Offer letter to buy a house template

Writing an offer letter when purchasing a home is a critical step in the process. Make sure your letter reflects your commitment and desire for the property, showcasing both your seriousness and appreciation for the home. Use a formal tone and address the seller directly to create a connection.

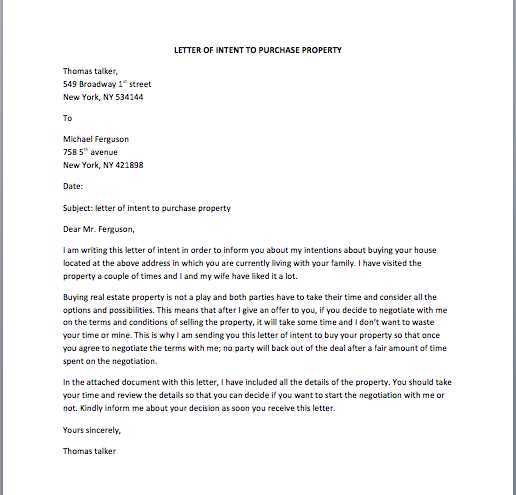

Begin with an introduction that briefly states your interest in the property. Include the property’s address and the exact offer you are willing to make. Be clear and concise to ensure the seller understands your intentions from the start.

Express your personal connection to the home. Sellers appreciate buyers who show a genuine interest in the home beyond just the price. If you have specific reasons for wanting the property, such as proximity to family or work, mention them briefly. This personal touch can help set you apart from other potential buyers.

Outline your financial readiness to buy the home. Highlight your ability to secure financing, whether through a pre-approval letter or proof of funds. This reassures the seller that you are capable of closing the deal without complications.

End with a respectful closing that reinforces your enthusiasm for the property. Thank the seller for considering your offer and express your hope for a positive response. Make sure to include your contact information for easy follow-up.

Sure! Here’s a detailed plan for an article on “Offer Letter to Buy a House Template” with 6 practical and specific headings:

Creating a strong offer letter is key when buying a home. Your offer letter can help set you apart from other buyers and show the seller your serious intent. Below is a plan with specific sections that will guide you through the process of writing a powerful offer letter:

1. Highlight Your Interest in the Property

Begin by showing your genuine interest in the property. Acknowledge the features that attract you, whether it’s the layout, location, or design. Personalizing your letter by mentioning specific aspects that align with your needs will demonstrate thoughtfulness and investment in the property.

2. Provide Your Offer Amount and Terms

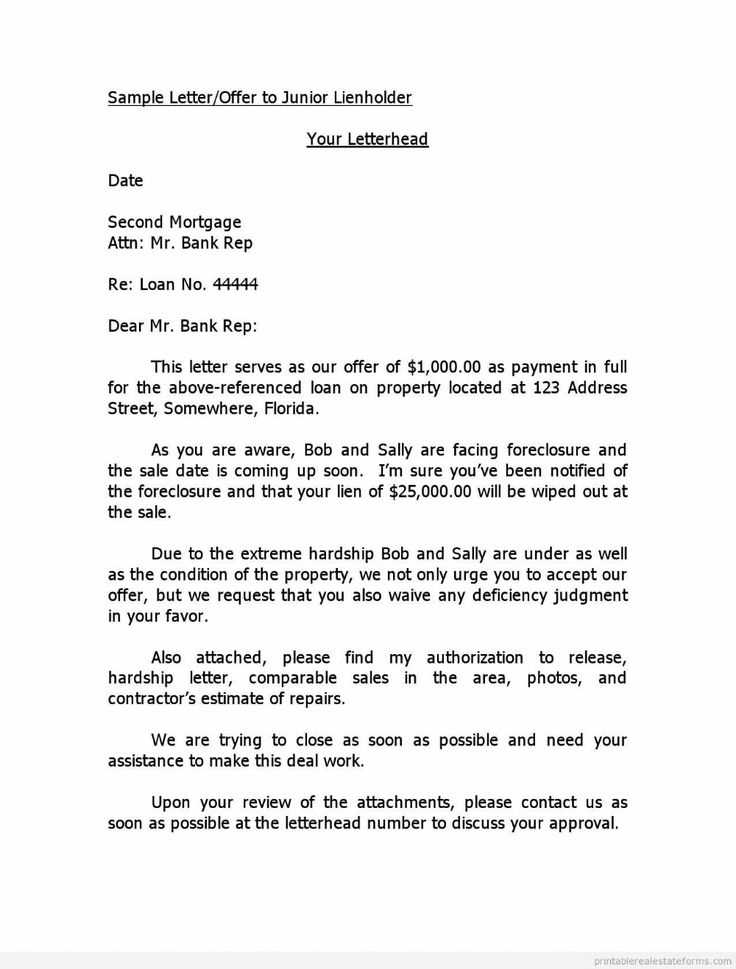

Clearly state the price you are willing to pay for the home and any additional terms, such as contingencies or financing details. Transparency at this stage is crucial to avoid any misunderstandings. Be specific about the timeline for closing to ensure alignment with the seller’s expectations.

3. Express Your Financial Readiness

Emphasize your ability to secure financing. If you’ve been pre-approved for a mortgage, mention this as it shows the seller that you’re financially prepared and that your offer is serious. This section builds trust and provides confidence to the seller that the deal can proceed smoothly.

4. Introduce Yourself and Your Family

Give a brief introduction of who you are and any personal details that might help the seller connect with you. If you’re a first-time homebuyer or have a family, mention how this home will be an ideal space for your needs. This human touch can resonate with sellers on an emotional level.

5. Acknowledge the Seller’s Situation

If you know any specifics about the seller’s situation, such as they are looking to relocate quickly, show empathy. Tailoring your letter to reflect the seller’s goals and timelines can strengthen your position. If you’re flexible with your moving date or other conditions, make that known.

6. Close with Gratitude and Openness

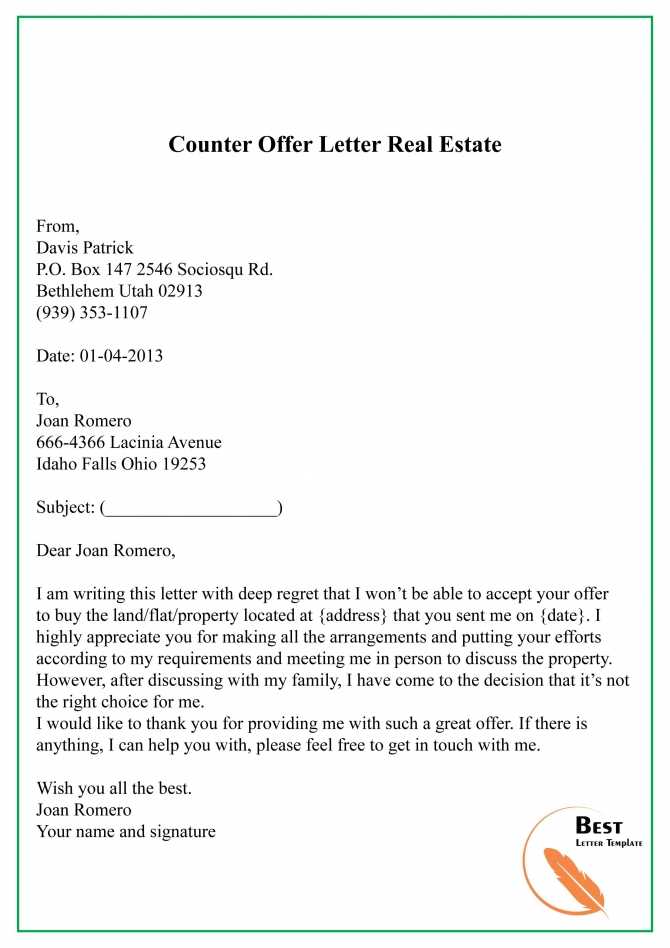

End your letter by thanking the seller for considering your offer. Express your eagerness to proceed with the purchase and remain open to negotiations. A respectful tone can leave a positive impression and keep the lines of communication open.

- Offer Letter to Buy a House Template

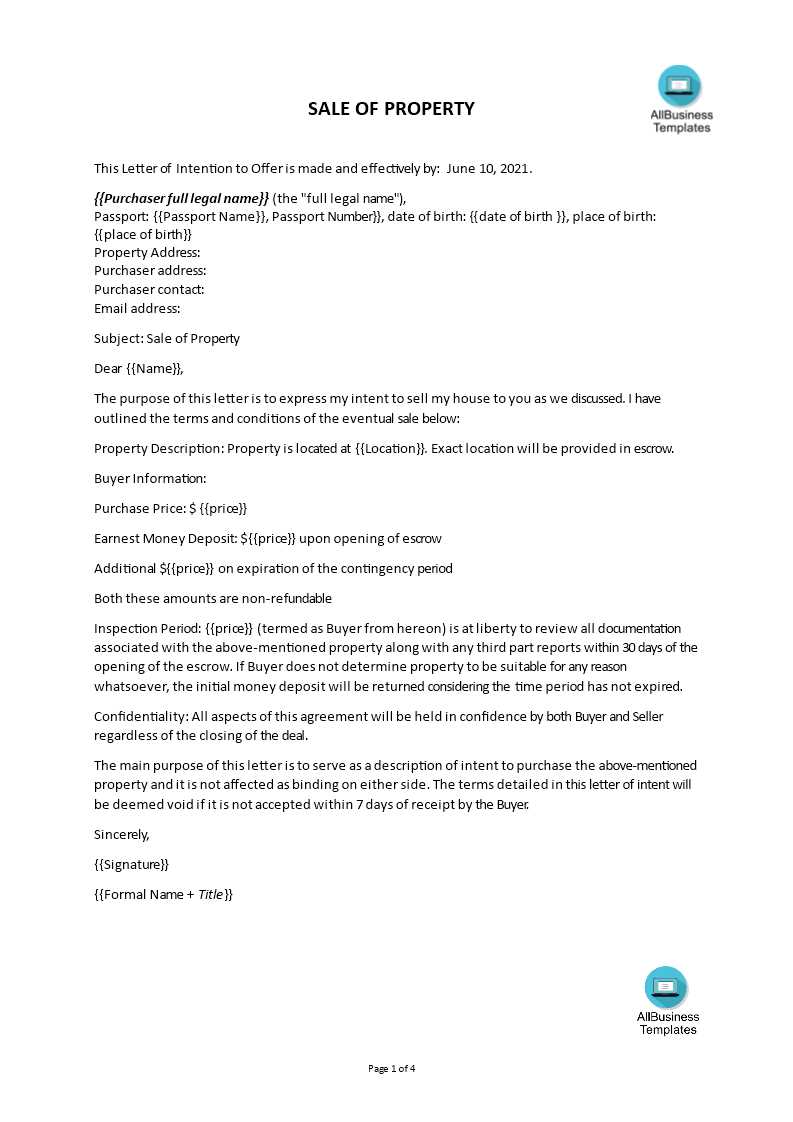

When crafting an offer letter to buy a house, clarity and conciseness are key. Start with a formal yet warm tone to introduce yourself as the buyer. Clearly state your intent to purchase the property, including the address and offering price. Here’s an example format for your letter:

- Subject Line: Offer to Purchase [Property Address]

- Introduction: Begin by addressing the seller respectfully, stating your interest in their home and why it appeals to you.

- Purchase Price: Clearly mention the offer amount you are willing to pay, ensuring it aligns with your financial planning and current market value.

- Financial Details: Highlight your financing status, whether you are pre-approved for a mortgage, making a cash offer, or need time to finalize the financial arrangements.

- Closing Timeline: Indicate your preferred closing date. This shows you are ready to move forward quickly.

- Personal Touch: Share a personal story about why this home suits your family. Sellers appreciate buyers who genuinely connect with their property.

- Contact Information: End with your contact details, including phone number and email. Express eagerness to discuss the offer further.

This format helps establish a professional yet personal connection with the seller. It demonstrates both seriousness and respect for their time and property.

Begin by clearly stating your intent in the first paragraph. Identify the property you are interested in and express your desire to purchase it. Include the address and other relevant details to make it easy for the seller to identify the property.

Next, include your offer amount. Be specific and provide any conditions tied to your offer, such as financing or contingencies. Ensure the tone remains respectful and professional, as this sets the stage for negotiations.

In the following section, explain why you are a good candidate for purchasing the property. This could include your financial standing, readiness for a quick closing, or your personal connection to the home. This is your opportunity to present yourself as a committed buyer.

Conclude with a clear statement of your expectation for a response. Specify a timeline for when you hope to hear back, and express your willingness to discuss further details if needed. Maintain a positive tone to leave a good impression on the seller.

| Section | Details |

|---|---|

| Introduction | State your intent to purchase the property and identify the property address. |

| Offer Amount | Provide a clear offer, including any conditions such as contingencies or financing requirements. |

| Why You Are a Good Buyer | Explain why you are a strong candidate, such as financial stability and readiness to close quickly. |

| Closing | End with your expected response time and willingness to discuss further details. |

In your offer letter, highlight the following key elements to ensure clarity and a professional tone:

- Purchase Price: Clearly state the price you are offering for the property. Include any contingencies or adjustments if applicable.

- Deposit Amount: Mention the amount you are willing to put down as earnest money, demonstrating your serious intent.

- Payment Method: Specify how you plan to finance the purchase, whether through a mortgage, cash, or other means.

- Closing Date: Propose a date for closing that works for both parties, ensuring enough time for any required procedures.

- Contingencies: Include any conditions that must be met for the deal to proceed, such as financing approval or a satisfactory inspection.

- Inclusions: List any fixtures or appliances you expect to be included in the sale, like kitchen appliances or window treatments.

- Expiration Date of Offer: Set a clear deadline for the seller to respond to your offer.

These elements form the core of a well-structured offer letter and help set the tone for a smooth negotiation process.

Contingencies are conditions that must be met before the purchase agreement becomes final. They protect both the buyer and the seller by ensuring that certain factors align before the deal is completed. If a contingency is not satisfied, the buyer can walk away from the deal without losing their earnest money deposit.

Common Contingencies to Include in Your Offer

| Contingency Type | Purpose |

|---|---|

| Inspection Contingency | Allows the buyer to request repairs or back out of the deal if significant issues are discovered during the inspection. |

| Financing Contingency | Ensures that the buyer can secure a mortgage. If financing falls through, the deal can be canceled without penalty. |

| Appraisal Contingency | Protects the buyer in case the home appraises for less than the offer price, potentially lowering the loan amount. |

| Title Contingency | Ensures that the seller can transfer clear title to the buyer, free of any legal disputes or claims. |

How to Use Contingencies Effectively

Include contingencies that align with your needs and protect your investment. Avoid overwhelming the seller with too many conditions, which can make your offer less appealing. Work with your real estate agent to balance protective contingencies with a competitive offer. Understanding each contingency’s terms and ensuring they are clear will reduce the risk of misunderstandings and potential issues down the road.

Determine the fair market value of the property by researching comparable sales in the area. Look for homes with similar features, square footage, and condition. This will give you a baseline for your offer. Adjust your price based on your own financial situation and what you’re willing to pay, considering both your budget and the home’s perceived value.

If the property has unique features or requires repairs, factor those into your price. Don’t overestimate the value of upgrades unless they significantly enhance the home’s appeal. It’s also wise to consider the seller’s situation–if they’re motivated to sell quickly, they may accept a lower offer.

Leave some room for negotiation. Setting your price slightly below your maximum budget gives you flexibility and shows that you’re open to a reasonable counteroffer. Keep in mind that an offer too low might risk losing the property to another buyer, so balance the numbers carefully.

Clearly state the proposed closing date in your offer letter. Specify whether it is flexible or firm, as this will give the seller a better understanding of your expectations. If you’re open to adjusting the date based on the seller’s preferences, mention that flexibility. This can make your offer more attractive, especially if the seller is on a tight timeline or needs extra time before moving out.

- Include a specific date for the closing and mention any contingencies tied to it.

- If you need more time for financing or inspections, indicate that as well.

- Provide details about who will cover the closing costs, if applicable.

Clarify whether you plan to sign a specific agreement or need additional time for paperwork. If you have specific requests related to the timing of the closing, outline those here to avoid confusion later.

One common mistake is not verifying the financing options before making an offer. Ensure your budget is clear and that you have a pre-approved loan or sufficient funds ready. This prevents delays once your offer is accepted and shows the seller you’re serious.

Another mistake is overlooking contingencies. Always include necessary contingencies in your offer letter, such as inspection or appraisal clauses. These safeguard you from unexpected issues that may arise with the property.

Don’t forget to research the local market conditions. Submit an offer that reflects the current market and the property’s value. Overpricing can make your offer less appealing to the seller.

Lastly, avoid using vague or generic language in the letter. Be clear about your intentions and how you value the property. Personalize the offer to demonstrate genuine interest, but stay professional to avoid giving the impression of desperation.

Ensure your offer letter is clear and precise. List the offer price, terms of the purchase, and any contingencies. Make sure the language is formal but friendly, aiming for clarity without being overly technical. Specify your ability to proceed quickly if possible, demonstrating your seriousness.

Outline Key Offer Details

Start with the offered price and how it compares to the asking price. Include a deposit amount and any timelines for closing. Acknowledge any conditions, such as inspection outcomes or financing approval. This helps avoid misunderstandings later.

Highlight Flexibility

If possible, mention areas where you are flexible, such as a preferred closing date or your willingness to adjust based on seller preferences. This shows you’re accommodating and can facilitate a smoother transaction.