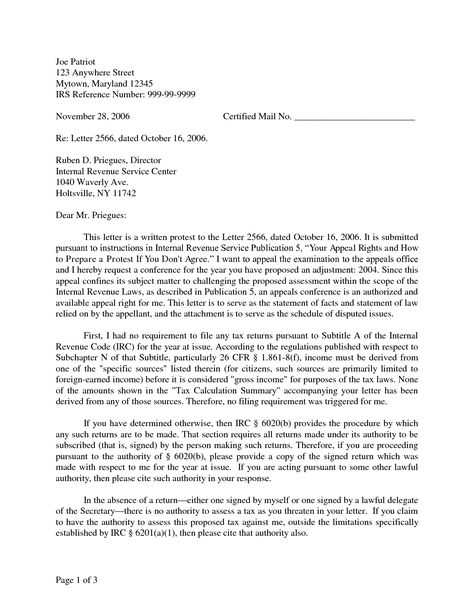

Irs letter response template

Responding to an IRS letter requires clarity and accuracy. Begin by addressing the specific issue raised in the correspondence. Clearly identify the letter you received, including the notice or letter number, and the reason the IRS has contacted you. This ensures your response is directly tied to their inquiry.

Make sure to provide relevant supporting documents that back up your claims or corrections. Include copies of tax forms, payment receipts, or any additional evidence the IRS may need. Avoid sending originals, as they may get lost or damaged during processing.

Be concise in your response, directly addressing any discrepancies or concerns. Acknowledge any errors on your part, and if applicable, provide the steps you’ve taken to resolve them. Clear communication will help prevent delays in processing your case.

End the letter by thanking the IRS for their attention to the matter. Provide your contact information and offer to provide further details if needed. By responding promptly and accurately, you can ensure a smooth resolution to your tax issue.

Here are the corrected lines:

If the IRS has sent you a notice or letter requiring a response, it’s crucial to address each point accurately. Below are common corrections to make in your reply:

1. Correct the Filing Status

Ensure your filing status is correctly reflected. If your marital status or dependents have changed, update it in the response. Double-check that the information matches your tax return or any additional documents submitted.

2. Update Your Income Information

Verify all reported income sources, including W-2s, 1099s, or other documentation. If the IRS has indicated discrepancies, provide supporting evidence like bank statements, corrected forms, or amended returns.

3. Clarify Deductions and Credits

Make sure any deductions or credits you’ve claimed align with IRS guidelines. If adjustments are needed, explain the correction in detail and attach the relevant paperwork, such as amended forms or receipts.

Addressing these points ensures that the IRS will have accurate information to process your case. Always use precise language and include supporting documents where applicable to avoid delays.

- IRS Letter Response Template Guide

Begin with the IRS notice number: Always reference the IRS notice you received. Include the notice number in the subject line for proper identification.

State your position: Clearly explain whether you agree or disagree with the IRS’s findings. If you agree, confirm the necessary action taken. If you disagree, outline your reasons with any supporting documentation.

Provide relevant documentation: If disputing the IRS’s request, attach supporting evidence such as receipts, bank statements, or tax records to back up your claim.

Describe your resolution plan: If you intend to resolve the issue, explain your next steps. If you need more time, request an extension and propose a new deadline. If applicable, provide payment plan details.

Include contact details: List your full name, address, and contact information. Offer to discuss the issue further if necessary and thank the IRS for their attention.

Sign and date your response letter. Retain a copy for your records before mailing the original letter.

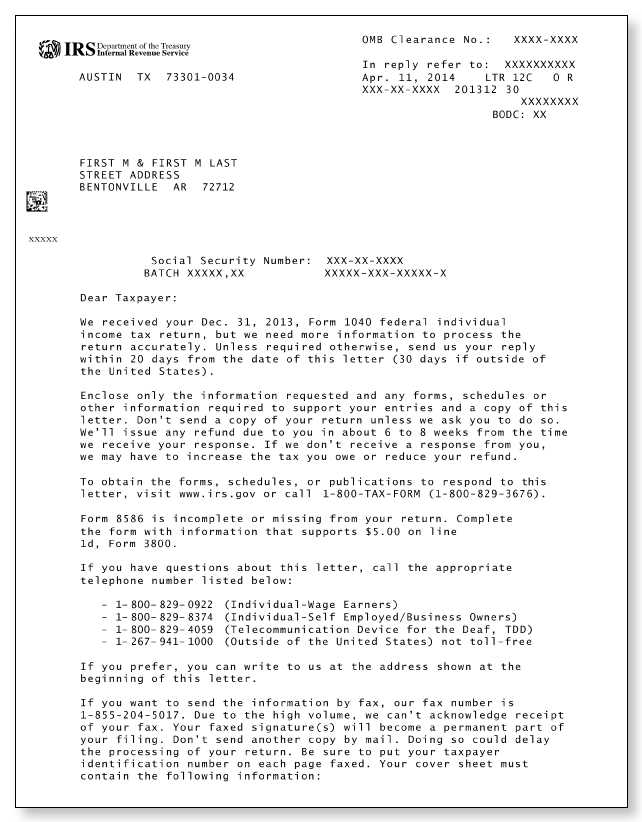

Carefully read the IRS letter to ensure full understanding of its contents. Highlight the sections with the requested action or additional information needed. Verify if you need to respond, make a payment, or provide further documents. Never ignore a letter from the IRS, as this can lead to additional penalties.

In your response, be clear and concise. Begin by addressing the letter’s reference number, which can be found on the top right section of the letter. This ensures that your response is correctly matched with your case in the IRS system.

Next, clearly state the reason for your response. If you disagree with the IRS’s findings or claim, provide documentation to support your case. Attach copies of relevant tax returns, forms, or records that validate your position. Never send original documents unless explicitly instructed by the IRS.

Be polite and respectful in your language. The IRS handles a large volume of cases, so clarity and professionalism will help your case be processed faster. Provide all requested information and meet any deadlines indicated in the letter.

| Action | Details |

|---|---|

| Read the letter thoroughly | Ensure you understand the request and any deadlines |

| Provide supporting documents | Send copies of tax forms, receipts, or other relevant documents |

| Use the reference number | Include the IRS case number for quicker processing |

| Be clear and professional | State your case or request in a clear, concise, and respectful manner |

If you cannot meet the deadline, contact the IRS to request an extension. Be sure to keep a record of all correspondence and interactions with the IRS, including phone calls and written responses.

Start by reviewing the IRS notice or letter you’ve received. It typically indicates which form you need to respond to. Look for any references to a specific form number or category, such as Form 1040, Form 1099, or Form 4506. The IRS is specific about the form relevant to your situation.

Check IRS Form Instructions

Each IRS form comes with detailed instructions. These guide you through the completion process and help identify if this is the correct form for your situation. Look for the section that discusses eligibility criteria and what specific issues the form addresses.

Use the IRS Website or Contact IRS Support

If the instructions are unclear, visit the IRS website for more information on specific forms. You can also reach out to IRS customer support to confirm which form you should use based on your tax situation. Ensure that you reference the specific issue or notice you received for faster assistance.

Gather all relevant documents before responding to an IRS letter. Ensure you include records that directly address the issue mentioned in the letter, such as tax returns, receipts, or supporting statements. The more accurate and organized your documentation is, the easier it will be to review your case. For example, if the IRS requests proof of income, submit your W-2s or 1099s along with bank statements showing deposits.

Organize Your Documents

Group your documents by category for clarity. This could mean separating income records from deductions or organizing documents chronologically. This structure not only makes your case easier to review but also shows the IRS that you’ve taken care to provide all necessary information. Clearly label each document and double-check for accuracy before sending.

Submit Clear Copies

Make sure that any copies of original documents are legible. Avoid sending documents with faded print or poor quality. If you’re mailing physical copies, consider using certified mail or another service that provides delivery confirmation. If submitting electronically, ensure the files are in a readable format, such as PDF.

Double-check your information before submitting a response to the IRS. Simple errors, like misspelled names or incorrect tax identification numbers, can delay the processing of your reply. Verify that all personal details match the records the IRS has on file.

Failing to address the specific issue mentioned in the IRS notice can result in confusion or additional inquiries. Always refer directly to the issue highlighted in the letter and provide clear, concise explanations and relevant documentation.

Don’t ignore deadlines. Missing the required submission date can lead to penalties or other consequences. If you need more time, request an extension instead of simply delaying your response.

Use the correct forms and ensure you are responding with the appropriate method specified in the IRS notice. This includes mailing or electronically submitting your reply as indicated.

Avoid providing unnecessary or irrelevant information. Stick to the facts and only include documentation that directly supports your response. This prevents overwhelming the IRS and helps keep your case moving forward smoothly.

Lastly, do not forget to sign and date your response. An unsigned letter can be returned, causing further delays in the resolution of your case.

If you receive a notice from the IRS that seems unclear, contact them immediately. Misunderstandings or errors in the notice may lead to incorrect filing or delays in processing your tax return. When you don’t understand a tax-related decision or calculation on your account, it’s best to reach out. Clear up any confusion regarding your tax obligations, refunds, or penalties promptly. If there’s conflicting information on your tax return or if the IRS makes an unexpected adjustment to your refund, it’s wise to inquire further. Waiting too long may lead to additional fees or complications.

Always contact the IRS when you notice discrepancies in your account that haven’t been explained. If you receive a refund smaller than expected or a balance due that you believe is incorrect, inquire with the IRS for clarification. Reach out as soon as you notice issues with your return or any correspondence, ensuring timely resolution without further complications.

After submitting your response to the IRS, the next step is to ensure your submission is received and processed. A follow-up ensures you stay informed and ready to address any additional requests promptly.

1. Wait for Confirmation

After submitting, check for an acknowledgment or confirmation from the IRS. They may provide a reference number or confirmation email, which confirms receipt. Keep this information for future correspondence.

2. Contact the IRS

If you haven’t received any acknowledgment within a reasonable timeframe (typically 30 days), contact the IRS. Be prepared with your submission details, such as your reference number, the date of submission, and your personal details. You can reach them by phone or through their online portal.

3. Be Specific in Your Inquiry

When reaching out, be direct and concise. Mention your case, provide all necessary identifiers (e.g., tax year, reference number), and ask for confirmation that your response has been processed or if any further action is needed.

4. Follow Up Regularly

If you don’t get a response or if there is no update after the initial inquiry, follow up again. A reasonable follow-up period would be 30 to 45 days. Each time, keep records of your communication for your reference.

5. Keep Detailed Records

- Record the date and time of every call.

- Note down the representative’s name and any case numbers provided.

- Save all emails or written responses from the IRS.

6. Seek Professional Help If Needed

If communication proves difficult or if you are unsure about the next steps, consider seeking help from a tax professional. They can assist with managing follow-ups and ensure your response is handled correctly.

Responding to an IRS letter requires a clear and direct approach. Ensure you address every point raised in the letter without unnecessary details. Follow these steps to effectively respond:

- Carefully review the IRS letter, noting the issues and deadlines outlined. This ensures you focus on the specific concerns raised.

- Draft a concise letter that acknowledges the IRS’s inquiries or requests. Clearly state the actions you’ve taken to resolve any issues. Be factual and include relevant dates, amounts, or other necessary data.

- If necessary, include supporting documentation. Attach only documents that directly address the IRS’s requests, such as receipts or corrected tax forms.

- Maintain a polite and professional tone throughout the response, avoiding emotional language or unnecessary explanations.

- Double-check for accuracy before sending your response. Ensure all required forms are included and that the response adheres to any deadlines provided in the IRS letter.

- Send the response via certified mail to ensure proof of delivery and to track any further correspondence from the IRS.

By following these steps, you can address the IRS’s concerns efficiently and avoid unnecessary complications.