Social security benefit letter template

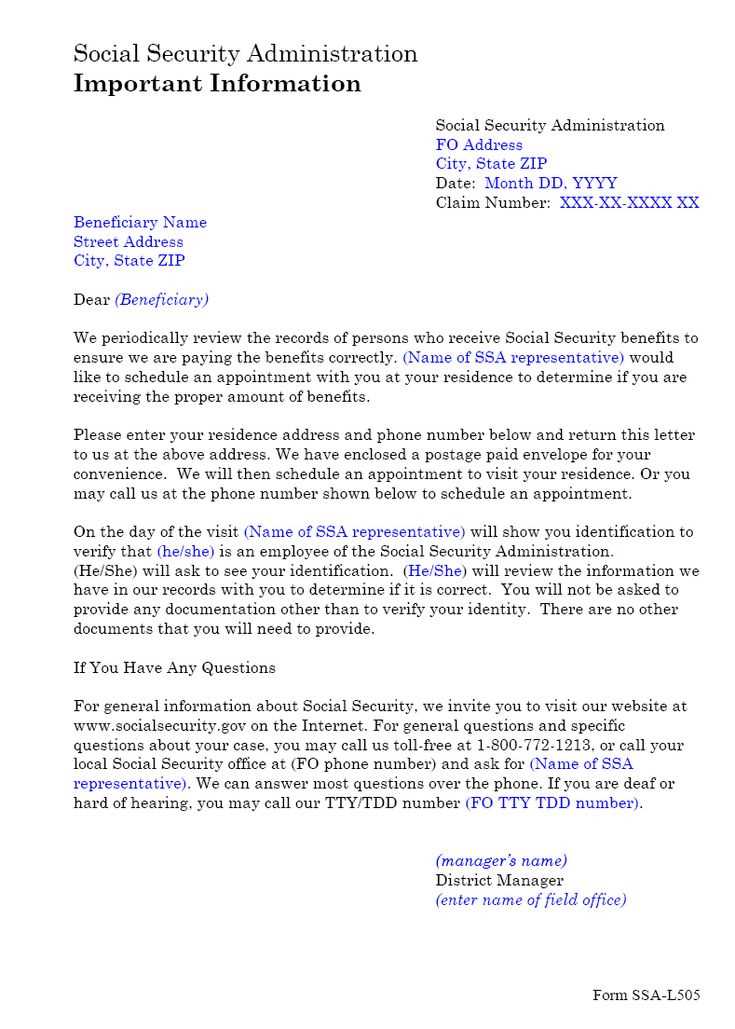

If you need to create a Social Security benefit letter, it’s important to follow a straightforward structure that ensures clarity and accuracy. A well-organized letter can help present your case effectively when applying for benefits or verifying your status with financial institutions or government bodies.

First, include your personal details: Start with your full name, Social Security number, and current address. This will help identify you and ensure your letter is linked to the correct account. Provide details on the benefits you are receiving, such as the type of benefit (e.g., retirement, disability), along with the date you started receiving payments.

Next, add the purpose of the letter: Explain why you are requesting the letter. Whether it’s for a loan application, proof of income, or another specific reason, include this information clearly. Providing the purpose will make it easier for the reader to understand your request and the context of the letter.

Lastly, verify the details: Confirm the amount of benefits you are receiving, along with any additional information that may be necessary, such as your payment schedule or changes in your benefits. End the letter with a formal closing and contact details, should any follow-up be needed.

Sure! Here’s the revised version with reduced word repetition:

To create a concise social security benefit letter, ensure the details are clear and direct. Start by stating the recipient’s full name, social security number, and relevant benefit information. Include the type of benefits provided and the payment amounts, as well as the effective date. Keep the language professional and straightforward.

Key Sections to Include

Begin with a formal greeting and introduce the purpose of the letter. Highlight the benefits the recipient qualifies for and provide a summary of the benefit amounts and payment frequency. Ensure the contact information is correct for any follow-up questions.

Closing the Letter

Conclude the letter with a polite sign-off, emphasizing the availability of customer service for further assistance. Include the signature of the authorized person from the Social Security Administration.

- Social Security Benefit Letter Template

To create a Social Security benefit letter, follow this simple template to ensure clarity and accuracy. Include the necessary details about the individual’s benefits and personal information. A well-written letter makes it easier for the recipient to understand their entitlements.

- Sender’s Information: Begin with the Social Security office’s contact information at the top, including the address, phone number, and date of the letter.

- Recipient’s Information: Follow with the recipient’s full name, address, and Social Security Number (SSN), keeping personal details confidential where possible.

- Subject Line: Clearly state the purpose of the letter, such as “Confirmation of Social Security Benefits.” This makes it immediately clear what the letter addresses.

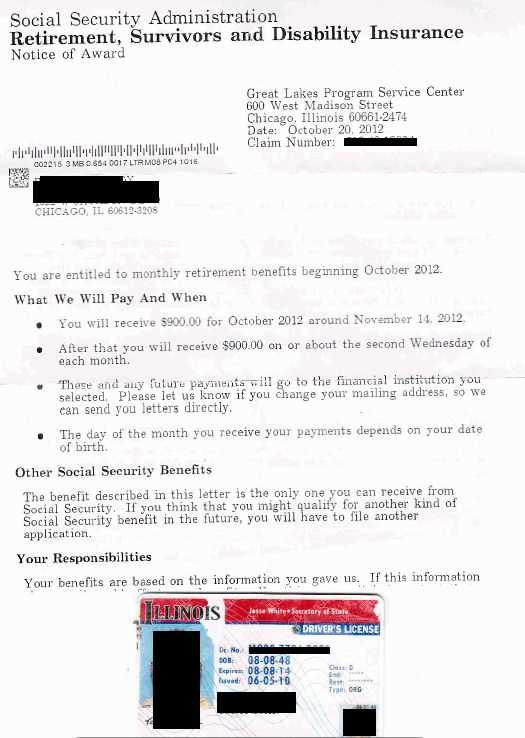

- Benefit Details: Specify the type of benefits, the amount, and any adjustments or changes. Include start dates and other critical information, such as the payment frequency.

- Signature: Conclude with the signature of the Social Security office representative, their title, and the office’s contact details for further inquiries.

Using this structure, the letter will be concise, straightforward, and professional. It ensures that the recipient gets all the relevant details in an easy-to-read format.

A benefits letter provides proof of the benefits you are receiving and outlines important details such as the amount, type, and duration of assistance. It serves as a key document when applying for loans, housing, or other financial assistance, as well as when verifying your income for legal or tax purposes.

This letter helps recipients demonstrate their eligibility for various programs and can be used to confirm that they are receiving government aid or other benefits. It includes clear information on the type of assistance, eligibility requirements, and any additional details needed to clarify the benefits provided.

When requesting a benefits letter, make sure to specify the exact information needed. The letter can be customized to show specific dates, amounts, or the program under which the benefits are provided. This level of detail ensures that the letter meets the specific needs of the person requesting it.

| Benefit Type | Amount | Duration |

|---|---|---|

| Social Security | $1,200 | Monthly |

| Unemployment Insurance | $400 | Weekly |

| Disability Benefits | $1,000 | Monthly |

Having a benefits letter on hand can streamline various processes, ensuring you can provide the necessary proof quickly. Whether for personal, financial, or legal reasons, understanding the purpose of this letter can help you navigate necessary procedures with confidence.

To request a verification letter from the Social Security Administration (SSA), you can use their online service, phone, or mail. The quickest option is through your personal SSA account online. Here’s how to do it:

Requesting Online

Log in to your SSA account at www.ssa.gov/myaccount. After logging in, navigate to the “Request a Social Security Card” section. Choose the option for a verification letter and follow the instructions. You can download or print the letter immediately after submitting your request.

Requesting by Phone or Mail

If you prefer, you can call the SSA at 1-800-772-1213. After confirming your identity, the representative will assist you in requesting a verification letter. Alternatively, you can mail a request to your local SSA office. Make sure to include your full name, Social Security number, and date of birth. You may also need to provide additional documents depending on your situation.

Provide the recipient’s full name, address, and Social Security number. This ensures that the letter is correctly attributed to the intended individual and can be easily referenced in future communications.

1. Benefit Type and Amount

Clearly state the type of benefit being awarded, such as retirement, disability, or survivor benefits, along with the exact amount the recipient is entitled to receive. Specify whether it’s a monthly or lump-sum payment.

2. Effective Date

Include the date when the benefit will begin. This is critical for the recipient’s financial planning and helps avoid confusion about payment start times.

3. Duration of the Benefit

Specify whether the benefit is temporary or permanent. For temporary benefits, include the expected duration and any conditions that could affect the continuation of the benefit.

4. Payment Method

State the method of payment (e.g., direct deposit, check) and provide any necessary details such as account numbers or addresses for where payments will be sent.

5. Contact Information

List the relevant contact details for further inquiries, including phone numbers, email addresses, or physical addresses. Ensure that the recipient knows where to turn for clarification or support.

6. Additional Information or Documentation

Include any further details that might be relevant, such as changes in the recipient’s circumstances that could affect benefits, or instructions for submitting additional paperwork.

- Provide a clear statement about the eligibility conditions that apply.

- Note any penalties or reductions that might apply based on the recipient’s income or other factors.

Use clear headings to separate key sections. Start with the title of the letter, such as “Social Security Verification Letter,” followed by the recipient’s details. This allows the reader to quickly understand the purpose of the letter.

Organize Information Logically

Start with a concise introduction that identifies the letter’s purpose. Then, include essential details in a structured manner. Use bullet points or numbered lists to break down complex information, ensuring clarity.

Keep Language Simple and Direct

Use straightforward language and avoid unnecessary jargon. Be concise, and make sure each sentence adds value. Avoid overly formal or complex phrasing, as simplicity aids understanding.

Include all necessary details–such as full name, social security number, and the specific benefit information you are verifying. Ensure these details are accurate to prevent delays in processing.

Proofread before sending. Check for grammatical errors and ensure the information is correct. An error-free letter reinforces professionalism and attention to detail.

Clearly state the purpose of the benefit letter. Avoid vague language or ambiguous wording. Make sure the reader can quickly identify the reason for the letter, such as confirming eligibility or detailing benefit amounts.

Incorrect or Missing Information

Verify all personal details, such as names, addresses, and dates. Double-check any benefit amounts or entitlement periods to ensure accuracy. Any discrepancies can lead to delays or confusion.

Failure to Follow Format Guidelines

Benefit letters often require a specific structure or format. Adhere to the required layout, which may include sections like a header, body, and closing. Skipping any section or using an unconventional format can cause problems with the review process.

Be direct and concise in your statements. Avoid including unnecessary information that may detract from the main message of the letter. Each detail should serve a clear purpose to support the reader’s understanding.

A benefit letter serves as proof of your entitlement to financial assistance, and can be used for a variety of applications. It’s helpful when you need to verify your eligibility for government programs, secure housing, or apply for loans. Depending on your situation, the letter can support claims for housing benefits, student loans, or other financial aid.

For Housing Applications

When applying for rental properties, you may need to provide proof of your income or benefits. A benefit letter can verify the financial assistance you receive, which is important for landlords or housing agencies assessing your ability to pay rent. Include the letter along with any other documents required by the housing authority to expedite your application process.

For Loan or Credit Applications

Financial institutions often request documentation of your income to assess your eligibility for loans or credit cards. A benefit letter shows your monthly financial support, which can be a key factor in securing a loan. Ensure that the letter clearly outlines the amount and frequency of the benefits you receive, as well as any other relevant details about your financial situation.

Let me know if you need further adjustments!

Once you’ve drafted your social security benefit letter, review it for accuracy. Ensure that all personal details, such as your name, address, and social security number, are correct. Double-check the benefit amount and the payment schedule for clarity. Be clear in your request, whether it’s for a benefit confirmation or an inquiry about eligibility. Use concise and direct language, as this helps in communicating your needs effectively.

If you are submitting your letter electronically, save it as a PDF to preserve formatting and prevent any accidental changes. If mailing, ensure that it is properly signed and include any supporting documentation requested by the Social Security Administration.

Tip: Before sending the letter, verify that the address or email you’re sending it to is the correct one. Keep a copy of the letter for your records in case you need it for future reference.