Diminished value claim letter template

To draft a diminished value claim letter, begin by clearly stating your intent to seek compensation for the loss in value to your property after an accident. Be direct and precise, outlining the key facts such as the date of the accident, the extent of damage, and how it affects the resale value of your property.

Start with the basics. Mention your name, contact information, and the details of your insurance policy. Ensure that your description of the accident is clear, including any repairs made and the current market value of your property.

Next, support your claim by referencing any expert assessments or appraisals. If possible, provide evidence of the diminished value, such as quotes from dealerships or comparison prices for similar vehicles in the market. This will help substantiate the loss you are claiming.

Conclude your letter by specifying the amount you are requesting and reiterating your desire to resolve the matter promptly. Be professional yet firm, and make sure your contact information is easily accessible for any follow-up communication.

Here’s the revised version with minimized word repetition while maintaining the meaning:

To begin, the letter should clearly state your intention to claim the diminished value of your vehicle. Start by mentioning your vehicle’s details, including make, model, year, and VIN. Provide any documentation that supports the loss in value, such as repair estimates and an appraisal report. Mention the date of the incident that led to the depreciation and specify how it has affected your car’s market value.

Key Points to Include in the Claim:

- Details of the accident or incident leading to the diminished value.

- Vehicle information: make, model, year, and VIN.

- Supporting documents, including repair estimates or appraisal reports.

- Specific dollar amount you are claiming for the diminished value.

- Your contact details and a request for further communication.

Be sure to use clear language, keeping the focus on facts and specific numbers. Avoid ambiguous statements, and keep the tone professional but firm. Provide your insurance company with all the necessary information to support your claim and ensure it is processed smoothly.

Sample Claim Letter Table:

| Section | Details |

|---|---|

| Vehicle Information | Make: Toyota, Model: Camry, Year: 2020, VIN: 1HGBH41JXMN109186 |

| Incident Date | October 10, 2024 |

| Claim Amount | $3,500 |

| Supporting Documents | Repair estimate from XYZ Auto Shop, appraisal report by ABC Appraisers |

| Contact Information | John Doe, 555-1234, [email protected] |

Once all sections are properly filled out, send the letter along with the required documents. Follow up with your insurance company for updates on the claim status. Be clear about your expectations and the steps needed to resolve the situation.

- Diminished Value Claim Letter Template

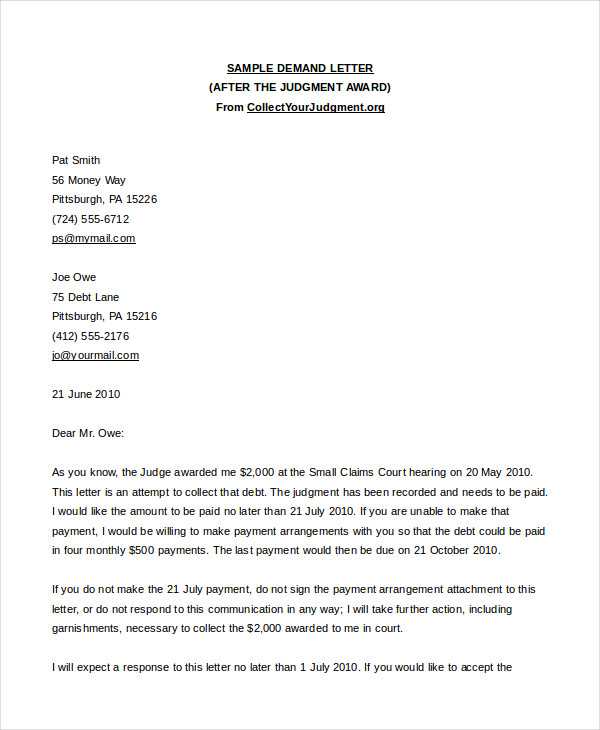

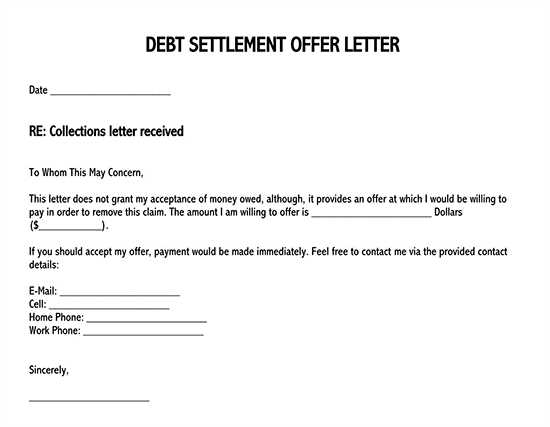

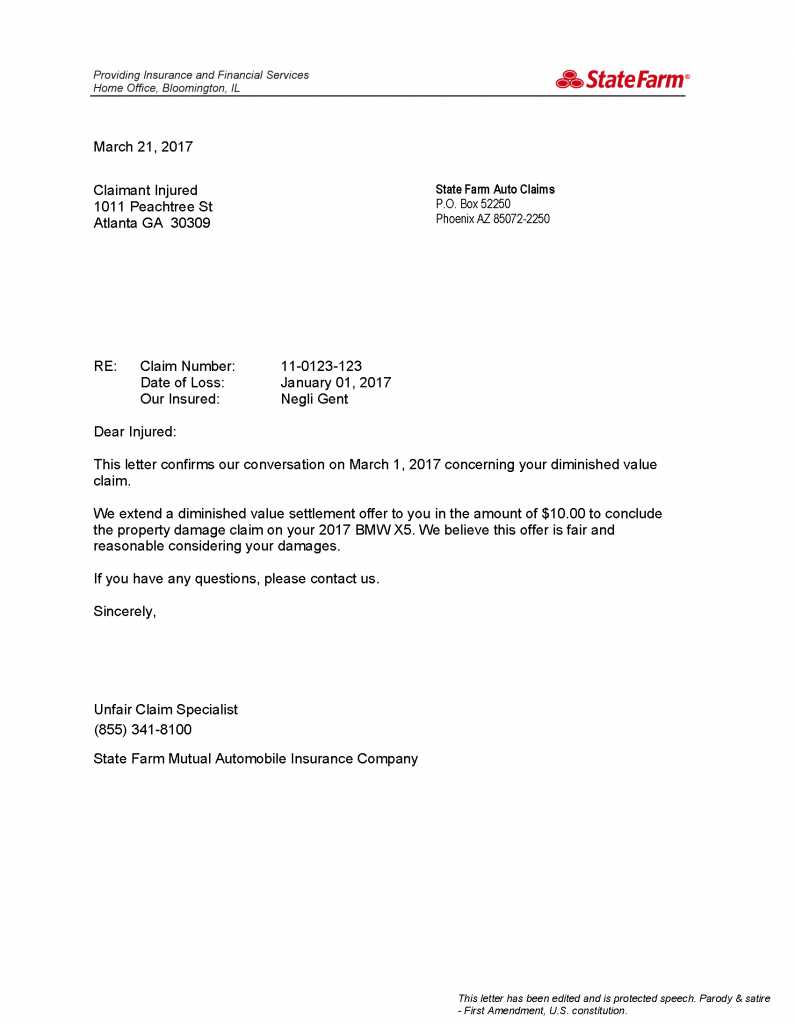

To file a diminished value claim, it’s key to address the matter directly and professionally in your letter. Begin with your contact details and the recipient’s information, including the insurance company’s name, address, and the claim number. Specify the incident date and provide a brief summary of the event that led to the damage, focusing on the financial implications of the diminished value of your vehicle.

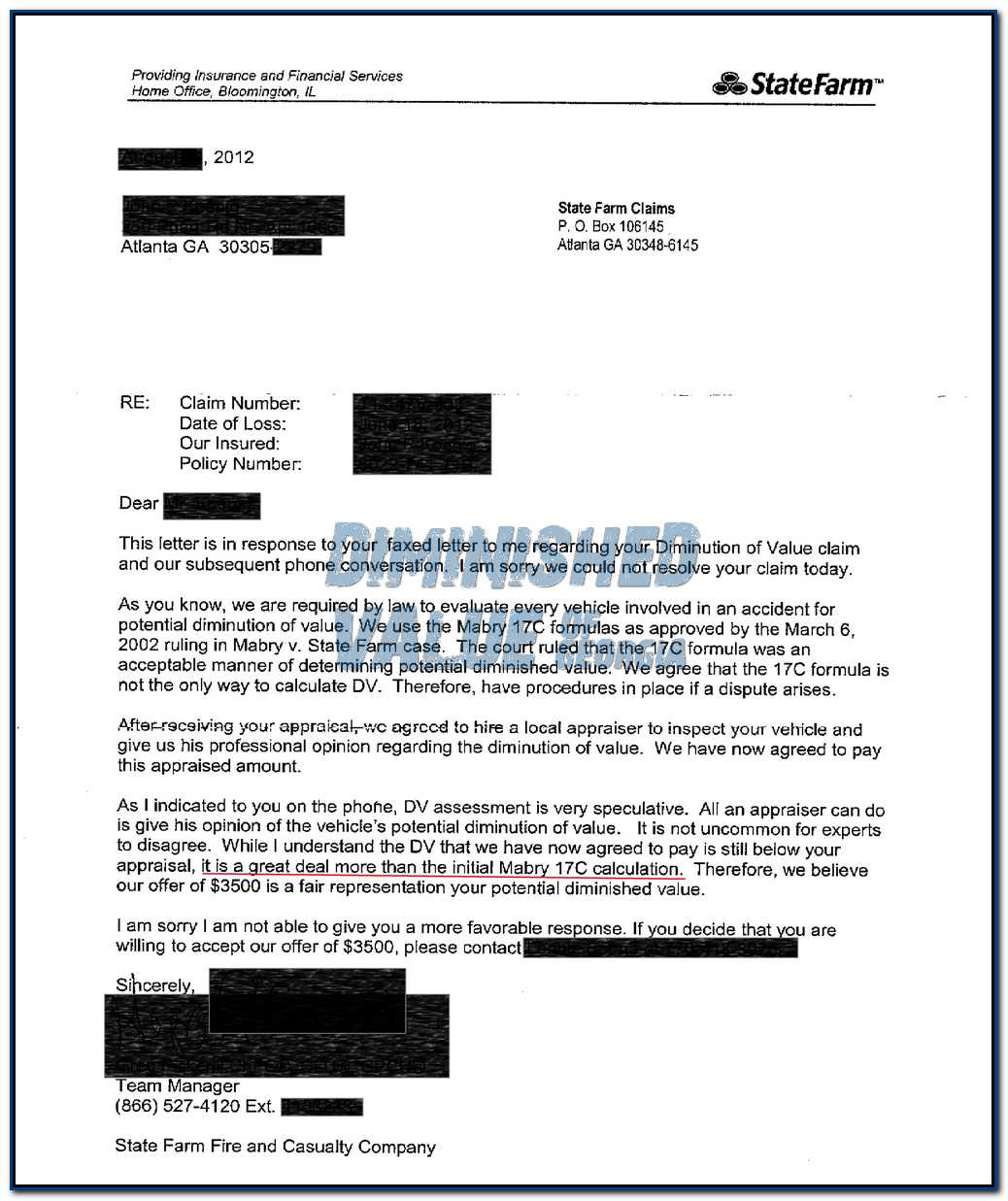

Clearly state your claim, explaining the reduced market value of your car after the accident. Use any professional appraisal or valuation to support your case, attaching these documents as evidence. If available, include estimates from auto repair shops that outline the extent of the damage and repairs done. Acknowledge any previous communications or offers from the insurance company to keep the record clear.

Request a prompt response, specifying the outcome you expect–whether it’s a revised offer or further investigation. Conclude by expressing appreciation for their attention to the matter and your willingness to provide any additional information if needed. Make sure to sign and date the letter before sending it out.

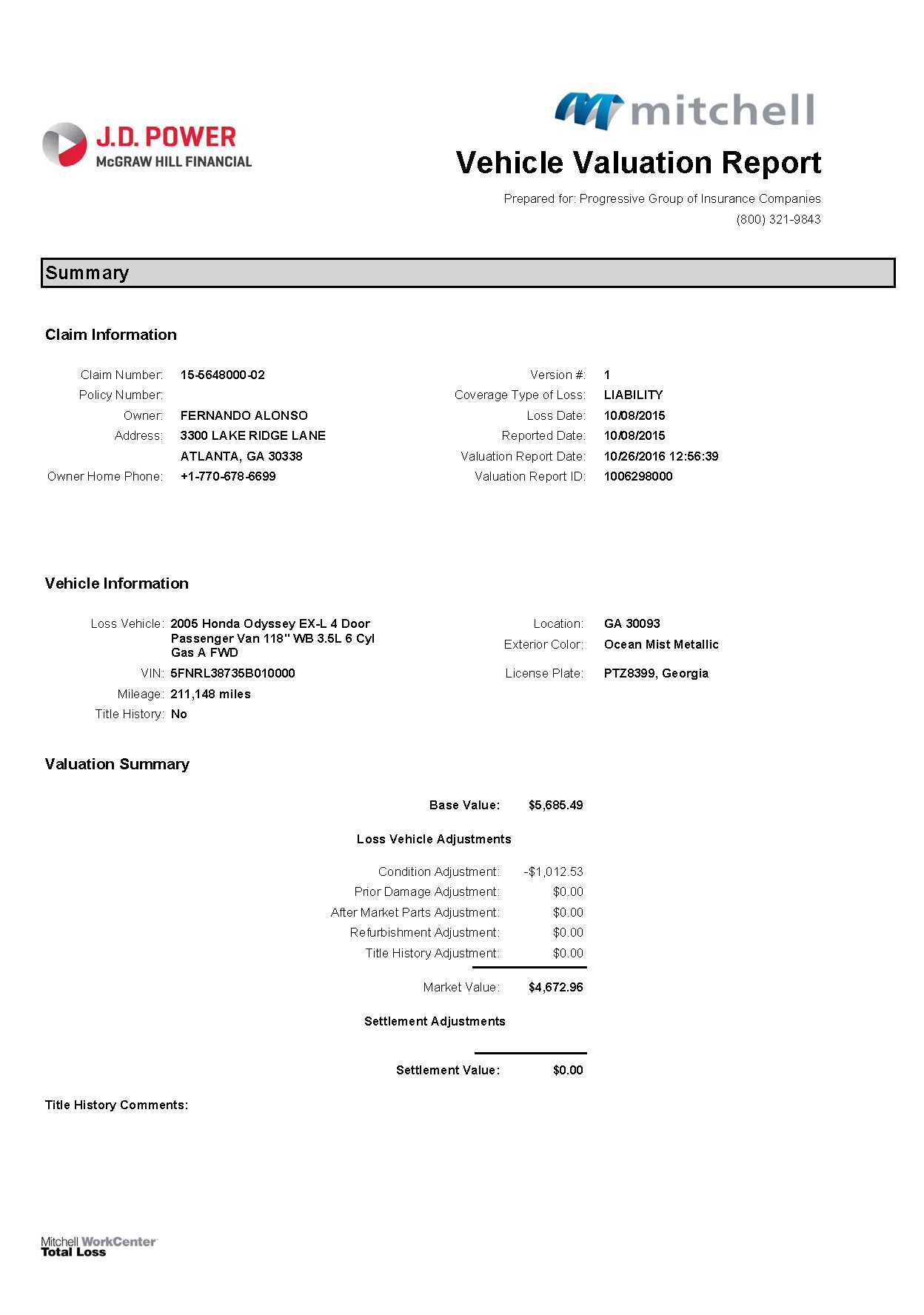

To file a diminished value claim, first establish the financial loss due to the accident. A vehicle’s value typically drops after it is involved in a collision, regardless of the repairs. To support your claim, document the pre-accident value through market research or an appraisal.

Gather evidence such as:

- Pre-accident appraisals or purchase records

- Estimates or invoices for repairs completed post-accident

- Market comparisons showing the difference in value before and after the incident

Next, assess the degree of damage. A minor fender bender may result in a smaller diminished value claim than a major accident. Insurance companies will evaluate the car’s history and severity of damage to calculate the reduction in value.

Be prepared to argue for a fair settlement. If the insurance company undervalues the loss, consider hiring an independent appraiser to provide a second opinion. Keep records of all communications and follow up regularly to ensure timely processing of your claim.

Begin with a clear, direct statement of the diminished value claim. Identify the vehicle involved, providing the make, model, year, and VIN number. Mention the specific accident and the impact on the car’s value, supported by facts such as the extent of damage and repairs made.

Next, include an objective evaluation of the loss in value. Use a professional appraisal or valuation report that highlights how the accident reduced the vehicle’s market worth. Reference comparable vehicles to show the difference between pre-accident and post-accident values.

Outline the claim amount. Be clear on the financial loss, detailing both the estimated diminished value and any supporting calculations. The letter should indicate the amount you’re requesting and the basis for this figure.

Include your contact information and request a prompt response. Specify how you wish to be contacted (email, phone), and mention any additional documents you are attaching, such as photos, repair estimates, or insurance reports. End with a courteous request for the insurer to address the claim in a timely manner.

Begin with the basics: clearly state the purpose of your letter. The goal is to inform the recipient about the diminished value of your vehicle due to an accident. Start with a formal introduction and identify yourself. Provide necessary information like your name, vehicle details, and claim number (if applicable).

1. Provide Vehicle Information

List the make, model, year, and vehicle identification number (VIN). Include a brief description of the damage, referencing any relevant documentation, such as repair estimates or photos.

2. Detail the Diminished Value

Explain how the accident has reduced the market value of your vehicle. You can refer to appraisals or expert opinions to back up your claim. Be specific with the figures if possible, showing the difference between the pre-accident and post-accident value.

3. Present Supporting Documents

Attach any documents that support your claim, such as repair invoices, photos of the damage, or an independent appraisal report. Ensure each document is clearly labeled for easy reference.

4. State Your Expectations

Be clear about the outcome you’re seeking, whether it’s compensation for the diminished value or reimbursement of certain expenses. Specify the amount you’re requesting and provide a reasonable explanation for why it’s justified.

5. Be Professional and Concise

Keep your language polite and direct. Avoid unnecessary details or emotional statements. Focus on presenting facts that support your claim.

6. Close with a Call to Action

Conclude by requesting a response within a reasonable timeframe. Make sure to include your contact information and express your willingness to provide any further details if necessary.

- Be concise and to the point.

- Ensure all necessary documents are attached and referenced.

- Keep the tone respectful and professional.

To calculate the diminished value of your car, begin by determining its pre-accident value. This is the price the car would have fetched if it had not been involved in any accidents. Use reliable sources such as the Kelley Blue Book or NADA Guides to find the accurate market value based on the make, model, year, and condition of your car.

Next, assess the severity of the damage. The more significant the damage, the greater the loss in value. Minor repairs will result in a smaller diminished value, while extensive damage will lead to a higher decrease. A good rule of thumb is to estimate that cars with more severe damage can lose up to 30% of their value or more.

After that, apply the formula for diminished value: Pre-accident value × Damage percentage = Diminished value. For example, if your car’s pre-accident value is $20,000 and the damage percentage is 20%, the diminished value is $4,000. This figure represents the amount by which your car’s value has decreased after the accident.

Finally, be mindful of the factors that might influence the final diminished value, such as your car’s mileage, the extent of repairs made, and the reputation of the repair shop. Keep all records, including repair invoices and insurance assessments, to support your claim and ensure a fair evaluation.

Accuracy is key. Double-check all details, including your vehicle information, repair costs, and the damage assessment. Mistakes here can delay the processing or result in your claim being denied.

Be Clear and Direct

Avoid vague language. Be specific about the damage, the value of your claim, and the compensation you are seeking. Providing clear, concise, and relevant information helps your claim to be processed faster.

Don’t Overcomplicate the Request

A claim letter should not include unnecessary details or emotional language. Stick to the facts and outline the damage, the cause, and how it has impacted the value of your property. Keep it simple and professional.

Neglecting Required Documentation

Always attach all necessary documentation to support your claim. This includes repair invoices, police reports, photos, or estimates. Missing paperwork can cause delays or result in rejection.

Failure to Address the Correct Recipient

Ensure your letter is addressed to the appropriate department or person. Failing to direct your letter to the right individual or office may cause unnecessary delays or confusion in processing your claim.

If your diminished value claim is denied, take immediate action. Review the denial letter carefully to understand the reasons behind the decision. Look for specific details that could indicate misunderstanding or misinterpretation of facts.

Gather additional evidence to support your case. This could include updated repair estimates, expert opinions, or comparable vehicle sales data. Any information that strengthens your claim can help during the appeal process.

Contact the insurance company and request a detailed explanation of the denial. Ask for clarification on the specific grounds and inquire about possible steps to appeal. This could open up a productive conversation or reveal additional pathways to resolve the issue.

If the insurance company remains uncooperative, consider filing a complaint with your state’s insurance department. This step may prompt a review of your case and lead to further negotiations.

Consider hiring a lawyer or professional adjuster if the case is particularly complex. Legal experts or claims professionals can assist in presenting your case more effectively and may help you secure a fair settlement.

Finally, be prepared to negotiate. Insurance companies may be willing to revisit the claim with new information or after further discussion, especially if they recognize that the initial denial was based on incomplete or inaccurate data.

To build a strong diminished value claim letter, be direct and clear. Begin by stating the specifics of the accident, such as date, location, and parties involved. Mention the insurance companies handling the case, and provide your policy details. Highlight the repair history of your vehicle and attach any documentation that demonstrates the repair quality and costs. Additionally, include an independent appraisal or a report from a professional evaluator that outlines the diminished value of the vehicle post-repair. This adds credibility to your claim.

Clearly outline the financial impact of the diminished value on your car’s resale potential. Use evidence such as market comparisons or examples of similar vehicles with similar damage to show how the accident has affected the vehicle’s value. Conclude by specifying the compensation you are seeking and how you would like the insurer to proceed with your claim.