Overpayment letter to employee template

If you discover that an employee has been overpaid, sending a clear and direct letter is the best way to address the situation. A well-crafted letter can maintain a professional relationship while ensuring the necessary steps are taken to resolve the error. The tone should be polite yet firm, outlining the specifics of the overpayment and the actions the employee needs to take.

Start by explaining the nature of the mistake without causing embarrassment. Acknowledge the issue and specify the amount of the overpayment. Be transparent about how the error occurred and offer a plan for repayment. This could involve deductions from future paychecks or a lump sum payment, depending on the circumstances and company policy.

Clearly outline the next steps for both the employee and your company. Provide instructions for repayment and any additional paperwork that may be needed. It’s important to keep the communication concise, focusing only on the necessary details to avoid confusion. End the letter with an offer to discuss any concerns the employee might have, showing your willingness to find a reasonable solution.

Here’s the corrected version without word repetition:

To address overpayment, begin by clearly outlining the amount of excess payment. Specify the total, the period during which it occurred, and the specific reasons that led to the error. Directly state the steps that need to be taken to rectify the situation. Be concise and transparent to avoid any confusion.

Clarify the Refund Process

Provide clear instructions on how the employee can return the excess amount. Whether the adjustment will be made via payroll deductions or a direct refund, ensure the process is simple and well-explained. Include the timeline and any necessary actions from both sides to finalize the correction.

Address Any Concerns

Offer an opportunity for the employee to ask questions regarding the overpayment. Make it clear that support is available for any uncertainties they might have about the process or their pay. Maintaining open communication is key to resolving the issue amicably.

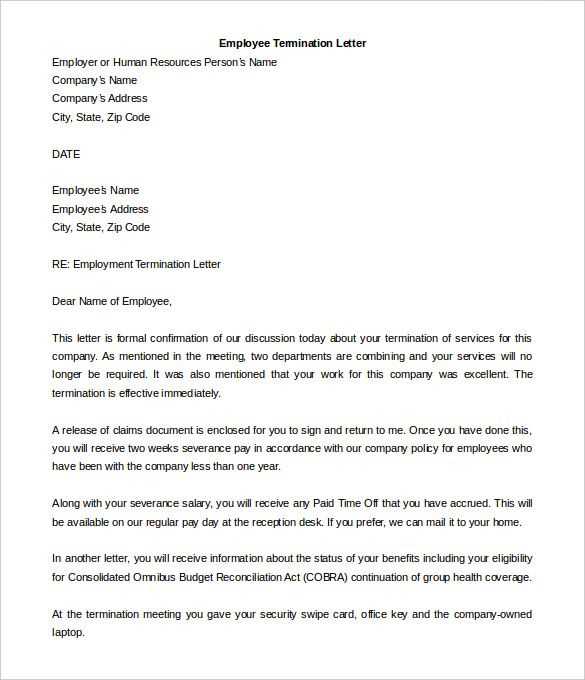

- Overpayment Letter Template for Employees

Use this template to communicate an overpayment to an employee. The letter should be clear, professional, and concise, ensuring both parties understand the situation and next steps.

Subject: Notice of Overpayment

Dear [Employee’s Name],

We are writing to inform you that an overpayment has been made in your recent paycheck dated [Date of Overpayment]. After reviewing our payroll records, we have determined that you received an excess amount of [Amount of Overpayment].

To correct this, we kindly request that you reimburse the overpaid amount. You may choose one of the following options for repayment:

- Deduction from your next paycheck of [Amount to be Deducted]

- Full repayment via [Payment Method, e.g., bank transfer] by [Repayment Deadline]

If you have any questions or concerns about this matter, please do not hesitate to contact the HR department at [HR Contact Information]. We appreciate your prompt attention to this issue and your cooperation in resolving it as soon as possible.

Thank you for your understanding.

Sincerely,

[Your Name]

[Your Job Title]

[Company Name]

Regularly compare employee compensation with the established pay structure. If an employee’s total pay exceeds the agreed-upon salary, overtime, bonuses, or benefits without justification, it’s a red flag. Regular payroll audits help catch discrepancies early. Look for any unexpected increases in pay without documented approvals or changes in job duties.

1. Review Pay Stubs and Time Records

Consistently monitor timekeeping systems. If overtime or bonuses seem unusually high, verify that they align with the company’s policies. Pay stubs should clearly reflect any adjustments made, such as retroactive pay increases. A mismatch between pay records and approved hours worked often signals overpayment.

2. Compare Against Industry Standards

Conduct regular market comparisons. If an employee’s compensation is significantly higher than the industry average for the same role and experience level, reassess the justification for these payments. This will help identify if there’s an overpayment due to misclassification or unapproved raises.

By maintaining clear records and regularly auditing compensation, you can detect excess payments before they become a recurring issue. Always ensure that any deviations from the norm are thoroughly reviewed and documented.

Begin with a clear statement of the overpayment, including the exact amount mistakenly paid. Specify the period during which the overpayment occurred and how it was identified. Provide the employee with a concise breakdown of the overpaid sum and clarify any relevant details, such as taxes or deductions that may have been affected.

- Overpayment Amount: State the exact figure that was overpaid and include any adjustments made, if applicable.

- Period of Overpayment: Identify the pay periods or specific dates when the overpayment took place. This helps the employee understand when and how the issue occurred.

- Reason for Overpayment: Briefly explain how the overpayment happened, such as payroll errors or miscommunication regarding hours worked.

- Action Steps: Outline the next steps. Will the amount be deducted from future paychecks? Is a repayment plan being set up? Be specific about the process and timeline.

- Contact Information: Offer a way for the employee to reach out for clarification or further discussion, such as a phone number or email address.

- Legal Considerations: If relevant, mention any legal rights or obligations related to the overpayment, ensuring the employee is aware of the process from a legal standpoint.

Conclude by thanking the employee for their attention to the matter and offering assistance if they need further explanation. Keep the tone respectful and professional throughout the letter.

Begin by verifying the error details. Double-check the payment amount and compare it to the employee’s records to confirm the overpayment. Accuracy at this stage avoids unnecessary confusion.

1. Notify the Employee Promptly

Contact the employee as soon as the error is identified. Email or direct message is appropriate, but always follow up with a formal letter. Avoid delaying communication, as this could cause stress for the employee.

2. State the Error Clearly

Be straightforward about the mistake. Specify the exact amount that was overpaid and mention the correct payment amount. Include relevant dates and any supporting documents that clarify the discrepancy. Keep the tone professional yet empathetic.

Offer a solution that works for both parties. Propose an easy way to return the excess amount, such as deducting it from the next payment or creating a payment plan. Make sure the solution is reasonable and feasible for the employee.

Ensure all communication remains transparent. Provide the employee with a clear point of contact for any questions, and express willingness to work through any concerns they may have.

Legal Aspects of Requesting Repayment from an Employee

Employers must follow specific procedures when requesting repayment from an employee for overpayment. First, review the payment records to confirm that the overpayment occurred. Document the amount and nature of the error to avoid misunderstandings. It’s advisable to notify the employee in writing, clearly stating the overpaid amount and providing an explanation for the repayment request.

Legally, an employer can seek repayment, but this must be done in a manner that complies with local labor laws. Some jurisdictions require employers to provide reasonable timeframes for repayment. This ensures the employee is not unduly burdened. In addition, any deductions from the employee’s wages must be agreed upon and should not exceed the limits set by law.

Employers should also be aware of any contractual obligations that may affect the repayment process. If the overpayment occurred due to a mistake in payroll, the employer may have the right to recover the funds, but they must ensure the employee’s rights are respected throughout the process. Seeking legal counsel may be beneficial to navigate complex situations, especially if the employee disputes the repayment request.

Establishing a Repayment Plan for Excess Funds Recovery

Clearly define the amount to be repaid, ensuring that both parties agree on the exact sum. Break down the repayment into manageable installments to avoid strain on the employee’s finances.

Steps to Set Up a Repayment Plan

- Agree on the total overpayment amount.

- Determine the repayment period based on the employee’s financial situation.

- Choose a consistent payment schedule (weekly, bi-weekly, or monthly).

- Clarify any interest charges or additional fees, if applicable.

- Ensure that the employee acknowledges and signs the repayment agreement.

Considerations for Flexible Repayment Options

- Allow for temporary suspension of payments in case of unforeseen financial hardship.

- Provide options for early repayment without penalties to support the employee’s flexibility.

- Review the plan periodically to ensure it remains feasible for both parties.

Maintain open communication to resolve any issues that may arise during the repayment process. It’s important to keep the arrangement clear and transparent to avoid misunderstandings.

Managing Employee Responses and Resolving Disputes Over Refunds

Address employee concerns directly and provide clear explanations. Start by reviewing all payroll records to confirm the overpayment and ensure transparency when communicating the findings. Clearly state the exact amount overpaid and offer a straightforward plan for reimbursement.

If an employee disputes the refund request, engage in a calm and respectful conversation. Listen to their concerns thoroughly to understand the reasons behind their objections. Be prepared to provide evidence supporting the overpayment and explain the company’s refund process.

Offer a flexible repayment schedule if possible. If the employee is facing financial hardship, consider negotiating a manageable installment plan that works for both parties. Always keep the tone collaborative rather than confrontational.

Document every step of the process, including communications, agreements, and actions taken. This helps protect both the company and the employee in case of future disputes or misunderstandings. Keep the dialogue open and ensure both sides feel heard and understood.

Finally, if the dispute cannot be resolved through communication, suggest involving a neutral third party, such as a mediator, to facilitate the resolution. Mediation can help clarify misunderstandings and provide a fair solution for both sides.

How to Address Overpayment in a Letter to an Employee

When addressing overpayment to an employee, clearly outline the specifics of the issue in the letter. Acknowledge the overpayment and provide a detailed explanation of how it occurred, including any relevant dates or transactions. Be polite but direct in requesting repayment and propose a reasonable timeline for resolving the matter. Offering options for repayment (such as deductions from future paychecks or a lump sum payment) can help smooth the process.

| Step | Action |

|---|---|

| 1 | State the overpayment clearly, with reference to the exact amount and date it occurred. |

| 2 | Provide details on how the error was discovered and verified. |

| 3 | Offer repayment options (e.g., deductions, installment plan, or full refund). Include clear instructions. |

| 4 | Set a specific deadline for repayment and mention any possible consequences of non-compliance. |

| 5 | End with a friendly but firm closing, expressing your willingness to assist with the process. |

By outlining the situation in detail, you provide transparency, helping the employee understand the circumstances and the steps they need to take to resolve the issue. Make sure to remain respectful and offer support as needed during the repayment process.