Bookkeeper cover letter template

Craft a compelling cover letter with confidence. A well-structured bookkeeper cover letter highlights your attention to detail, expertise in financial recordkeeping, and ability to manage accounting tasks efficiently. Make sure to address the specific job requirements mentioned in the listing to show you understand the company’s needs and how you can contribute to their success.

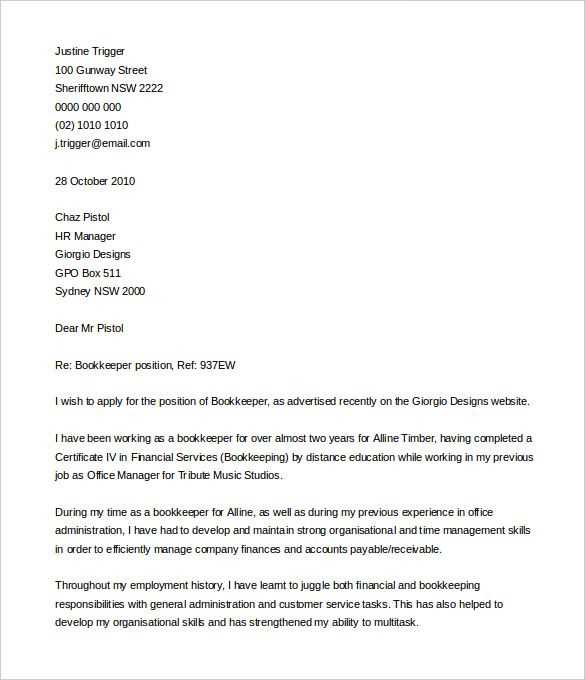

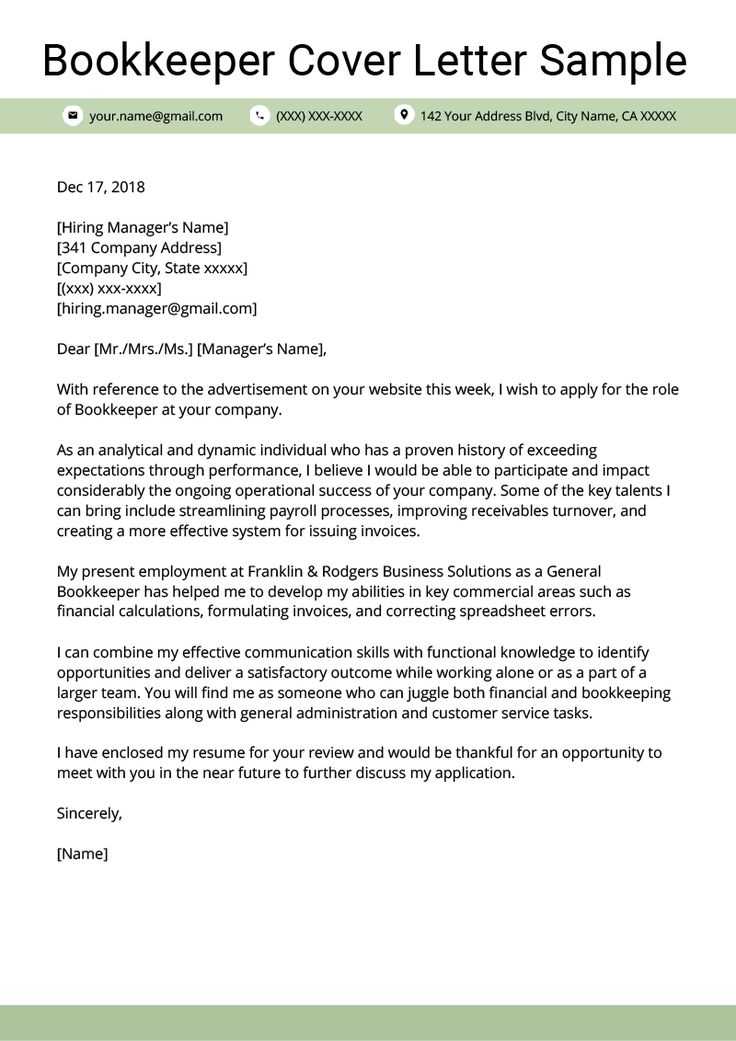

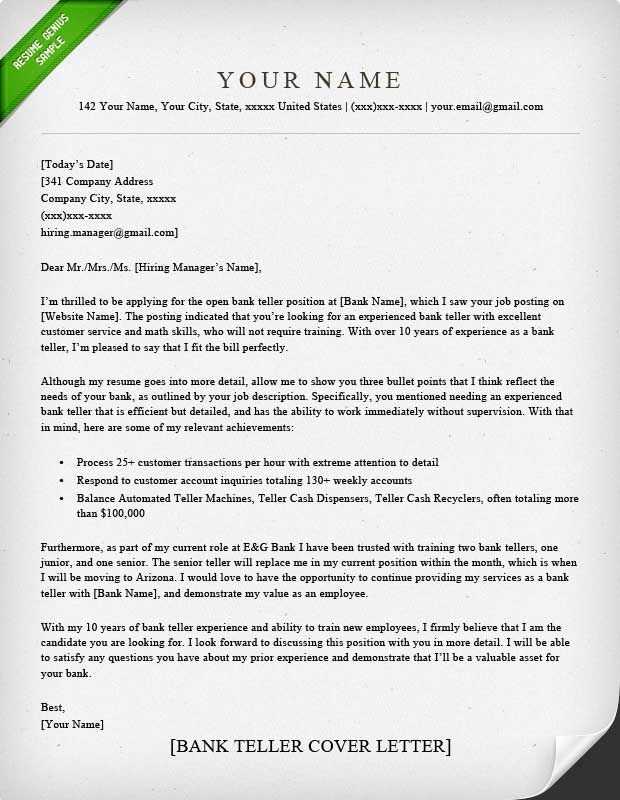

In the opening paragraph, introduce yourself and express your interest in the position. Mention any relevant experience that matches the job description, whether it’s maintaining financial records, reconciling accounts, or preparing reports. Avoid vague phrases and get straight to the point–emphasize your skills and what sets you apart from other candidates.

In the next section, go further into your qualifications, showcasing your proficiency in accounting software like QuickBooks, Xero, or Excel. Employers look for candidates who can handle numbers with precision and accuracy, so highlight any relevant certifications or training. If you’ve helped streamline processes or contributed to saving costs, make sure to include those accomplishments as well.

Close your letter with a confident statement of interest. Let the employer know you’re eager to discuss how your background aligns with their needs. Sign off professionally, and make sure to thank them for their time and consideration.

Here is the revised version with minimized repetitions:

Customize your cover letter by focusing on your key skills and experiences relevant to bookkeeping. Avoid redundancy by clearly articulating your expertise with financial software, attention to detail, and organizational skills. Highlight your ability to manage multiple tasks and meet deadlines, demonstrating your value to the company.

Show your familiarity with accounting principles and the capacity to ensure accurate financial reporting. Keep the tone professional yet approachable. Reframe similar points to avoid repetition while reinforcing your competencies. Be direct and concise while maintaining a friendly and clear approach.

Personalize the content to each job application by referencing specific requirements mentioned in the job posting. Tailoring your letter makes your application stand out without reiterating the same qualifications. This method highlights your interest and shows you’ve done your research.

- Bookkeeper Cover Letter Template

To create a strong bookkeeper cover letter, focus on your skills, relevant experience, and ability to handle accounting tasks accurately. Here’s how to structure your letter for the best impact:

1. Introduction

Begin with a brief introduction that mentions the job you’re applying for and where you found the job listing. If you have a referral, include that as well. Be clear and direct in your first few sentences.

2. Skills and Experience

Highlight your bookkeeping skills with specific examples. Focus on areas like managing accounts, processing payroll, or handling accounts payable and receivable. Mention any relevant certifications or software proficiency (QuickBooks, Xero, Excel, etc.).

Here’s a table summarizing key points to include in this section:

| Skill/Experience | Example |

|---|---|

| Account Management | Successfully managed a team of accountants, ensuring monthly reports were delivered on time. |

| Payroll Processing | Processed bi-weekly payroll for over 100 employees using QuickBooks software. |

| Financial Reporting | Generated monthly balance sheets and profit and loss statements for senior management review. |

3. Closing Paragraph

Reaffirm your interest in the role and explain why you are the right fit. Offer to discuss further details in an interview. Be polite and professional in your closing statement, thanking them for considering your application.

Sign off with your full name and contact details. Keep the tone confident but humble.

Begin by analyzing the job listing carefully. Identify key skills, qualifications, and experiences the employer seeks. Highlight the aspects of your background that directly match these requirements. Customize your letter to reflect your understanding of the position’s demands and how your experience aligns with them.

Focus on Relevant Skills

For each position, emphasize skills that are specifically requested in the job description. If the job asks for proficiency in accounting software, mention your expertise with those tools. Demonstrating your familiarity with the company’s needs will show you’ve done your research and are a strong candidate.

Showcase Achievements

Instead of listing generic job duties, share measurable achievements that demonstrate your ability to succeed in the role. If you improved the financial reporting process in your last job, mention how your efforts resulted in a time savings or reduced errors. Quantifying your success makes a stronger impact.

- Match the tone of the job description: If the listing is formal, keep your letter professional; if it’s more relaxed, feel free to add some personality.

- Address the hiring manager directly, using their name if available. Personalizing your letter gives it a more genuine feel.

- Tailor your opening paragraph to reflect the specific role and company. Highlight your enthusiasm for the job and why you’re a good fit.

Highlight these critical sections in your cover letter to make a lasting impression:

1. Contact Information

- Place your name, phone number, email, and address at the top.

- Include the recipient’s name, title, company name, and address if known.

2. Salutation

- Use a formal greeting, such as “Dear [Hiring Manager’s Name],” when possible.

- If you don’t know the hiring manager’s name, “Dear Hiring Manager” works as a neutral option.

3. Introduction

- Introduce yourself and briefly state the position you’re applying for.

- Highlight any connection you have to the company (referral, mutual contact, or specific interest).

4. Body Paragraph(s)

- Focus on your skills and experiences relevant to the role. Be concise and specific.

- Show your understanding of the company’s needs and how you can contribute to its success.

5. Closing Paragraph

- Express enthusiasm for the opportunity and your willingness to discuss your qualifications further.

- Include a polite thank you for considering your application.

6. Sign-Off

- Use a formal closing, such as “Sincerely” or “Best regards,” followed by your name.

- If submitting a physical letter, leave space for your signature.

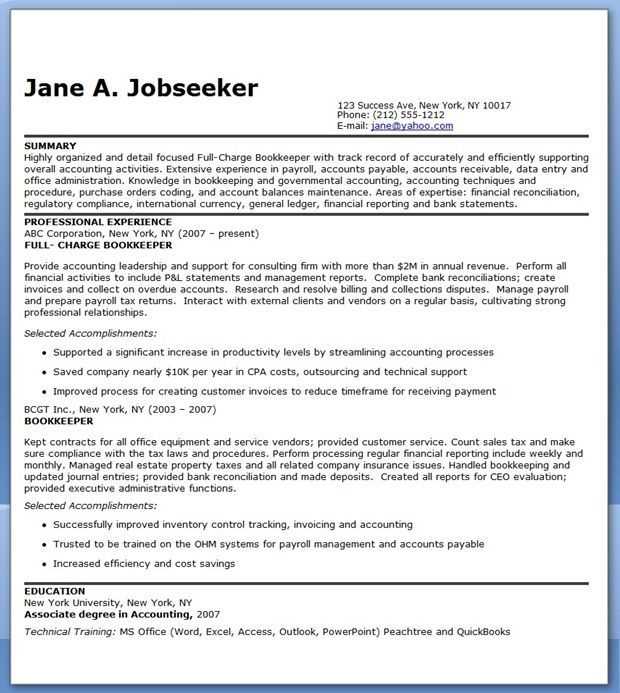

Focus on showcasing your proficiency with accounting software. Mention specific tools you’ve used, such as QuickBooks, Xero, or FreshBooks, and describe how you’ve applied them in day-to-day operations. Being familiar with these platforms indicates your ability to handle finances efficiently.

Key Accounting Skills

Highlight your understanding of financial statements and your ability to prepare balance sheets, income statements, and cash flow reports. Demonstrating experience with reconciling accounts, managing ledgers, and tracking expenses builds credibility in your technical expertise.

Attention to Detail and Accuracy

Employers value accuracy in financial roles. Share examples where your attention to detail has prevented errors or improved the quality of financial reporting. This could include catching discrepancies or ensuring that all transactions are properly categorized.

Additionally, if you’ve worked with budgets or forecasts, mention your experience in budgeting processes, helping businesses stay on track with financial goals. This highlights your ability to manage funds responsibly and contribute to long-term planning.

Lastly, consider any previous experience in tax preparation or payroll processing. These skills are highly sought after as they demonstrate your knowledge of compliance and regulatory standards. Mention any relevant certifications that can further set you apart, like a CPA or bookkeeping certification.

How to Address Employment Gaps or Lack of Experience

Be upfront and direct about gaps in your employment history. Employers appreciate honesty and clarity. If you took time off for personal reasons, education, or other pursuits, briefly explain the situation. Focus on what you learned or how you stayed engaged during that period. This shows that you remained motivated and ready to return to work.

If you lack experience in the field, highlight transferable skills from previous roles. Emphasize any relevant tasks or accomplishments, even if they were not directly related to bookkeeping. For example, organizational skills, attention to detail, or experience with managing finances in other capacities can be useful in this role.

Show your commitment to learning and improving. Mention any relevant certifications, courses, or self-study you’ve completed to enhance your skills. This demonstrates initiative and a proactive approach to your career development.

Keep the tone confident but humble. Acknowledge the gap or lack of experience, but emphasize your willingness and readiness to contribute to the company’s success.

Conclude your cover letter by clearly expressing your enthusiasm for the position and company. Restate briefly how your skills align with the role and how you can contribute to the team. Keep the tone confident yet humble to leave a lasting impression.

Show Confidence and Interest

Avoid generic phrases. Instead of saying, “I would love the opportunity,” opt for something more specific like, “I am eager to bring my bookkeeping expertise to your team.” It demonstrates both confidence and interest in the position, making your closing feel personalized and impactful.

Encourage Follow-Up

Close by encouraging further communication. A simple sentence such as, “I look forward to the possibility of discussing how my experience can support your team’s goals,” invites the hiring manager to reach out, leaving the door open for future conversation.

End your letter with a polite sign-off like “Sincerely” or “Best regards” to keep the tone professional. Follow it with your name, and you’re done! The closing should feel natural, concise, and professional–leaving a memorable final impression.

Common Mistakes to Avoid When Writing a Cover Letter

Tailor your cover letter specifically to the job and company. Generic letters that don’t show genuine interest in the role often get overlooked. Highlight your relevant skills and experiences to show why you’re a strong candidate for this particular position.

Another mistake is being too vague about your achievements. Use numbers and concrete examples to illustrate how you’ve made an impact in your previous roles. This makes your qualifications stand out and gives the reader a clear picture of what you bring to the table.

Avoid Being Too Formal or Too Casual

Finding the right tone is key. Striking the balance between professional and approachable will help you sound confident but not overly stiff. Avoid using slang or overly casual language, but also steer clear of robotic or excessively formal phrasing.

Don’t Forget to Proofread

Grammatical errors and typos can make your cover letter seem careless. Always proofread your letter and, if possible, ask someone else to review it as well. A polished cover letter reflects attention to detail and professionalism.

Showcase Your Key Skills and Experience

Highlight your bookkeeping expertise right from the start. Focus on your hands-on experience with accounting software like QuickBooks, Xero, or FreshBooks. Mention any relevant certifications such as CPA, or courses you’ve completed in accounting. Include specifics–like the number of years spent managing financial records or handling accounts for small businesses or large companies. Employers are looking for proof of your ability to handle various financial tasks, from invoicing to tax preparation.

Highlight Your Attention to Detail

In the world of bookkeeping, accuracy is key. Stress your ability to spot discrepancies and ensure that every transaction is properly recorded. You might want to include an example where your attention to detail helped resolve a potential financial issue or streamlined a client’s process. Keep it clear and direct to show how you’ve added value in previous roles.

Demonstrate Your Organizational Skills

Employers need a bookkeeper who can maintain order in complex financial systems. Explain how you’ve kept documents and records well-organized to make audits smoother or how you efficiently manage multiple accounts. Showing how you’ve handled deadlines or dealt with high-volume tasks will reassure hiring managers that you can handle the demands of the role.