Hardship letter due to covid template

If you’re facing financial difficulties because of the COVID-19 pandemic, writing a hardship letter can help communicate your situation to lenders, creditors, or other institutions. A well-crafted letter can explain the impact of the pandemic on your ability to meet financial obligations and request a form of relief, such as deferred payments or modified terms.

Your letter should be clear and to the point. Start by stating your name, account number, and the specific hardship you’re experiencing due to the pandemic. Describe how your income has been affected, whether through job loss, reduced hours, or other financial setbacks. Be honest about your situation and include any relevant supporting documents, such as unemployment statements or medical bills, to validate your claims.

In the body of the letter, express your willingness to work with the institution for a solution. Mention any steps you’ve taken to manage your finances during this challenging time, and request the specific assistance you need. Make sure to include a reasonable timeframe for your request, ensuring it’s clear and actionable.

End the letter with gratitude and a professional tone. Acknowledge that while the situation is difficult, you are committed to resolving the matter and maintaining a positive relationship moving forward. A clear, respectful tone will help demonstrate your willingness to cooperate during this time.

Here is the corrected version of the text:

To create a hardship letter due to COVID-19, focus on clarity and accuracy. Start by stating the financial difficulty caused by the pandemic. Mention specific circumstances such as loss of income, business closure, or medical expenses. Include the timeline of these events and how they have impacted your ability to meet financial obligations.

Provide any supporting documents, such as unemployment benefits, medical bills, or a letter from your employer confirming job loss. Be transparent about your current situation, showing the steps you’ve taken to manage the hardship and any efforts to find alternative solutions.

For example, if you lost your job, include details about your job title, company, and the date you were laid off. If you’re self-employed, explain how your business has been affected and include relevant financial statements if possible.

| Details | Example |

|---|---|

| Financial Difficulty | Lost job due to company closure |

| Supporting Documents | Unemployment claim statement, medical bills |

| Efforts to Resolve | Seeking new job opportunities, applying for relief programs |

End the letter by expressing your willingness to discuss the situation further and request understanding or assistance in resolving your financial obligations. Keep the tone professional, and avoid emotional language or blaming others for the situation.

- Hardship Letter Due to COVID Template

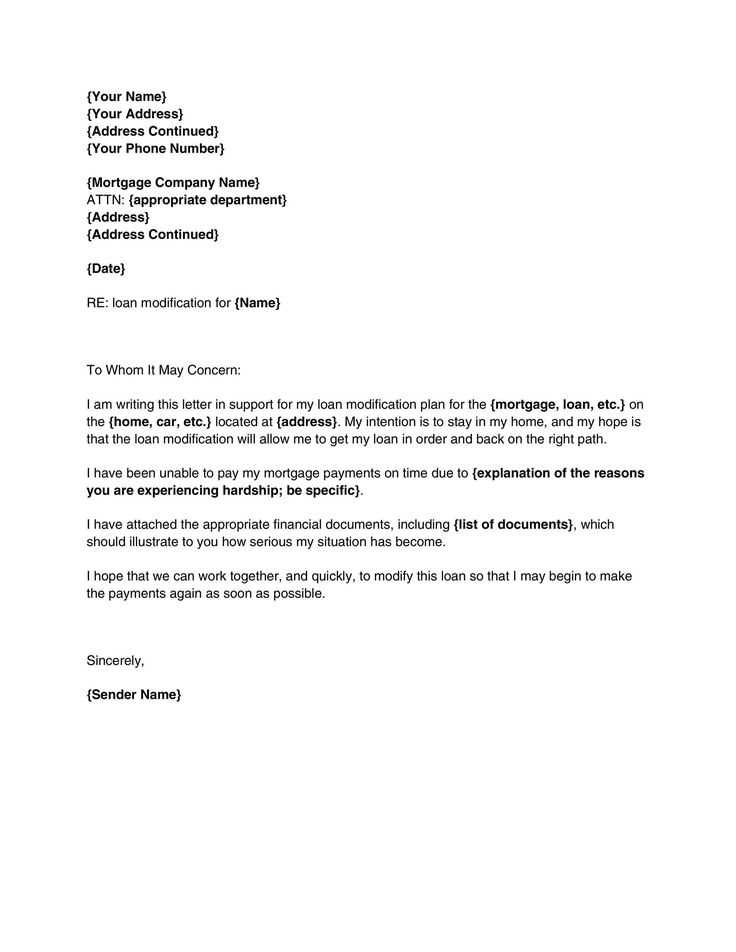

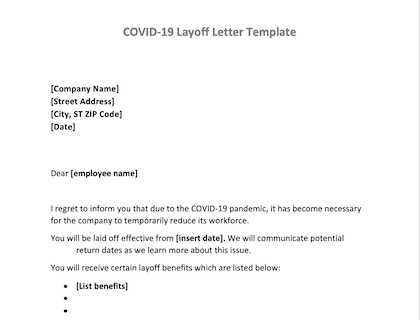

To write a hardship letter due to COVID-19, it’s important to be clear, honest, and provide relevant information to explain your current financial situation. Use the following template to structure your letter effectively:

1. Personal Information

- Include your full name, address, and contact information at the top of the letter.

- Provide details of the lender or company you’re addressing, including their name, address, and any specific department if known.

2. Opening Paragraph

- Begin with a clear statement of your situation, such as “I am writing to explain my current financial hardship due to the impact of COVID-19.” This sets the context for the rest of the letter.

- Be straightforward and specify any relevant dates, such as when you lost employment or had a significant reduction in income.

3. Explanation of Hardship

- Describe the specific ways COVID-19 has impacted your financial stability. For example, mention job loss, medical expenses, or other relevant circumstances.

- If applicable, explain any attempts you have made to resolve the situation, like applying for unemployment or assistance programs.

4. Financial Impact

- Provide concrete details on how your income has been affected. Mention your previous income and any current earnings if relevant.

- If possible, include a short-term plan for addressing the hardship, such as payment extensions or partial payments.

5. Request for Assistance

- Be clear about the help you are requesting. For example, “I request a temporary payment deferral” or “I would appreciate consideration for a payment reduction.”

- State your willingness to provide documentation to support your claims, such as medical bills or a termination letter from your employer.

6. Closing Statement

- End the letter by thanking the recipient for their consideration and expressing hope for a positive resolution.

- Sign the letter with your name and any necessary contact details.

Keep your tone polite and professional. Tailor the template to your specific circumstances for the best chance of success.

Begin by clearly identifying yourself. Include your full name, address, phone number, and email address. This allows the recipient to verify your identity and easily contact you if needed. Make sure this information is accurate and up-to-date.

Explain the Situation Briefly

Next, state the reason you are facing financial hardship. Be specific, but keep the explanation concise. For instance, mention if you lost your job, had a decrease in income, or incurred unexpected medical expenses due to COVID-19. Avoid excessive details–focus on the core issue.

Outline the Impact

Describe how your situation has affected your ability to meet financial obligations. Highlight how the pandemic has directly caused or worsened your financial challenges. Provide evidence of any loss of income, increased expenses, or job instability. This strengthens your case.

- Loss of employment or reduced work hours

- Increased medical or caregiving expenses

- Inability to access normal support systems

Lastly, express any steps you are currently taking to recover, such as applying for unemployment, seeking other work, or adjusting your budget. This shows that you are actively trying to improve your situation, which may help your case.

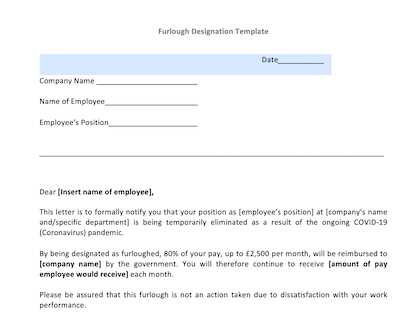

Be clear and direct about how COVID-19 disrupted your income sources. If you were laid off, had your working hours reduced, or experienced a decrease in business revenue, explain these changes with specific dates or periods. Mention any job losses, salary cuts, or business closures that directly impacted your financial stability.

Provide Financial Impact Details

Outline the specific financial struggles you’ve faced. Include any missed payments, increased debt, or inability to meet financial obligations due to reduced income. Provide concrete examples, such as missed rent payments or outstanding bills that accumulated because of job loss or business slowdown. Be honest about your current financial standing and how the pandemic exacerbated these issues.

Highlight Efforts to Overcome Challenges

Describe any steps you’ve taken to manage the situation. This could include finding alternative income sources, cutting non-essential expenses, or seeking government relief programs. Acknowledge your persistence in managing your finances during this challenging time. This not only paints a clearer picture of your situation but also shows your commitment to overcoming financial hardship.

Explaining Financial Struggles: Demonstrating the Impact on Income and Expenses

Clearly outline how COVID-19 has affected both income and expenses. Break down specific numbers to paint a clear picture of the financial situation.

- Income Losses: Describe any loss of income, such as reduced work hours, layoffs, or furloughs. Include percentage reductions or specific dollar amounts if possible. For example, “My income dropped by 40% due to a reduction in working hours and the inability to take on additional freelance projects.”

- Increased Expenses: Detail any unexpected expenses that have arisen due to the pandemic. This might include medical bills, childcare, or higher utility costs. Specify the dollar amounts or percentage increases where relevant. For instance, “I’ve seen a 30% increase in monthly grocery bills, totaling an extra $200 per month.”

- Debt Accumulation: If applicable, mention any new debt incurred as a result of the pandemic, such as using credit cards to cover living expenses. Mention any specific interest rates or loan amounts. Example: “I had to put $1,500 of essential expenses on my credit card, which has accrued $150 in interest so far.”

- Government Assistance: If you have received unemployment benefits, government aid, or relief payments, include this in the context of how it has helped but also how it may still fall short. For example, “While I’ve been receiving $600 per week in unemployment benefits, this has only covered 70% of my typical monthly expenses.”

By providing concrete numbers, you help build a stronger case for why you’re struggling financially due to COVID-19 and why you need assistance or consideration.

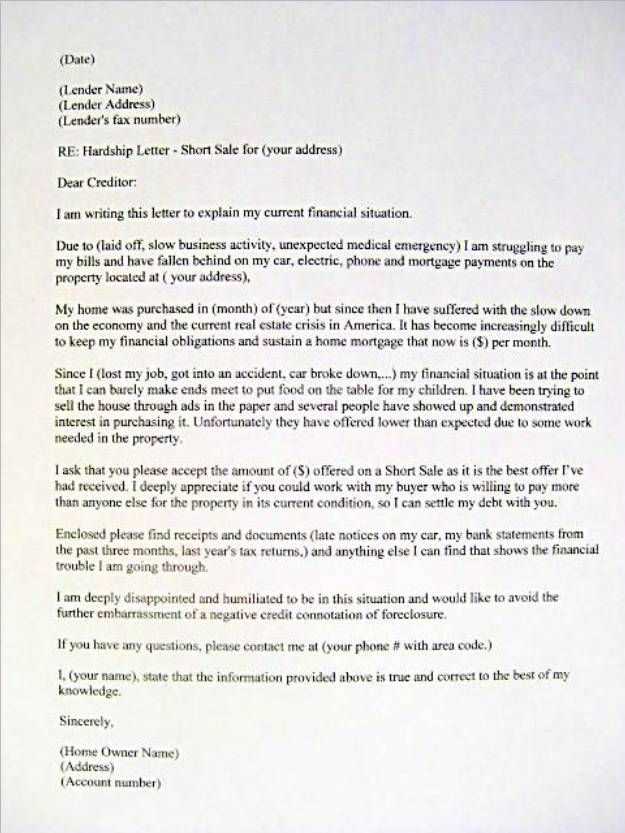

Include documents that clearly demonstrate the financial impact of COVID-19 on your situation. Start with proof of loss of income, such as pay stubs, unemployment benefit records, or a letter from your employer confirming job termination or furlough. These documents provide a clear picture of how your income was affected during the pandemic.

Provide copies of medical bills or statements if health issues related to COVID-19 have contributed to your financial difficulties. If you or a family member had to take time off due to illness, include doctor’s notes, medical records, or hospital bills to validate your claims.

If you had to reduce working hours, include your work schedule or payroll records that reflect the change. For those in self-employment, include tax returns, bank statements, or client contracts showing the reduction in business activity.

Also, provide any official communications from creditors or financial institutions showing deferred payments, loan modifications, or other adjustments made due to the pandemic. These documents will help support the claim that you have been actively addressing your financial struggles.

Finally, consider adding a personal statement or any additional evidence that could further clarify your situation, such as a letter from a social service agency or nonprofit that can verify your hardship due to COVID-19. This will strengthen your case by offering a well-rounded view of your financial standing.

Be direct and transparent about the challenges you’re facing. Clearly explain how COVID-19 has impacted your financial situation or ability to meet obligations. Use specific examples, such as job loss, reduction in hours, or medical issues that affected your income. Avoid vague statements; provide measurable details when possible.

Provide Documentation

Attach supporting documents that verify your situation. Bank statements, medical bills, or a layoff notice from your employer can reinforce the validity of your claim. This will give your letter more weight and credibility. Make sure the documents are up-to-date and relevant to the hardship you’re explaining.

Keep It Concise and Focused

Stick to the key points. Avoid lengthy explanations or unnecessary background information. A concise letter makes it easier for the reader to understand your situation and the assistance you’re requesting. Ensure the content flows logically, without straying from the main topic.

Be polite but firm in your request for help. State clearly what kind of assistance you are asking for, whether it’s a payment deferral, reduction, or another form of relief. Reaffirm your commitment to resolving the situation as soon as you are able.

Once you’ve sent your hardship letter, there are several key steps to anticipate. The recipient will review your request, typically within 7-14 business days, depending on their workload and the complexity of your situation.

Communication from the Lender or Organization

Expect to hear back via email, phone, or mail. The organization may request additional documentation to support your claim, such as medical bills, pay stubs, or unemployment verification. Be prepared to respond quickly to avoid delays in processing.

Decision or Alternative Solutions

If your hardship letter is approved, you’ll receive details about any modifications to your payment plan, interest rates, or terms. In some cases, the organization may offer alternative solutions, such as deferred payments or loan forbearance. If they deny your request, they will typically explain why and might offer options to appeal or renegotiate.

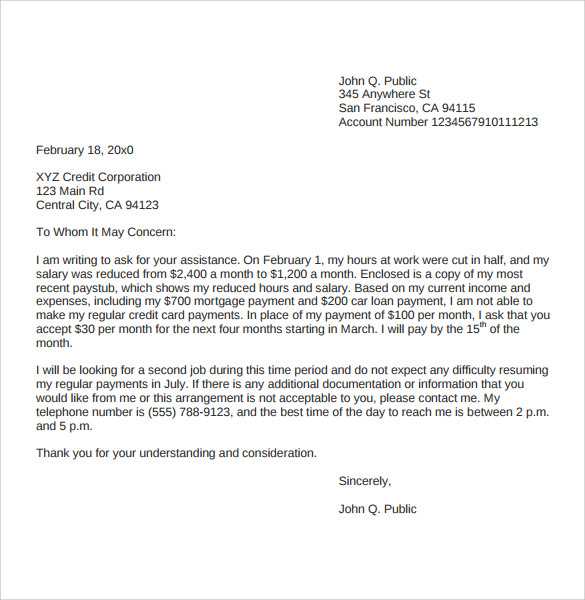

Hardship Letter Template Due to COVID-19

When writing a hardship letter due to COVID-19, be clear and direct. Explain how the pandemic has impacted your financial situation and any supporting details that will help your case. Here’s a basic structure to follow:

| Section | Details |

|---|---|

| Introduction | State your request and mention the hardship caused by COVID-19. For example, “I am writing to request a modification of my loan terms due to financial hardship caused by the COVID-19 pandemic.” |

| Impact on Employment | Describe any changes in your employment status, such as job loss, furloughs, or reduced hours. Be specific about dates and the nature of the changes. |

| Financial Details | Provide a summary of your current financial situation, including changes in income and any difficulty meeting financial obligations. Attach relevant documents, such as pay stubs, unemployment benefits, or a reduction in income. |

| Request | Clearly state the assistance you are requesting. For example, “I am requesting a payment deferral for the next three months,” or “I am seeking a reduction in the monthly payment.” |

| Conclusion | Express gratitude for their consideration and provide contact information for follow-up. Close with a professional statement like, “Thank you for your time and understanding.” |

Ensure that your letter is concise and includes all necessary supporting documents. This can increase your chances of a positive outcome. Always keep a copy of your letter for your records and follow up if you don’t receive a response within a reasonable time frame.