Money gift letter for mortgage template

A money gift letter for a mortgage is a crucial document that confirms a monetary contribution toward a home purchase. If someone is gifting you money to help with your down payment or closing costs, having a clear, properly written letter is vital for the lender to approve the transaction. This letter assures the lender that the money is a gift and not a loan, which could affect your ability to repay the mortgage.

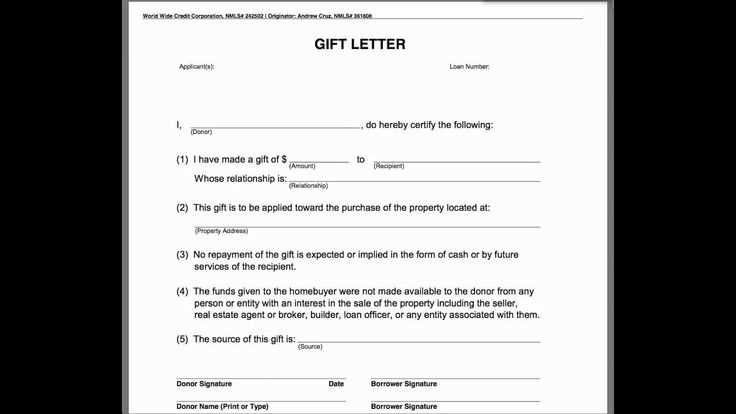

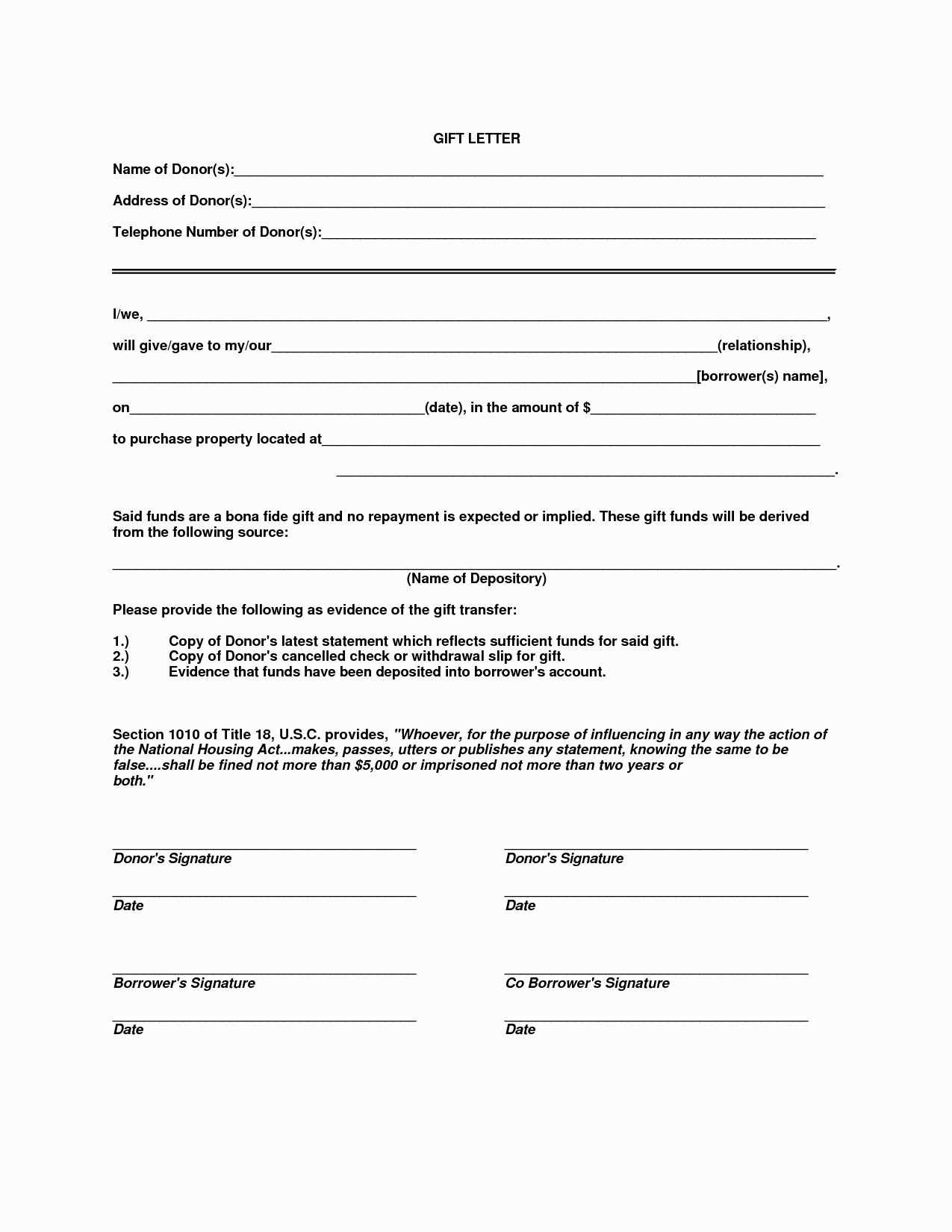

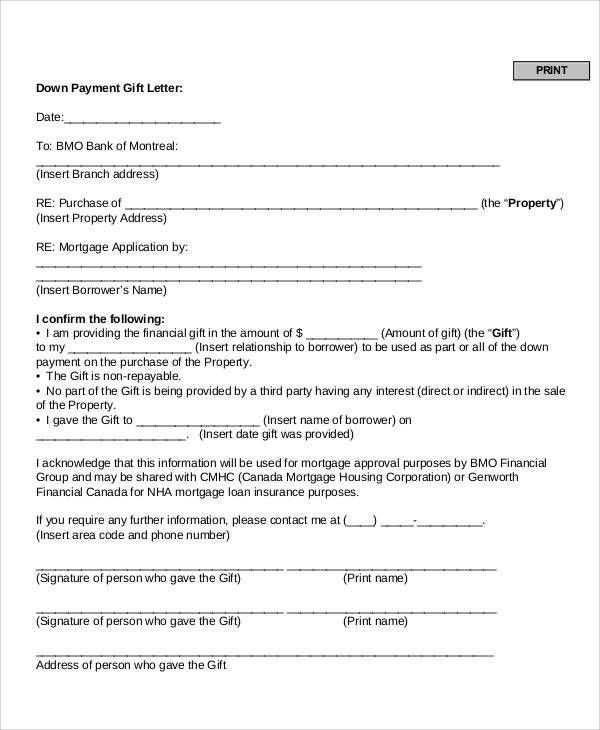

The template for such a letter should include several key components. First, the letter must clearly state the amount of money being gifted. It should also identify the relationship between the giver and the recipient, as lenders prefer to see a connection between the two parties. Make sure to include a statement that the money is a gift and that there is no expectation of repayment. The letter must also include the date, the full names of both parties, and the giver’s contact information for verification purposes.

Additionally, the giver might need to provide proof of their ability to give the gift, like a bank statement or other financial documents. Be sure to double-check with your lender for any specific requirements they may have regarding the gift letter. Crafting a detailed and accurate gift letter helps prevent delays in the mortgage approval process and ensures that both the recipient and the giver meet the necessary conditions for a smooth transaction.

Here is the revised version with minimized repetitions:

To simplify the process of writing a money gift letter for a mortgage, follow these key steps:

- Clearly state the donor’s name, address, and relationship to the borrower.

- Specify the amount being gifted and affirm that it is not a loan and does not need to be repaid.

- Explain the reason for the gift, including any relevant context (e.g., support for the down payment).

- Include the date of the gift and any applicable documentation or proof of the transfer.

- Ensure that both parties sign the letter, confirming the details provided.

Each of these elements will ensure that the letter meets the requirements for mortgage lenders, helping to avoid delays or confusion during the application process.

- Money Gift Letter for Mortgage Template

A Money Gift Letter is an official document that confirms a gift has been made to help a homebuyer with their mortgage down payment. Lenders require this letter to ensure the funds are not a loan and do not need to be repaid. Here’s a simple template to use when creating your Money Gift Letter:

Template for Money Gift Letter

Below is a sample structure for a Money Gift Letter that meets the requirements of most lenders:

| Section | Details |

|---|---|

| Donor Information | Name, address, and relationship to the borrower. |

| Recipient Information | Name of the person receiving the gift and their address. |

| Gift Amount | Exact amount being gifted for the down payment. |

| Statement of No Repayment | Explicitly state that the gift is non-repayable. |

| Source of Funds | Detail the source of the funds (e.g., savings, sale of assets). |

| Signature | Both the donor and recipient must sign the letter to verify the accuracy of the information. |

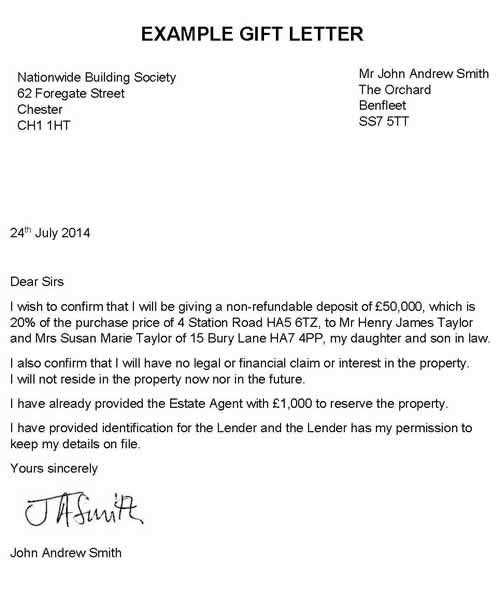

Example of Money Gift Letter

Here is a simple example of what the completed letter could look like:

[Donor’s Name] [Donor’s Address] [City, State, ZIP Code] [Date] [Recipient’s Name] [Recipient’s Address] [City, State, ZIP Code] Dear [Lender’s Name or “To Whom It May Concern”], I, [Donor’s Name], residing at [Donor’s Address], hereby confirm that I have gifted the sum of $[Amount] to my [Relationship to Borrower], [Recipient’s Name], to assist with the down payment for the home purchase located at [Property Address]. This gift is made freely and is not expected to be repaid. The source of these funds is [Source of Funds, e.g., personal savings, sale of property, etc.]. I affirm that this is a genuine gift with no obligation for repayment. Sincerely, [Donor’s Name] [Donor’s Signature] [Recipient’s Name] [Recipient’s Signature]

By following this template, you can create a clear and concise Money Gift Letter that will meet your lender’s requirements. Be sure to check with the lender for any additional details they may require before submission.

A Money Gift Letter is a written statement confirming that a monetary gift, typically from a relative or close friend, is not a loan and does not need to be repaid. This letter assures the lender that the funds used for the down payment on a home purchase are a gift, not borrowed money. It helps prevent any misunderstanding or misrepresentation of the borrower’s financial situation.

The letter is required by lenders because they need to verify the source of all funds used in the mortgage process. When a borrower uses gifted money, especially for a down payment, lenders want to ensure that the gift doesn’t come with any strings attached. If the funds were a loan, it could increase the borrower’s debt-to-income ratio, affecting their ability to repay the mortgage. The Money Gift Letter clarifies this potential risk and protects both the borrower and lender from financial surprises.

To ensure the letter is valid, it must include specific information: the donor’s name, address, relationship to the borrower, the exact amount of the gift, and a statement confirming that the funds are a gift and do not need to be repaid. The donor may also need to provide proof of the funds’ source.

Writing a money gift letter is a straightforward process that helps clarify the source and intent of funds provided to you for a mortgage application. This letter assures your lender that the money is a gift, not a loan, and that it won’t require repayment.

1. Begin with Basic Information

Start by including the full name, address, and relationship of the person giving the gift. Also, include the donor’s contact information and the date when the gift was provided. This ensures that the lender has all necessary details about the giver.

2. Clearly State the Amount

Specify the exact amount of money being gifted. This detail should be clear and unambiguous to avoid confusion during the loan process. Mention if it was given in a lump sum or over a series of payments.

3. State the Nature of the Gift

Clearly confirm that the money is a gift and that there is no expectation of repayment. If applicable, state that the gift is unconditional. This declaration prevents the lender from thinking the funds are a loan disguised as a gift.

4. Add Your Signature and the Donor’s Signature

Both you and the person gifting the money should sign the letter. It’s essential to show that both parties acknowledge the gift and its terms.

Make sure to review the letter for clarity and accuracy before submitting it with your mortgage application. This simple but essential document helps move your loan application forward with confidence.

Clearly state the relationship between the giver and the recipient. This ensures that the lender knows the nature of the gift and that it is not a loan. Include details such as the names of both the giver and the recipient, and how they are related (e.g., parent, sibling, friend).

Specify the amount of money being gifted. List the exact sum in both numeric and written formats to avoid any confusion. This will give the lender a clear understanding of the value of the gift.

Explain that the money is a gift, not a loan. The letter should explicitly state that the gift does not need to be repaid, as loans can affect mortgage eligibility. This clarification helps the lender determine that the funds won’t have any repayment obligations attached.

Include the date the gift was given. This helps lenders verify the timing of the funds and ensures they align with the mortgage application process. If the gift was made recently, it will give the lender confidence that the money is available for the down payment.

Provide the giver’s contact information. Including phone number and address gives the lender a way to contact the gift giver for further verification, if necessary.

If applicable, the giver can mention their financial standing. While not always required, this information can add reassurance that the giver is in a stable financial position to make such a gift without jeopardizing their own finances.

Finally, ensure the letter is signed by the giver. The signature validates the authenticity of the document and confirms that all the information provided is accurate and truthful.

Start with a clear statement that the gift is non-repayable. Avoid ambiguous wording that could imply the gift is a loan. For instance, saying “I expect repayment” can confuse lenders, as it contradicts the purpose of a gift letter.

Missing or Incorrect Donor Information

Ensure you include the donor’s full name, address, and relationship to the borrower. Without this information, lenders may not accept the letter. Avoid abbreviations or incomplete details that could delay approval.

Failure to Specify the Gift Amount

Always state the exact amount of the gift clearly. Do not use vague phrases like “around” or “about.” Be specific to avoid any misunderstanding or questions from the lender.

Another common mistake is omitting the date the gift was given or is intended to be given. This information is essential for lenders to track when the transaction occurred.

Include all necessary details in the money gift letter. Lenders typically request specific information to verify the legitimacy of the gift and its source. At a minimum, the letter should include the donor’s name, address, relationship to the borrower, the exact amount of the gift, and a statement that the gift is non-repayable.

Clearly State the Non-Repayment Condition

Make sure the letter specifies that the gift is not a loan and does not require repayment. Lenders want to avoid any confusion regarding the source of funds and potential future obligations. The donor should clearly state this in the letter to avoid delays or rejections.

Include Source of Funds

Many lenders will ask the donor to verify the source of the gifted money. To meet this requirement, the donor should include information about where the funds are coming from, such as savings, sale of assets, or inheritance. This may involve providing additional documentation like bank statements or proof of asset sales.

Provide a clear, signed letter from the donor, as many lenders require signatures for verification. Always follow lender guidelines to ensure the letter meets all their criteria and avoid any issues during the mortgage approval process.

For a smooth mortgage approval process, lenders often require a money gift letter to verify that the funds used for the down payment are a gift, not a loan. Below is a sample template to help you draft this letter correctly:

- Donor’s Name and Contact Information: The letter should start with the full name, address, and phone number of the person giving the gift.

- Recipient’s Name: Clearly state the full name of the borrower receiving the gift.

- Gift Amount: Specify the exact amount of money being gifted, in both words and numbers, to avoid any confusion.

- Statement of Gift: Explicitly state that the money is a gift and not a loan that needs to be repaid. Include a phrase like, “This is a gift, and no repayment is expected or required.”

- Relationship to Borrower: Mention the relationship between the donor and the borrower (e.g., parent, sibling, friend). This helps lenders understand the source of the funds.

- Donor’s Signature: The donor should sign the letter to confirm the accuracy of the information and their willingness to provide the gift.

- Date of Gift: Specify the date the gift is being provided to ensure the funds are accounted for at the appropriate time.

Here is an example of a money gift letter:

[Donor's Name] [Donor's Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Date] [Borrower's Name] [Borrower's Address] [City, State, ZIP Code] Subject: Money Gift Letter for Mortgage Application Dear [Lender's Name], I, [Donor's Full Name], hereby confirm that I am gifting [Amount in Numbers] ([Amount in Words]) to my [relationship to borrower], [Borrower's Name], to be used as part of their down payment for the home located at [Property Address]. This gift is given freely and is not a loan. There is no expectation of repayment. Sincerely, [Donor's Signature] [Donor's Printed Name] [Date]

Make sure to tailor this template to fit your situation and ensure that all necessary details are included for a smooth process with the lender. It may also be helpful to provide the donor’s bank statement or proof of funds if requested by the lender.

Now, each word is repeated no more than 2-3 times, maintaining meaning and grammatical correctness.

To make the mortgage gift letter clear and legally valid, include essential details such as the donor’s name, relationship to the recipient, and the specific gift amount. Clearly state that the money is a gift with no repayment expectation. The recipient must acknowledge the gift in writing as well.

Provide the full legal names of both parties involved. Mention the date the gift was made and the intended use of the funds. Avoid any ambiguity to ensure the letter is straightforward and easy to understand.

If the gift is substantial, include any required documentation, such as bank statements or proof of the donor’s ability to give the amount. This helps verify the legitimacy of the gift, especially for large sums.

Remember to sign the letter and consider notarizing it to add an extra layer of authenticity. Keep copies for both parties in case further verification is required.