Proof of funds letter template word

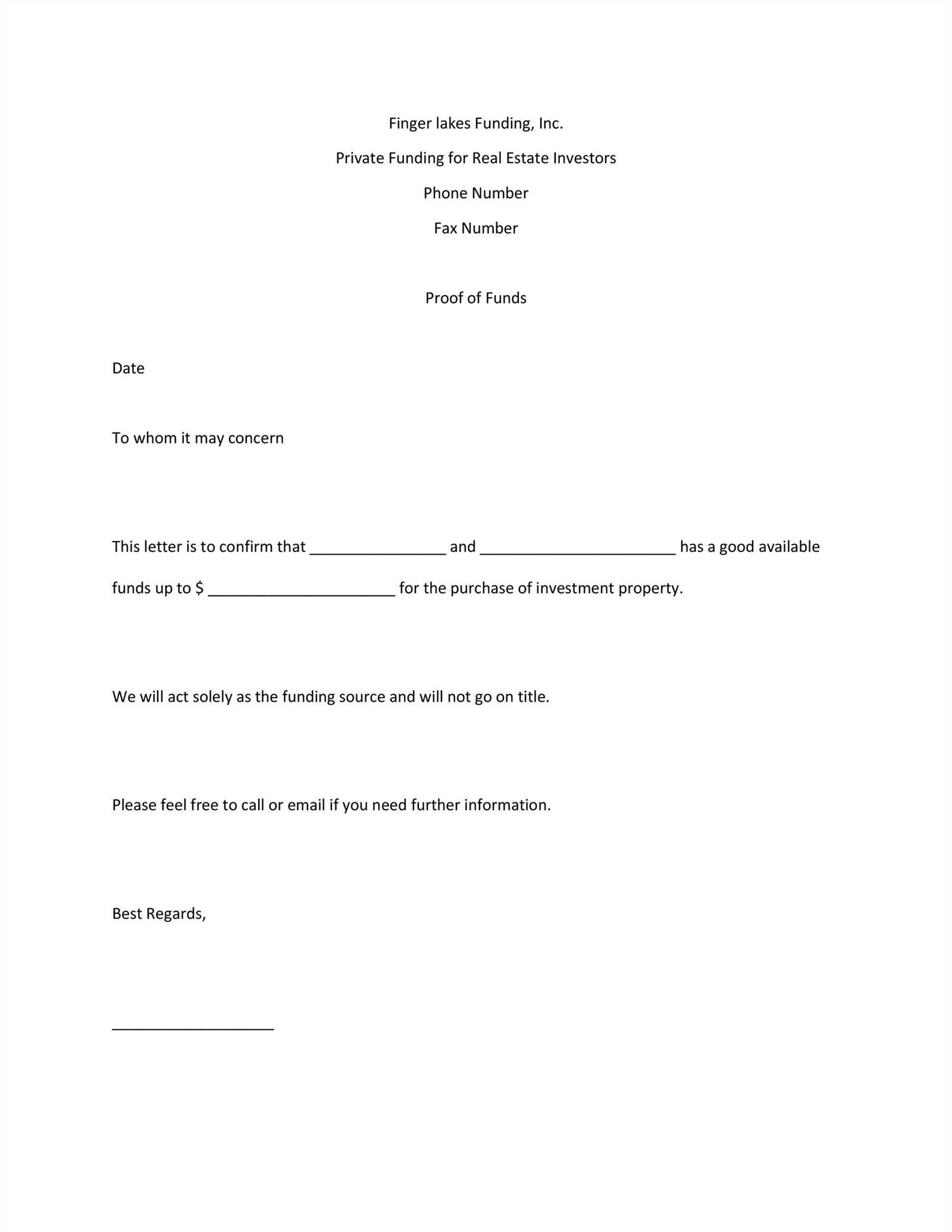

When preparing a proof of funds letter, clarity and accuracy are key. A well-crafted letter ensures the recipient can easily verify that sufficient funds are available. Begin with a straightforward introduction, stating the purpose of the letter and the amount of money in question. The tone should remain formal but clear, avoiding unnecessary complexity.

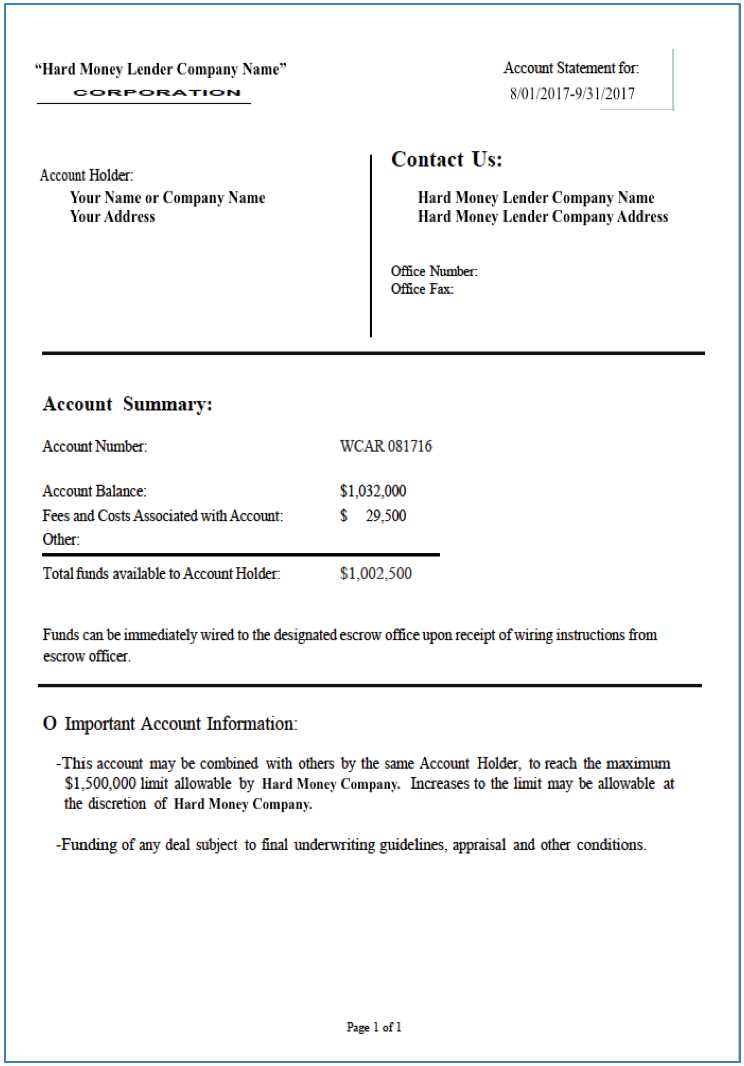

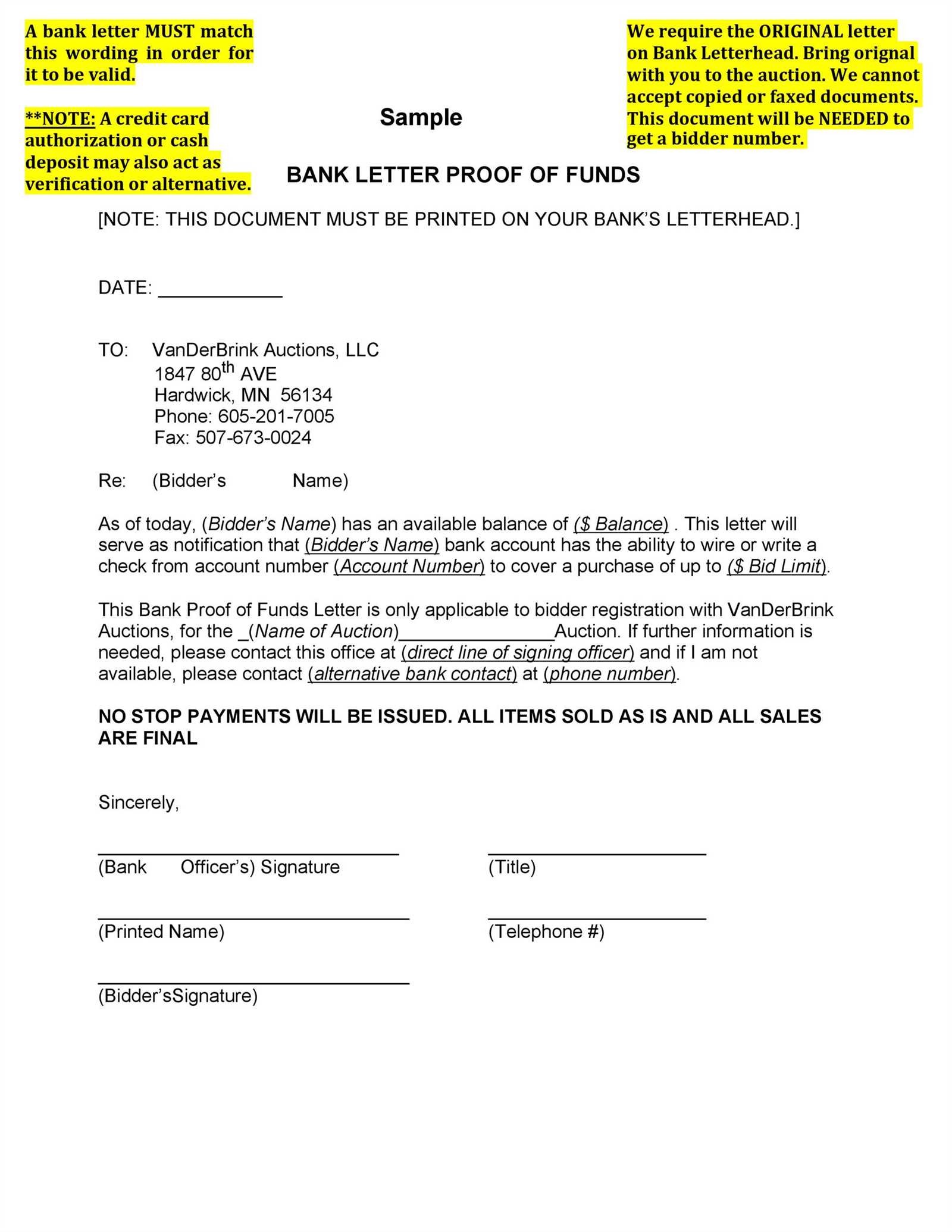

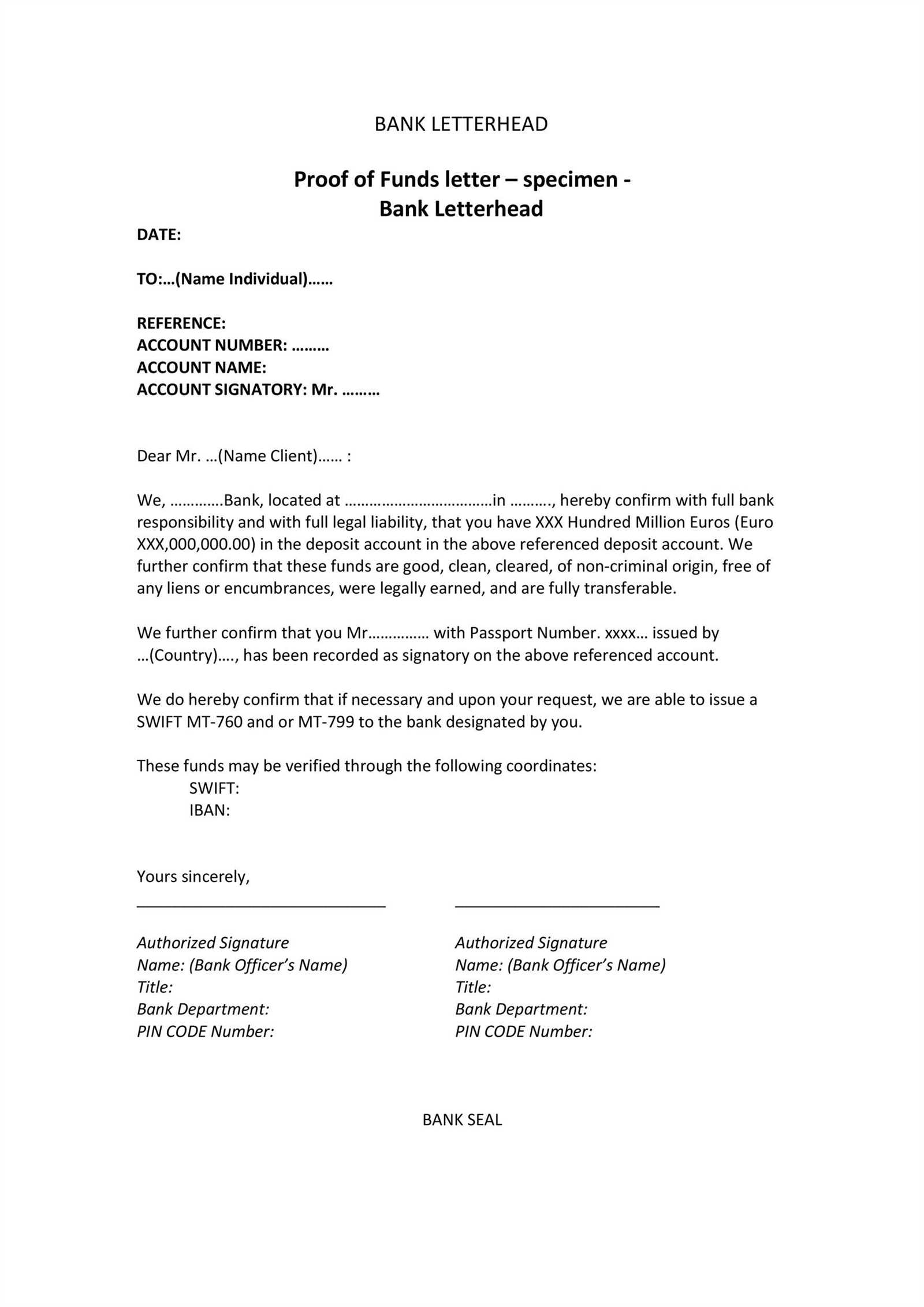

Include specific details about the source of the funds, such as bank account numbers, assets, or investment details. It is crucial to provide verification that these funds are readily accessible. Banks or financial institutions usually provide official templates or specific requirements for such letters, which can be customized for your needs.

End the letter with a statement of confirmation that the funds are available, and include the contact details of a representative or the issuer of the letter for further inquiries. Always ensure that the letter is signed by an authorized individual and includes their title or position within the institution.

Here’s the revised version, reducing the repetition of words while maintaining clarity and correctness:

Use precise language when drafting a proof of funds letter. Clearly state the purpose and provide supporting documentation. Start with a straightforward statement of funds availability, such as, “I am writing to confirm that I have sufficient funds to cover [mention purpose].” Make sure to include specific amounts and bank details, such as account number, type, and balance, if necessary.

Include a date and ensure that the letter is signed by a relevant financial officer or representative, if applicable. Avoid unnecessary details that don’t add to the validation process, such as irrelevant transactions. Focus on the specifics that prove financial capability for the stated purpose.

Be concise and direct. Remove any redundant phrases. Reaffirm the authenticity of the statement by indicating that the information is accurate as of the date of the letter.

Proof of Funds Letter Template

Understanding the Purpose of a Proof of Funds Letter

Key Elements to Include in the Document

Step-by-Step Guide to Writing the Letter

Common Mistakes to Avoid When Creating It

Choosing the Right Format for the Document

When and Why You Might Need This Letter

A Proof of Funds letter is a document used to verify the availability of funds for a specific purpose, such as purchasing a property or securing a loan. It’s necessary when you need to show that you have sufficient financial resources for a transaction.

Key elements to include in this letter are the amount of funds available, the source of the funds, and confirmation from the financial institution that holds the funds. You should also provide clear details about your account type and the name of the account holder, ensuring there is no ambiguity about the source of the funds.

To write this letter, start by addressing the recipient directly. Include the date and a statement confirming the availability of funds in your account. Specify the exact amount and source of funds, and state that the funds are available for immediate use. Make sure to sign the letter for authenticity.

Avoid vague language. Ensure that you clearly specify the amount and provide concrete evidence, such as a bank statement or certificate. Refrain from including unnecessary details or personal information unrelated to the transaction.

Choosing the right format is key. Use formal business letter format with clear headings and paragraphs. The document should be printed on official letterhead if possible, or at least signed by an authorized representative of your bank or financial institution.

You might need a Proof of Funds letter when applying for a mortgage, making an investment, or when a seller requests it before finalizing a real estate deal. It helps to assure the other party that you have the financial means to proceed with the transaction.