Failure to pay letter template

If a payment remains unpaid past its due date, sending a failure to pay letter is an effective way to address the issue directly. This letter serves as a reminder of the obligation and specifies the actions needed to resolve the situation. The tone should remain firm but respectful, ensuring clear communication without escalating the issue unnecessarily.

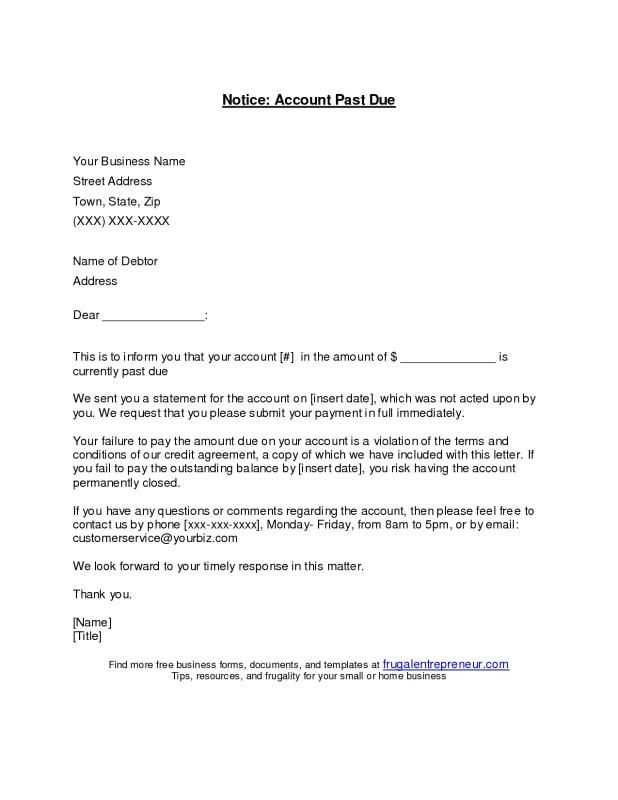

The letter should start with a concise statement of the outstanding amount and its due date. Next, outline the consequences of non-payment, including any late fees or potential legal actions, without sounding overly threatening. A clear request for payment and a reasonable deadline for resolution are crucial to avoid further delays.

For a straightforward and effective approach, include these key elements: a description of the debt, the total amount owed, a reminder of the due date, any additional charges, and a specific request for payment. Keep the tone professional yet approachable to maintain a constructive relationship with the recipient.

Here’s the corrected version without word repetition:

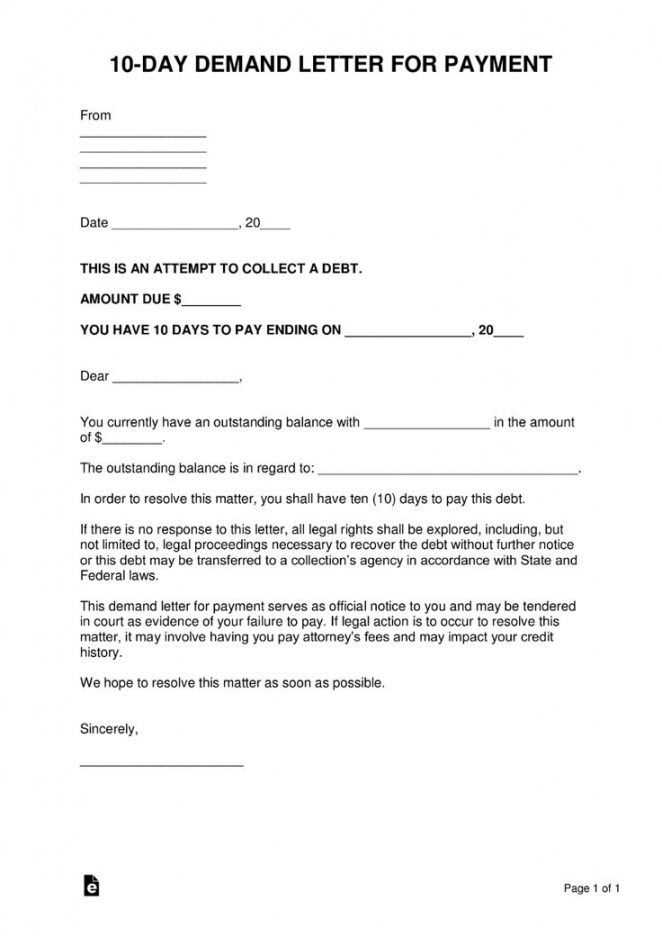

When drafting a “Failure to Pay” letter, make sure to keep your tone clear and direct. Avoid unnecessary wording that can confuse the reader or weaken your message. Start with a straightforward statement about the overdue payment and specify the amount due. Mention the date by which payment is expected and the consequences of non-payment, such as additional fees or legal action. Be polite but firm throughout the letter.

Use clear deadlines: For example, “Please make the payment by [insert date] to avoid further action.”

Outline payment methods: Provide details on how the recipient can settle the balance, such as bank transfer details or an online payment link.

State consequences without aggression: “If payment is not received by [insert date], we may be forced to initiate legal proceedings.” This shows seriousness but maintains professionalism.

Keep the letter short and to the point: Avoid lengthy explanations or personal comments. Stick to the facts and necessary details to encourage swift action.

Failure to Pay Letter Template: A Practical Guide

How to Structure a Payment Reminder for Clarity and Impact

Key Legal Aspects to Include in a Payment Reminder Letter

Common Errors to Avoid When Writing a Non-Payment Letter

How to Address Outstanding Payments with a Professional Tone

Follow-Up Steps After Sending a Non-Payment Letter

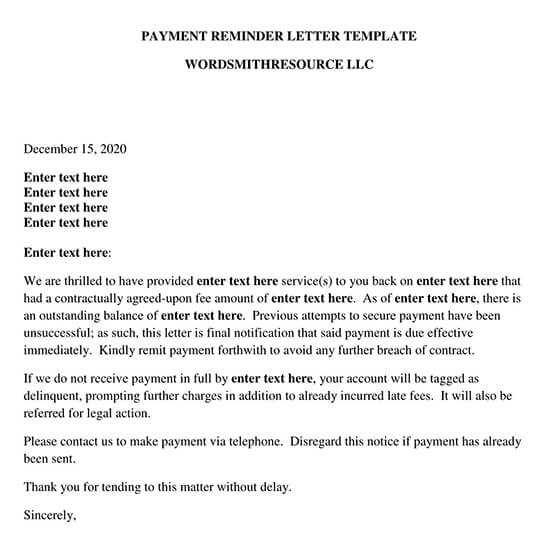

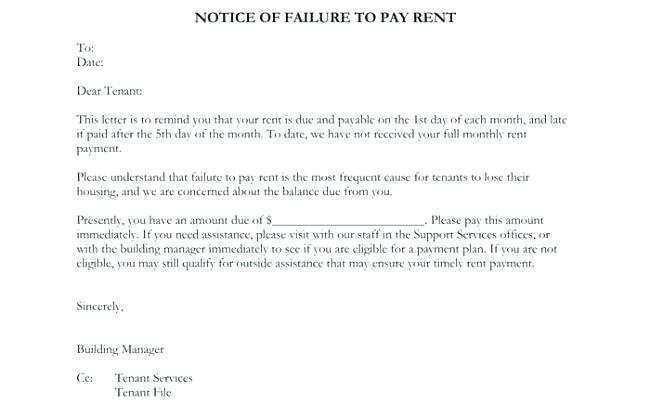

Sample Failure to Pay Letter Template for Immediate Use

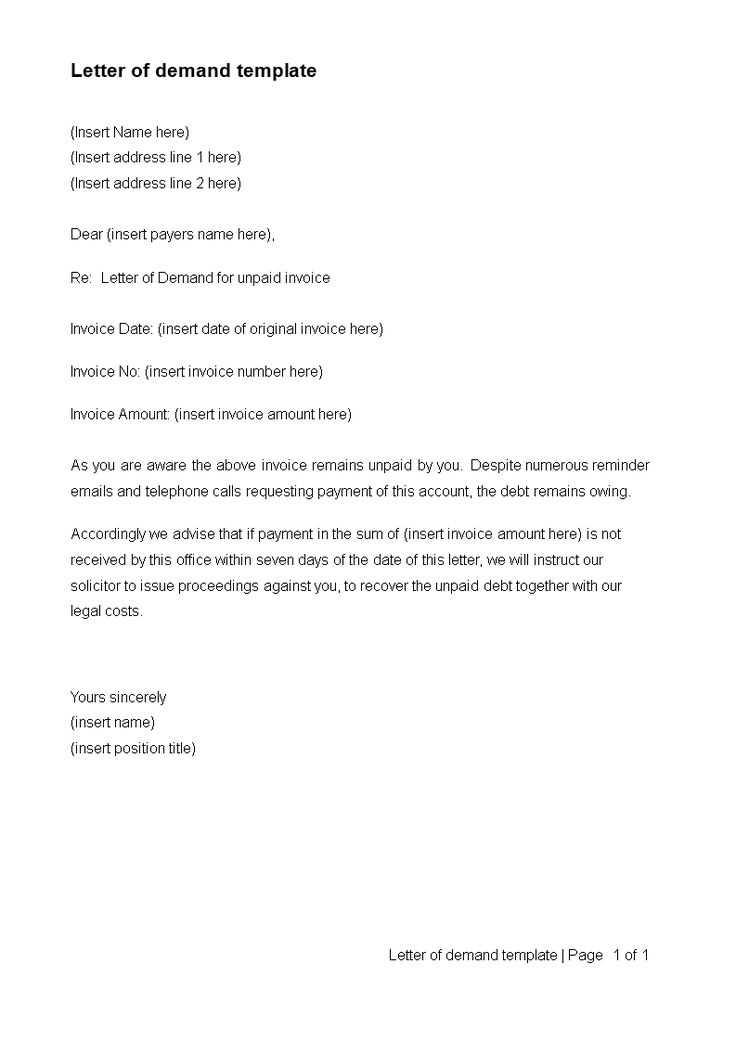

Begin with a direct and clear opening statement. State the outstanding amount, the due date, and the reason for the letter. Be firm but respectful in your tone to maintain professionalism. For example: “This is a reminder regarding your unpaid invoice [Invoice Number], which was due on [Due Date]. The total amount due is [Amount].”

Include key legal elements in your letter to avoid any confusion or disputes. Specify payment terms, including penalties for late payment if applicable. It’s helpful to reference the original agreement or contract and note any applicable interest or fees for overdue payments. You may also want to mention your rights in collecting the debt. For instance: “As per the agreement dated [Date], a late fee of [Amount or Percentage] will be added for any payments not received within [Number of Days].”

Avoid vague statements or threats. Stick to the facts and provide clear instructions for the next steps. Provide a payment method and deadline, and let the recipient know how they can contact you with any questions. Phrases like “Please pay immediately” or “Failure to comply will result in legal action” should be avoided unless absolutely necessary. Instead, say something like: “Please remit payment by [New Date]. We would appreciate your prompt attention to this matter.”

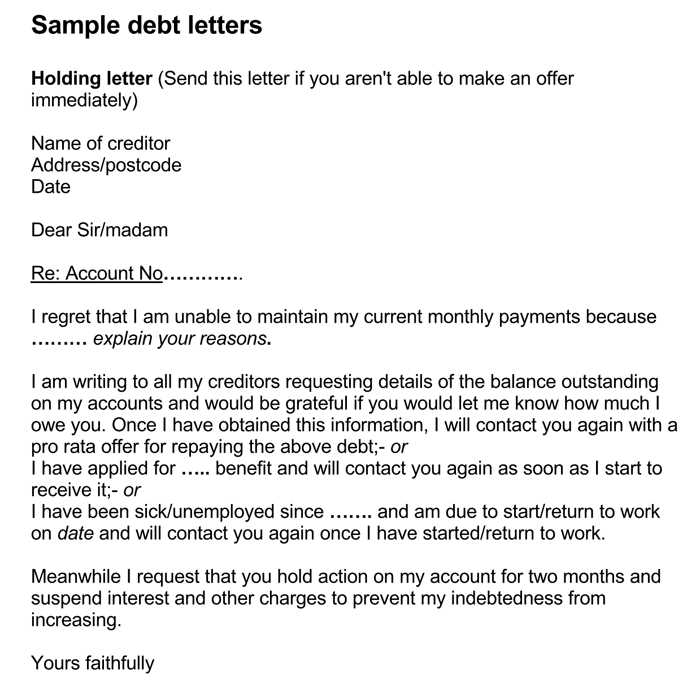

Maintain a professional tone throughout the letter. Address the recipient by their formal name and avoid emotional language. Using terms like “I would appreciate your cooperation” or “I look forward to resolving this promptly” creates a respectful tone while still communicating urgency.

After sending the first letter, if no payment is made within the specified period, send a follow-up letter. This should restate the outstanding balance, remind them of the original terms, and state the consequences of continued non-payment. A second reminder may also include an option for a payment plan, depending on your business practices.

Here is a sample failure-to-pay letter template to use as a reference:

Subject: Payment Reminder for Invoice [Invoice Number]

Dear [Recipient’s Name],

We are writing to remind you of the outstanding payment for invoice [Invoice Number], issued on [Date]. The total amount of [Amount] was due on [Due Date]. We request that payment be made as soon as possible to avoid additional fees.

If you have already processed the payment, please disregard this notice. Otherwise, we kindly ask that you remit the outstanding amount by [New Date]. Payment can be made via [Payment Method]. Should you require any assistance, or wish to discuss alternative payment options, please contact us at [Phone Number or Email].

If payment is not received by [New Date], we will consider further steps in accordance with our agreement, which may include [Details of Consequences, if applicable].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]