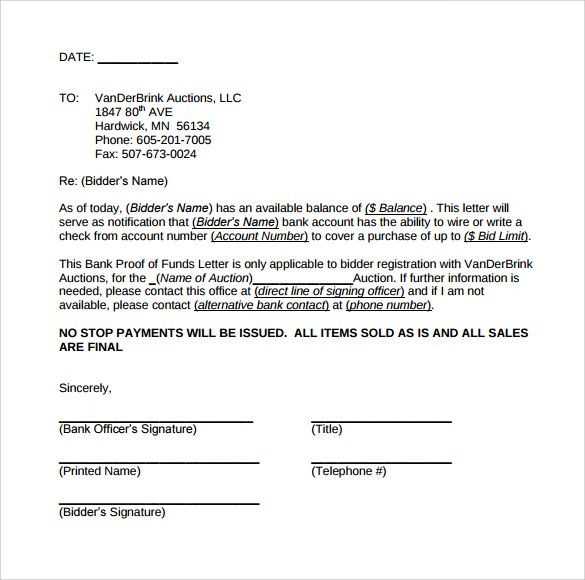

Structure the Document Correctly

The next step is to organize the information in a clear and formal manner. This typically involves including the date, a declaration of the available amount, and any supporting financial records, along with a statement from the financial institution confirming the details. A well-structured statement makes the verification process smoother and more reliable.

Essential Information to Include in the Document

When creating a statement to verify available capital, it is important to ensure that the document includes all necessary details. These key elements help establish the authenticity of the provided information and make the verification process more efficient.

Critical Components

To ensure the document meets the required standards, it should contain the following details:

- Amount of Available Assets: Clearly state the total amount of available capital.

- Source of Assets: Include details about where the assets originated, such as bank accounts or investments.

- Financial Institution Confirmation: A statement from the financial institution verifying the available balance or assets.

- Date of Verification: Indicate the date when the verification was issued to ensure its relevance.

Additional Considerations

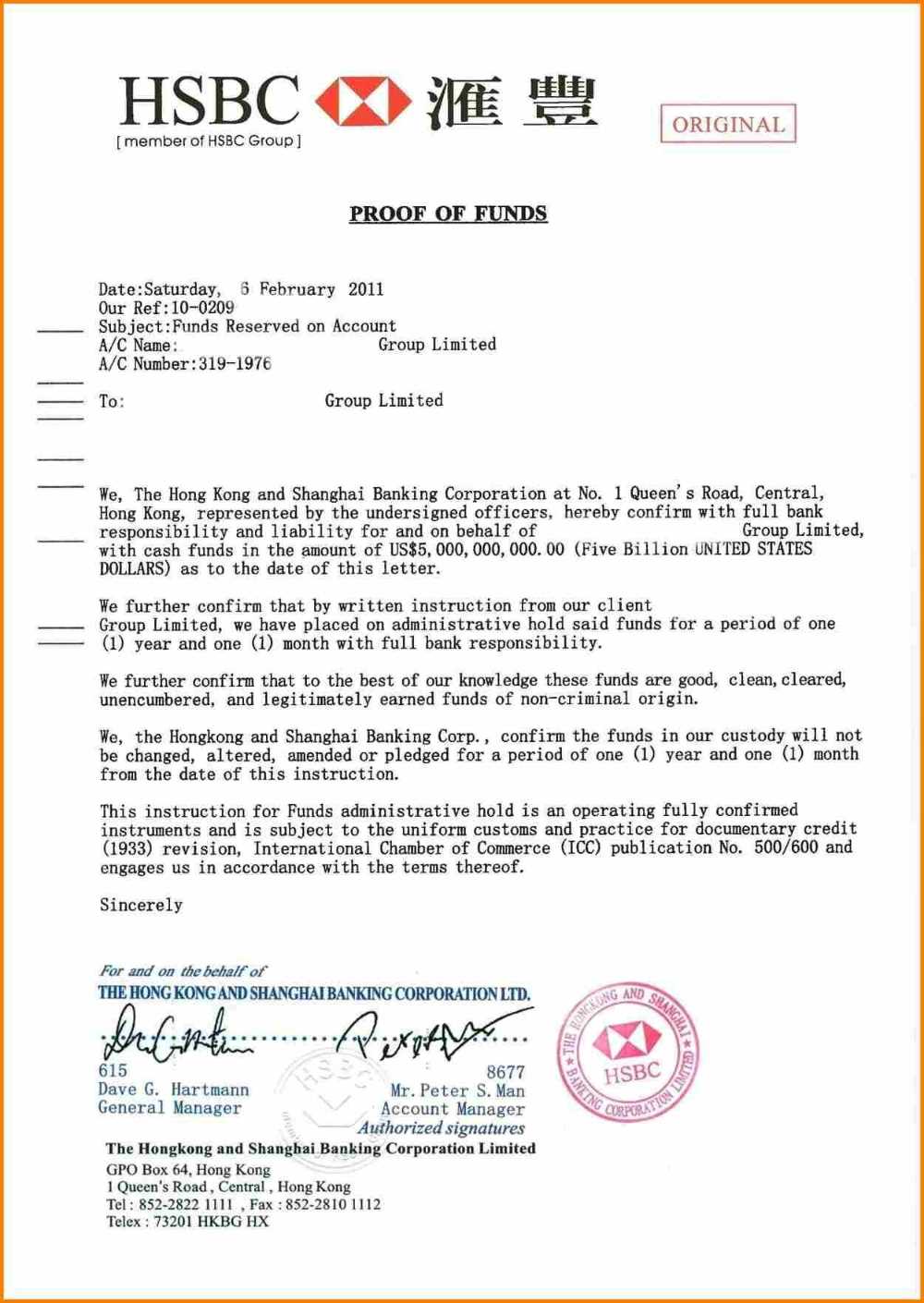

In some cases, it may be necessary to include further supporting documentation, such as bank statements, investment portfolios, or official certifications from the financial institution. These documents help confirm the claims made in the statement and provide additional assurance to the requesting party.

How to Format a Financial Verification Document

When drafting a document to verify available assets, it is important to follow a structured format to ensure clarity and professionalism. The format not only helps in organizing the content but also ensures that the necessary information is easily accessible to the recipient.

Basic Structure of the Document

A well-formatted statement typically includes several key sections, including an introduction, a detailed list of available assets, and a formal confirmation from the financial institution. Below is a sample structure:

| Section | Details |

|---|---|

| Introduction | State the purpose of the document and the total amount of available assets. |

| Asset Details | Provide a breakdown of the assets, including their sources and relevant values. |

| Confirmation | A statement from the financial institution confirming the available balance or assets. |

| Date | Indicate the date of verification to ensure the document’s accuracy. |

Additional Tips for Proper Formatting

Make sure that the document is clear and professional in appearance. Use formal language and avoid unnecessary jargon. Organize the sections logically, and ensure that the document is easy to read and understand by the recipient. A clean and well-structured format helps convey reliability and attention to detail.

Common Mistakes to Avoid in Proofs

When preparing a document to confirm the availability of assets, it is essential to avoid certain errors that can compromise the validity or clarity of the information. These mistakes can lead to confusion or rejection of the verification, delaying or even canceling important transactions.

Inaccurate Information: One of the most common mistakes is providing incorrect or outdated details. Ensure that the total amount of assets, their sources, and supporting records are current and accurate. Any discrepancies between the provided information and official records can raise doubts about the legitimacy of the statement.

Failure to Include Required Details: Omitting crucial components such as the official confirmation from the financial institution or the specific asset breakdown can make the document incomplete. Make sure all necessary elements are included to avoid the need for revisions.

Using Informal Language: Using casual language or informal terms in a formal document can reduce its professionalism. Always use formal, clear, and precise language to ensure the document conveys credibility.

Incorrect Formatting: Improper structure can make the document difficult to understand. Follow a consistent format, with clear headings and a logical flow of information. Poor formatting can make the document look unprofessional and may lead to delays in processing.