Collateral letter template

To draft a collateral letter, focus on clarity and accuracy. This document must detail the assets used as collateral in a transaction. Start by addressing the recipient, stating the purpose of the letter, and clearly identifying the parties involved. Provide a brief description of the collateral, including the type and value. Be specific about the terms of use and the circumstances under which the collateral will be returned or forfeited.

Next, outline the responsibilities of both the borrower and lender. Specify any required actions or conditions for the collateral’s release. Ensure the language is straightforward and avoids ambiguity to prevent future disputes. It is also helpful to include a section about the legal implications, confirming that the terms are binding and enforceable.

Before closing the letter, consider adding a clause for dispute resolution or any other legal procedure that applies. Sign the letter with appropriate authority, ensuring both parties understand their obligations under the agreement. If necessary, seek legal advice to ensure the letter complies with relevant regulations.

Here are the corrected lines with removed repetitions:

Ensure your collateral letter clearly outlines the necessary financial details, such as the amount of credit and the terms. Specify any conditions that apply to the collateral to avoid confusion later on. Be direct and clear in your explanations, omitting unnecessary information.

Each clause should be straightforward, focusing on the most critical aspects of the agreement. Repeating the same idea in different words can make the letter longer than needed. Use a simple structure to make the letter easy to follow.

For clarity, avoid using redundant expressions like “at this point in time” or “for the most part”. These phrases add little value and take up space unnecessarily.

Review the letter for any phrases that can be replaced with more concise alternatives, ensuring that the content remains clear and professional without unnecessary elaboration.

- Collateral Letter Template

A collateral letter serves as a formal document that outlines the terms of collateral being pledged in a financial agreement. It must clearly specify the collateral offered, including its description, value, and conditions under which it can be claimed. It is crucial to provide accurate and clear details to avoid future disputes.

Key Elements

Begin with the lender’s and borrower’s details, including names and contact information. Specify the collateral being pledged, including its current value, ownership, and any legal implications of its use. Ensure the letter includes the terms of the loan, including repayment deadlines and interest rates. The collateral letter should also outline the actions the lender may take if the borrower defaults, such as seizure or liquidation of the collateral.

Tips for Writing

Use concise and unambiguous language to avoid misinterpretation. Be sure to include the type of collateral, whether it’s real estate, equipment, or other assets. Highlight the agreement terms, including any conditions for the release of collateral. Conclude by requiring the signature of both parties to validate the agreement. If necessary, include a notary’s certification for further legal assurance.

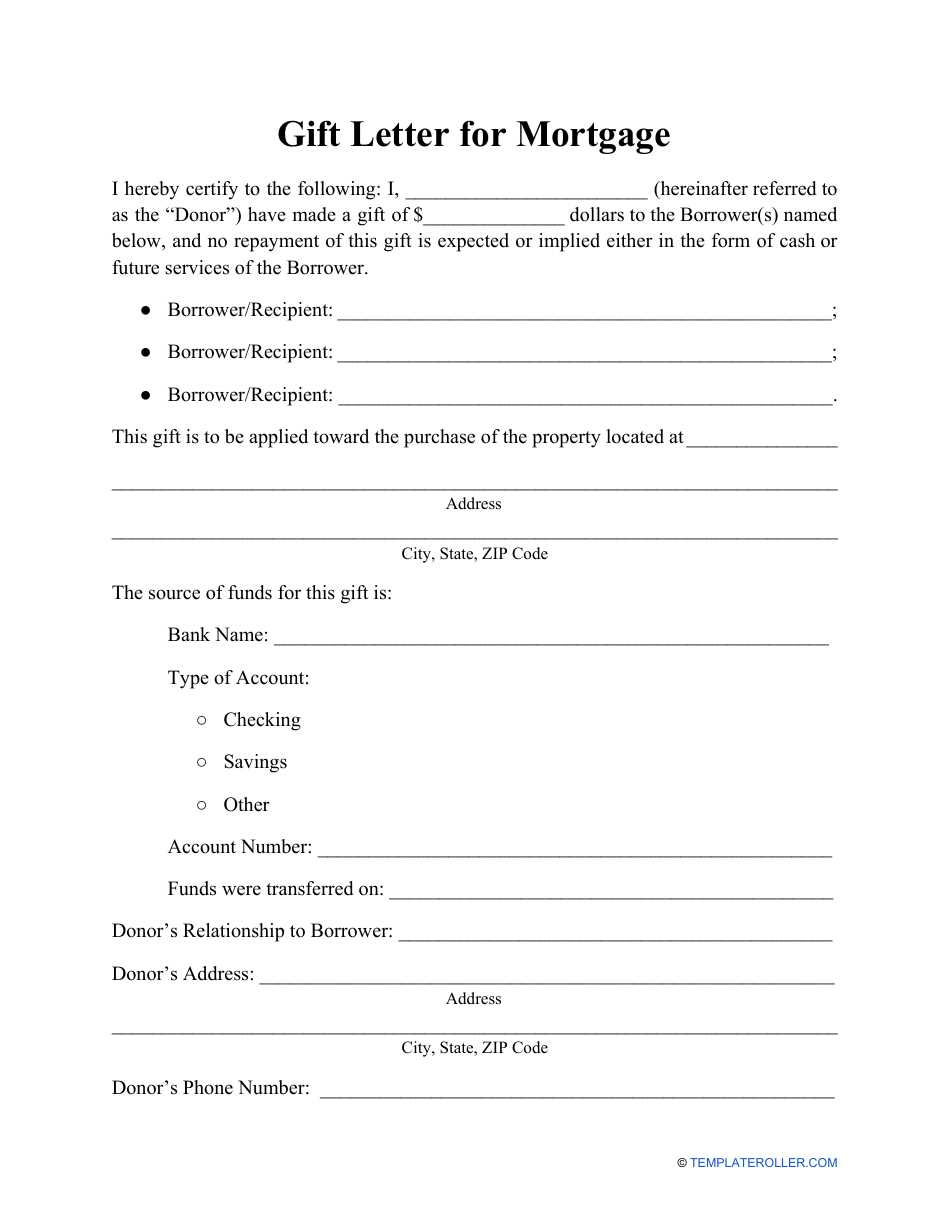

The main purpose of a collateral letter is to outline the terms and conditions surrounding the use of collateral. It typically serves as a written agreement between a borrower and a lender, providing security for the loan. Here are the key elements to include in such a letter:

1. Identification of Parties

Clearly state the names of the borrower and the lender. Include their addresses and contact information to avoid any confusion. This section sets the legal framework for the agreement.

2. Description of Collateral

Provide a detailed description of the collateral being pledged. This may include serial numbers, types, or any distinguishing features that help identify the asset. The more specific the description, the better the protection for both parties.

3. Terms of the Loan

Include the loan amount, repayment terms, and interest rate. This will clarify the financial arrangement and set expectations for repayment.

4. Purpose of the Collateral

State the purpose for which the collateral is being provided. This ensures that the collateral is only used for the intended purpose, protecting both parties in case of a dispute.

5. Rights and Obligations of Both Parties

Detail the rights of the lender, such as the ability to seize the collateral if the borrower defaults. Also, outline the borrower’s obligations, such as maintaining or insuring the collateral during the loan period.

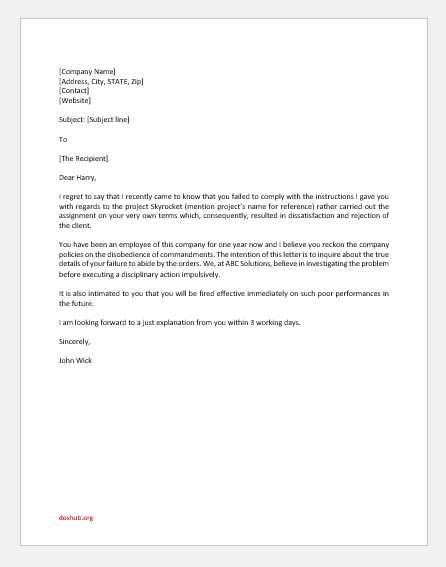

6. Default and Consequences

Clearly define what constitutes default and the steps that will be taken in the event of default. This can include the lender’s right to seize the collateral or demand full repayment.

7. Dispute Resolution

Include a clause outlining how disputes will be resolved, whether through mediation, arbitration, or legal action.

8. Signature and Date

Ensure both parties sign the document and date it. This validates the letter and makes it legally binding.

| Element | Description |

|---|---|

| Identification of Parties | Names, addresses, and contact information of the borrower and lender. |

| Description of Collateral | Detailed description of the collateral, including any distinguishing features. |

| Terms of the Loan | Loan amount, repayment schedule, and interest rate. |

| Purpose of the Collateral | Clarifies the intended use of the collateral. |

| Rights and Obligations | Outlines the rights of the lender and obligations of the borrower. |

| Default and Consequences | Defines default conditions and penalties. |

| Dispute Resolution | Specifies how disputes will be resolved. |

| Signature and Date | Validates the letter with signatures and dates. |

Begin by clearly identifying the purpose of the collateral letter. Ensure that the content reflects the intent to offer security for a financial or legal agreement. This letter should address both the party providing collateral and the party receiving it.

1. Introduce the Parties

Start with the names and contact details of the involved parties. Specify the relationship between the two, highlighting the agreement under which collateral is being provided. State whether the collateral is personal or business-related.

2. Define the Collateral

Clearly describe the collateral being offered. Include detailed descriptions such as asset types (e.g., real estate, securities) and their estimated value. Be as specific as possible to avoid any ambiguity.

Ensure that the terms for the collateral, including how it will be managed, used, or liquidated in case of default, are explicitly outlined.

3. Outline Conditions and Obligations

State the conditions that apply to the collateral. This includes the obligations of the borrower, what actions may trigger the release of collateral, and under what circumstances the lender may claim the collateral. Be precise about the terms, including the duration and any potential penalties.

4. Specify Governing Law

Identify the jurisdiction whose laws govern the collateral agreement. This ensures that both parties are aware of which legal system applies in case of disputes.

5. Closing the Letter

End the letter by reiterating the intent behind the agreement and confirming mutual understanding. Both parties should sign the letter, ensuring that each one acknowledges the agreement under the specified conditions.

One major mistake in collateral letters is unclear or vague language. Be specific about the collateral being pledged, the terms of the agreement, and the obligations of each party. Avoid general phrases like “valuable assets” or “important items,” and instead list exact assets or describe the collateral in detail. This prevents misinterpretation and ensures clarity.

Another common error is failing to include the necessary details regarding the conditions for the release of collateral. Make sure to outline the exact circumstances under which the collateral will be returned. Leaving this out can lead to confusion or disputes later on.

Also, neglecting to properly identify all parties involved is a frequent issue. Double-check that all names, titles, and roles are accurate. Errors in party identification can render the letter ineffective or legally ambiguous.

Inadequate signatures or lack of witness statements is another pitfall. Ensure that the document is signed by all required parties and, when necessary, witnessed by a third party. Incomplete signatures can undermine the document’s legal validity.

Lastly, be cautious with the use of overly complex legal jargon. While some terms may be necessary, excessive use of technical language can confuse those unfamiliar with legal documents. Use simple, straightforward language wherever possible to avoid misunderstandings.

Ensure the collateral letter clearly defines the obligations of all parties involved. Specify the terms, such as the amount of collateral, due dates, and any penalties for non-compliance. Identify the collateral’s nature and its value, including detailed descriptions if necessary.

It is essential to use legally binding language, ensuring that the agreement is enforceable in court. Avoid ambiguity and ensure the letter covers all relevant provisions, such as the rights of both parties in the event of default. In some jurisdictions, collateral letters may require notarization or additional documentation to be legally valid.

Be aware of local regulations that may affect the validity of the collateral letter. Laws regarding collateral, such as the rights of creditors and the process of liquidation, may vary depending on your location. Verify that all required signatures are present and properly executed to avoid disputes.

Ensure that the letter adheres to the governing contract laws. A collateral letter may be considered part of a larger agreement, and its terms must align with the broader contract’s conditions. Avoid contradictory clauses between the two documents to prevent confusion or legal challenges.

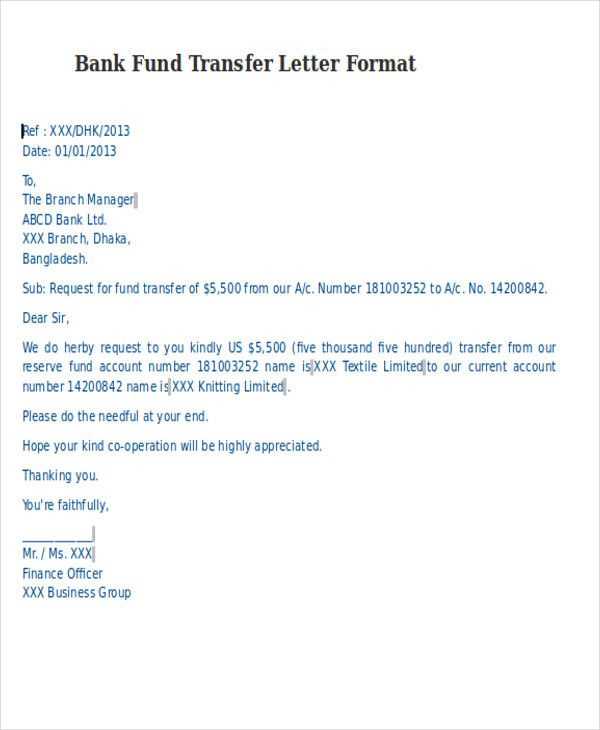

Ensure your letter has a clear structure. Start with your contact information at the top, followed by the date and recipient’s details. Use a formal salutation like “Dear [Recipient’s Name],” and keep the tone respectful and direct throughout.

1. Maintain Proper Spacing

- Leave a space between each section, including your contact details, the salutation, body paragraphs, and closing.

- Avoid crowding text together. Aim for single spacing within paragraphs and double spacing between them.

2. Use Clear Paragraphs

- Each paragraph should cover a single point. Keep paragraphs concise, focusing on clarity.

- Avoid long, dense blocks of text. Break them into smaller, digestible sections to enhance readability.

3. Font and Size

- Choose a professional font such as Times New Roman or Arial. Set the font size to 11 or 12 pt.

- Maintain consistent font and size throughout the document for a polished look.

4. Consistent Margins

- Set your margins at 1 inch on all sides for a clean, balanced layout.

- Avoid using large margins that create unnecessary white space.

5. Closing and Signature

- End with a professional closing such as “Sincerely” or “Best regards,” followed by a comma.

- Leave space for your signature above your typed name. If sending digitally, use a scanned signature or sign with a stylized font.

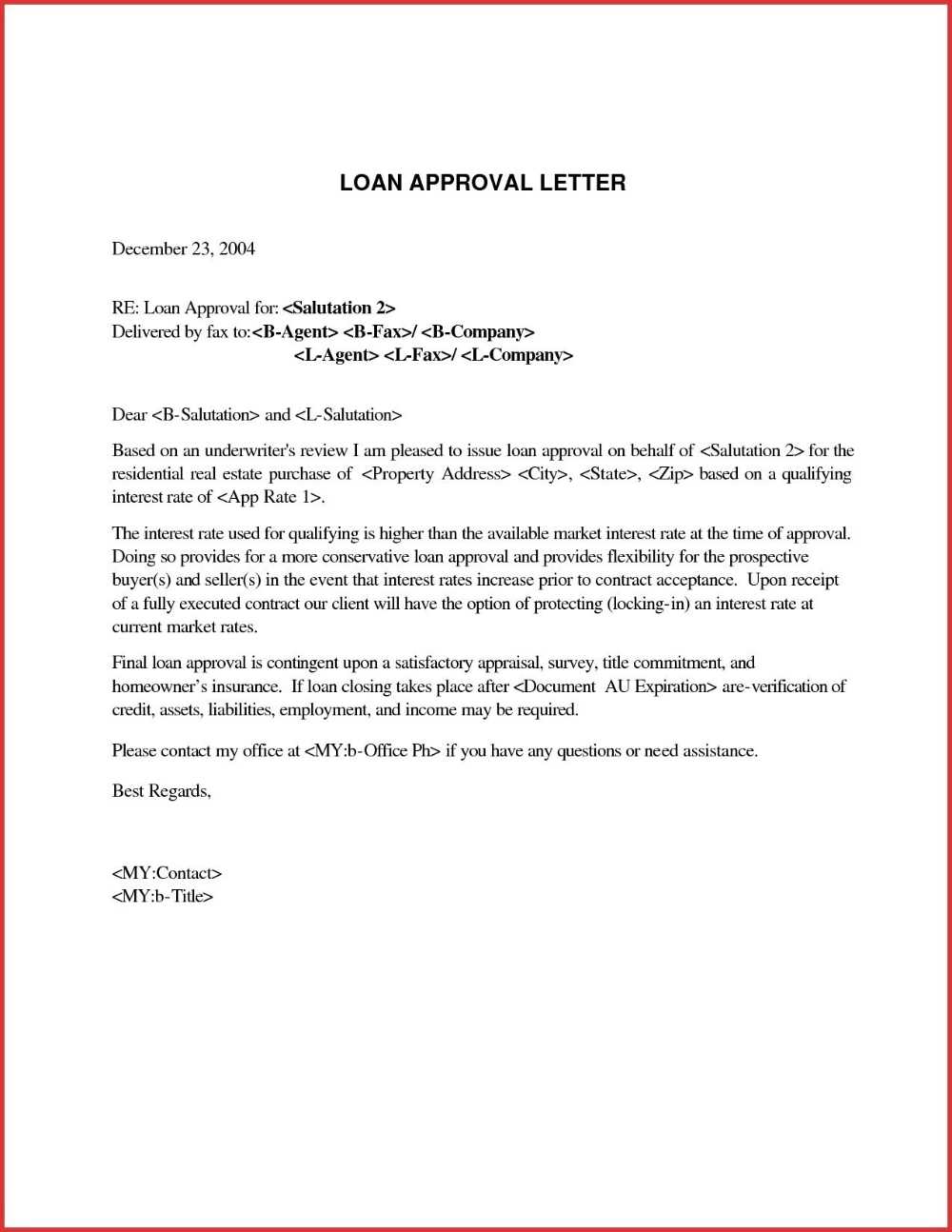

To adapt a collateral letter template for particular needs, begin by assessing the key requirements of the case. Understand the purpose of the letter, the type of relationship with the recipient, and any legal or financial stipulations involved. Customizing the tone, structure, and details of the template will ensure it fits the specific context effectively.

Modify the Introduction

The introduction should align with the recipient’s role or the specific situation. If the letter is directed towards a financial institution, emphasize formal language. For business partners, a more conversational yet professional tone may be appropriate. Adjust the wording to reflect the context accurately, ensuring clarity from the start.

Adjust the Body Content

- Include specific details relevant to the case, such as loan amounts, collateral value, and terms.

- Modify clauses or terms based on the agreement with the recipient. For example, if it’s a loan guarantee, highlight repayment terms or interest rates.

- Use language that is direct and clear, avoiding unnecessary legal jargon unless required for the case.

By focusing on these adjustments, the template can be tailored to suit the particular case without losing its formal structure or purpose. Every section of the letter should reflect the unique circumstances at hand.

Ensure your collateral letter is clear, direct, and formal. Include key details like the purpose of the collateral, the amount, and the duration. Specify the terms of repayment or conditions tied to the collateral. It is crucial to state whether the collateral is movable or immovable and provide any necessary identifiers such as serial numbers or property details.

Clarify both parties’ obligations and rights under the agreement. Provide information about potential consequences in case of non-fulfillment. The tone should remain professional while being transparent about risks involved. Lastly, always include the date and the signatures of the involved parties for legal validity.