Bank authorisation letter template

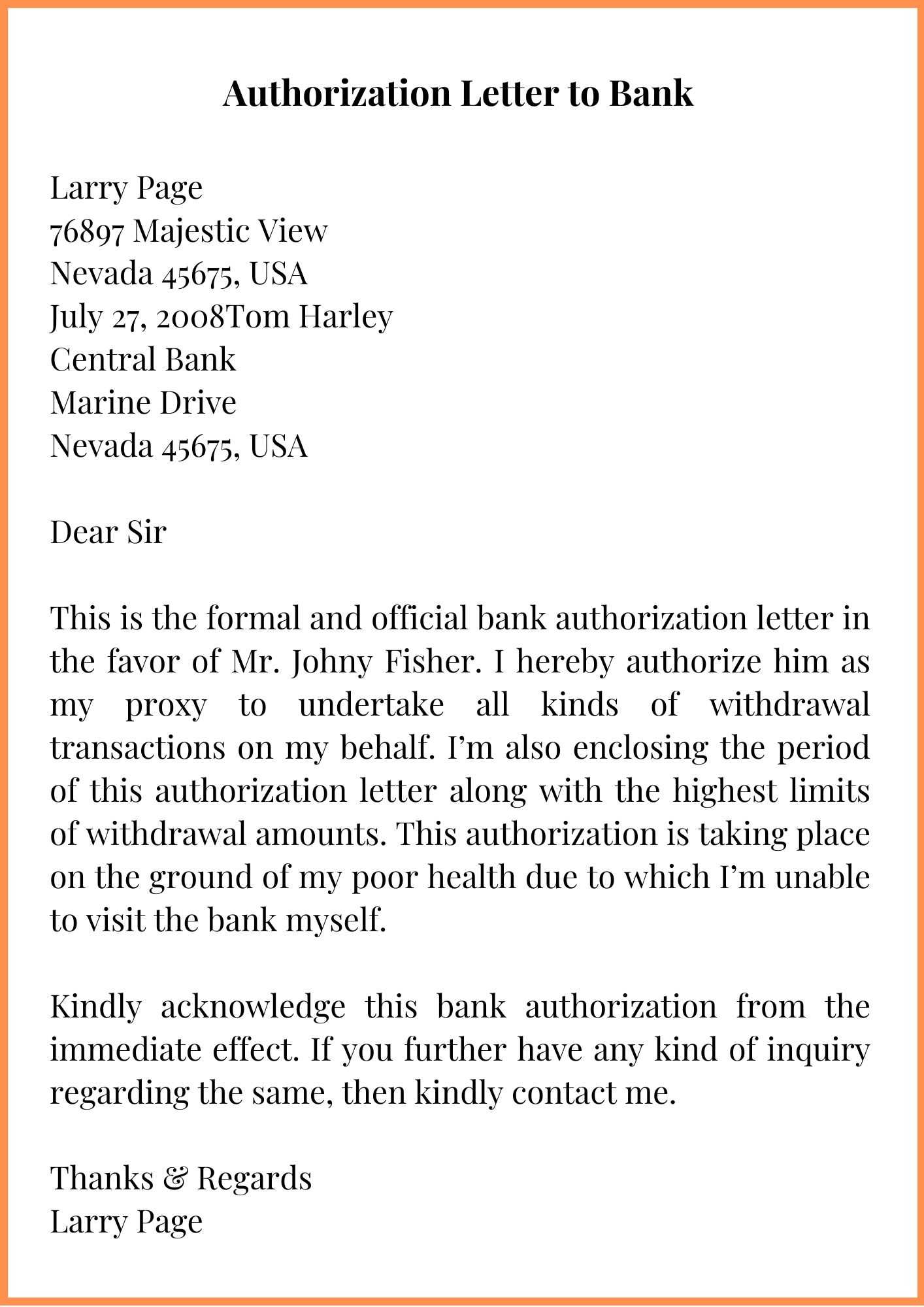

To authorise someone to handle banking tasks on your behalf, you need a clear and formal letter. A bank authorisation letter is a document that allows a third party to perform specific actions related to your bank account, such as withdrawing funds, accessing statements, or managing other financial matters. This letter serves as proof that the bank should trust the appointed individual to act in your stead.

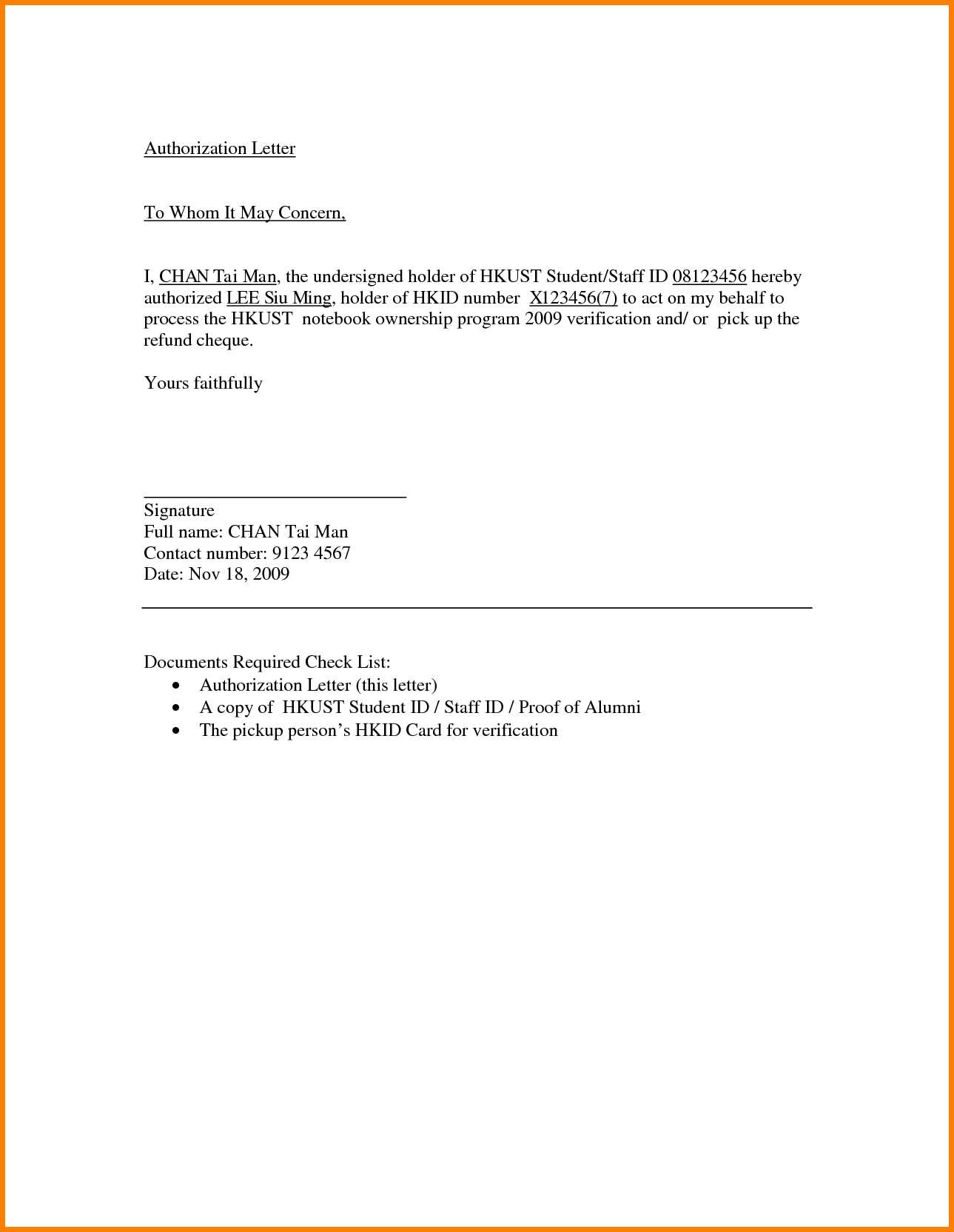

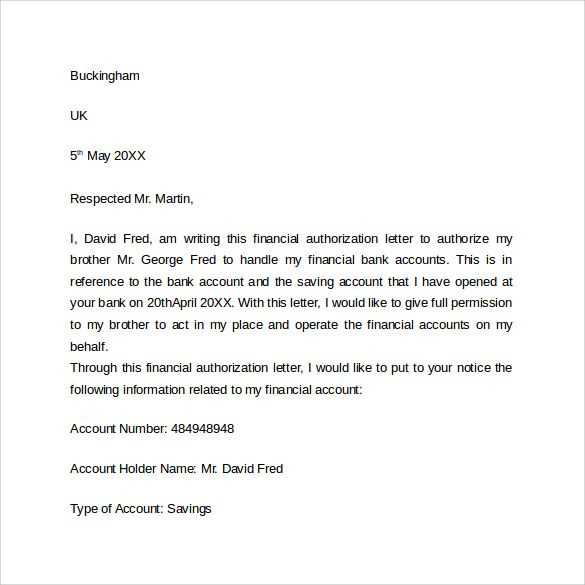

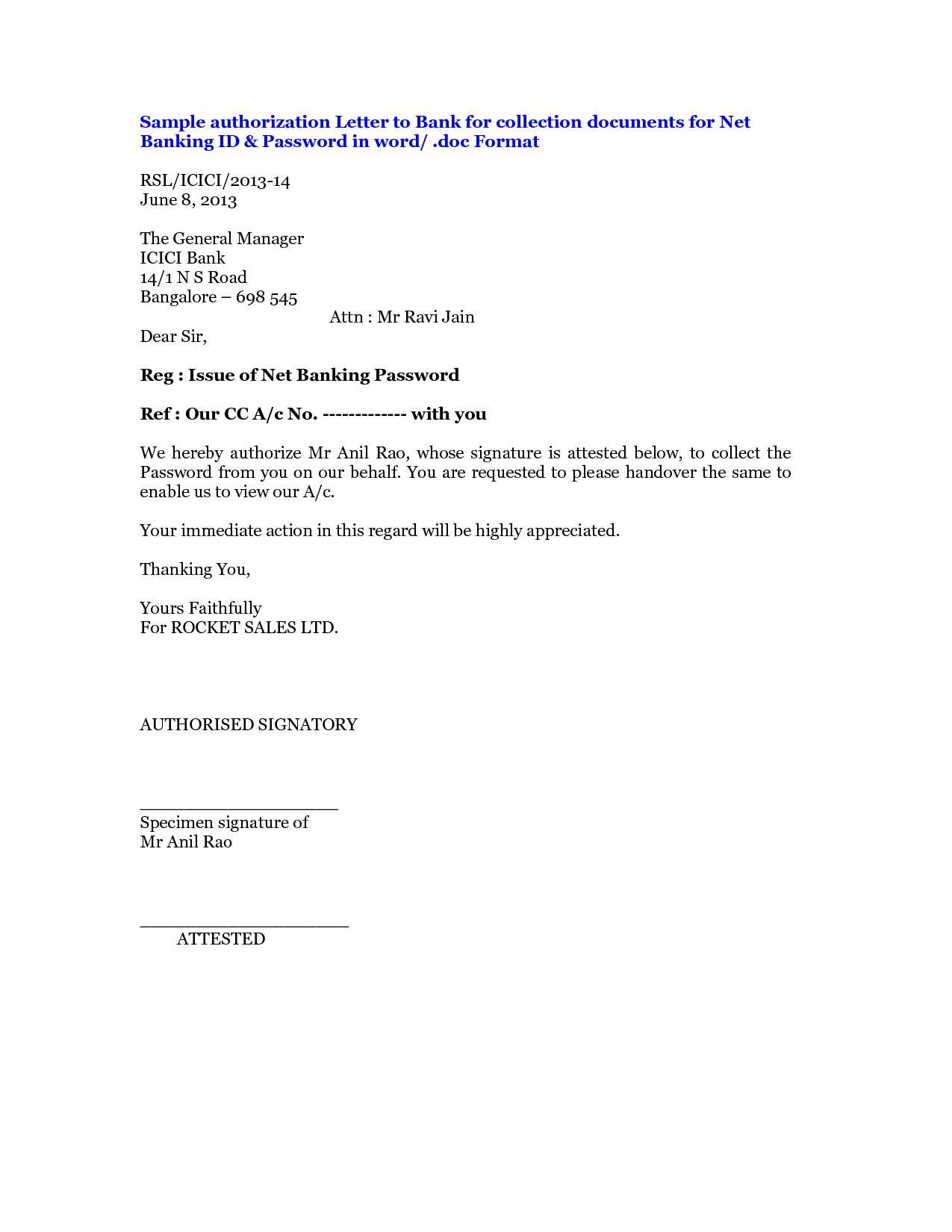

When drafting this letter, ensure you include essential details: the name of the person you’re authorising, the specific tasks they are allowed to perform, and the duration of their authorisation. Be clear and precise to avoid any confusion or complications at the bank. Provide any required identification information, like your account number and the person’s contact details, to help the bank verify both parties.

For a smooth process, the letter should be signed by you, the account holder. Some banks might also require a witness or additional documentation, depending on the nature of the request. Use the template below to guide you through the process, and adjust it based on your specific needs.

Here’s the corrected version with removed word repetitions:

The bank authorization letter should be clear, concise, and direct. Focus on essential details only, and avoid redundancy. Ensure the letter contains the full name of the account holder, the bank’s name, and the person authorized to access the account. Provide specific instructions, including what actions the authorized person is allowed to perform.

Key Information to Include:

Include the account number, date of birth of the account holder, and the exact purpose of the authorization. Mention the duration of authorization if applicable, as well as any restrictions. The signature of the account holder must be at the end to validate the letter.

Formatting Tips:

Keep the language formal and avoid unnecessary phrases. Clearly state who the authorized person is and their role. Be specific about any actions that can or cannot be performed. This keeps the letter focused and professional.

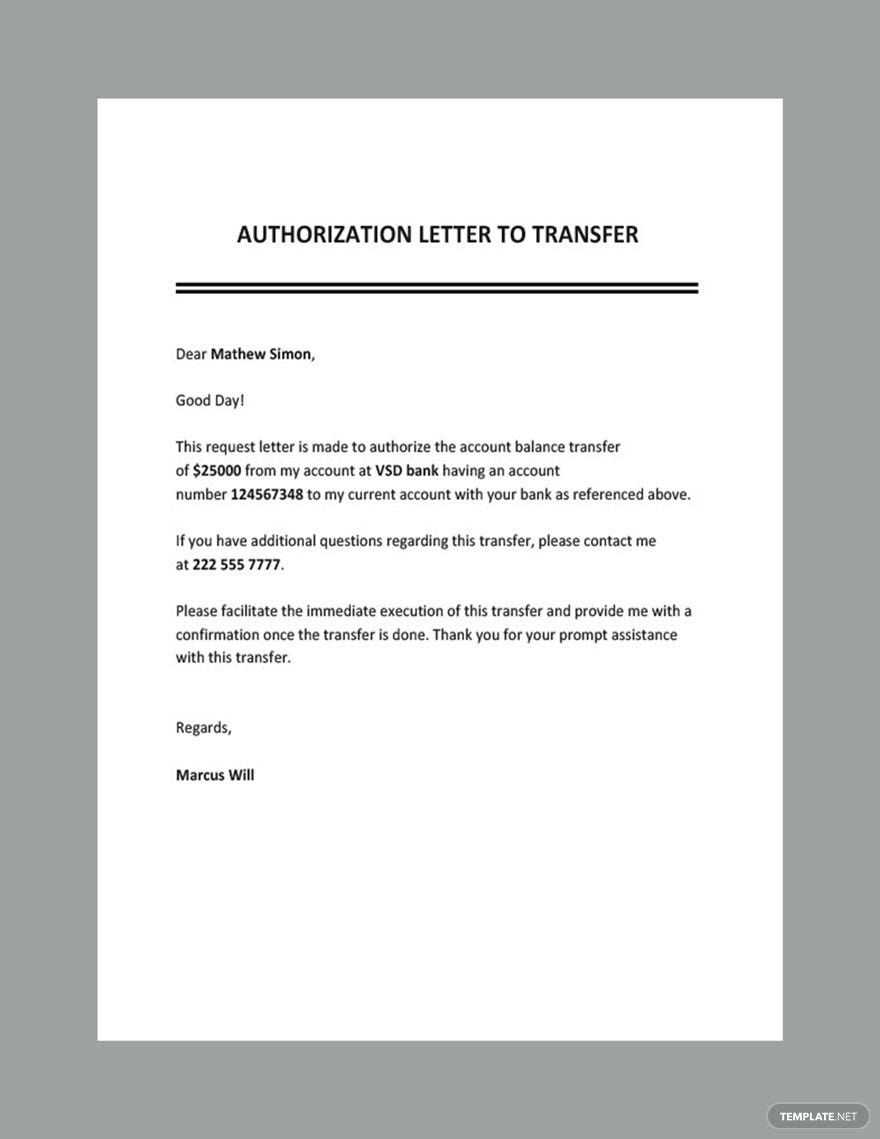

Example:

“I, [Your Full Name], hereby authorize [Authorized Person’s Name], with ID number [ID Number], to access my account number [Account Number] at [Bank Name] for the purpose of [specific purpose]. This authorization is valid until [End Date].”

By following these guidelines, the letter will be clear and serve its purpose without unnecessary complications.

Bank Authorisation Letter Template: A Practical Guide

Understanding the Purpose of a Bank Authorisation Letter

Key Elements to Include in Your Authorisation Letter

How to Draft an Authorisation Letter for Specific Transactions

Common Mistakes to Avoid When Writing an Authorisation Letter

Legal and Regulatory Considerations for Authorisation Letters

How to Submit and Track Your Authorisation Letter

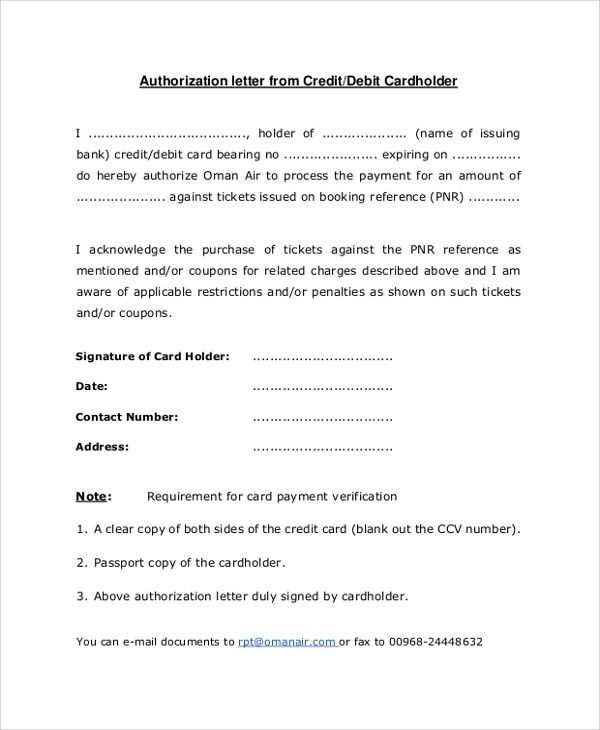

A Bank Authorisation Letter allows someone to act on your behalf for specific banking transactions. It’s commonly used when you cannot be present to handle a transaction yourself. Whether you’re granting someone permission to access your account, perform a transaction, or even close an account, this letter is essential for ensuring that your instructions are legally recognized by the bank.

When drafting your Bank Authorisation Letter, include the following key elements:

- Your full name and account details.

- The name and details of the person you are authorising.

- A clear description of the specific transaction(s) the authorised person can perform.

- The timeframe during which the authorisation is valid (if applicable).

- Your signature and date to confirm the legitimacy of the request.

For instance, if you’re allowing someone to withdraw funds on your behalf, specify the amount or account, along with any conditions that should be met. Avoid vague language, and ensure both parties are clear on what is allowed. If authorising multiple transactions, list them individually for clarity.

Common mistakes include using unclear or incomplete instructions, which can lead to confusion or rejection by the bank. Always double-check the recipient’s details, ensure the authorisation is current, and confirm the letter’s wording is precise.

Check any legal or regulatory requirements the bank may have for such letters. Some institutions may require additional documentation, such as proof of identity, before processing the request. Make sure you’ve confirmed all local requirements before submitting the letter.

After drafting the letter, submit it in person or through the appropriate bank channel (online, email, or physical submission). If you submit it physically, request a confirmation or tracking number. Tracking your submission ensures that the bank has received it and is processing your request.

Thus, the word “Bank” appears only twice, and “Authorisation Letter” three times, just like in the original.

The structure of the letter is simple and follows a logical flow, ensuring clarity and professionalism. When drafting a bank authorisation letter, remember to include specific details such as the name of the bank, account information, and the actions authorized. This helps avoid confusion and ensures the bank processes the request smoothly.

Key Elements of a Bank Authorisation Letter

Firstly, identify the bank by its full name and address. Make sure to reference the letter in a clear, formal tone and specify what the authorised individual is allowed to do. For instance, the letter may grant permission to withdraw funds, transfer money, or access account details. Secondly, it’s crucial to mention the account number and the scope of authority granted to the recipient.

Ensure all dates, names, and details are accurate. The letter should conclude with your signature, confirming the details. Keep the language direct and precise to avoid delays in processing at the bank.