Repayment plan template letter

To create a repayment plan, first, outline the details of your current financial situation. Include the total amount owed, the payment schedule, and any changes to your monthly payment that might be required. This letter should convey a clear commitment to pay the debt and request an adjustment if necessary.

Begin by addressing the recipient directly, stating the purpose of the letter, and offering a detailed explanation of the reasons for the proposed changes. Specify your ability to adhere to the new repayment terms, providing a realistic plan based on your current financial status.

Next, highlight any supporting information that may help your case, such as a recent pay cut or unexpected expenses, that justifies the request for a modified plan. Be transparent but concise–keep the letter professional yet personal, showing your intention to resolve the issue responsibly.

End the letter with a positive tone, expressing your desire to cooperate and reach a mutually agreeable solution. Include your contact information and be open to discussing the terms further to ensure both parties are satisfied with the repayment arrangement.

Here’s a revised HTML plan for an informational article titled “Repayment Plan Template Letter” with six practical headings, each addressing specific aspects of the topic:

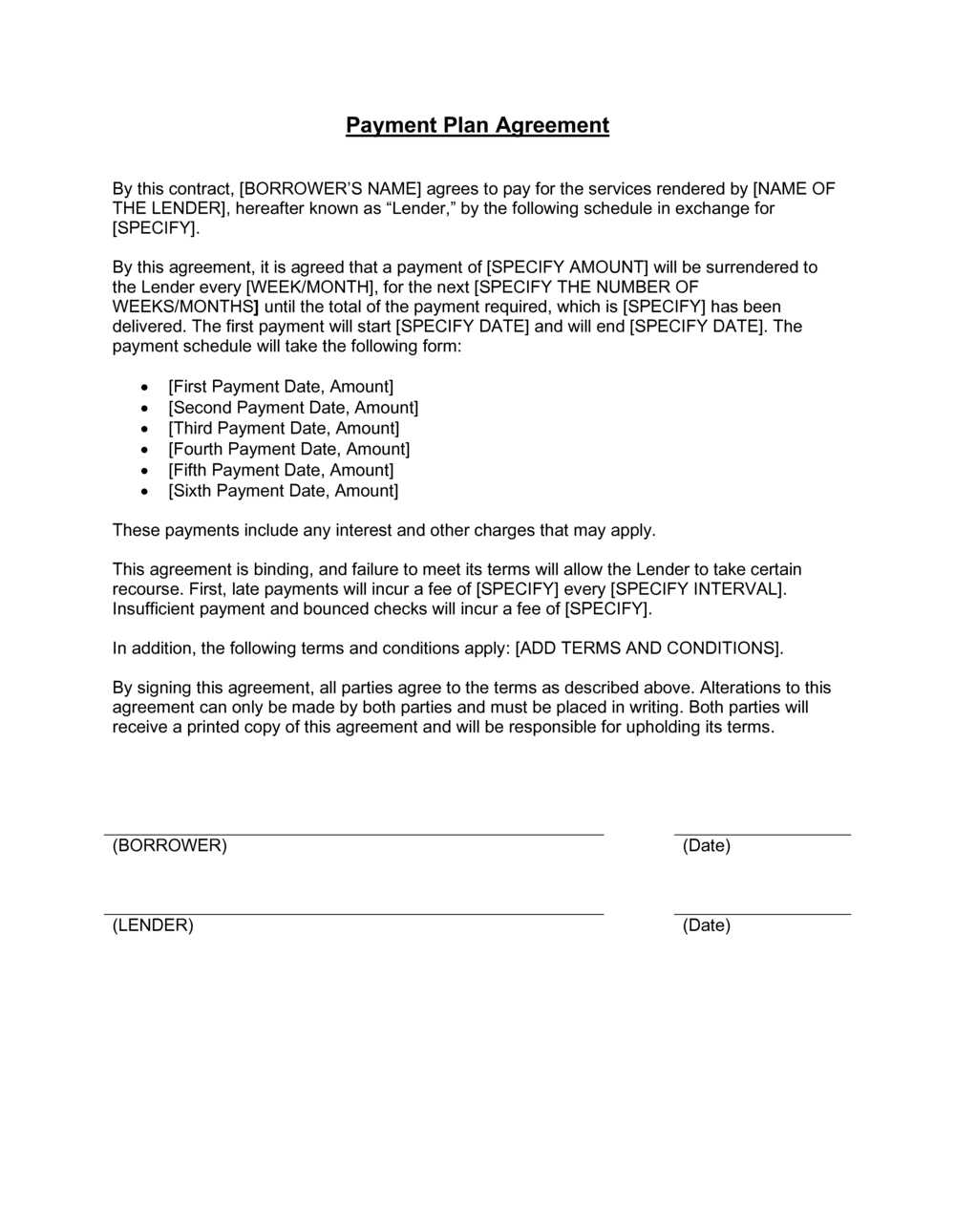

1. How to Structure a Repayment Plan Letter

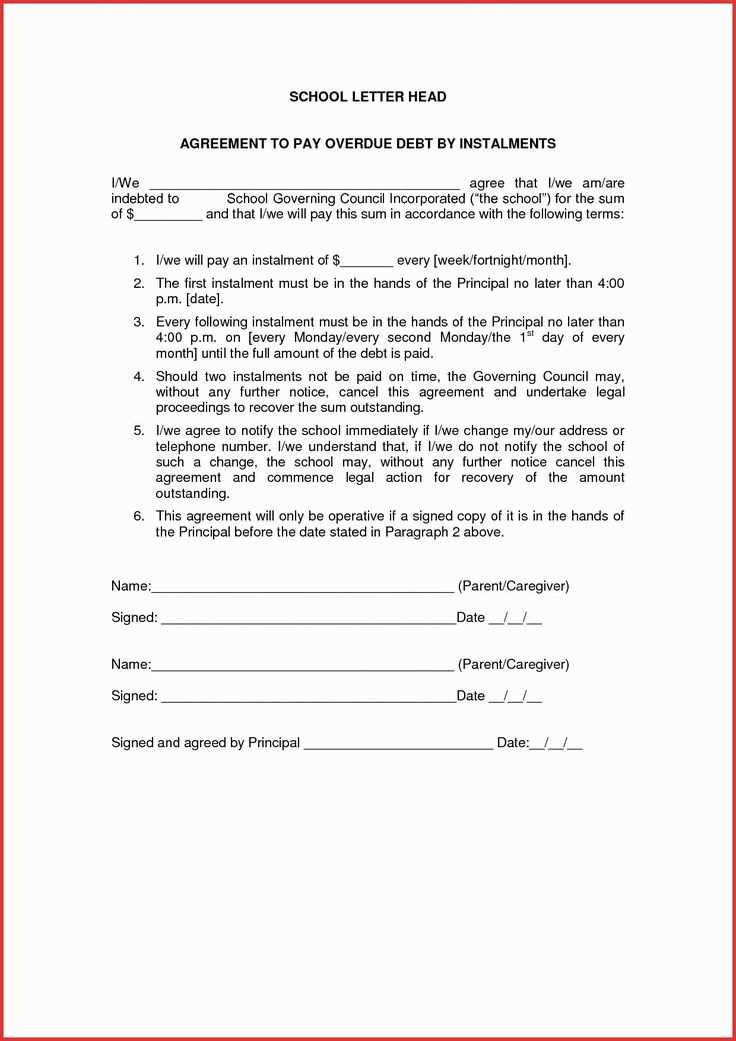

Start by addressing the recipient formally. Clearly state the amount owed and explain the reason for the repayment request. Mention the proposed repayment amount and the time frame for each payment. Ensure your tone is respectful and cooperative, aiming for a mutually agreeable resolution.

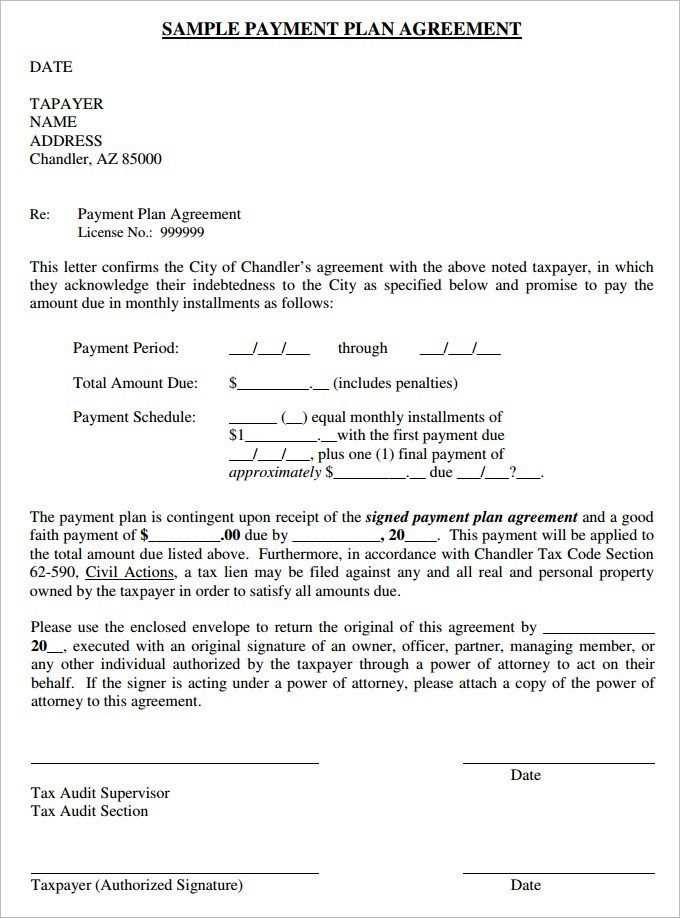

2. Key Details to Include in Your Repayment Plan

Include full names, contact information, account numbers, and the total debt amount. Mention any previous communications related to the debt and how you plan to address it. Transparency helps in creating trust with the recipient.

3. How to Calculate Repayment Amounts

To calculate monthly payments, consider your financial capacity. Include a breakdown of how long it will take to pay off the debt based on your current financial situation. Use realistic numbers that ensure timely repayment without overburdening your finances.

4. Negotiating the Repayment Terms

If the suggested plan doesn’t suit the recipient, be open to negotiations. Propose flexible terms, such as adjusting the payment dates or reducing the total amount in case of financial hardship. A willingness to discuss can lead to a positive outcome.

5. Legal Considerations in a Repayment Plan

Make sure the repayment agreement is clear and legally binding. If necessary, consult a legal professional to ensure that both parties’ rights are protected and the terms are enforceable under the law.

6. Final Steps: Sending the Repayment Plan

Once the plan is agreed upon, send the letter via certified mail or another traceable method. This way, both parties have a record of the agreement. Retain a copy for your own reference and ensure follow-up communications are kept professional and courteous.

- How to Write a Clear Repayment Proposal

Begin by specifying the total amount owed. Clearly state the full debt figure and include any relevant details, such as interest rates or additional fees. This ensures transparency and sets a solid foundation for the repayment terms.

Outline Repayment Terms

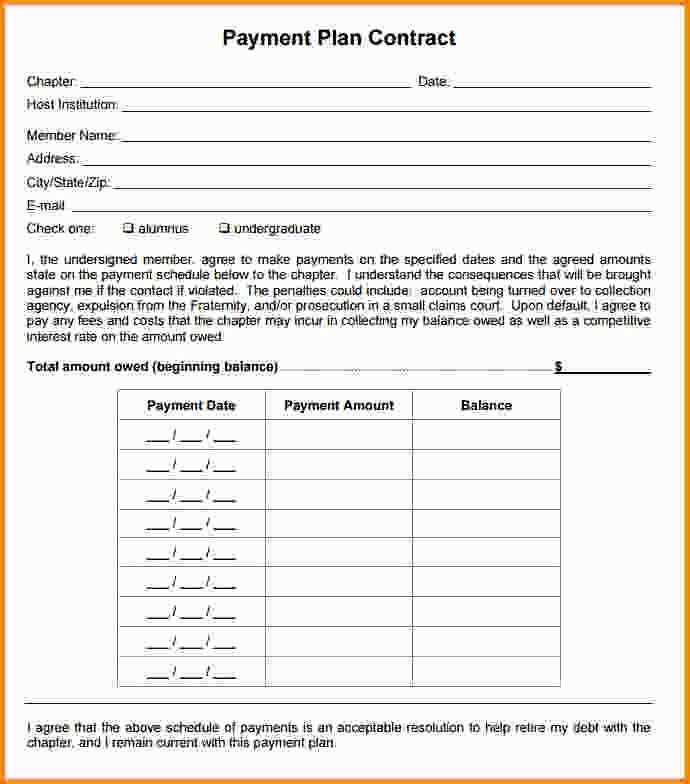

Set a realistic repayment schedule. Divide the total amount into manageable installments, whether weekly, bi-weekly, or monthly. Be specific about the payment amounts and the due dates to avoid misunderstandings.

Provide Payment Methods

Include the accepted payment methods, such as bank transfers, checks, or online payment platforms. Mention any preferred details like account numbers or reference codes, ensuring the process is clear for both parties.

Clarify consequences in case of missed payments. Outline how you plan to handle delayed or missed payments, whether it involves renegotiating terms or adding late fees. This helps maintain accountability while offering a sense of structure.

Finish by inviting feedback. Let the recipient know you’re open to discussing the terms further if needed. This shows flexibility while keeping the process straightforward.

Be clear and precise in outlining the amount you owe and how you plan to repay it. Specify the total debt, any interest or fees, and the expected repayment period. Break the total amount into smaller, manageable payments that fit your financial situation.

Payment Schedule

List the specific dates for each payment. This helps you stay on track and shows commitment to your repayment schedule. Include the payment method you plan to use for each installment, whether it’s via bank transfer, check, or another method.

Communication Plan

Clarify how often you will communicate with the creditor. Include a statement regarding updates in case of changes to your financial situation. This keeps transparency open and shows you’re proactive in managing your obligations.

Address any potential concerns that may arise. If possible, offer additional details such as your current income, expenses, or any other commitments that affect your ability to repay. This will build trust with the creditor and demonstrate your responsibility.

Common Mistakes to Avoid in Repayment Letters

Be clear and concise. Avoid vague language or overcomplicated explanations. A repayment letter must clearly state the terms of repayment without leaving room for confusion.

1. Failing to Include Payment Details

Always specify the amount to be repaid, the schedule, and any interest rates if applicable. This information should be unambiguous to prevent future misunderstandings.

2. Ignoring the Tone of the Letter

A repayment letter should maintain a respectful and professional tone. Avoid using language that could be interpreted as aggressive, dismissive, or confrontational.

3. Not Acknowledging the Debt

Do not overlook the importance of acknowledging the debt in the letter. Clearly state the amount owed and confirm your intention to settle the debt as agreed.

4. Providing Incomplete Information

Make sure you provide all necessary contact information and include any relevant account numbers or reference numbers. Missing information can delay the process.

5. Not Offering Flexibility

If circumstances change, don’t hesitate to offer a revised payment plan. Flexibility helps build trust and can lead to better outcomes for both parties.

6. Omitting a Closing Statement

Always conclude with a clear closing statement, such as “Thank you for your understanding” or “I look forward to resolving this matter.” This ensures the letter ends on a polite and positive note.

Send a repayment letter as soon as you realize you won’t be able to make a payment on time. Addressing the situation early helps maintain good communication with creditors and shows your willingness to resolve the issue. Avoid waiting until the due date has passed to show responsibility for your financial obligations.

Before the Due Date

If you foresee any challenges in meeting a payment deadline, send a letter ahead of time. This gives the recipient ample notice to review and consider your proposed plan. It sets a positive tone for collaboration and demonstrates proactive financial management.

After Missing a Payment

If you miss a payment, send the letter as soon as possible. Acknowledge the missed payment, explain the situation briefly, and offer a clear repayment plan. Waiting too long can negatively impact your credit or strain the relationship with the creditor.

| Timing | Action | Effectiveness |

|---|---|---|

| Before Due Date | Inform about potential delay | Shows responsibility, keeps trust |

| After Missed Payment | Apologize and propose repayment plan | Helps prevent penalties, builds goodwill |

First, assess your financial situation accurately. Understand how much you can realistically pay each month without stretching your budget too thin. This will prevent defaulting on payments and keep the repayment plan manageable.

Adjust the Payment Amount

When determining your monthly payment, factor in your income and essential expenses. Adjusting the payment amount ensures it aligns with your financial capacity. If necessary, ask the lender to extend the repayment period, which could lower your monthly obligation.

Set a Payment Schedule

Choose a payment schedule that fits your cash flow, whether it’s weekly, bi-weekly, or monthly. Make sure it works with your income cycle. Consistent payments can also help you avoid late fees and penalties.

Consider discussing with your lender if you expect temporary financial difficulty. They may allow for a temporary adjustment or deferment. Customizing the repayment plan provides flexibility while maintaining a clear path to full repayment.

Send a polite, clear follow-up message a week or two after submitting your proposal. This shows you’re serious about the repayment plan while respecting their time.

- Be specific: Mention the exact date you sent the proposal and ask if they had the chance to review it.

- Express understanding: Acknowledge that they may need time to consider the proposal and show your patience.

- Reaffirm your commitment: Highlight that you’re still open to discussing any adjustments or questions they may have.

- Set a clear next step: Propose a date for a follow-up call or meeting to discuss any feedback they may have.

- Stay professional: Keep the tone friendly and professional, avoiding any sense of pressure or frustration.

These simple actions will help keep the conversation moving forward while maintaining a positive relationship with the recipient.

Make sure to clearly state your financial situation and ability to make repayments. Include specific amounts, due dates, and any adjustments needed based on current income. Mention any special circumstances that may affect repayment, like temporary hardships, and provide a detailed breakdown of payments.

Keep the tone polite but firm, and avoid vague statements. Show your commitment to repaying the debt by outlining a realistic timeline for completion. Confirm that you are open to discussion if adjustments are necessary, but provide a clear plan that demonstrates you understand the seriousness of the agreement.

End the letter with a willingness to cooperate, making sure to include your contact information for further communication. Double-check all figures and dates to ensure accuracy before sending.