Credit reporting agency dispute letter template

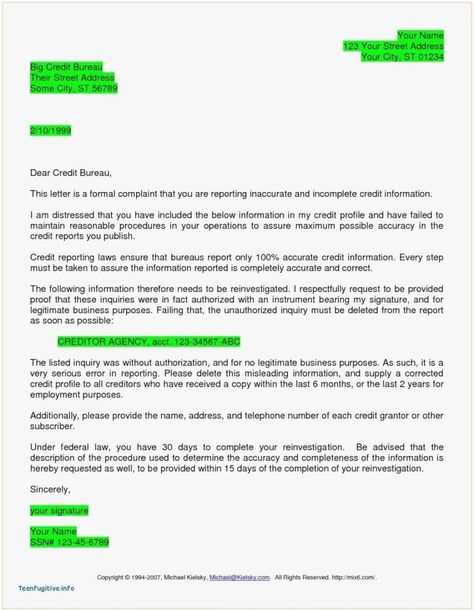

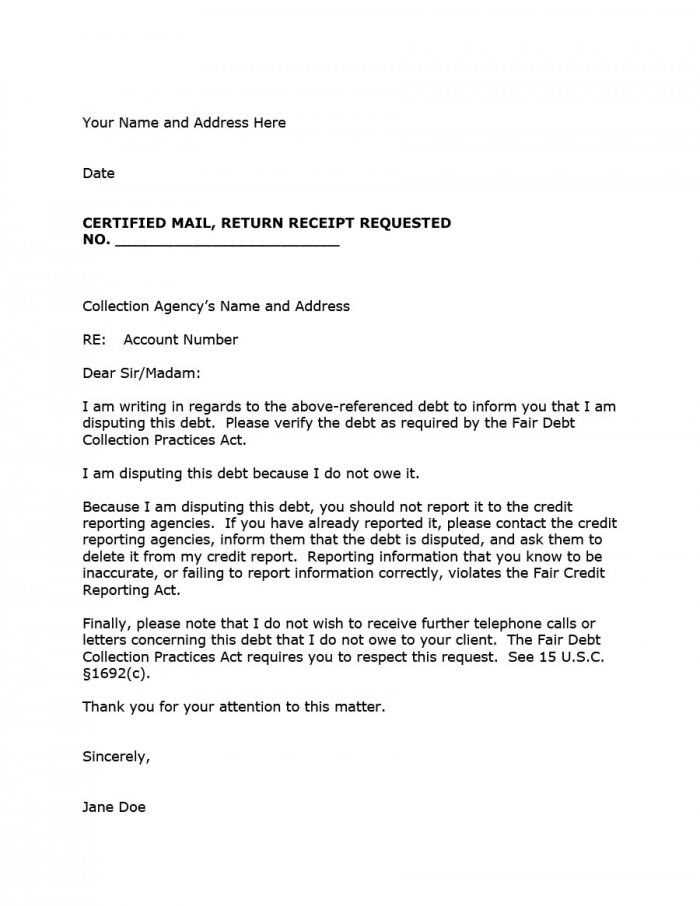

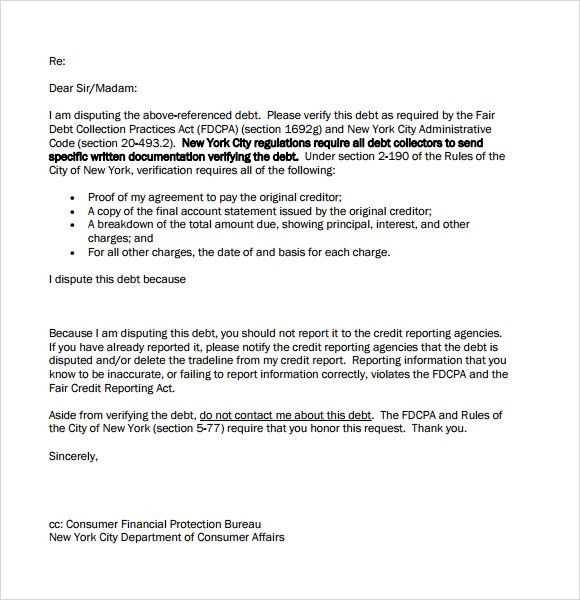

Begin by clearly stating the reason for your dispute in the opening paragraph. Mention the specific error in your credit report and provide the necessary details such as account numbers, dates, and amounts involved. Be direct and concise, ensuring that the agency understands what is being disputed.

Next, provide any supporting documentation that strengthens your claim. This could include receipts, bank statements, or communications that verify your position. Attach these documents as evidence, ensuring they are easy to reference.

In the following section, request a resolution. Be firm but polite in your language, asking for a correction to your credit report. Specify any actions you expect from the agency and include a reasonable timeframe for them to respond. Clearly state your intention to follow up if the matter is not resolved promptly.

End the letter by including your contact information and express appreciation for their attention to the matter. Keeping the tone professional and clear will improve the chances of your dispute being addressed in a timely and effective manner.

Here are the corrected sentences, keeping the meaning intact and avoiding repetition of words more than two or three times:

Ensure the letter addresses specific errors in the credit report and provides supporting documents for the dispute.

Clearly state the nature of the dispute and the exact items that need to be corrected.

Provide accurate details, such as the account number, and reference the incorrect information directly.

Ask for a detailed response from the agency regarding how the dispute is resolved.

Request that the corrections be made in accordance with relevant laws and guidelines.

Include a polite but firm closing, reiterating the importance of timely resolution of the issue.

Credit Reporting Agency Dispute Letter Template

How to Identify Mistakes on Your Credit Report

Steps to Collect Supporting Documents for Disputes

Key Elements to Include in Your Dispute Letter

Proper Formatting and Tone for a Credit Disagreement Letter

How to Submit Your Dispute to Reporting Agencies

What to Do If Your Dispute Is Rejected or Unresolved

Begin by carefully reviewing your credit report for any inaccuracies. Common mistakes include incorrect personal details, misreported accounts, duplicated entries, or outdated information. Focus on identifying discrepancies between the reported data and your own records.

Steps to Collect Supporting Documents for Disputes

Gather all relevant documents that back up your claim. This could include bank statements, account statements, or legal documents showing a payment history. Ensure that these documents clearly demonstrate why the reported information is incorrect and why it needs to be updated or removed.

Key Elements to Include in Your Dispute Letter

Make sure your letter contains the following elements: your full name, address, and date of birth for identification; a description of the error with details on why it’s incorrect; references to any documents supporting your claim; and a clear request for the removal or correction of the inaccurate data.

For tone, maintain a professional yet assertive approach. Avoid overly emotional language. Stay focused on the facts and the need for a resolution. Proper formatting makes your letter clear and easy to read. Use a simple, formal structure and ensure that your contact information is at the top of the letter.

Submit your dispute directly to the credit reporting agency via their online platform, mail, or fax. Always keep a copy of your dispute for your own records and track the submission if possible.

If your dispute is rejected or unresolved, request a formal explanation from the agency. If necessary, escalate the matter to a higher authority or seek legal advice on further actions to correct the error.