Debt paid in full letter template

If you’ve successfully paid off your debt and need official confirmation, a Debt Paid in Full letter serves as the formal document to wrap up the process. This letter acts as proof that the debt has been cleared and that no further obligations exist. It’s crucial to send it to the lender or creditor to ensure your financial record reflects the payment accurately.

Start by including key details such as the account number, the full amount paid, and the date of payment. This information will help both parties confirm the debt is fully settled. Be clear and concise, specifying that no outstanding balance remains and that the account is closed. It’s a good idea to request the lender’s acknowledgment of this letter in writing to ensure both sides are on the same page.

Once the letter is sent, keep a copy for your records. This document could be helpful in case of any future disputes or inquiries about the debt status. It serves as solid proof that you’ve met your financial commitment in full and on time.

Here’s the revised version with minimized word repetition:

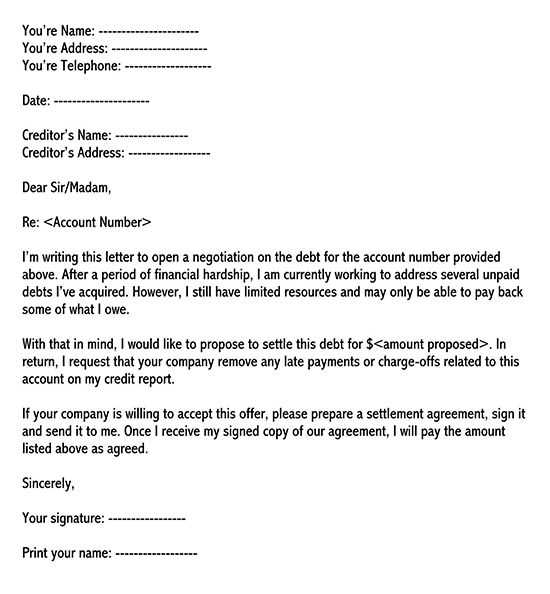

When requesting a “Debt Paid in Full” letter, it is critical to keep the language clear and direct. Ensure your letter includes the specific amount paid, the date of payment, and the name of the creditor. This will eliminate any confusion regarding the debt’s status.

Key Elements to Include

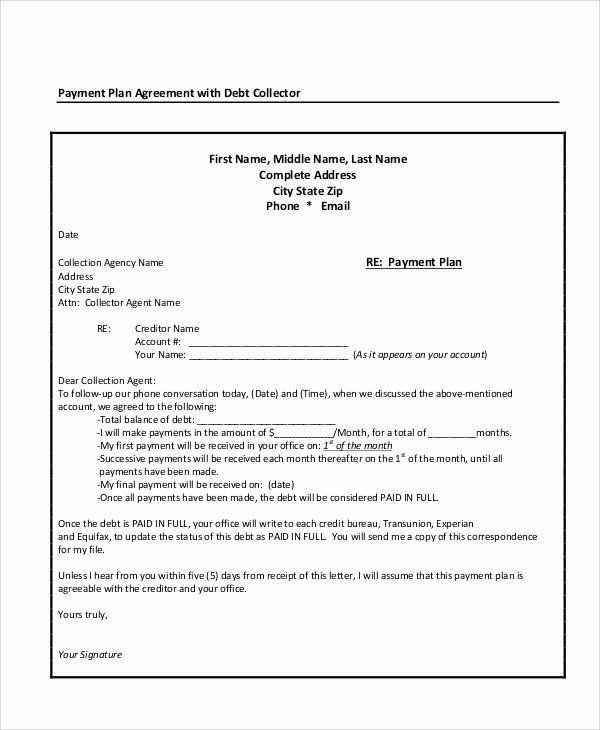

Start by stating your full name, address, and account number associated with the debt. Mention the exact payment made and the method of payment. Clarify that the debt is fully settled and ask for confirmation in writing.

Final Steps

Request that the creditor send a letter acknowledging that the debt has been paid in full. Specify that the account should be reported as “paid” to any credit reporting agencies. Always keep a copy of the letter for your records.

- Debt Paid in Full Letter Template

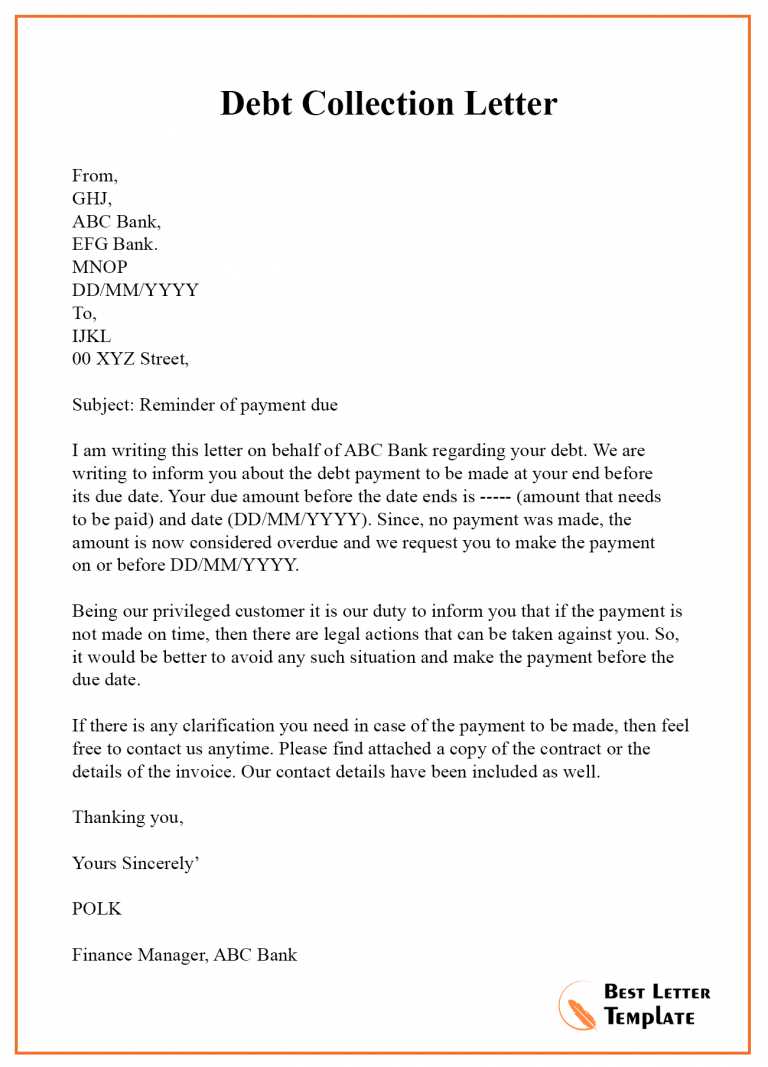

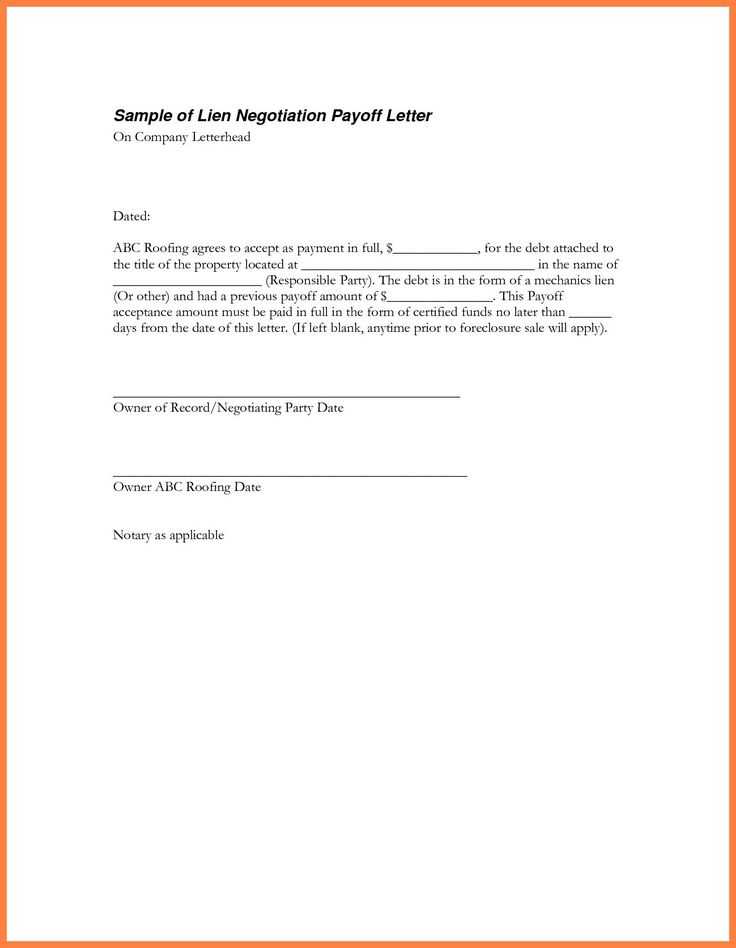

Here’s a straightforward template for a Debt Paid in Full letter that ensures clear communication with the creditor about the settlement of the outstanding debt.

Use the following structure:

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Creditor's Name] [Creditor's Address] [City, State, Zip Code] Subject: Debt Paid in Full Dear [Creditor's Name], I am writing to confirm that I have paid in full the debt associated with account number [account number]. The total amount of [total amount paid] has been received and processed as of [payment date]. Please update your records to reflect that this debt has been fully settled and consider the account closed. I request that you provide written confirmation of this status for my records. Thank you for your attention to this matter. If you need any additional information, feel free to contact me. Sincerely, [Your Name]

This letter ensures that both parties have a clear record of the debt’s settlement and avoids any future confusion about the account status. Make sure to keep a copy for your files. It’s also a good idea to follow up with the creditor if you don’t receive a written confirmation within a reasonable period.

Requesting a debt paid in full confirmation letter ensures that you have proof of your financial responsibility and protects you from any future disputes. Once your debt is fully paid, this letter confirms that no further payments are owed. This is crucial for your credit history and financial security. Without it, a creditor might mistakenly claim you owe more, potentially damaging your credit score.

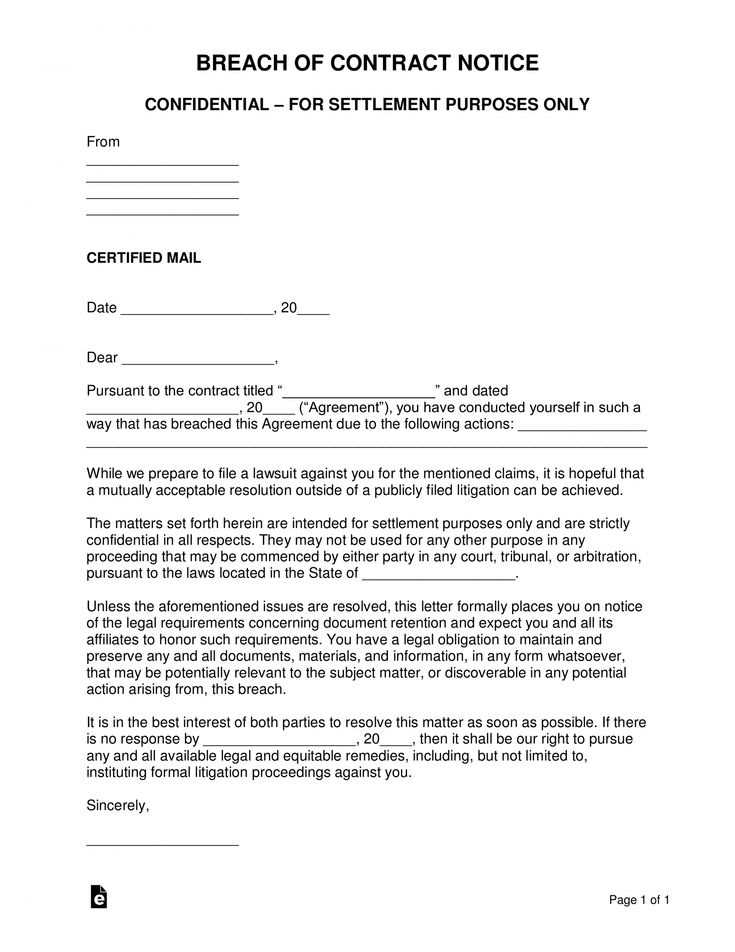

Preventing Future Legal Issues

Having a written confirmation helps avoid misunderstandings that can lead to legal action. If a lender claims you still owe money after settling your debt, this letter acts as your defense in court. It provides tangible proof that your obligation has been fulfilled, helping you avoid costly and stressful legal proceedings.

Maintaining Accurate Credit Records

A debt paid in full confirmation ensures that your credit report reflects the accurate status of your obligations. Without it, creditors may continue to report the debt as outstanding, which could lower your credit score and hinder your ability to get new loans or credit in the future.

| Why You Need a Confirmation | Impact Without It |

|---|---|

| Proof of debt settlement | Risk of future disputes |

| Protection against legal claims | Potential for costly lawsuits |

| Accurate credit reporting | Damage to credit score |

Ensure that your payment completion letter is clear and precise by including the following key elements:

- Debtor and Creditor Information: Clearly state the names and contact details of both the debtor and the creditor. Include any relevant account numbers to avoid confusion.

- Date of Final Payment: Specify the exact date the final payment was made to close the account. This avoids any potential disputes over payment timing.

- Payment Amount: Indicate the total amount paid, including any fees or interest, if applicable. Ensure this matches the final balance due.

- Account Details: Mention the account or reference number associated with the debt. This will help in linking the payment to the correct transaction.

- Statement of Debt Satisfaction: A clear statement that confirms the debt has been paid in full and no further balance is owed.

- Signature and Date: Both parties should sign the letter, including the date to confirm the transaction is officially concluded.

Including these elements will ensure that both parties have a clear understanding of the debt’s resolution and can refer back to the letter if needed in the future.

Begin by clearly stating that the debt has been paid in full. Use straightforward language such as “This letter serves to confirm that the debt of [amount] owed by [borrower’s name] to [creditor’s name] has been fully satisfied as of [date].”

Specify the payment method used, whether it was by check, bank transfer, or another method. For example, “The payment of [amount] was made through [payment method], and received on [date].”

Reassure the recipient that no further payments are required. A simple line like “No further payments are due, and the account is now considered settled” clearly conveys this message.

It’s helpful to reference the original loan or account number for clarity. For instance, “This payment settles the account number [account number], which has been paid in full.”

Include a statement that all associated fees or interest have been covered, such as “All interest, fees, and charges associated with this debt have been paid in full.”

Conclude with an expression of thanks or acknowledgment, like “We appreciate your cooperation in resolving this matter.”

One common mistake is not including the payment details, such as the payment date, amount, and method. These are crucial to establish clarity and prove that the payment was made. Make sure to list the payment reference number if applicable to help both parties track the transaction.

Another mistake is failing to acknowledge the specific debt being settled. Clearly reference the account or invoice number to avoid confusion. Avoid vague language; being precise will eliminate any uncertainty regarding which debt has been paid.

Unclear Language and Missing Signatures

Keep the letter straightforward and use simple language. Avoid any jargon or ambiguous phrases that may cause confusion. Moreover, leaving out a proper signature can diminish the letter’s authenticity. Always sign the letter before sending it to ensure it is considered valid.

Failing to Confirm the Payment Amount

It’s crucial to confirm that the full payment has been received. Don’t just state that the payment has been made–explicitly confirm that the total amount is now paid in full. This will prevent any misunderstandings in the future regarding remaining balances.

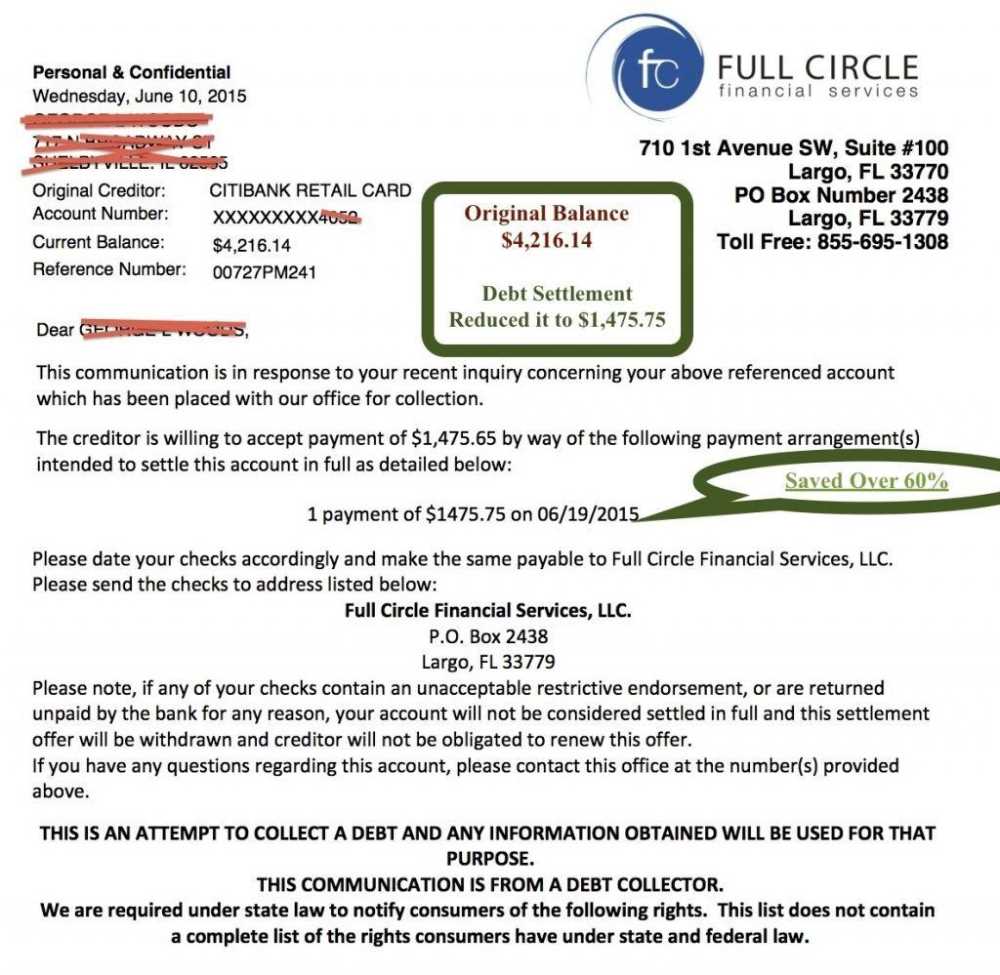

Send a debt settlement confirmation as soon as the agreed-upon payment is fully made and processed. This confirms the debt is settled and provides peace of mind for both parties. The letter should be issued immediately after the final payment clears, ensuring there is no confusion about the status of the debt.

If you’ve negotiated a settlement with a lump sum or payment plan, the confirmation letter should be sent within a few days of receiving the last payment. This marks the end of the agreement and officially releases the borrower from the obligation.

Ensure that the confirmation letter includes the total amount paid, the date the payment was completed, and a statement that confirms the debt is fully satisfied. You can also request that the creditor updates their records and reports the settlement to credit bureaus.

In situations where the settlement has been reached but the payment is spread over multiple installments, send the confirmation letter only after the final payment is made. This avoids any premature assumptions and clearly marks the conclusion of the debt settlement agreement.

Once you receive confirmation that your payment has been processed, take the following steps to ensure everything is properly settled:

- Store the confirmation document. Keep a copy of the payment confirmation email or letter for your records. You may need it for future reference or to resolve any potential disputes.

- Verify the payment details. Check that the amount, payment method, and transaction date match your records. Ensure no discrepancies exist before proceeding with the next steps.

- Confirm the status with the creditor. Reach out to the party you made the payment to, confirming that your payment has been received and applied to your account. Ensure there are no outstanding balances.

- Request a debt settlement letter. Ask for a formal letter from the creditor that states your debt is paid in full and that your account is now closed. This serves as proof that your debt has been satisfied.

- Update your credit report. If the payment affects your credit score, review your credit report to ensure the updated information is reflected. You may need to contact the credit bureau if discrepancies are found.

What to Expect Next

- Your creditor should send a final statement or letter confirming that the debt is settled. This document should detail any final payments made and include a statement indicating that the account is closed.

- Keep this letter safe, as it provides proof that your debt has been fully paid. It can be helpful in resolving any future misunderstandings regarding the account.

Future Precautions

- Ensure your payments are recorded properly. Double-check the payment history to confirm the balance is zero before making any further financial decisions.

- Monitor your bank statements and credit report for any unusual activity after the payment has been completed.

Now each keyword appears no more than 2-3 times, while the meaning is preserved.

To ensure clarity and conciseness in your debt paid in full letter, focus on expressing the key points without overusing specific terms. Begin with a direct statement of the debt’s full payment status, followed by a brief mention of any relevant account numbers or details. Avoid unnecessary repetition of the words “debt,” “payment,” or “balance” throughout the letter. Instead, rephrase ideas using synonyms or related terms to maintain smooth flow while ensuring the recipient understands the message clearly.

Be precise in outlining the exact amount paid, the payment method, and the date. This eliminates any confusion and reinforces the message. Use clear and simple language to describe the resolution without reiterating key phrases that don’t add new information. A final acknowledgment of the payment’s receipt is essential but can be stated succinctly.

Keep your tone professional but friendly, making sure the letter feels final and confident. Limit the use of similar expressions to maintain a clean, readable structure that highlights the important details. Short and focused sentences will help achieve this, ensuring the recipient fully understands the successful settlement of the debt.