Collections letter template

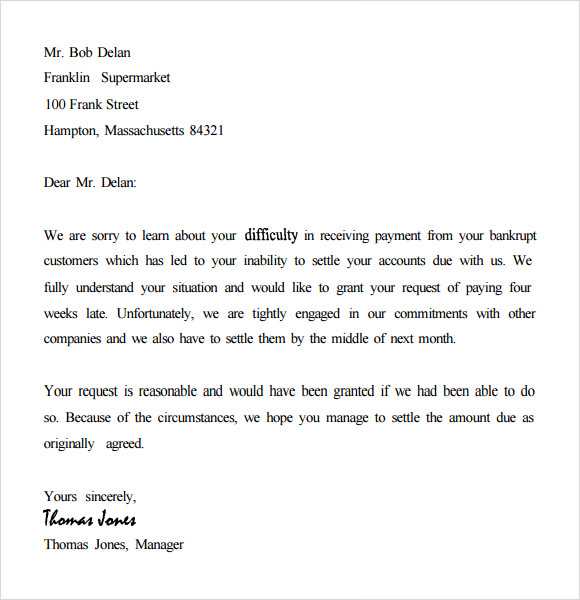

To ensure a clear and polite communication with debtors, use a well-structured collections letter. It should be direct, courteous, and professional, outlining the debt amount and due date. Start with a respectful salutation and immediately state the reason for the letter. Clearly mention the amount owed and any late fees that may have accrued, along with the payment deadline.

Be concise in explaining the situation, but avoid sounding threatening. Offer payment options, such as installment plans, if applicable. Provide your contact details and a clear call to action, requesting payment or further communication if the debtor needs assistance or has questions.

End with a firm but polite closing. Use language that encourages cooperation without alienating the reader. A well-crafted collections letter not only improves chances of payment but also maintains a professional tone that can help preserve the relationship between you and your client.

Here’s an example where repetitive words are reduced, but the meaning remains the same:

Begin by addressing the recipient directly. State the amount owed and the due date clearly. Keep the tone firm but polite, emphasizing the need for payment to avoid further action. Specify the available payment methods and provide contact details for inquiries. End by requesting prompt settlement and offering to discuss any issues they might have regarding the debt.

For example:

Dear [Name],

Your payment of [amount] was due on [date]. We kindly request that this outstanding balance be settled immediately. Please use the following payment methods:

- Bank Transfer: [Account Details]

- Online Payment: [Payment Portal Link]

If you have any questions or require clarification, please do not hesitate to contact us at [phone number] or [email address]. We look forward to receiving your payment without further delay.

Sincerely,

[Your Name]

[Your Company]

- Collections Letter Template

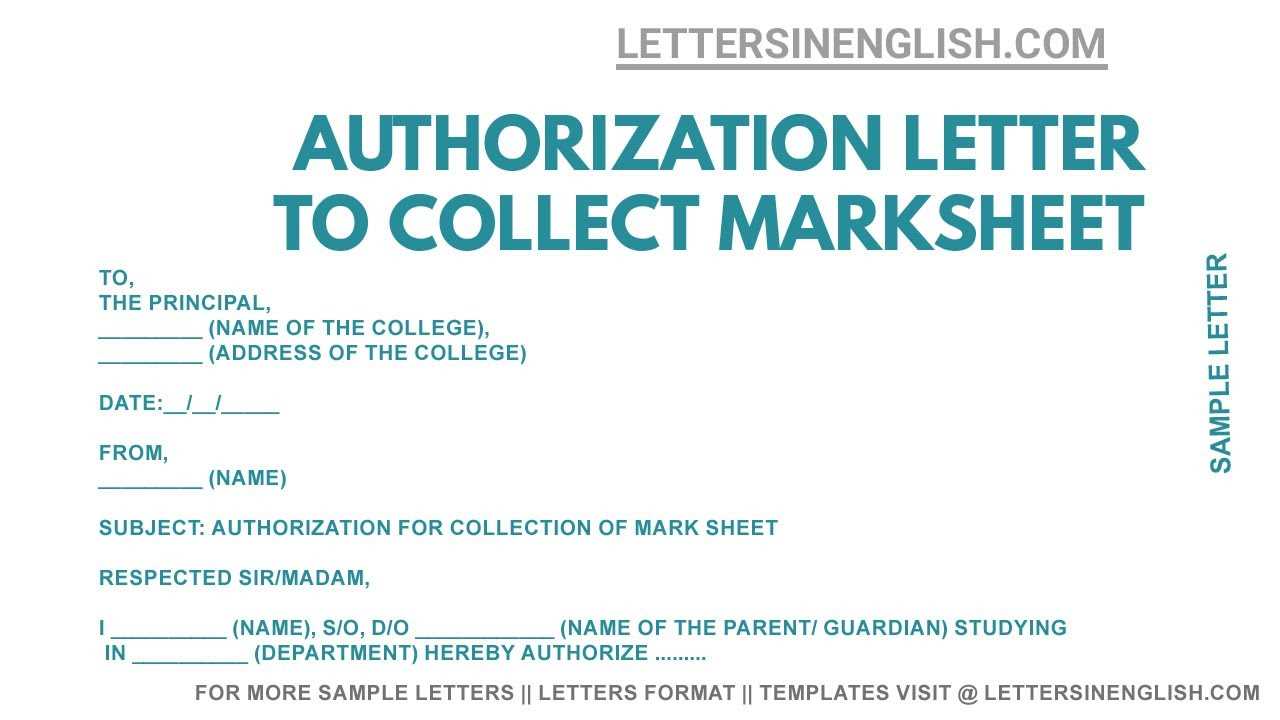

Begin your collections letter with a clear and concise subject line. Make it straightforward, such as “Payment Reminder” or “Outstanding Balance Notice,” so the recipient knows the purpose immediately.

Address the recipient respectfully, using their name and company (if applicable). Start by stating the amount due and the original due date, ensuring that the terms are clear and precise.

- State the balance owed.

- Include the date the payment was due.

Provide details of the payment method and where the payment should be sent. Be transparent about the payment options and any late fees if applicable.

- Outline accepted payment methods (e.g., bank transfer, credit card).

- Clarify if any penalties will apply after a certain date.

Include a polite yet firm reminder that failure to pay by the given deadline may result in further action, such as referral to a collection agency or legal steps.

Conclude the letter with a request for immediate payment and provide your contact information for any queries or clarifications. End on a professional note, encouraging the recipient to resolve the issue promptly.

- Ask for prompt resolution of the payment issue.

- Provide contact details for further communication.

Ensure the tone remains professional but firm, aiming for a resolution without creating unnecessary conflict.

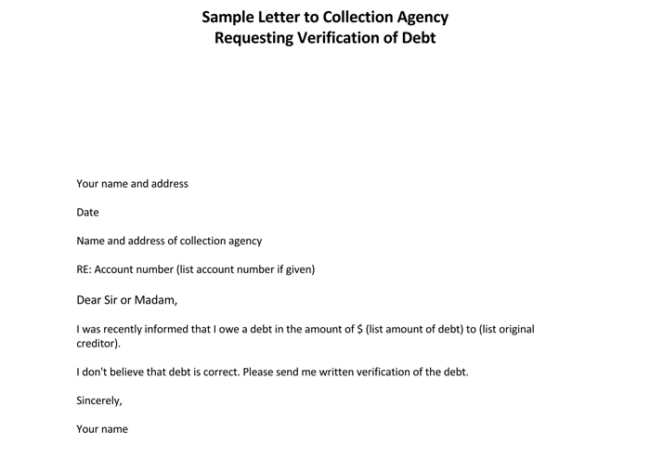

A debt collection letter is a direct communication to inform the recipient about an outstanding payment. It serves to request payment in a clear and professional manner, outlining the amount owed, due date, and any actions that will be taken if payment is not made. The goal is to encourage prompt repayment while maintaining a respectful tone to preserve business relationships.

The letter highlights the seriousness of the situation without being confrontational, offering a last opportunity for the debtor to settle their account before further action, such as involving a collection agency or legal measures, is taken. Clear language and specific details about the debt are key to avoiding confusion and prompting action.

It is also a way to document communication, providing a formal record of the debt collection process. This can be helpful in case the matter escalates and legal steps are required. A well-constructed debt collection letter can effectively motivate the recipient to resolve the debt without the need for further intervention.

Clearly state the amount owed and the due date. This provides clarity and reinforces the seriousness of the matter.

Provide detailed information on the debt. Include invoice numbers, the services or goods provided, and any relevant terms from the original agreement. This helps eliminate confusion and verifies the legitimacy of the debt.

Specify the payment deadline in bold to avoid misunderstandings. Set a reasonable timeframe for payment, such as 14 days, and make sure it is clearly highlighted in the letter.

Include payment instructions clearly, including the preferred payment method, account details, or link for online payments. Avoid leaving room for ambiguity.

State consequences for non-payment. Politely but firmly indicate any potential actions, such as legal action or involvement of a collections agency, should the debt remain unpaid.

Offer options for resolving the debt if possible. Acknowledge that you are open to discussions regarding repayment plans or partial payments to accommodate their financial situation.

Maintain a professional tone throughout. Avoid using harsh language; instead, focus on the facts and remain courteous. This helps preserve a professional relationship while being firm on expectations.

Use clear and concise language. Avoid unnecessary jargon or overly complex sentences that could confuse the reader. Stick to simple, straightforward phrasing that conveys your message directly.

Maintain a polite and respectful tone. Even in challenging situations, express understanding and empathy. Address the reader with courtesy, acknowledging any issues without sounding accusatory or aggressive.

Be specific and actionable. Instead of vague statements, provide clear next steps or solutions. Offering clear guidance demonstrates competence and makes it easier for the reader to understand what is expected of them.

Keep the focus on facts. Avoid emotional language or subjective opinions. Stay neutral and focus on the facts of the situation. This helps maintain a professional tone and keeps the conversation objective.

Check for tone and clarity before sending. Reread your letter to ensure the tone is consistent and that the message is clear. A message that is both professional and easy to follow will be much more effective.

Use positive language whenever possible. Instead of highlighting problems, try to focus on solutions. For example, rather than saying “You have failed to make the payment,” say “We noticed the payment has not yet been received.” This keeps the tone neutral and constructive.

Begin by making your purpose clear right from the start. The first few sentences should quickly establish the reason for the letter and what action you expect the recipient to take. Keep the introduction brief, and avoid unnecessary details that could confuse the reader.

Use Clear, Concise Language

Keep your language simple and direct. Avoid overly technical terms or jargon unless it’s essential. Each sentence should communicate one idea. If you need to explain something complicated, break it into smaller, manageable parts, and explain one step at a time. This ensures the reader isn’t overwhelmed.

Highlight Key Information

Use formatting tools like bullet points or bold text to draw attention to crucial details. If payment amounts or deadlines are involved, make them stand out to avoid misunderstandings. Organizing your information this way will help the reader process the letter more effectively.

If the recipient fails to settle the debt after receiving the collections letter, you can follow these steps to proceed further and protect your rights:

1. Send a Follow-up Letter

2. Consider Third-Party Mediation

If direct communication does not resolve the issue, consider engaging a third-party mediator or debt collection agency. They can assist in negotiating a payment plan or other resolution options. Choose a mediator with a track record of handling similar cases effectively.

3. Explore Legal Action

If the debt remains unresolved and the debtor continues to ignore your efforts, legal action might be the next step. You can initiate a small claims court case or hire an attorney to explore further legal options based on the situation. This route should be considered carefully, as it could incur additional costs.

4. Report the Debt to Credit Bureaus

5. Evaluate the Debt’s Collectability

Sometimes, continuing collection efforts may not be worth the time or expense. Assess whether pursuing the debt is financially viable based on its size and the likelihood of payment. If the debt is considered uncollectible, you might decide to write it off as a loss.

| Action | Potential Outcome |

|---|---|

| Follow-up Letter | Increased urgency for payment and potential settlement. |

| Third-Party Mediation | Possibility of reaching a settlement or payment plan. |

| Legal Action | May result in court judgment, but with potential legal costs. |

| Report to Credit Bureau | Negative impact on the debtor’s credit score, prompting payment. |

| Debt Evaluation | Determines whether further collection efforts are justified. |

Tailor your collection letter template to suit different situations, ensuring that each one resonates with the recipient and fits the context. Adjust the tone, structure, and details based on the type of collection you’re handling.

- Late Payments: Keep the tone firm but polite. Clearly state the overdue amount, the original due date, and a request for immediate payment. Consider adding a specific deadline for payment before further actions are taken.

- Partial Payments: Acknowledge the partial payment, but highlight the remaining balance. Include details on how the outstanding amount needs to be settled. Offer flexible payment options if possible.

- Disputed Debt: Be diplomatic and professional. Focus on resolving the misunderstanding by providing supporting evidence, such as invoices or contracts. Offer a way to discuss the matter further and come to a resolution.

- Repeated Late Payments: Adopt a sterner approach, explaining the consequences of continued late payments, such as potential service disruptions or legal actions. Reinforce the need for prompt payment to avoid further issues.

- High-Value Debt: For larger sums, emphasize the seriousness of the situation. Clearly outline any terms for payment arrangements or settlement discounts. It’s crucial to strike a balance between professionalism and urgency.

Adapt your template’s structure based on these scenarios, changing the message’s tone and approach as needed. This will ensure that your collection letters are as effective as possible in each situation.

For a well-crafted collections letter, it’s crucial to maintain clarity and professionalism. Start by addressing the recipient with their full name, ensuring the tone is respectful and straightforward. Provide a clear breakdown of the overdue amount, including the original due date, and outline any previous attempts to contact the debtor. This transparency helps avoid confusion and encourages timely payment.

Include Specific Payment Instructions

Offer simple, easy-to-follow payment instructions. Whether it’s through a bank transfer, check, or an online payment portal, be clear about the available methods. Providing multiple options increases the chances of a faster resolution.

Be Firm but Polite

While being firm about the consequences of non-payment, such as legal action or service suspension, it’s important to remain courteous. Striking the right balance can motivate the debtor to pay while preserving a professional relationship.