Investment Banking Engagement Letter Template Guide

In the world of finance, establishing clear and precise terms for services is crucial. Properly outlining the responsibilities, expectations, and compensation can prevent misunderstandings and ensure smooth collaborations. This document serves as a formal understanding between the parties involved, establishing a framework for their professional relationship.

Clarity and specificity are key when drafting such agreements. A well-structured document not only protects both sides legally but also sets a foundation for future operations. Whether it’s a large-scale corporate deal or a smaller advisory role, defining every aspect of the arrangement ensures that both parties are aligned in their goals and actions.

By utilizing a comprehensive model, professionals can focus on the core aspects of the transaction without being bogged down by legal complexities. This approach saves time and reduces the risk of disputes, allowing both sides to engage confidently and transparently.

What is an Agreement for Financial Services

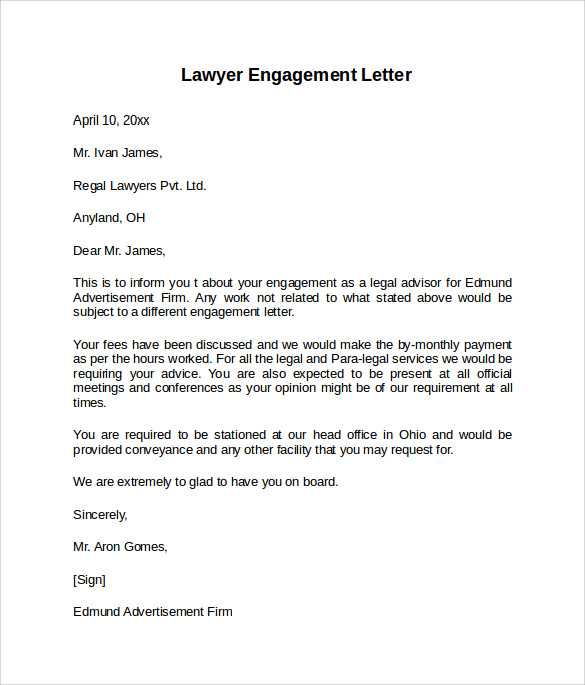

This document serves as a formal contract that defines the terms and conditions between a client and a financial service provider. It outlines the nature of the relationship, the scope of services to be delivered, and the expectations for both parties. Such a document is a vital tool for ensuring transparency and mutual understanding, reducing the chances of conflicts or ambiguities.

The agreement typically includes details about the compensation structure, the responsibilities of each party, and the duration of the professional relationship. By establishing clear parameters, it provides both sides with legal protection and sets the tone for the collaborative work ahead.

While it may vary in length and complexity depending on the specifics of the project or transaction, the purpose remains the same: to create a solid foundation for a professional partnership, built on clarity and trust.

Key Elements of a Professional Service Agreement

A comprehensive agreement should cover all critical aspects to ensure a clear understanding between the parties involved. It helps both the client and the service provider know their obligations, rights, and responsibilities throughout the collaboration. The primary components are structured to prevent misunderstandings and create a solid legal foundation.

- Parties Involved: Identifies the individuals or organizations entering into the contract and their roles.

- Scope of Services: Clearly defines the services to be provided, outlining any specific tasks, deliverables, and timelines.

- Compensation Terms: Details the payment structure, including fees, deadlines, and any performance-based compensation.

- Confidentiality and Privacy Clauses: Ensures sensitive information is protected, establishing non-disclosure agreements and restrictions.

- Duration and Termination Conditions: Specifies the agreement’s length and the terms under which it can be amended or terminated.

- Dispute Resolution: Outlines the process for addressing any disagreements, often including arbitration or mediation procedures.

These elements are crucial for ensuring that the agreement is legally binding and that both parties are aligned on expectations. A well-drafted document helps foster a transparent and professional relationship, minimizing the potential for issues down the line.

Importance of Clear Contractual Agreements

Establishing a well-defined agreement is essential for any professional collaboration, ensuring that both parties understand their roles and responsibilities. Without a clear framework, there is a greater chance for confusion or disputes to arise, which could damage the working relationship or result in legal challenges.

A comprehensive and transparent agreement sets expectations from the outset. It helps both the client and the service provider know exactly what is required, preventing any misunderstandings that could lead to delays or conflicts. Clear terms also provide a sense of security, knowing that both sides are protected in case issues arise during the course of the partnership.

Moreover, a solid agreement reduces the likelihood of costly legal disputes. By addressing key points upfront, such as the scope of work, payment terms, and timelines, it minimizes ambiguity and helps avoid disagreements later. In the long run, a well-crafted contract saves both time and money while promoting a more productive, efficient, and harmonious working relationship.

How to Customize Your Professional Agreement

Tailoring a formal agreement to fit the specific needs of both parties is essential for ensuring that all aspects of the collaboration are addressed. By customizing the document, you can ensure that the terms accurately reflect the nature of the services and the expectations of both the client and the provider.

The first step in customization is to clearly define the scope of work. Outline the specific tasks and deliverables expected from both sides, making sure to include deadlines and milestones where applicable. This helps prevent any misunderstandings regarding the extent of the responsibilities.

Next, adjust the payment terms to match the agreed-upon structure, whether it’s a fixed fee, hourly rate, or performance-based compensation. Clearly state how and when payments will be made, and outline any additional costs that may arise during the course of the project.

Additionally, consider including clauses that reflect the unique needs of your situation, such as confidentiality agreements, intellectual property rights, or dispute resolution methods. By ensuring that these key elements are properly addressed, you can create a stronger, more reliable framework for your working relationship.

Ultimately, customizing your agreement helps set the foundation for a smooth and professional collaboration, reducing the potential for conflict and ensuring that both parties are aligned in their goals and expectations.

Legal Considerations in Financial Service Contracts

When drafting formal agreements for financial services, several legal factors must be considered to ensure compliance, clarity, and protection for all parties involved. These considerations not only safeguard the interests of both sides but also help prevent potential disputes that could arise throughout the business relationship. It is essential to address these points early in the process, as they lay the foundation for a legally binding contract.

Key Legal Aspects to Address

Some of the most important legal elements include confidentiality, intellectual property rights, and liability clauses. Each of these aspects must be clearly defined to avoid ambiguity, ensuring that both parties understand their rights and obligations. Below is a table outlining critical legal aspects commonly included in such agreements:

| Legal Aspect | Description |

|---|---|

| Confidentiality | Protects sensitive information shared between parties during the course of the agreement. |

| Intellectual Property | Defines ownership rights over any intellectual property created or used during the collaboration. |

| Indemnification | Specifies the conditions under which one party may be held liable for damages or losses incurred by the other party. |

| Termination Clauses | Outlines the conditions under which the agreement can be terminated and the consequences of early termination. |

Ensuring Compliance with Laws

It is also vital to ensure that the contract complies with relevant laws and regulations governing the financial industry. This includes adhering to guidelines on fraud prevention, regulatory requirements, and dispute resolution processes. Failure to comply can result in severe legal and financial repercussions.

Incorporating these legal considerations into your contract will help protect all parties, minimize risks, and create a more reliable framework for the professional relationship.

Common Mistakes to Avoid in Agreements

Even the most carefully planned formal agreements can fall short if certain mistakes are overlooked during the drafting process. These errors, though often subtle, can lead to confusion, disputes, or even legal complications. Understanding and avoiding these common pitfalls ensures that both parties are fully aligned and protected from the outset of the relationship.

One frequent mistake is failing to clearly define the scope of services. Without a detailed description of what is expected from both sides, misunderstandings can easily arise. This can result in unmet expectations and frustration down the line.

Another common issue is neglecting to specify payment terms. If the structure, deadlines, or methods of compensation aren’t explicitly laid out, it can lead to disagreements about when and how payments should be made, causing unnecessary delays or disputes.

In addition, overlooking important clauses, such as confidentiality agreements, intellectual property rights, and dispute resolution mechanisms, can leave both parties vulnerable. These elements are crucial for protecting sensitive information and providing a clear path for resolving any issues that may arise during the course of the agreement.

By paying close attention to these details and addressing them thoroughly in the document, both parties can ensure a smoother, more transparent relationship moving forward.