Section 129 Letter of Demand Template Guide

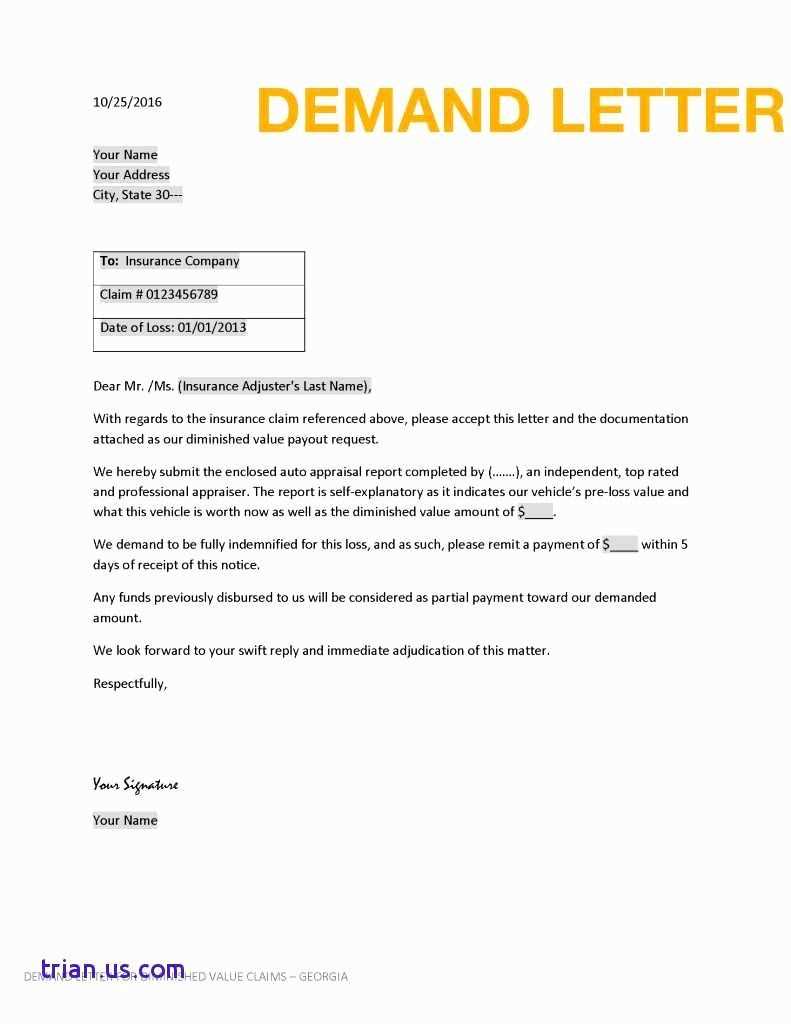

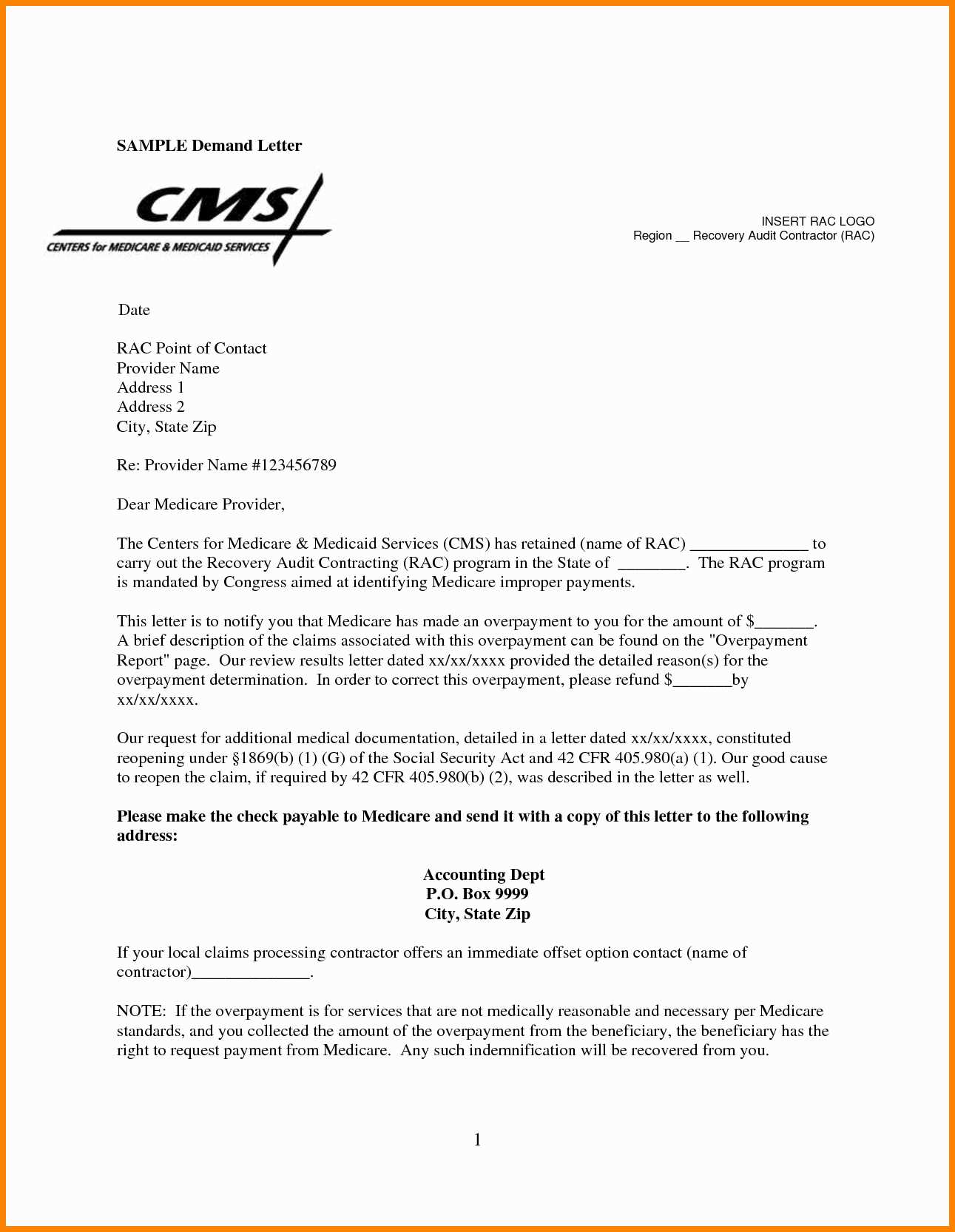

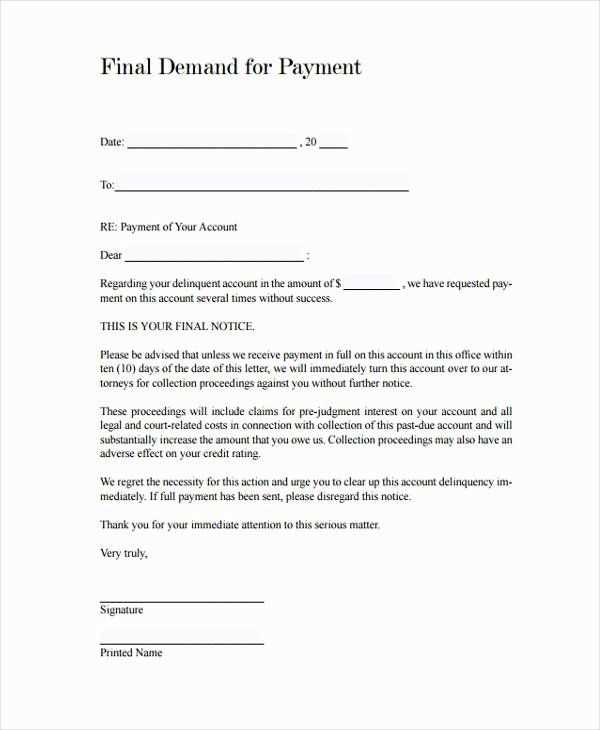

In business transactions, there are instances where a creditor needs to formally request payment for outstanding debts. This document serves as a written notification to the debtor, urging them to settle the amount owed within a specified timeframe. It is a critical tool in debt recovery, providing both legal clarity and a clear course of action if the payment is not made.

Key Elements of a Payment Request

The structure of this document is straightforward but essential for effective communication. Below are the main components typically included:

- Creditor’s Details: The full name, address, and contact information of the entity requesting payment.

- Debtor’s Information: Details of the individual or company owing the money, including their contact information.

- Amount Owed: The exact sum that is being claimed, along with any applicable interest or penalties.

- Deadline for Payment: A clear deadline specifying when the payment must be received to avoid further action.

- Consequences of Non-Payment: A description of the legal actions that may follow if the debt is not paid in time.

When to Issue a Payment Request

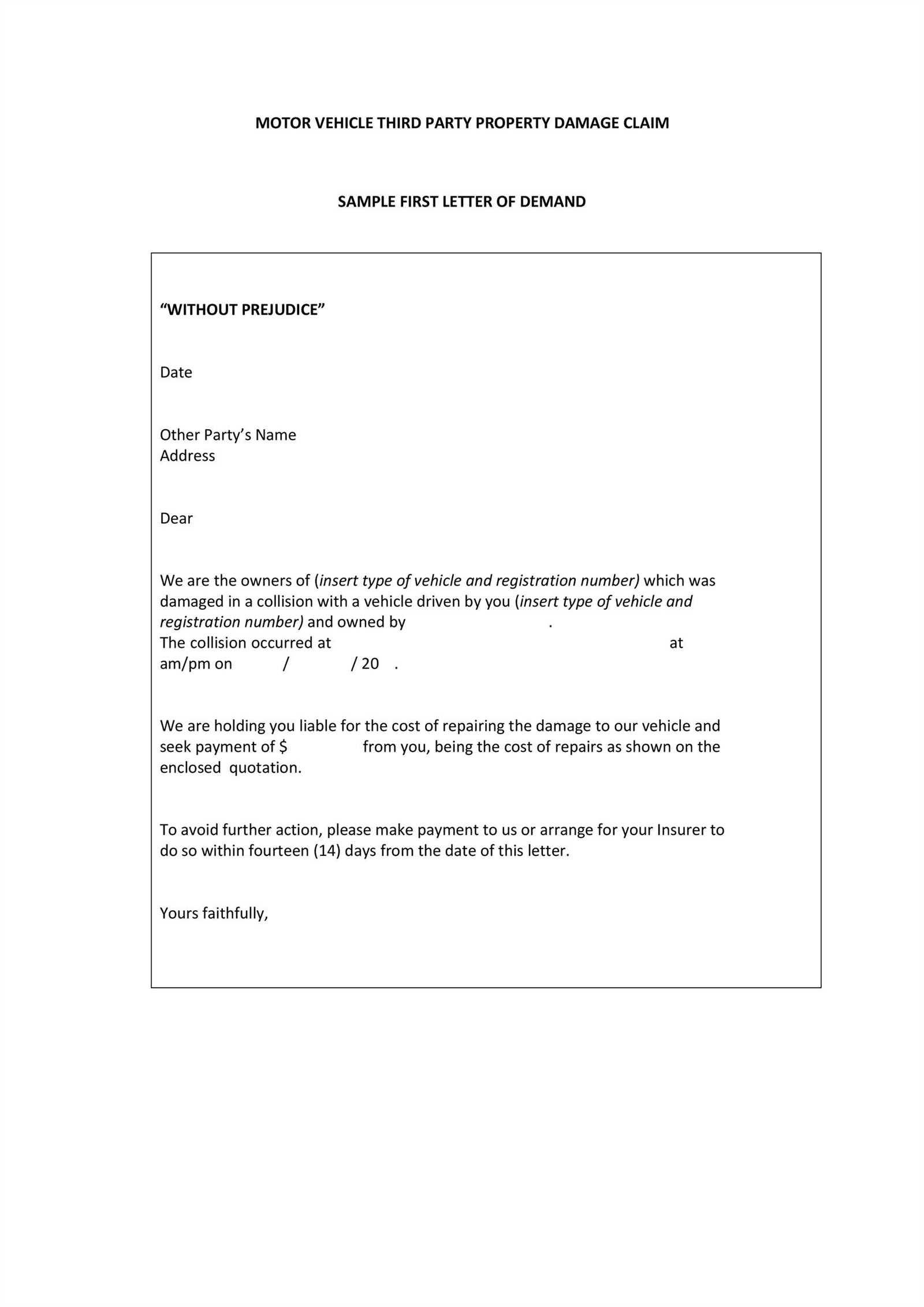

This formal request should be used when previous informal attempts to collect the owed amount have failed. It is typically sent after reminders or phone calls have been made, signaling the seriousness of the situation. By issuing this document, you formally set a deadline for payment, which may serve as a final warning before escalating the issue to legal proceedings.

Common Pitfalls to Avoid

- Vague Language: Ensure that all terms, amounts, and deadlines are specific and unambiguous.

- Failure to Follow Legal Guidelines: Understand the legal requirements surrounding such communications in your jurisdiction to avoid invalidating the request.

- Unclear Consequences: Be explicit about what actions will be taken if the debt remains unpaid, such as legal proceedings or credit damage.

Steps After Sending the Notification

If the recipient does not comply with the request, further actions may include initiating a legal claim or seeking professional help from debt recovery agencies. The key is to stay consistent and proactive in following up, ensuring that all steps align with applicable laws and regulations.

Understanding Formal Payment Requests

In certain circumstances, businesses or individuals may need to formally request payment for outstanding amounts. This communication serves to notify the debtor of the sum owed and the legal consequences if payment is not made within the given timeframe. The document provides clarity and a structured course of action, ensuring the creditor’s position is well-supported.

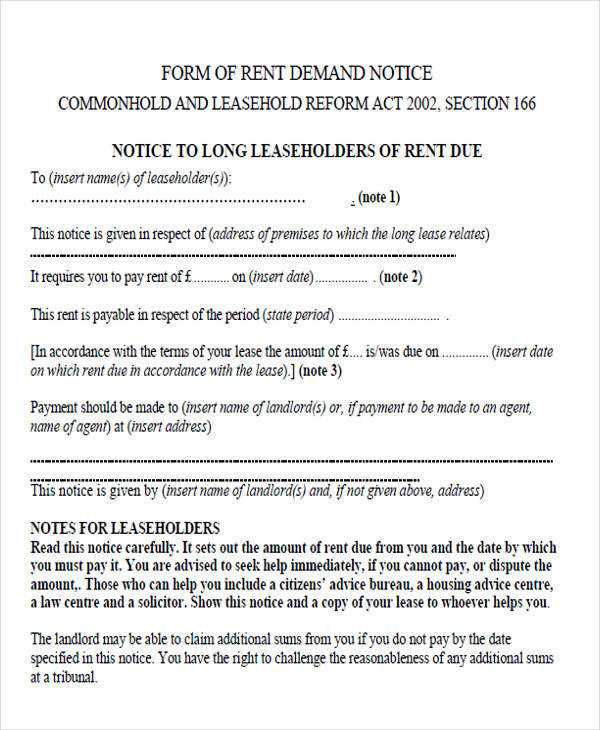

What is a Legal Notice of Payment

A legal notice is a formal communication informing the debtor of an unpaid debt. It typically specifies the amount due, the deadline for payment, and the consequences of non-compliance. This document serves as a crucial step before legal action is taken, allowing the debtor a final opportunity to resolve the matter outside of court.

When to Send a Payment Request

This formal notice is typically issued when prior attempts to collect payment informally have been unsuccessful. It’s often the last step before escalating the situation to legal channels, giving the debtor a clear deadline for settlement. The document helps establish a formal record, which could be valuable in future legal proceedings.

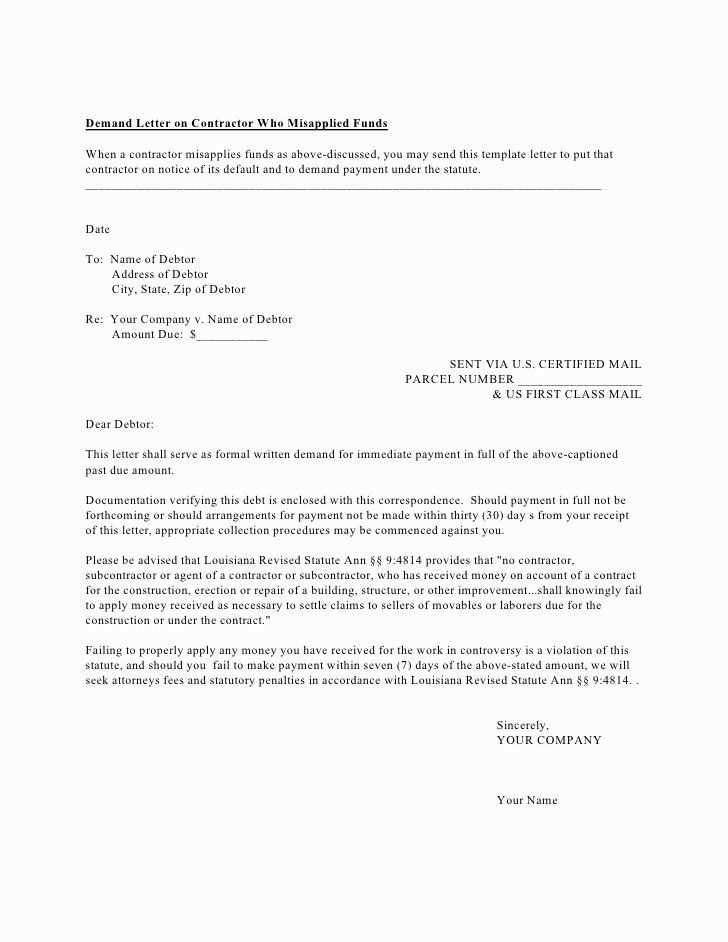

Key Components of the Formal Request

A well-crafted request includes several critical components to ensure clarity and effectiveness:

- Creditor’s Details: Name, address, and contact information.

- Debtor’s Information: Full name, address, and any relevant identification details.

- Amount Owed: The exact amount with an itemized breakdown if necessary.

- Payment Deadline: A clear and reasonable date by which the payment must be made.

- Consequences of Non-Compliance: Information about potential legal actions or additional costs if payment is not made.

Common Errors to Avoid in Drafting

When drafting this formal request, it’s important to avoid common mistakes that could undermine its effectiveness:

- Ambiguity: Avoid vague language and ensure all details, such as amounts and deadlines, are precise.

- Inaccurate Information: Verify that the debtor’s details are correct to prevent confusion.

- Lack of Clarity: Be clear about the potential consequences and legal actions that may follow if the debt is not settled.

How to Deliver the Payment Request

The notice should be sent through a method that ensures delivery and provides proof, such as registered mail or an email with a read receipt. This will help protect the creditor’s rights and provide evidence of the attempt to collect the debt.

Actions After Sending the Notice

If the debtor does not respond within the specified period, the creditor may proceed with further legal actions. This could involve initiating a court claim or seeking the assistance of a debt collection agency. It’s crucial to follow the correct legal process to ensure a successful resolution.