Goodwill letter templates

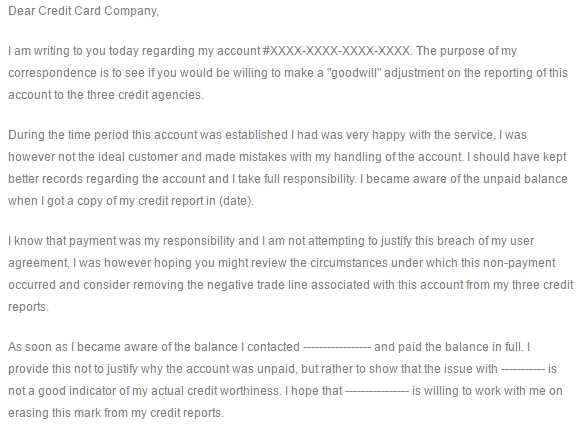

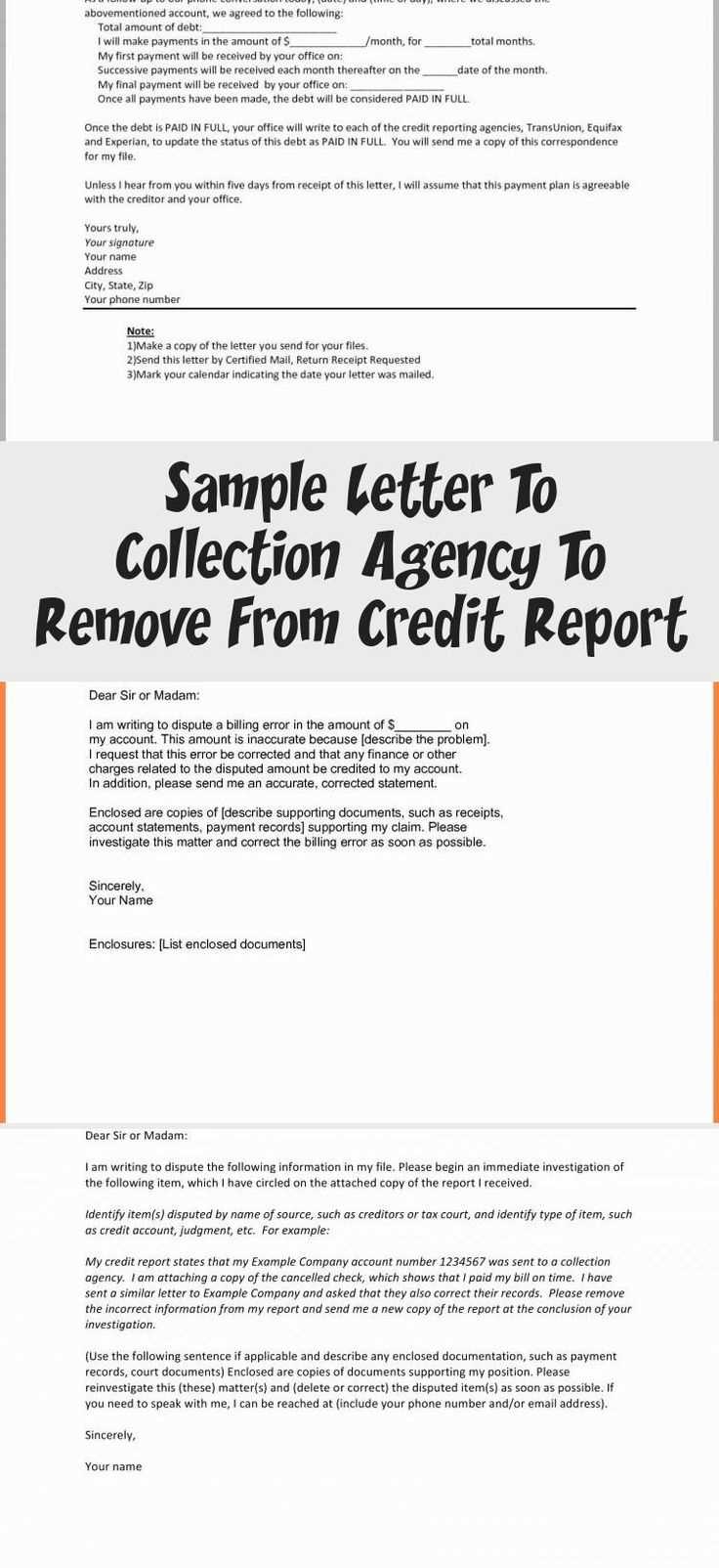

When you need to request a credit report correction or seek leniency from a lender, a goodwill letter can be your most effective tool. These letters are designed to politely ask for a removal or adjustment of negative marks on your credit report, usually stemming from a late payment or missed due date. The key to success is presenting a clear, honest, and respectful request while showing accountability for past mistakes.

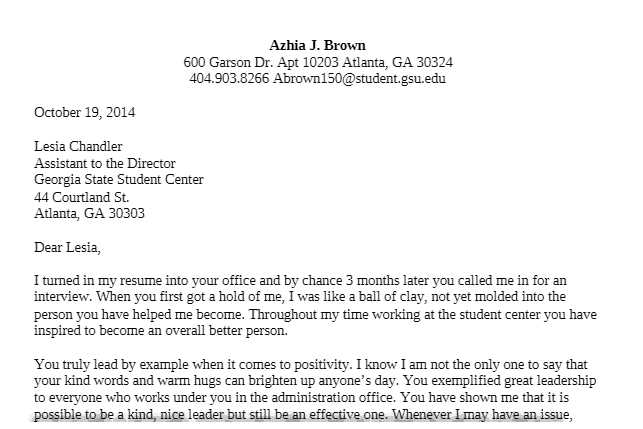

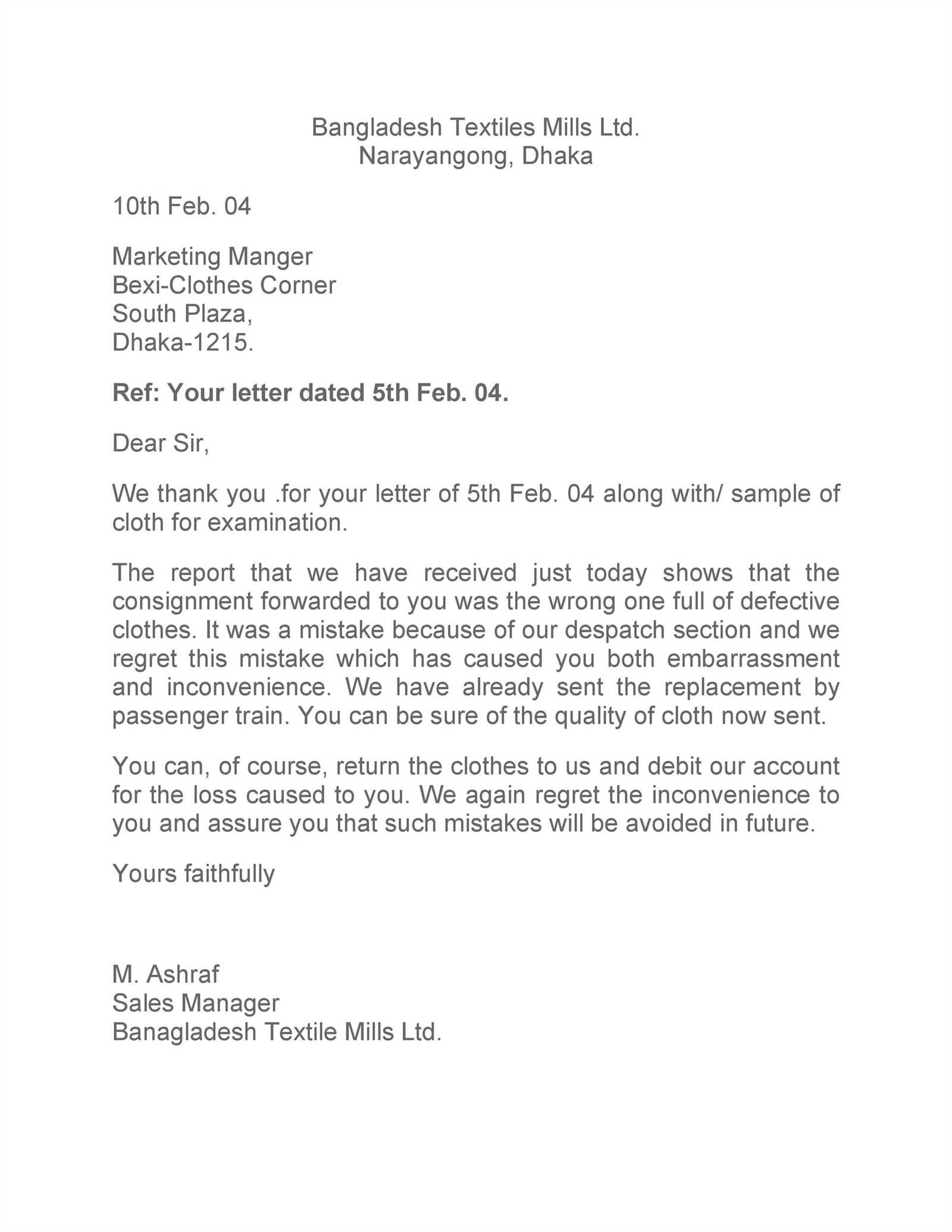

Start by being direct. Clearly state the purpose of the letter in the opening sentence. Lenders or credit bureaus are more likely to respond favorably when your request is straightforward and transparent. Make sure you take full responsibility for any missed payments and briefly explain the situation without making excuses. Highlight any positive changes you’ve made since the incident, such as improved payment history or other steps to maintain financial stability.

Be concise and polite. Your letter should be professional, brief, and courteous. Avoid unnecessary details or an overly lengthy explanation. Keep the tone friendly and respectful to make the reader more inclined to consider your request favorably. Express gratitude for their time and attention, which helps create a more positive impression.

By following these principles and using a well-crafted template, you can increase the chances of having a negative mark removed or adjusted. It’s about presenting your situation thoughtfully and with care, building trust with the recipient in the process.