Life insurance cancellation letter template

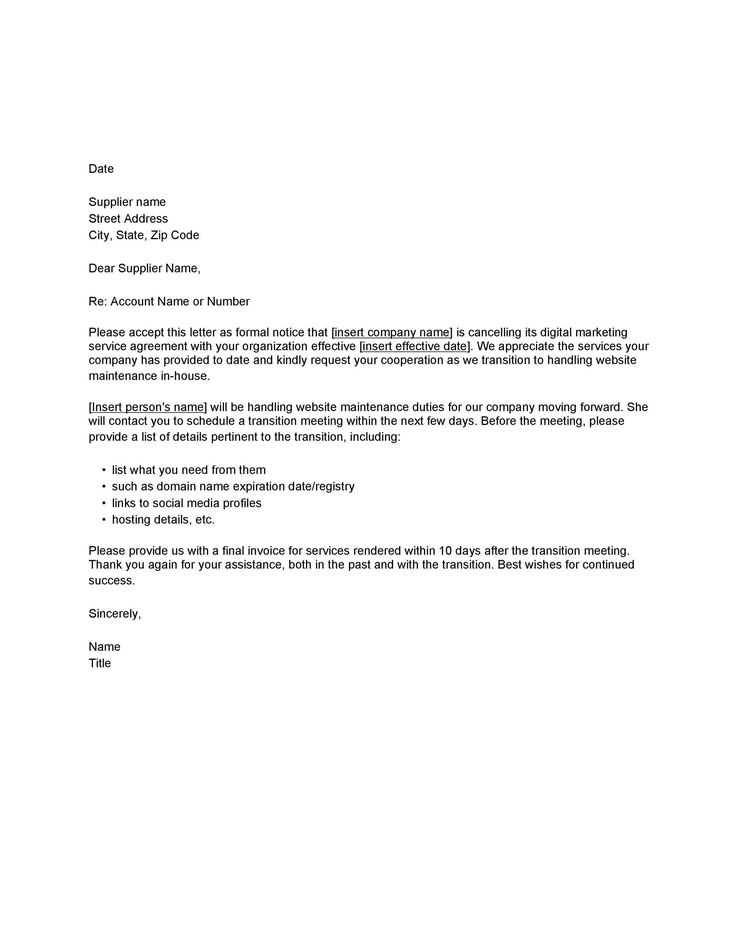

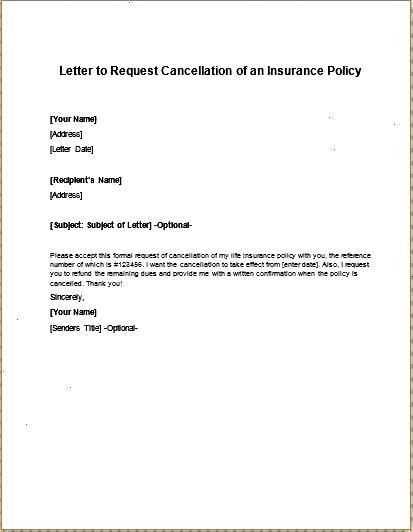

If you’ve decided to cancel your life insurance policy, it’s important to do so in writing. A well-crafted cancellation letter ensures clarity and prevents any potential issues during the process. Below is a straightforward template that you can modify to suit your needs.

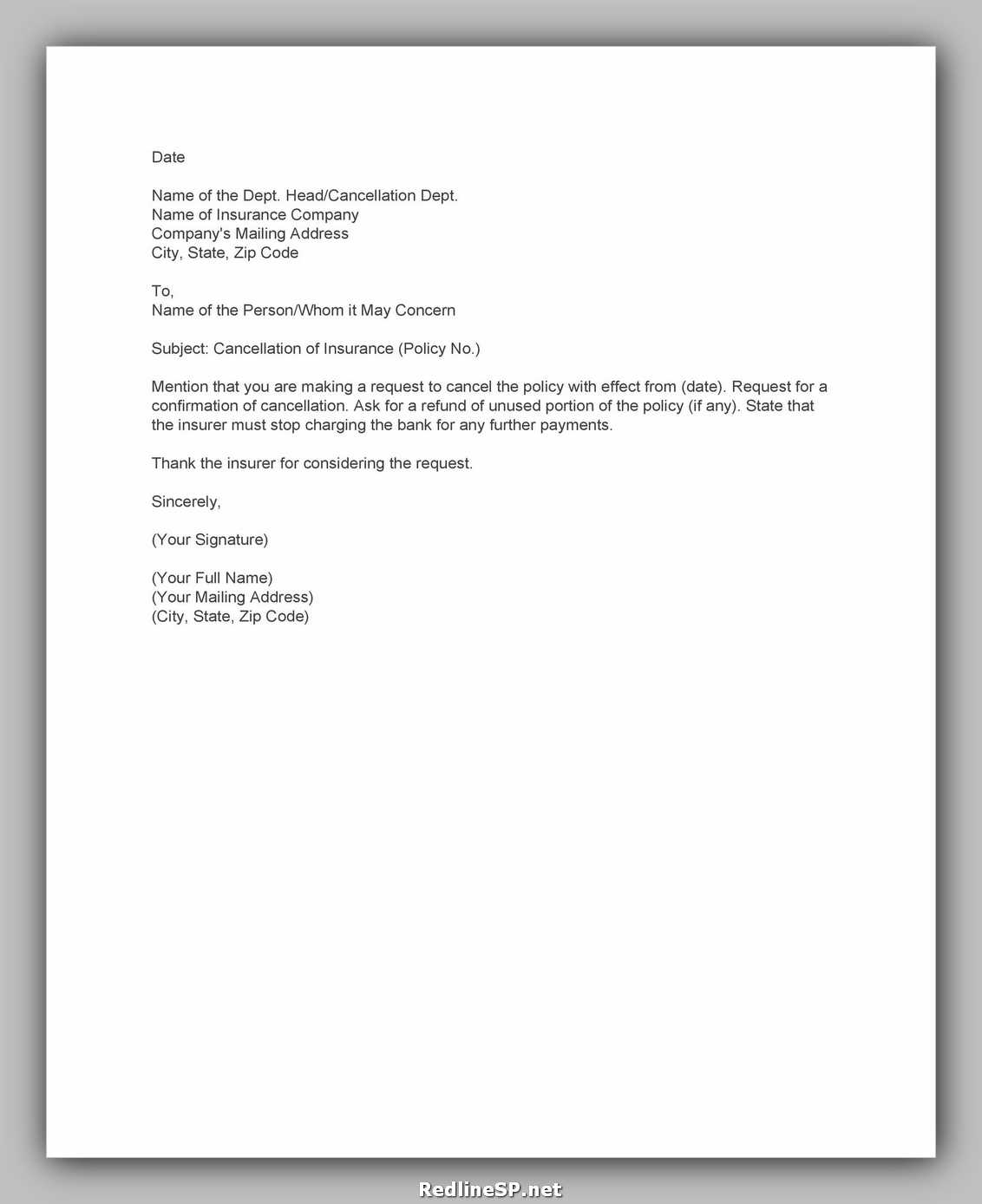

Begin the letter by stating your intention to cancel the policy. Include your full name, policy number, and the date you would like the cancellation to take effect. Clearly mention that you request confirmation of the cancellation once processed. This helps avoid any misunderstandings.

Here’s a basic example:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Insurance Company Name]

[Insurance Company Address]

[City, State, Zip Code]

Dear Sir/Madam,

I am writing to inform you that I wish to cancel my life insurance policy, [Policy Number], effective [Desired Cancellation Date]. Please provide written confirmation once this request has been processed. I understand that any applicable refunds or fees will be addressed according to the terms of the policy.

If you require any additional information or documentation, feel free to contact me at [Phone Number] or [Email Address].

Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

This simple structure ensures all necessary details are covered while keeping your request clear and professional. Adjust the content as needed based on your specific situation or the requirements of your insurance provider.

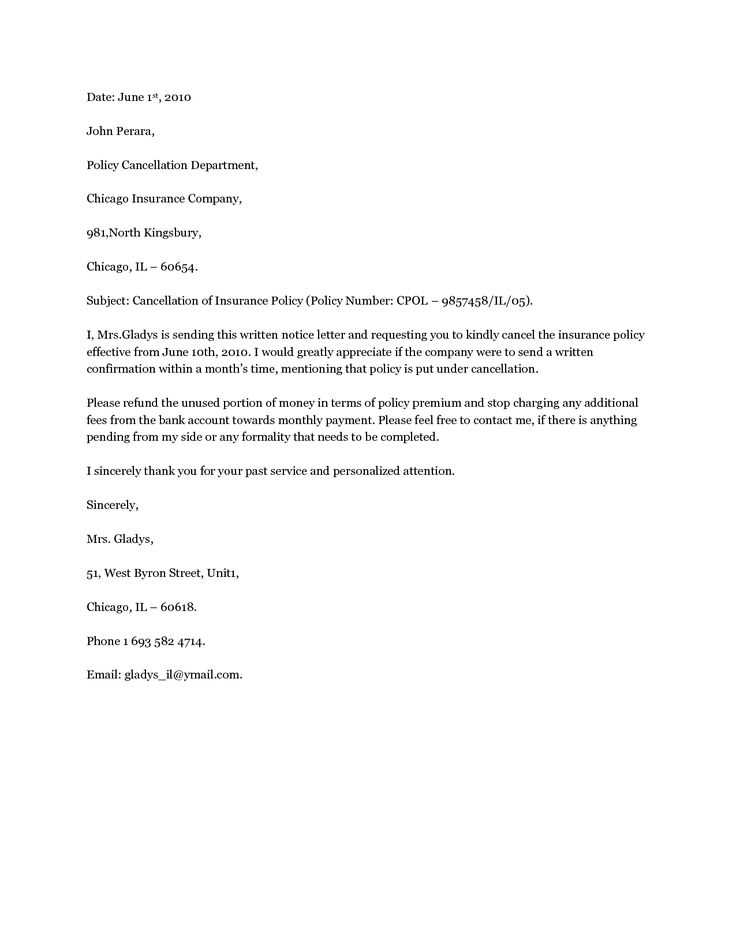

Here is the revised version:

To cancel your life insurance, you need to provide a clear and formal request. Ensure that your letter includes the policy number, your full name, and contact information. Mention the cancellation date and request a confirmation of receipt. Keep the tone polite but direct. Below is a suggested format:

Dear [Insurance Company Name],

I would like to formally request the cancellation of my life insurance policy. Please find the details of my policy below:

Policy Number: [Your Policy Number]

Policyholder Name: [Your Full Name]

Contact Information: [Your Phone Number or Email]

Cancellation Date: [Desired Date of Cancellation]

Kindly confirm the receipt of this request and inform me of any further actions required from my side. I would appreciate it if you could also send me a written confirmation of the cancellation once processed.

Thank you for your assistance.

Sincerely,

[Your Name]

- Life Insurance Cancellation Letter Template

To cancel your life insurance policy, follow this simple structure for an effective cancellation letter. Be sure to include necessary details to avoid any confusion or delays.

- Start with your personal details: Mention your full name, policy number, and contact information. This ensures the insurance company can easily identify your account.

- State your intent clearly: Specify that you wish to cancel the policy and include the effective cancellation date. This helps avoid any misunderstandings about when the policy ends.

- Request confirmation: Ask for written confirmation of the cancellation. This will serve as your proof of cancellation for future reference.

- Include policy details: Mention any relevant details, such as the type of life insurance and the premium payment schedule, to make the process smoother.

- Sign and date the letter: Always include your signature and the date at the end of the letter to ensure its authenticity.

Here’s a simple example of how the letter can be structured:

[Your Name] [Your Address] [City, State, Zip Code] [Phone Number] [Email Address] [Insurance Company Name] [Company Address] [City, State, Zip Code] Date: [Insert Date] Subject: Cancellation of Life Insurance Policy Dear [Insurance Company Name], I am writing to formally request the cancellation of my life insurance policy, policy number [Policy Number], effective from [Insert Date]. Please confirm the cancellation in writing and provide any necessary steps I should follow to finalize the process. Should you need any further information, feel free to contact me at [Phone Number] or [Email Address]. Thank you for your assistance in this matter. Sincerely, [Your Name]

Make sure to send this letter via certified mail to ensure it is received and acknowledged by the insurance company.

Begin by clearly stating your intention to cancel the life insurance policy. Provide the policy number and your personal details to make it easier for the insurer to identify your account. Use a formal tone and avoid unnecessary explanations.

Include the exact date you wish the cancellation to take effect. Mention whether you want a confirmation of cancellation in writing. This will help ensure that the process is completed properly and on time.

Make sure to sign the letter at the end. If submitting electronically, include a scanned signature or any other method your insurer accepts for verification.

Double-check all information for accuracy and completeness before sending the letter. Keep a copy of the letter for your records in case of future reference.

Be clear about your intention to cancel the policy, stating the specific date you want the cancellation to take effect. Mention your policy number to avoid confusion and help the insurer locate your account quickly. It’s also helpful to include your full name, address, and contact details for verification purposes.

Reason for Cancellation

While not always required, including a brief reason for the cancellation can provide clarity and prevent future follow-ups. Whether it’s due to financial constraints or a change in personal circumstances, keep the explanation short and professional.

Request for Confirmation

Ask for written confirmation of the cancellation, specifying the date of cancellation and any applicable refund if relevant. This ensures that both you and the insurer have a record of the transaction.

One of the biggest mistakes is failing to provide a written notice. Insurance companies often require written communication for cancellation requests. Verbal agreements or phone calls might not be sufficient for documentation purposes.

- Not Checking the Terms and Conditions – Always review the cancellation policy outlined in your contract. Some insurers impose penalties or specific procedures for early termination.

- Missing the Notice Period – Ensure you send your cancellation request within the specified timeframe. Missing this deadline can result in additional charges or an extension of your coverage.

- Not Getting Confirmation – Always request written confirmation from the insurer. Without it, you may have no proof that your cancellation was successfully processed.

- Not Cancelling All Coverage – Double-check that all parts of your insurance, such as riders or additional coverage, are included in the cancellation. Some policies have multiple components, and overlooking one could lead to unnecessary charges.

- Ignoring Refunds – If you’ve paid in advance, verify if you’re entitled to a refund. Failing to ask could mean leaving money on the table.

Canceling a life insurance policy can significantly impact your financial security. Before proceeding, evaluate potential penalties or fees. These can reduce the amount of your refund or leave you with a smaller payout if the policy has been active for a while.

Consider the loss of benefits, as stopping coverage means you’ll no longer be protected by the policy. If you rely on life insurance for a financial safety net, this could lead to a gap in your security plan. Be aware of any cancellation clauses that could affect the terms of your refund or payout.

If your policy includes a cash value component, canceling may result in forfeiting a portion of the value accumulated over time. Understand whether the policy’s cash value is refundable, and if so, how much you can expect to recover after cancellation.

Evaluate alternative options before deciding. In some cases, converting to a different policy or reducing coverage might provide a more favorable financial outcome than full cancellation. Carefully review the potential long-term financial impact and weigh it against the cost of maintaining coverage.

Send your cancellation letter through a reliable method to ensure it’s received. Registered mail or email with a read receipt are excellent options. Include all necessary details such as your policy number, personal information, and the reason for cancellation. If sending by mail, make sure to keep a copy of the letter for your records. If submitting electronically, confirm the company acknowledges receipt, either via an automated response or a personal confirmation. Always send the letter in a timely manner to avoid unwanted charges or penalties.

Once you cancel your life insurance policy, several important steps take place. Your coverage will end on the specified cancellation date, and you will no longer have protection from your insurer. If you’ve paid premiums in advance, you may be entitled to a refund, but it depends on your policy’s terms and whether you’ve used any benefits.

Refunds and Payments

If your policy was paid annually, you may receive a pro-rated refund for the remaining months. This depends on whether you’ve surpassed a certain policy period or if there were any fees associated with cancellation. Refunds are usually processed within a few weeks, but you should confirm the exact timeframe with your insurer.

Impact on Future Coverage

Cancelling your policy can affect your ability to obtain new coverage in the future. Some insurers may view cancellation as a negative indicator, especially if it was due to non-payment or claims history. However, if you decide to take out another policy, you may face higher premiums or stricter conditions depending on your age, health status, and other factors.

| Action | Possible Outcome |

|---|---|

| Policy Cancellation | Coverage ends, no more benefits |

| Refund | Partial refund if premiums paid in advance |

| New Coverage | Potential for higher premiums or stricter terms |

| Reinstatement | Possible reinstatement under specific conditions |

To cancel a life insurance policy, it is crucial to follow a clear process to ensure the request is processed smoothly. Begin by writing a formal letter to the insurance company, specifying your intent to cancel the policy. Include your policy number, personal details, and any required supporting documentation, such as identification or policy statements.

Steps to Take

1. Contact the insurance provider to confirm any necessary forms or processes required before submitting the letter.

2. Write a letter that includes your full name, address, policy number, and a statement requesting cancellation. Be clear about your decision to stop the coverage and the date you wish the cancellation to take effect.

Additional Tips

It’s beneficial to keep a copy of the cancellation letter for your records. Also, inquire about any potential refund or balance, especially if you have paid premiums in advance.