Letter to the irs template

If you’re writing to the IRS, it’s important to keep your message clear and concise. Begin with your full name, address, and taxpayer identification number. This helps the IRS locate your file quickly and avoid any confusion.

Next, specify the reason for your correspondence. Whether you’re asking for an extension, explaining an error, or disputing a tax issue, make sure to clearly state your concern in the opening lines. Provide any necessary details that will support your case.

Always include relevant documents such as copies of forms, notices, or receipts. Reference these documents in your letter to ensure the IRS understands the context of your request or explanation.

Lastly, close your letter with a polite request for the IRS to address your concern. Include your contact information and express your willingness to provide further details if needed. Ending on a courteous note can help keep the process moving smoothly.

Here’s an updated version where words are not repeated more than 2-3 times:

When addressing the IRS, clarity and precision are key. Begin with your personal information, including full name, address, and taxpayer identification number. Clearly state the purpose of your letter, whether it’s a request for a payment plan, a dispute over charges, or seeking clarification on a notice.

Outline the facts of your situation, including dates, amounts, and any relevant communication with the IRS. Attach supporting documentation such as receipts, tax returns, or previous correspondence to strengthen your case.

Be concise and respectful in your tone. Avoid including irrelevant details or emotional language. Keep your request specific and direct, making it easy for the IRS to process your inquiry. Finish by asking for a response or next steps, and provide a clear way for the IRS to contact you.

Finally, double-check for any errors or missing information before sending your letter. A well-organized, factual letter will help ensure a quicker and smoother resolution.

- Letter to the IRS Template

To draft an IRS letter, ensure it is clear, concise, and includes necessary details. Follow these steps for an effective template:

- Include Your Contact Information

At the top, list your full name, address, phone number, and taxpayer identification number (TIN) or Social Security Number (SSN). This helps the IRS quickly identify you.

- Address the IRS Department

Write to the appropriate IRS office, ensuring you address it to the correct department based on the reason for your letter (e.g., IRS, P.O. Box 1218, Chicago, IL 60690 for general inquiries).

- State the Purpose Clearly

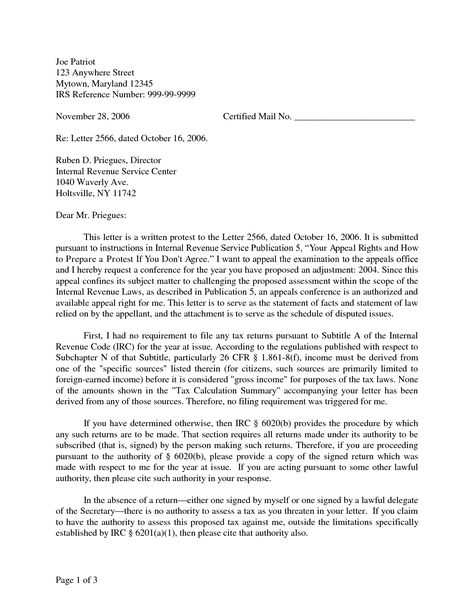

In the first paragraph, explain why you are writing. Be direct: mention if you are requesting information, disputing an issue, or making a payment. Include any relevant references, such as notices or previous correspondence.

- Provide Specific Details

Detail the issue, dispute, or request in the next section. Include all necessary information, such as account numbers, tax year, and reference numbers from IRS communications. Accuracy here is important for a quick response.

- State Your Request or Action Taken

Be clear about what you need from the IRS. Whether it’s a resolution, more time, or specific documentation, outline it here. Mention any actions you have already taken or payments you have made.

- Sign Off with a Polite Closing

End the letter professionally with a closing statement, such as “Sincerely” or “Respectfully,” followed by your signature and printed name. Always keep a copy for your records.

Begin your letter by addressing it directly to the appropriate department or office at the IRS. Include the specific IRS office address if you have it. This ensures your letter reaches the right people without delays.

Start with a Clear Introduction

Provide your full name, Social Security number (or taxpayer ID number), and any relevant case or reference numbers right at the beginning. This allows the IRS to easily identify your account and the issue at hand.

State the Purpose of Your Letter

Clearly explain why you are writing. Whether you’re responding to a notice, requesting an extension, or addressing an error, be direct. Include the relevant tax year and specific issue you are addressing to avoid any confusion.

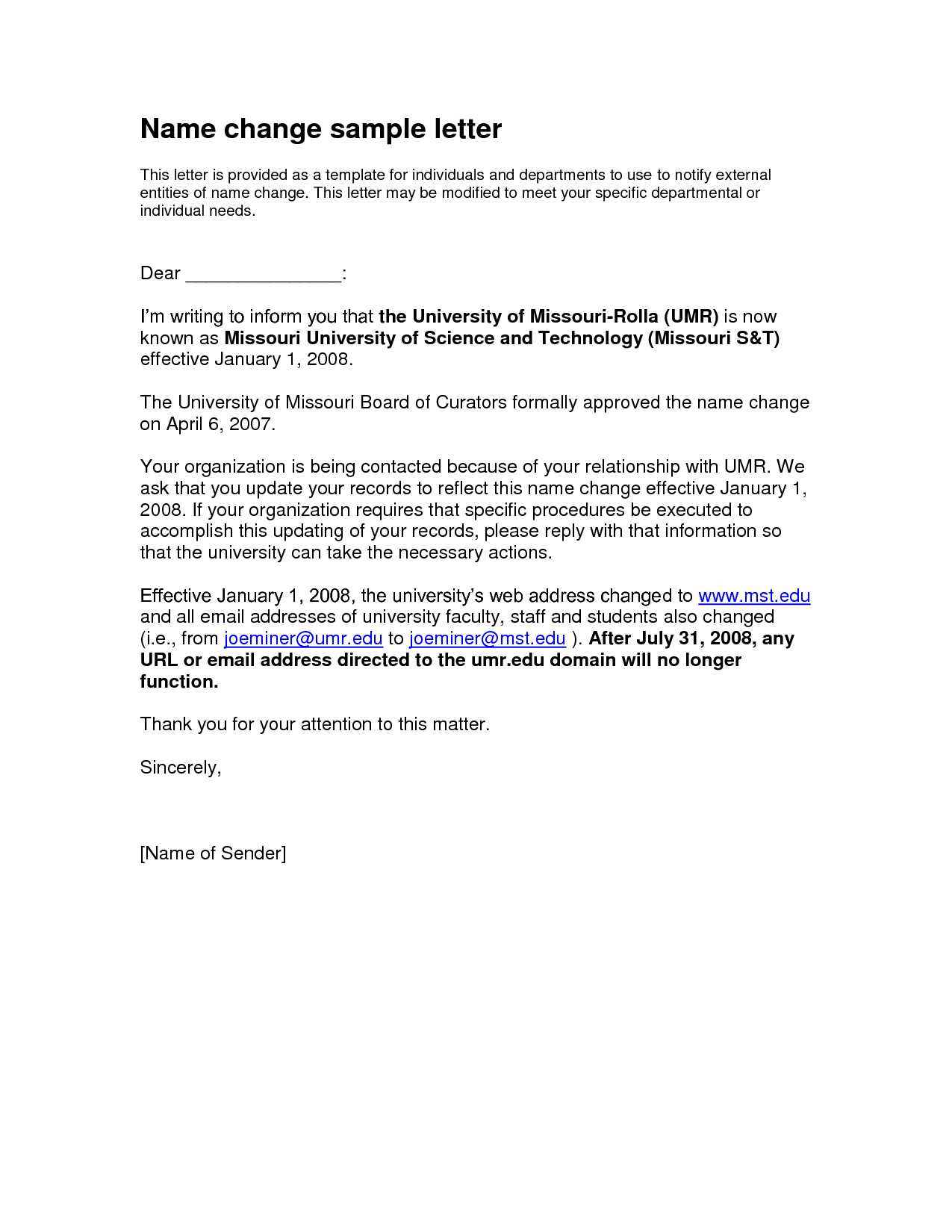

- Example: “I am writing in response to your letter dated [insert date], regarding my 2022 tax return.”

- Example: “I am requesting clarification on the status of my refund for the 2021 tax year.”

Ensure your letter is concise, and focus on the most important details right from the start. This will help the IRS process your letter without unnecessary back-and-forth.

Clearly state your full name, address, and taxpayer identification number at the beginning of the letter. This ensures that the IRS can accurately match your letter to your records.

Provide the reference number from any IRS correspondence you are addressing. This number helps the IRS quickly locate the related file and process your inquiry or response efficiently.

Detail the specific issue or request you are addressing. Avoid ambiguity–be direct about the action or clarification you are seeking from the IRS.

Include relevant documentation to support your case. Attach copies of forms, notices, or other materials that are directly related to the matter at hand.

If you are responding to a specific IRS notice, clearly indicate how the matter was resolved or explain any steps you have taken to resolve it. This demonstrates your proactive approach.

Lastly, close the letter with a request for confirmation of receipt or further instructions. This helps ensure you remain informed about the next steps in the process.

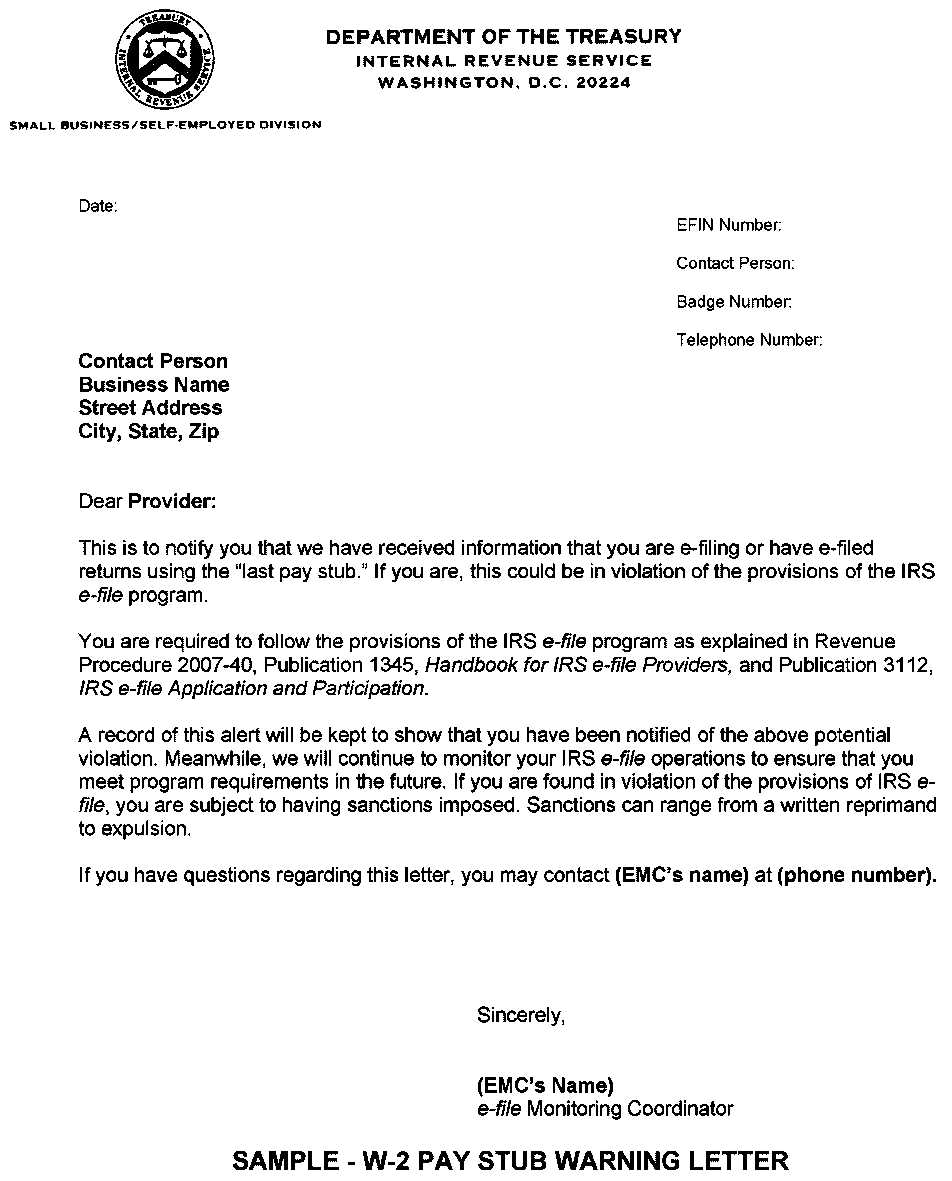

| Detail | Description |

|---|---|

| Full Name & Contact Information | Provide your name, address, and taxpayer ID to ensure proper identification. |

| IRS Reference Number | Include the reference number from any IRS communication you are addressing. |

| Specific Issue/Request | State clearly what the letter is about and what action you seek. |

| Supporting Documents | Attach all relevant forms, notices, and evidence related to the issue. |

| Request for Confirmation | Ask for confirmation of receipt or follow-up instructions. |

Begin with a clear statement of purpose. Mention the reason for writing and any specific issues you need to address with the IRS. Be direct and concise. Avoid unnecessary details, but include all relevant facts.

Organize your points logically. If you’re responding to a notice or inquiry, reference the specific document or correspondence you’re addressing. Use numbered or bulleted lists if multiple issues need attention, keeping the content straightforward.

Include all required documentation or supporting evidence. Attach copies of forms, receipts, or other relevant paperwork and refer to them within the text. This helps the IRS quickly identify the information they need.

Conclude the body with a call to action. Indicate how you wish the IRS to respond, whether it’s providing clarification, confirming receipt, or another action. Be polite and firm about what outcome you seek.

Ensure your name and address match exactly as they appear on IRS records. Discrepancies can cause delays or complications. Always check your tax identification number (TIN) to avoid mistakes.

Avoid using vague language. Be specific about the issue, including dates, amounts, and forms. This reduces back-and-forth communication and speeds up the resolution process.

Don’t forget to include all required documentation. Missing paperwork will only delay your case. Double-check the IRS instructions to ensure everything is included before sending your letter.

Be clear and concise in your explanation. Lengthy or unclear statements can confuse the IRS staff, potentially leading to misunderstandings or incorrect decisions.

Ensure that your letter is free of typographical errors. Incorrect spelling, especially of names, numbers, or tax-related terms, can cause processing issues or delays.

Send your correspondence via a trackable method. This helps you confirm receipt and provides peace of mind if the IRS needs to contact you about your letter.

Avoid addressing the IRS with informal language or tone. Maintain a professional and respectful tone throughout the letter. A courteous approach helps foster smooth communication.

End your letter by clearly stating the action you expect. For example: “I respectfully request a review of my tax situation and the correction of any discrepancies noted.”

If applicable, provide a timeline for a response: “Please respond within 30 days to confirm the resolution of this matter.”

Make sure to include your willingness to provide further information if needed: “If additional details are required, please contact me at your earliest convenience.”

Finish with a professional closing, such as: “Thank you for your attention to this issue. I look forward to your prompt response.” Then sign off with: “Sincerely, [Your Name].”

Once you’ve sent your letter to the IRS, it’s important to stay proactive. The first step is to track your letter. If you mailed it using certified mail, check the tracking number to confirm its delivery. Once received, the IRS may take several weeks to process the information, but you can always monitor the status of your issue.

If you don’t receive a response within the expected time frame, follow up with a call to the IRS. Have the details of your original letter on hand, including the date it was sent and any reference numbers. Be prepared for long wait times, so consider calling early in the morning or using the automated system to get updates on your case.

If the IRS requests additional documents or information, respond as soon as possible. Double-check that you’ve provided everything they need to avoid delays. Keep copies of any correspondence and documentation sent, as this will help track your communication history.

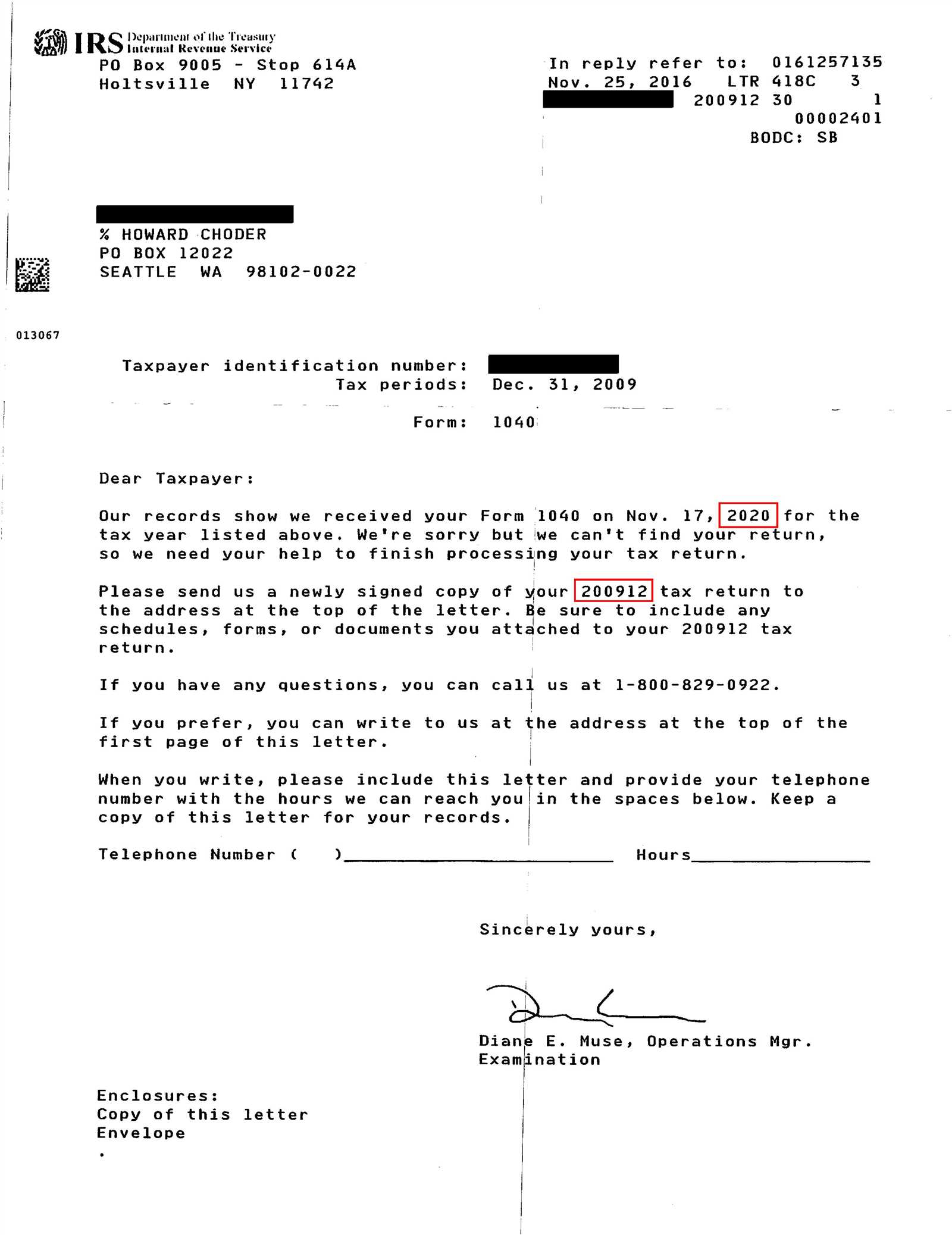

| Step | Action | Timeline |

|---|---|---|

| Track delivery | Check certified mail tracking or delivery confirmation | Within a few days after sending |

| Call the IRS | Request updates and provide letter details | After 4-6 weeks if no response |

| Respond to requests | Submit any additional documents or information | Within a few weeks of request |

Consider using the IRS online tools to check the status of your case or request more information. Stay organized and patient as these processes can take time, but persistence is key.

If you’re facing issues with the IRS and need to reach out, it’s crucial to write a clear and concise letter. Begin with a formal greeting and address the specific issue at hand. Mention the tax year or relevant details related to your situation to provide clarity.

State the Issue Clearly

Describe the problem or reason for writing. Whether it’s a discrepancy on your tax return or a request for clarification, ensure the explanation is direct and free of unnecessary details. Avoid including personal opinions–stick to facts and the situation at hand.

Provide Relevant Documentation

If applicable, include copies of supporting documents. These might include previous correspondence, tax returns, or payment receipts. Be sure to refer to these documents within your letter to demonstrate your points clearly and professionally.

Conclude the letter with a request for the desired outcome, whether it’s an extension, correction, or another action. Make sure to include your contact information so the IRS can reach you with further questions.