Insurance letter of demand template

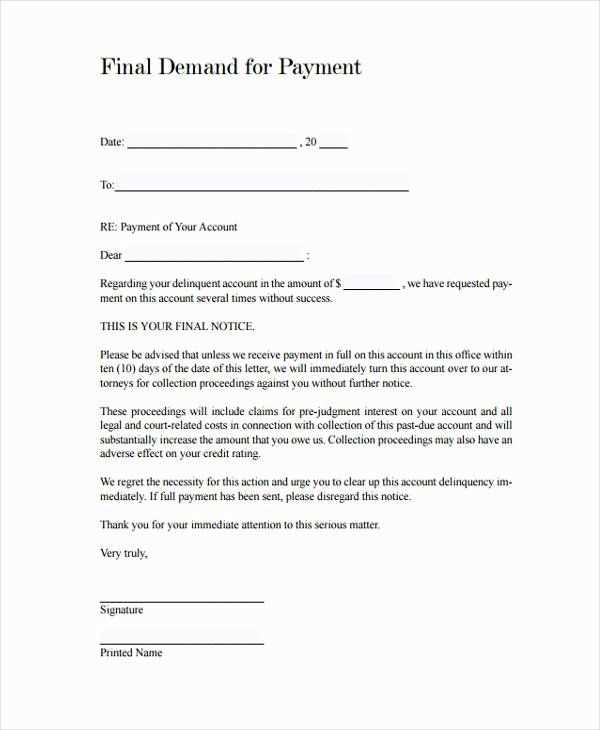

When requesting payment from an insurance company, clarity is key. A well-structured letter of demand serves as a formal document outlining the payment owed, the due date, and any legal actions that may follow if the debt is not settled. Use a direct and professional tone to convey urgency and avoid confusion. Your letter should be concise but contain all the necessary details to ensure the recipient understands the issue at hand.

Begin with a clear subject line stating the purpose of the letter. Include the policyholder’s information, the claim number, and a summary of the claim in the body. Be specific about the amount owed, including any relevant breakdowns or references to policies or agreements. Indicate a reasonable timeframe for payment, usually within 10 to 14 days, and mention that failure to comply may result in legal steps.

To close, reiterate the seriousness of the matter without being aggressive. Acknowledge the possibility of resolving the issue quickly and amicably. Providing a contact number or email for further communication helps to ensure smooth resolution. By keeping the tone professional and the structure clear, your letter can prompt timely action without unnecessary escalation.

Here is the revised version with minimal repetition:

Begin your letter with a concise and direct subject line that reflects the purpose of the demand. Specify the amount owed and the deadline for payment. Avoid including unnecessary details that could distract from the main point.

Structure the Content Clearly

State the facts of the case, such as the original agreement, the services provided, or goods delivered. Ensure the terms of payment were clearly outlined and that they remain unmet. Keep this section factual and to the point.

Offer Payment Instructions

Provide clear instructions on how the recipient can make the payment. Include payment methods, account details, and any other relevant information. Specify any late fees or interest that may apply if the payment is not received on time.

- State the consequences of non-payment, such as legal action or involvement of collection agencies.

- Be polite yet firm in emphasizing the importance of settling the matter promptly.

Conclude by reinforcing the urgency, but remain professional and courteous. Thank the recipient for their attention to the matter.

- Insurance Letter of Demand Template

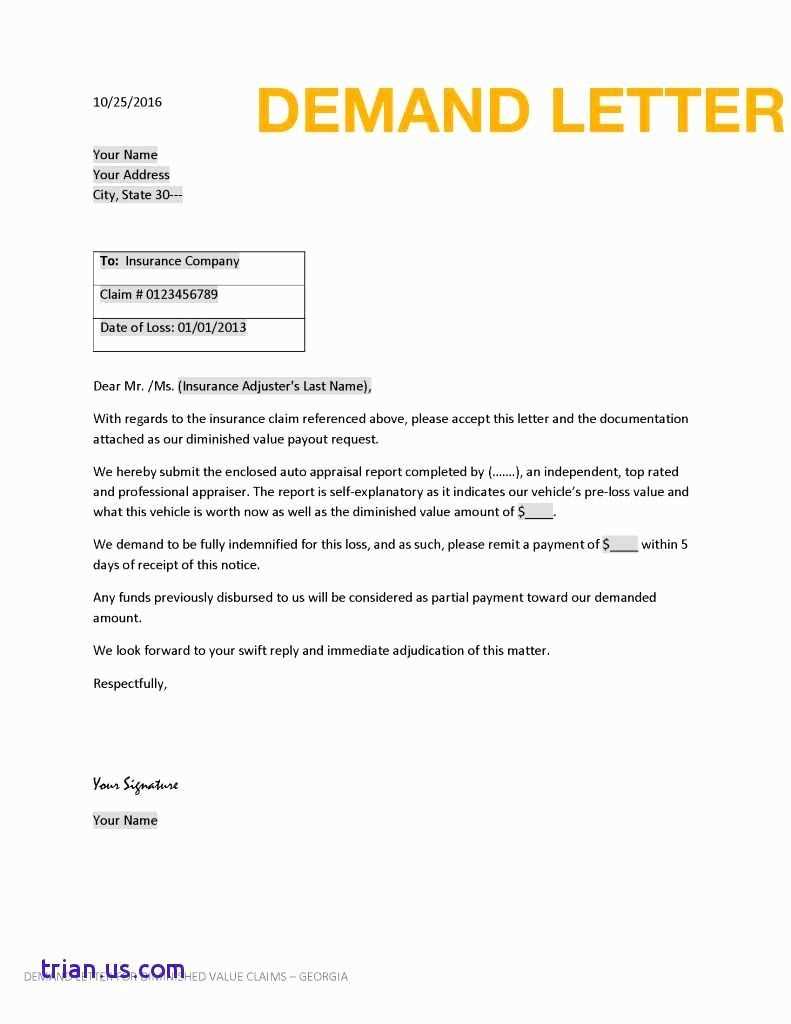

Begin your letter with a clear subject line, such as “Demand for Payment.” Address the recipient by name and clearly state the purpose of the letter right from the beginning. Include the details of the insurance claim, including the claim number, date of the incident, and any reference to prior correspondence or communications regarding the matter.

In the body of the letter, specify the amount owed, the reason for the demand, and a firm deadline for payment. Clearly indicate any interest or penalties that may apply if the payment is not made on time. If applicable, mention any prior attempts to resolve the matter or relevant actions taken to collect the debt.

Provide the recipient with options for making the payment, such as wiring funds, sending a check, or paying online. Make sure to include your contact details for any questions or clarification. Close the letter by stating the next steps if the payment is not received by the deadline, such as further legal actions or reporting to collections.

End the letter with a polite but firm closing, such as “Yours sincerely” or “Best regards,” followed by your name and title. Keep the tone professional, but direct, to ensure the recipient understands the seriousness of the demand.

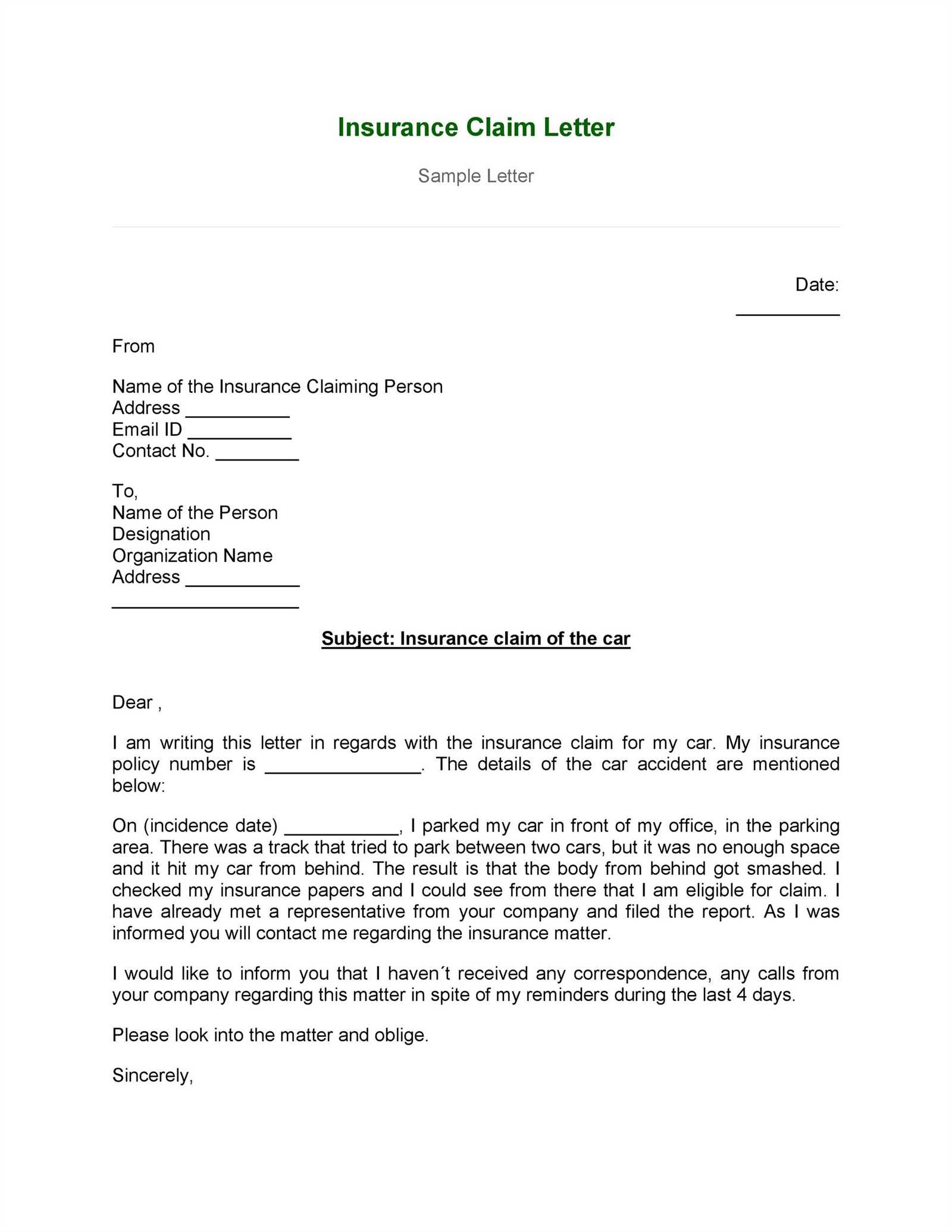

Begin with clear and concise details in the opening paragraph. State the purpose of your letter right away. For example, explain if you’re submitting a claim, making a demand, or seeking clarification on a policy matter.

1. Include the Necessary Contact Information

- Your full name and contact details

- Recipient’s name, position, and address

- Policy or claim number, if applicable

2. Clearly State Your Request or Concern

Be specific about what you want. Mention the exact amount you’re requesting or the action you’re asking the insurance company to take. Provide a detailed description of the incident or situation leading to the demand.

3. Back Up Your Request with Supporting Evidence

- Attach copies of relevant documents like police reports, invoices, or repair estimates.

- Ensure your evidence is organized and directly relates to the claim or request you’re making.

4. Set a Reasonable Timeline for Response

Give a clear deadline for the response or action you expect. For example, you can say, “Please respond by [date],” or “I expect a resolution within 30 days.” This helps ensure timely follow-up and resolution.

5. Maintain a Professional and Respectful Tone

While your letter may convey frustration or urgency, keep the tone polite and formal. A respectful approach encourages a positive response from the recipient.

6. Close with a Call to Action

End your letter by restating your request and expressing your hope for a prompt resolution. Thank the recipient in advance for their attention and action.

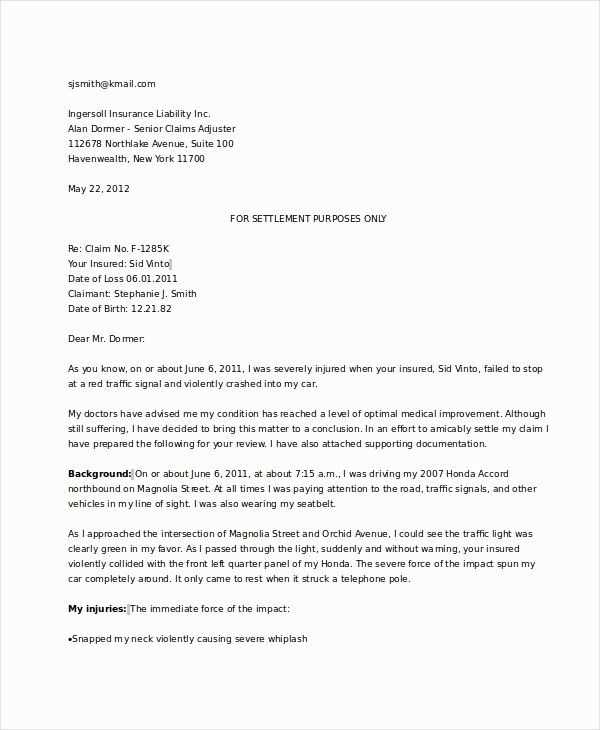

To ensure your insurance demand letter is legally sound, it must include specific information and adhere to regulations that will support your claim. Start by providing clear details of the incident or loss that prompted the demand. State the time, date, and location of the event, along with any parties involved. This establishes the foundation for your claim.

Next, include an accurate account of the damages or loss, supported by evidence such as medical reports, repair estimates, or receipts. This evidence strengthens your demand and ensures that the insurer has all necessary information to assess the claim.

Clearly outline the amount you are requesting, specifying both the total and any breakdown of expenses. This makes it easier for the insurance company to understand your expectations and review the validity of the claim.

Required Documentation

Attach any relevant documents, including policy numbers, copies of the insurance policy, and communication records with the insurer. This shows your right to the claim and facilitates a quicker review.

Deadline for Response

Set a reasonable deadline for the insurance company to respond. Be sure to reference any relevant state or local laws that may require a specific response timeframe.

| Element | Details |

|---|---|

| Incident Details | Time, date, location, and involved parties |

| Damages/Loss | Evidence like receipts, repair estimates, medical reports |

| Claim Amount | Specific breakdown and total amount requested |

| Documentation | Policy number, copies of insurance policy, communication records |

| Response Deadline | Set a clear response deadline, supported by applicable law |

Clearly state the exact amount being claimed, breaking down each element if necessary. Include the total sum, itemized costs, and any relevant fees. For example, if the claim involves medical expenses, list the costs for consultations, treatments, and medications separately. Be specific, ensuring the reader can easily verify the breakdown.

If applicable, mention any previous payments made or deductions already applied. This provides a complete picture and avoids confusion. Always use precise figures and avoid rounding off amounts, as this can lead to misunderstandings or delays.

Lastly, ensure that the amount stated matches any prior communication, such as an estimate or policy coverage, to maintain consistency and transparency.

Attach relevant documents that validate your claim. These may include police reports, medical records, repair estimates, or photographs of the damage. Each document should directly support the points made in your claim letter. For example, if you are claiming property damage, include detailed photos showing the extent of the damage along with any repair or replacement quotes.

Organize these documents clearly and label each one with its corresponding description. This makes it easier for the insurance company to review and assess the validity of your claim. If available, include any communication with third parties, such as contractors or witnesses, that can further substantiate your case.

Ensure all documents are legible and up to date. If any document requires clarification or additional information, provide a brief explanation or context to avoid confusion during the review process.

Specify clear timeframes for payment or response. This helps avoid confusion and sets expectations. For instance, state the exact number of days the recipient has to settle the claim or provide the requested information. Commonly, this period ranges from 7 to 30 days, depending on the nature of the claim.

Include any relevant legal deadlines, if applicable. In some cases, the recipient may need to comply with specific statutory time limits for payment or response. Make sure to mention these deadlines explicitly, using language like, “As per [law/regulation], payment must be made within X days from the date of this letter.”

If necessary, include a consequence for non-compliance, such as legal action or escalation. Be direct about what will happen if the recipient fails to act within the outlined timeframes. This creates a sense of urgency without being overly aggressive. For example, “Failure to respond within 14 days may result in further legal action.”

Keep the letter clear and concise. Ensure it is easy for the recipient to understand what is being requested and why. Avoid unnecessary details that could dilute the main issue.

1. Set a Clear Deadline

Specify a concrete deadline by which you expect a response. This creates a sense of urgency and helps avoid delays. Make sure the date is realistic but firm.

2. Use a Professional Tone

Stay respectful and professional in your communication. Even if you are dissatisfied, maintaining politeness increases the likelihood of getting a favorable response.

Provide all relevant documentation to support your claim. Attach copies of invoices, contracts, or any other evidence that strengthens your position. This allows the recipient to address your demand more efficiently.

Follow up if necessary. If you do not hear back within a reasonable time, send a polite reminder to show that you are serious about your request. Keep the tone courteous to maintain goodwill.

When drafting an insurance letter of demand, it’s critical to keep the structure clear and concise. Begin by stating the claim amount, followed by a breakdown of the services rendered or damages sustained. List each item separately with clear explanations for the charges.

Ensure that all relevant dates and references are included, such as the date of the incident, policy numbers, and claim numbers. This will prevent any confusion and help the recipient locate the necessary details quickly.

To avoid any miscommunication, present the demand in a straightforward manner, outlining the payment terms and deadline. Specify any penalties or interest charges if the payment is not made within the requested timeframe.

| Item | Description | Amount |

|---|---|---|

| Medical Costs | Emergency treatment at City Hospital on 12/05/2024 | $2,000 |

| Vehicle Repairs | Repair services at AutoFix Garage from 15/05/2024 | $3,500 |

| Legal Fees | Consultation with Legal Firm XYZ | $1,000 |

End the letter by providing clear instructions for the payment method and contact details in case the recipient requires further information. Close the letter with a polite yet firm reminder about the consequences of non-payment.